To view previous releases, select one from the dropdown box:

Currently displaying information released on: July, 2024

STUDY: HOMEOWNER-RENTER DWELLING, NEIGHBOURHOOD, LIFE SATISFACTION GAPS

Statistics Canada recently released a study examining the gaps between homeowner-renter dwelling, neighbourhood and life satisfaction using the 2021 Canadian Housing Survey (CHS) 2021. Data were collected for Canada’s 10 provinces and the territorial capitals of Whitehorse, Yellowknife and Iqaluit,with household weights ensuring the sample remains representative of the broader Canadian population. The study used households rather than individuals but are presented referring to renters (renter households) and owners (owner households, where at least one household member owns the dwelling as their primary residence).

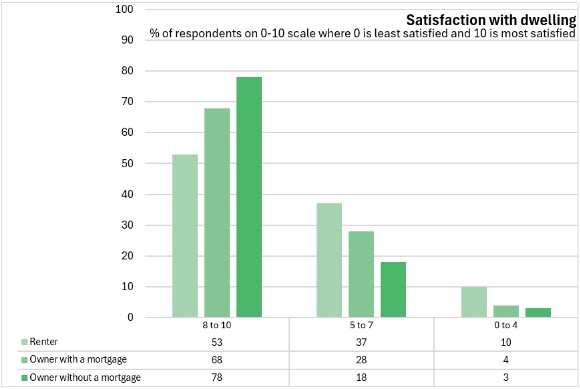

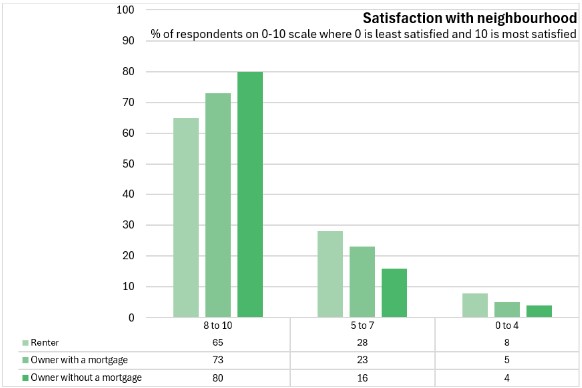

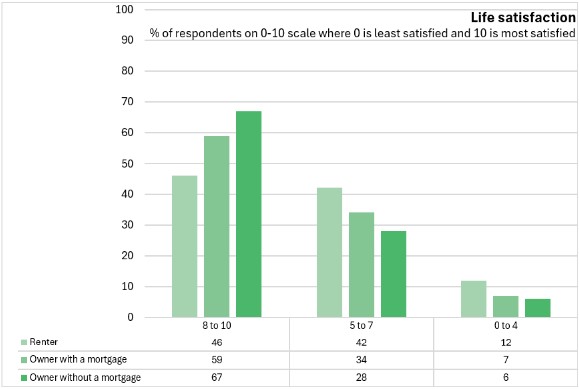

Survey respondents were asked to evaluate their satisfaction with their dwelling, neighbourhood, and life overall on a scale from 0 (lowest) to 10 (highest).

Overall, renters reported lower satisfaction levels for dwelling, neighbourhood, and life satisfaction while owners without mortgage reported the highest satisfaction levels across all categories.

