The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

June 11, 2024MULTIFACTOR PRODUCTIVITY GROWTH, 2022 Statistics Canada has released provincial results for multifactor productivity and related variables for the business sector for 2022.

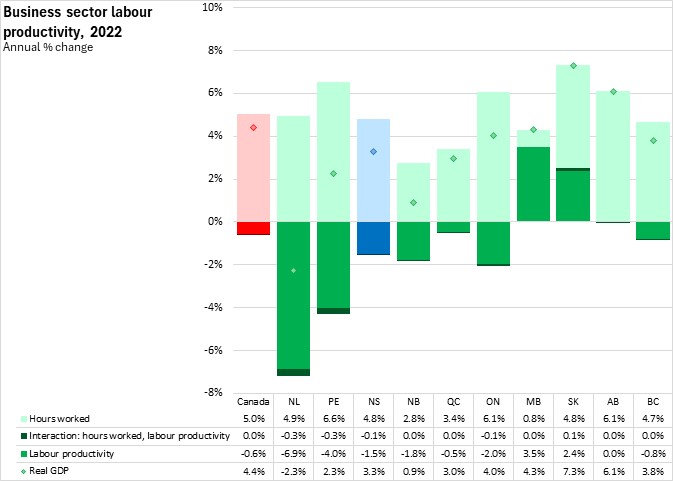

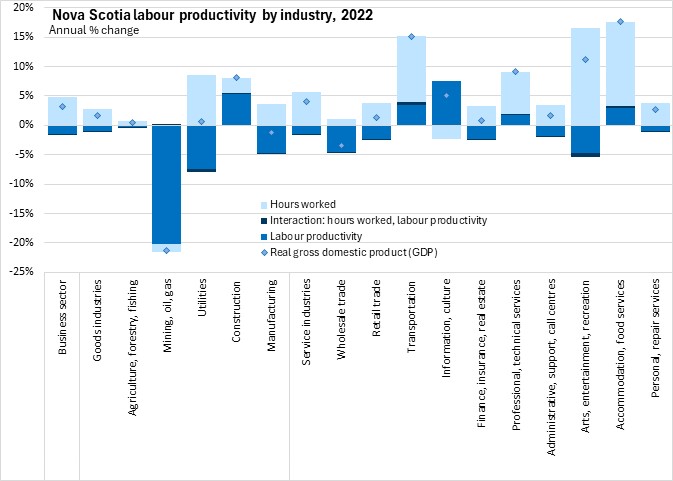

Growth in real value added (herein: real GDP) can be decomposed into growth in hours worked and growth in labour productivity. In most years, the interaction between changes in both labour productivity and hours worked is negligible, but with larger movements in productivity and hours worked, this interaction offsets some of the labour productivity gain.

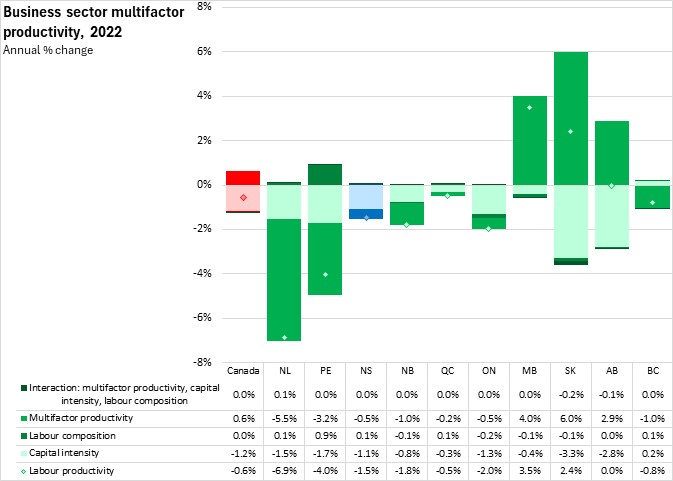

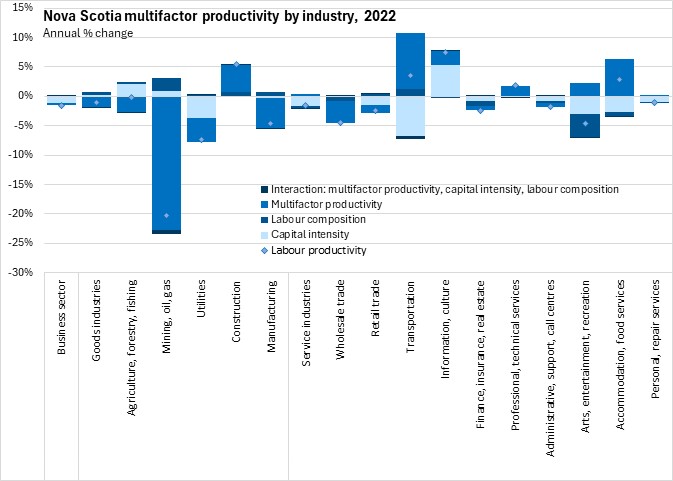

Growth in labour productivity can be further decomposed into growth in capital intensity (ie: the amount of capital used in production), labour composition (ie: skills upgrading) and multifactor productivity. Multifactor productivity is the residual of economic growth that cannot otherwise be accounted for and is meant to reflect intangible contributions to economic growth from unobserved variables such as branding, economies of scale, technology, management practice or entrepreneurship.

