The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

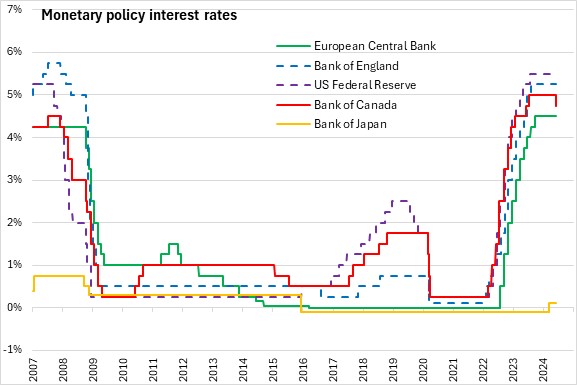

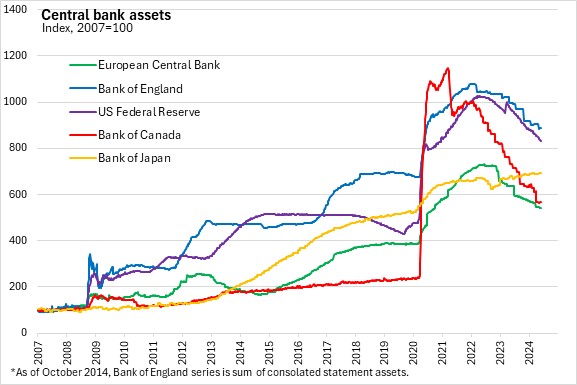

June 05, 2024BANK OF CANADA MONETARY POLICY The Bank of Canada reduced its target for the overnight rate to 4.75%, with the Bank rate reduced to 5.0% and the deposit rate down to 4.75%. The Bank is continuing its policy of balance sheet normalization.

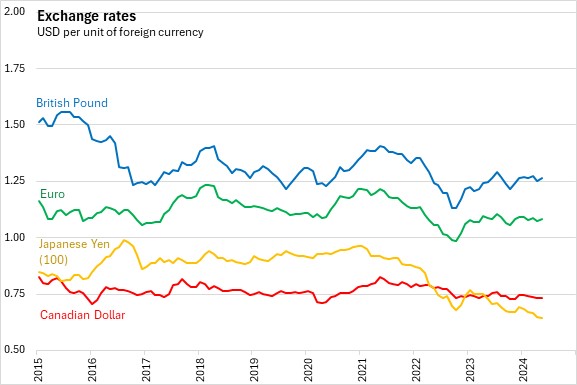

Global economy has grown 3% in the first quarter of 2024, in line with Bank's April projections. US economy expanded slower than expected, with weakness in exports and inventories. Private domestic demand eased, but remained strong. Growth was also seen in EU as well as China's economy. Most advanced economies are progressing towards price stability, but inflation is declining at different speeds.

Economic growth in Canada resumed in the first quarter of 2024 at 1.7% (slower than in the April forecast), dampened by weaker inventory investment. Real GDP from services-producing industries was up 1.5% in the first three months of 2024 compared to the same period in 2023. Consumption, business investment and housing activity have contributed to economic growth in the recent months.

Bussinesses continue to hire and employment has been growing, but at a slower pace than the working age population. Unemployment rate has remained unchanged in April at 6.1% while job vacancy rate has declined to 3.4% in March. Wage pressures are seen to be moderating. Overall recent data still suggest that the economy is still operating in access supply.

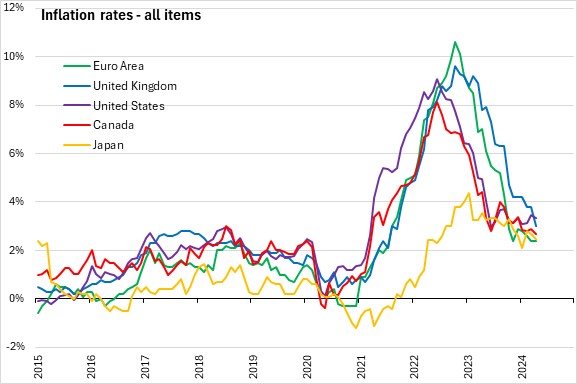

Inflation eased further to 2.7% in April, down from 2.9% in March. Bank's preferred measure of core inflation have come down to 2.75% in April and 3-month rates of core inflation slowed to 2.0% in March and April. Indicators of price increases are near their historical average, however, shelter price inflation remains high.

With continued evidence of inflation easing, Bank of Canada agreed to decreasing the policy interest rate by 25 basis points. Risks to the outlook for inflation still remain. The Governing Council is closely watching the balance between demand and supply, inflation expectations, wage growth, and corporate pricing behaviour.

The next scheduled date for announcing the overnight rate target is July 24, 2024. The Bank will publish its next full outlook for the economy and inflation, including risks to the projection on the same day.

Bank of Canada: Rate Announcement

<--- Return to Archive