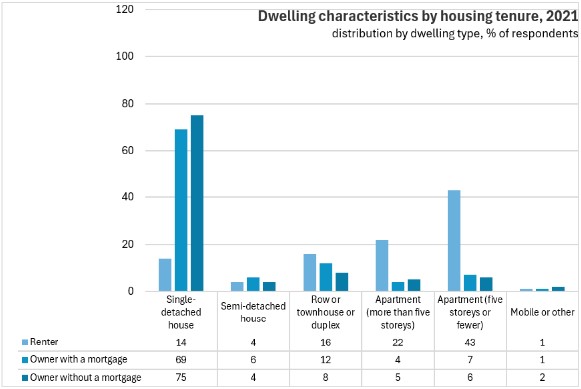

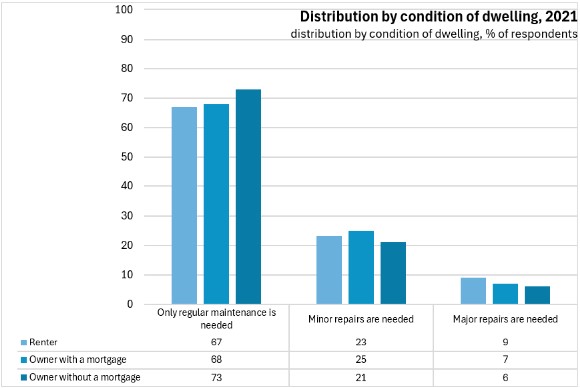

Differences in satisfaction reported by renters and owners reflects differences in the types and quality of dwellings in which they reside.

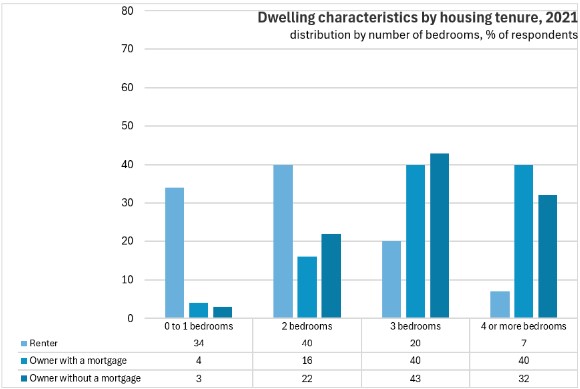

In terms of dwelling type, 65% renters resided in apartments compared with owners (11%). 75% of owners without mortgage resided in single-detached dwellings compared with just 14% of renters. The majority of renters resided in dwellings with 2 or fewer bedrooms while owners typically resided in structures with 3, 4 or more bedrooms.

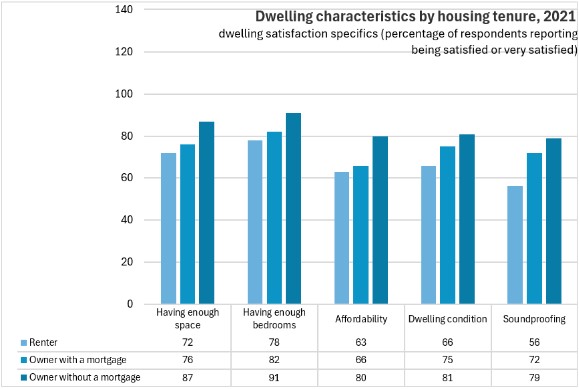

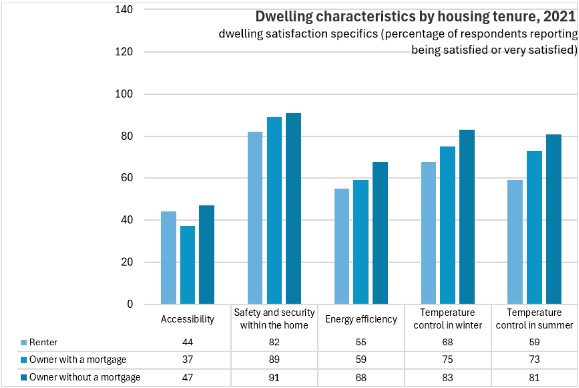

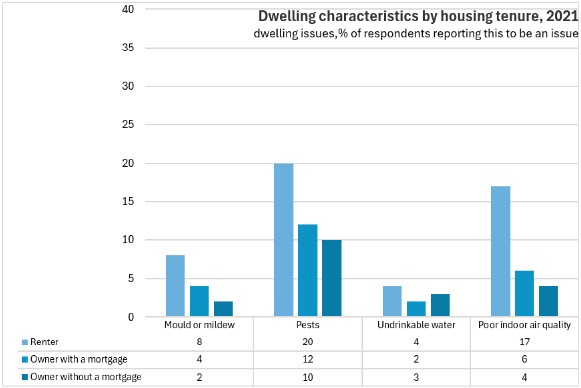

Renters were less satisfied than owners in all aspects of their dwellings, particularly in dwelling, sound proofing, and temperature control. Renters were also more likely than owners to report issues with mould and mildew, pests, and indoor air quality than owners.