Previously released data for Nova Scotia's labour productivity in 2022 showed a continued rebound in hours worked (+4.8%) was partially offset by a 1.5% decline in labour productivity, resulting in an increase in business sector real GDP of 3.3%. This reflects continued recovery in economic activity after the pandemic, during which labour intensive and lower productivity employment hours were significantly disrupted. With significant declines in hours worked for labour-intensive, lower-productivity activities, overall business sector labour productivity appeared to rise as many higher-productivity industries continued with less disruption. As lower productivity, labour-intensive workers returned to normal employment hours in 2021 and 2022, overall business sector labour productivity declined as these industries resumed their usual contribution to overall hours worked.

All provinces reported strong gains in hours worked in 2022, with the excetion of Manitoba where growth was weaker. Most provinces reported declines in productivity with the exceptions in Manitoba and Saskatchewan (as well as little change in Alberta). Considering both changes in hours worked and productivity, Newfoundland and Labrador was the only province in which the business sector reported a decline in real GDP.

Multifactor productivity estimates further decompose the sources of provincial labour productivity changes in 2022.

In Nova Scotia, business sector capital intensity contributed a 1.1% decrease to labour productivity, while labour composition (skill) added 0.1% to labour productivity growth. The residual 0.5% decline in Nova Scotia's labour productivity was attributable to multifactor productivity decline.

Declining business sector capital intensity was observed across all provinces except British Columbia. The contributions of labour composition (skills) had little influence on labour productivity in all provinces except Prince Edward Island, where labour composition contributed positively to labour productivity. Multifactor productivity change was a drag on labour productivity for 7 provinces, with the largest declines in Newfoundland and Labrador and Prince Edward Island. The three prairie provinces reported notably stronger contributions from multifactor productivity to labour productivity.

