For additional information relating to this article, please contact:

December 07, 2017SURVEY OF FINANCIAL SECURITY, 2016 Statistics Canada has updated the Survey of Financial Security to 2016, providing estimates of household assets, debts and net worth for Canada and the Provinces.

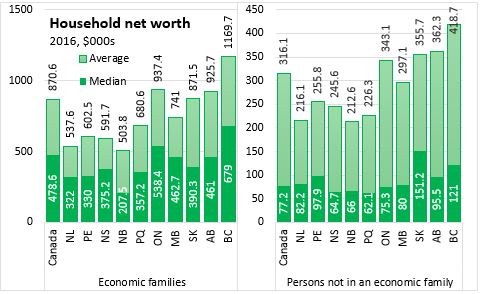

Average household net worth (assets less financial debts) was $870,600 for economic families in Canada; median net worth (not skewed by higher values) was $478,600 for economic families in 2016. Values for persons not in an economic family are lower: an average net worth of $316,100 and a median net worth of $77,200. Medians and averages reported here are among those who report having debt or assets.

Nova Scotia's net worth of economic families was $591,700 in 2016 with a median value of $375,200. For persons not in an economic family, Nova Scotia reported average net worth of $245,600 with a median of $64,700. Across Canada, net worth is lower in Atlantic Canada and Quebec while there are higher values in Ontario and western Canada. The highest values of average net worth were reported in British Columbia.

The Survey of Financial Security allows comparison of net worth by quintiles of net worth as well as by quintiles of income and by age cohort. These quintiles includes economic families as well as those not in economic families.

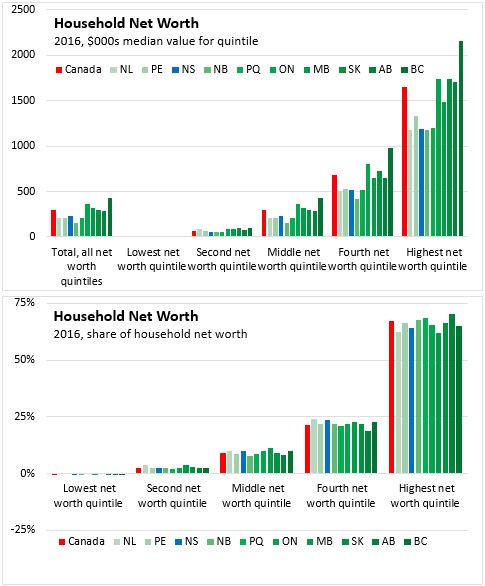

Those in the highest quintile by net worth in Canada (ie: those 20 per cent of the population that have the highest net worth) have a median net worth of $1.65 million and account for 67.3 per cent of the net worth in Canada. In Nova Scotia, the highest quintile by net worth had median net worth of $1.19 million, accounting for 64.0 per cent of the total net worth of Nova Scotians.

Nova Scotia households in lower quintiles had lower median net worth than comparable national quintiles. The first two quintiles of net worth reported 2.6 per cent of total net worth in the province - similar to the national average (those in the lowest quintile can report negative net worth).

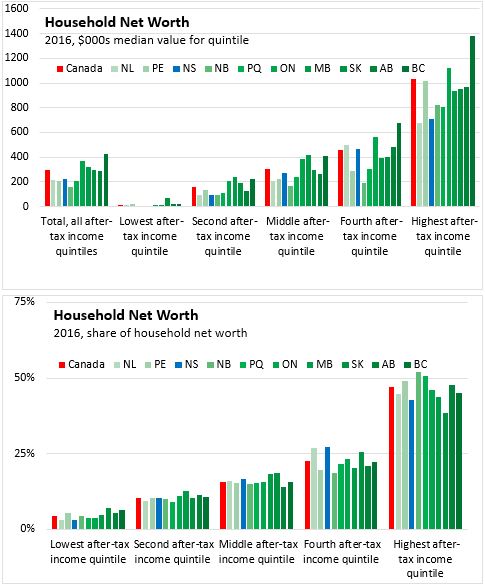

The population's net worth can also be divided into income quintiles as income and net worth are not necessarily coincident. The highest earning 20 per cent of Canadians had a median net worth of $1.03 million; the highest earning quintile had median net worth of $0.71 million in Nova Scotia. Median net worth of lower earning quintiles in Nova Scotia was closer to the national average.

The highest earning income quintiles account for 46.9 per cent of household net worth in Canada. Nova Scotia's highest earning quintile had 42.7 per cent of the province's net worth. In Nova Scotia, the middle and fourth quintiles had a higher share of the provincial net worth than their national counterparts had of national net worth.

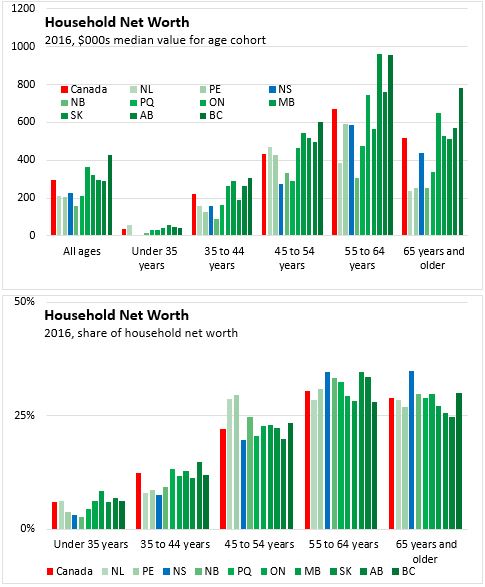

As assets accumulate and debts are repaid over time, the net worth of households rises, particularly for those aged 35-44 and 45-54. Those in the 55-64 age cohort report the highest median net worth. Older cohorts (who are drawing down on assets in retirement). As a percentage of total net worth, households in the 65+ and 55-64 cohorts have the highest share of net worth. In Nova Scotia's case, an older demographic profile results in a larger concentration of net worth in older age cohorts - either when compared with younger cohorts in the province or similar cohorts at the national level.