Homeowners without mortgages generally reported fewer complaints about dwelling qualities than homeowners with mortgages.

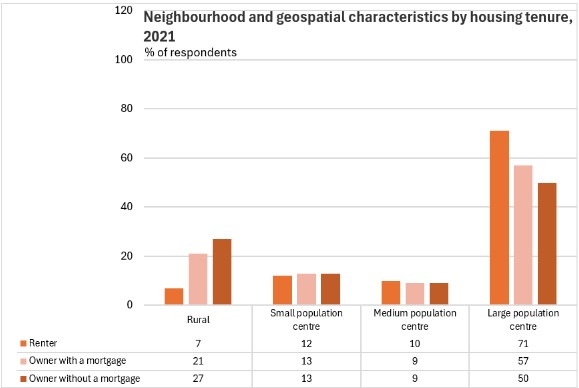

The difference in satisfaction reported by renters and owners could be reflected by differences in the types of neighbourhoods in which there reside. In 2021, 71% renters lived in large urban areas and in more densely populated neighbourhoods compared with 57% owners with a mortgage, and 50% owners without a mortgage.

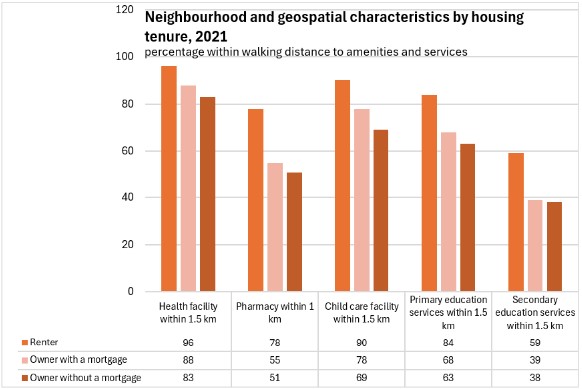

Renters were more likely to live in closer proximity to services and amenities than owners. The study noted that a larger proportion of renters lived within 1 or 1.5 kilometers of various amenities.

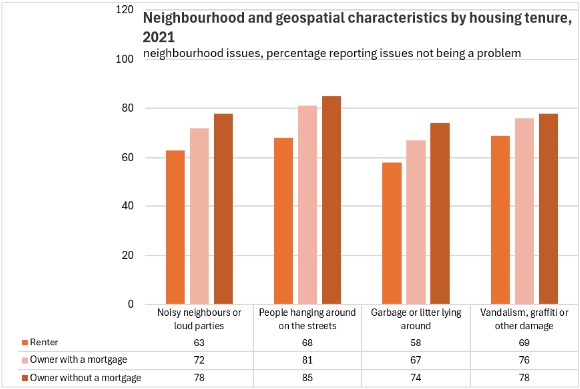

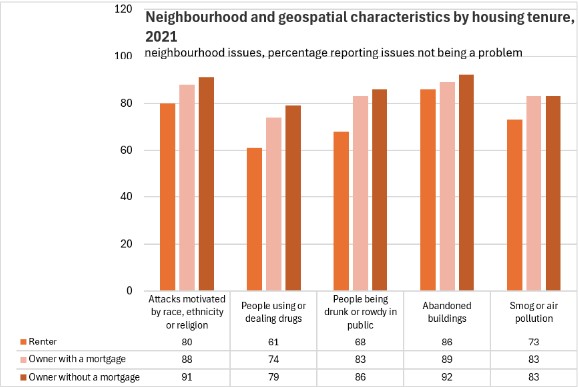

Renters reported lower satisfaction with other aspects of their neighbourhood though living closer to services and amenities.

The difference in satisfaction reported by renters and owners could be reflected by differences in the socioeconomic and demographic characteristics of the individuals in these groups.