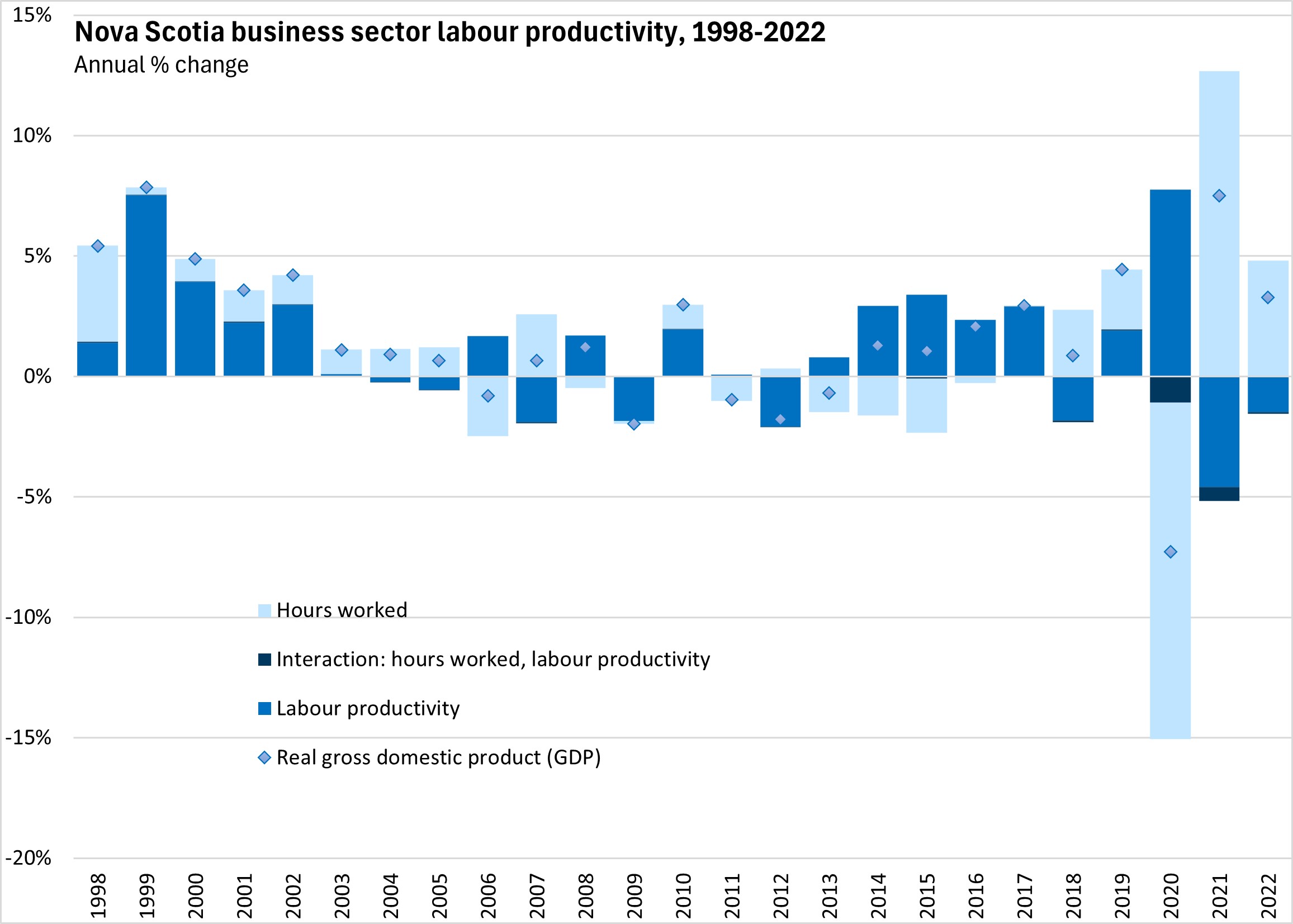

After strong productivity and real GDP growth from 1998-2003, during which natural gas production facilities were constructed and reached peak production, Nova Scotia's reported very little labour productivity growth from 2003 to 2013. Over this period, output from the province's natural gas fields was declining, which is typical of production patterns after peaking early in their life cycle. From 2013 to 2017, Nova Scotia's labour productivity made significant contributions to overall business sector real GDP growth even when labour's contribution from hours worked was flat or negative during substantial declines in the province's labour force. In 2018, there was an extraordinary increase in contribution to real GDP growth from labour hours worked and an offsetting decline in labour productivity. In 2019, Nova Scotia's business sector real GDP growth reached its fastest pace since 2002 on another strong increase in labour productivity.

During 2020, a sharp decline in hours worked for lower-productivity occupations boosted the average productivity across the remainder of the economy that continued operations with less disruptions. In 2021 and 2022, resumption of activities and hours worked in low productivity and labour-intensive activities dragged on the business sector average productivity.

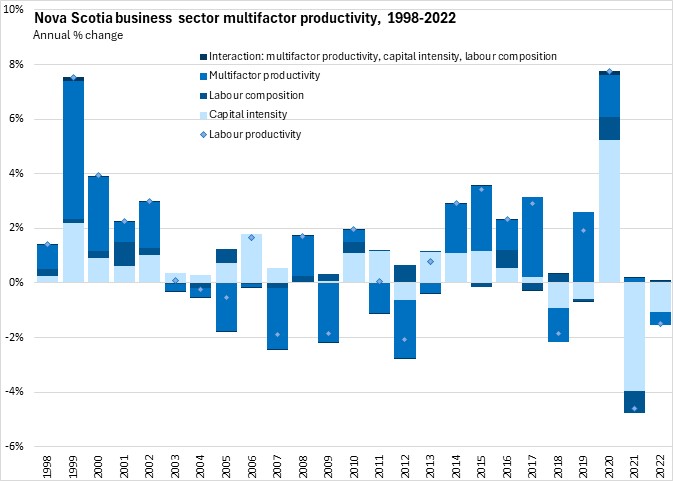

In the period from 1998-2003, labour productivity gains were driven mostly by capital intensity as well as multifactor productivity (which includes effects from bringing new natural resources into production). From 2003-2013, multifactor productivity growth was generally negative as natural gas output slowed - though capital intensity continued to grow through much of this period. Starting in 2014, multifactor productivity growth made significant contributions to business sector labour productivity gains and therefore to real GDP growth.

With the decline in hours worked in labour-intensive, low productivity occupations in 2020, there was a sharp increase in capital-intensity of the business sector reflecting the higher capital-intensity of remaining activities in the business sector. There were also notable contributions to the 2020 productivity spike from multifactor productivity and labour composition. As hours worked in labour-intensive occupations returned to normal in 2021 and 2022, capital intensity declined to pre-pandemic averages and weighed on labour productivity. Declining capital intensity has been the main source of decline in labour productivity's return to trend in 2021 and 2022.

Among industries, Nova Scotia's 2022 productivity declines were spread across most business sector industries - as were gains in hours worked (only mining and information/culture reported declining hours worked).

Most industries reported a drag on productivity from capital intensity (exceptions: agriculture, mining, construction, information/culture). Labour composition generally made small contributions to productivity change, with the exceptions of mining and transportation/warehousing (positive contributions) as well as arts/entertainment/recreation (negative contribution).

Multifactor productivity contributed to labour productivity improvements for many industries (exceptions: agriculture, mining, utilities, manufacturing, wholesale and retail trade, finance/insurance and administrative/support). The strongest contributions from multifactor productivity growth were reported in transportation, accommodation/food services and construction.

Statistics Canada. Table 36-10-0208-01 Multifactor productivity, value-added, capital input and labour input in the aggregate business sector and major sub-sectors, by industry; Table 36-10-0211-01 Multifactor productivity and related variables in the aggregate business sector and major sub-sectors, by industry

<--- Return to Archive