The Survey of Financial Security provides a breakdown of the total assets and liabilities of Nova Scotians. The province's total net worth of $199.5 billion consists of assets of $226.5 billion offset by debts of $27.0 billion.

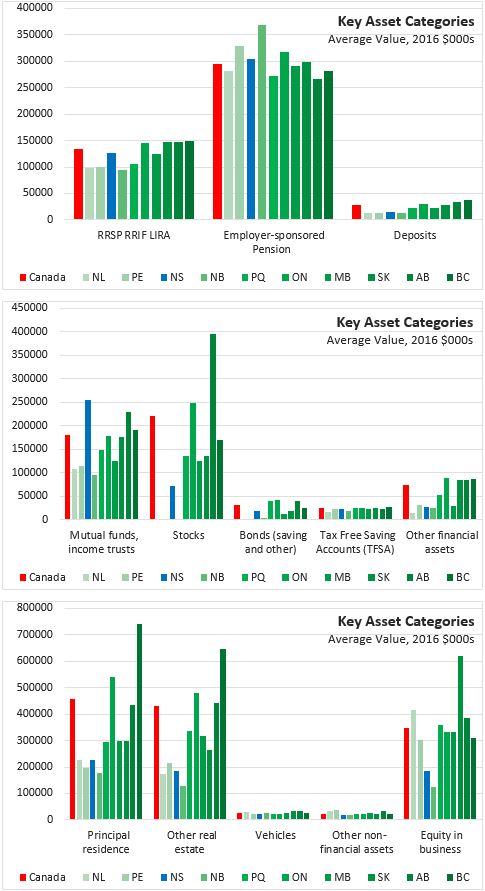

Of the total assets, 44 per cent are in pension-related assets. A further 10 per cent of Nova Scotians' assets are held in non-pension financial assets, with deposits and mutual funds as the largest categories. The largest non-financial asset for Nova Scotians is real estate. Equity in businesses accounts for 5 per cent of Nova Scotians asssets.

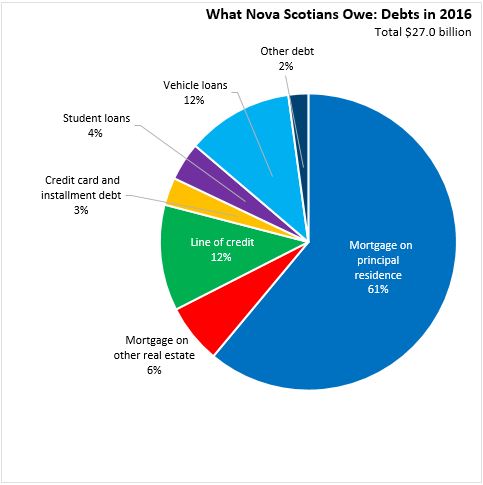

Nova Scotians owed a total fo $27.0 billion in debts in 2016. Over 67 per cent of this was related to mortgages, with 61 per cent on principal residence.

Compared with national averages by asset category, Nova Scotians have more pension assets and mutual funds, but lower than average amounts in all other financial asset categories. The value of Nova Scotians' non-financial assets are also lower than the Canadian average, particularly in comparison with higher real estate values in Ontario, Alberta and British Columbia. Average business equity (outside of financial assets) is lower in Nova Scotia than in every province except New Brunswick.

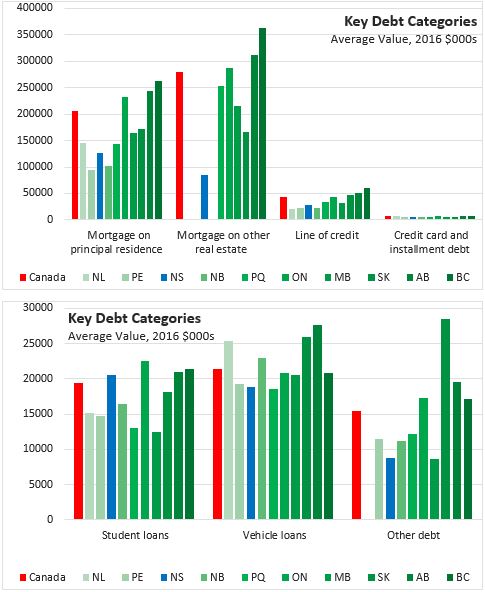

In comparison with other provinces, Nova Scotians have lower real estate mortgage debt, vehicle loans and lines of credit, but higher student debt.

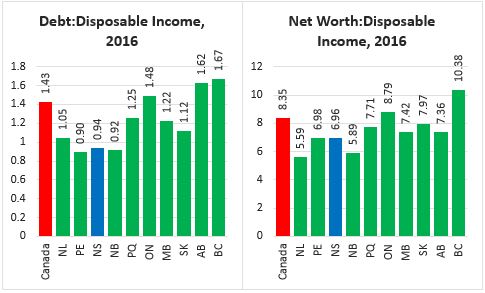

Taken as a ratio to household disposable income, Nova Scotians have a relatively low debt burden. Only New Brunswick and Prince Edward Island report lower debt as a share of disposable income. Higher debt burdens in Ontario and British Columbia are offset by higher net worth compared with disposable income. As a multiple of disposable income, net worth is highest in British Columbia and Ontario. Nova Scotia's net worth to disposable income is lower than in central and western provinces, but higher than in New Brunswick or Newfoundland and Labrador.

Statistics Canada, CANSIM tables 205-0002, 205-0004, 205-0005