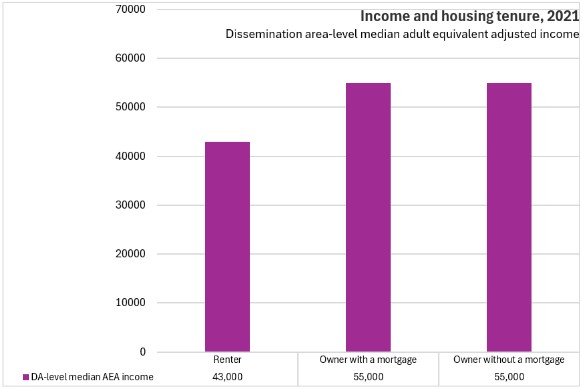

Renters reported lower incomes than owners and generally lived in lower-income neighbourhoods. Renters resided in a neighbourhood where the median adult-equivalent adjusted (AEA) family income was $43,000 while the average owner with or without a mortgage lived in a neighbourhood where the median AEA family income was $55,000.

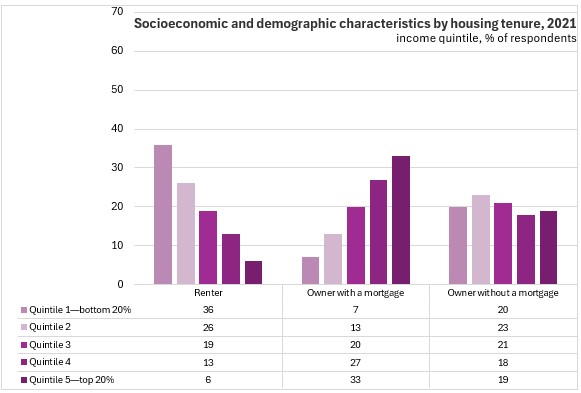

In 2021, 36% of renters had household income in the bottom quintile while just 6% were in top quintile of income earners. By comparison 7% of owners with a mortgage had household income in tje bottom quintile and while 33% were in the top quintile. 20% of owners without a mortgage had household income in the bottom quintile while 19% were in the top quintile.

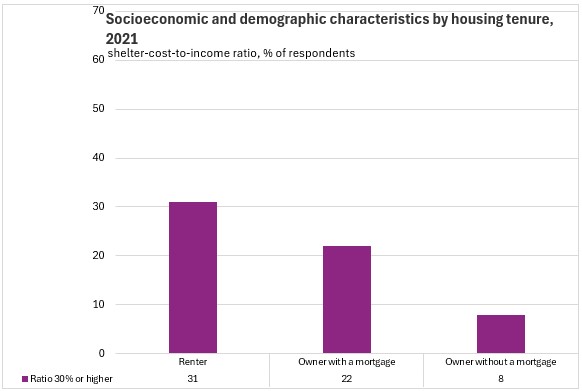

Renters typically spent a larger portion of their income on shelter costs: 31% of renters reported spending 30% or more of their income on shelter compared with 22% of owners with a mortgage and 8% owners without a mortgage.

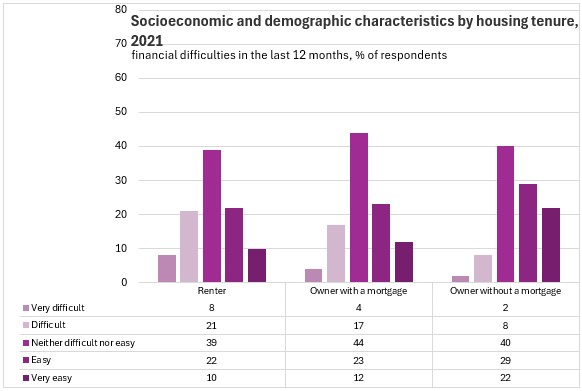

In 2021, 29% of renters reported experiencing financial difficulties in the last 12 months compared with 21% of owners with a mortgage and 10% of those without a mortgage.

While the findings of the study suggest that the impact of home ownership on satisfaction is relatively small, these findings does not rule out the possibility that ownership can provide other social or economic benefits.

Sources: Statistics Canada, Homeowner-renter dwelling, neighbourhood and life satisfaction gaps

|