The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

May 31, 2024NON-RESIDENTIAL FIXED CAPITAL INVESTMENT, Q1 2024 Non-residential fixed capital investment consists of expenditures made by business, governments and non-profit institutions serving households that add to the capital stock for production of goods and services in an economy. Investment that are included are buildings, engineering construction (i.e. bridge, mine structure), machinery and equipment, and intellectual property products (i.e. software, mineral exploration) but it doesn’t include non-reproducible assets (lands, mineral deposits, natural resources) or housing investment. Statistics Canada has begun to release quarterly data on non-residential fixed capital investment and stock for the provinces with historical data back to 2013. Note, the data is not seasonally adjusted and expressed in current prices.

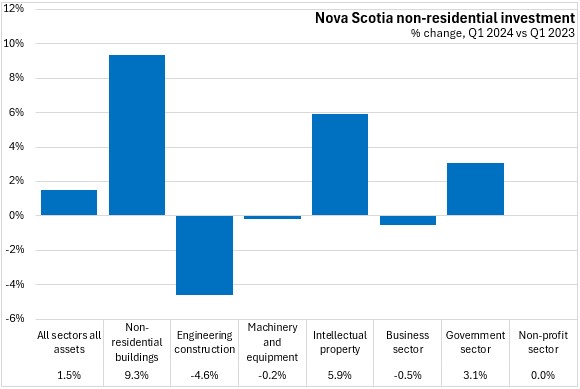

Year-over-year (Q1 2024 vs Q1 2023)

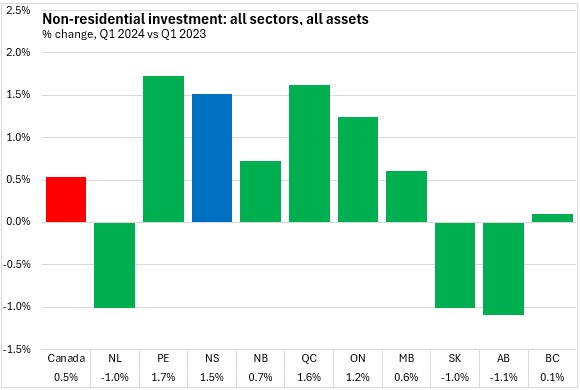

Nova Scotia non-residential investment (all sectors, all assets, current prices) increased 1.5% from Q1 2023 to Q1 2024. Nationally non-residential investment was up 0.5% with gains in 7 provinces. Prince Edward Island and Québec reported the strongest gains (followed by Nova Scotia). Alberta, Saskatchewan and Newfoundland and Labrador all reported similar declines.

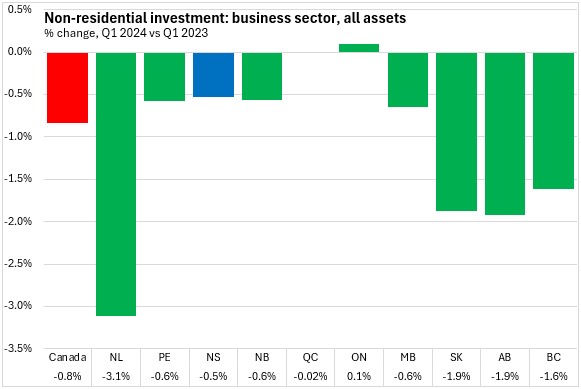

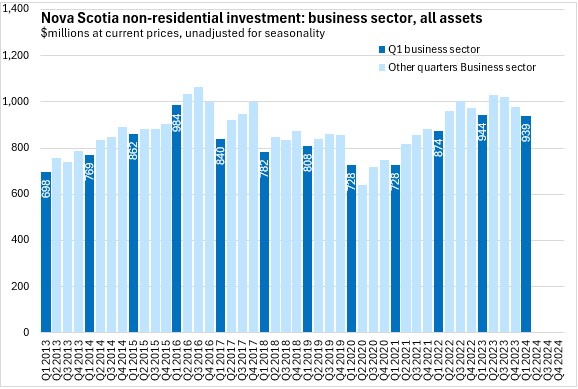

Business sector investment in Nova Scotia decreased 0.5%. National business non-residential investment was down 0.8% with declines in all provinces except Ontario (which only grew by 0.1%). Newfoundland and Labrador recorded the largest decline.

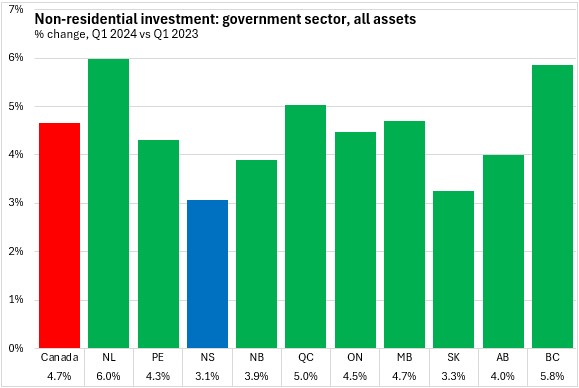

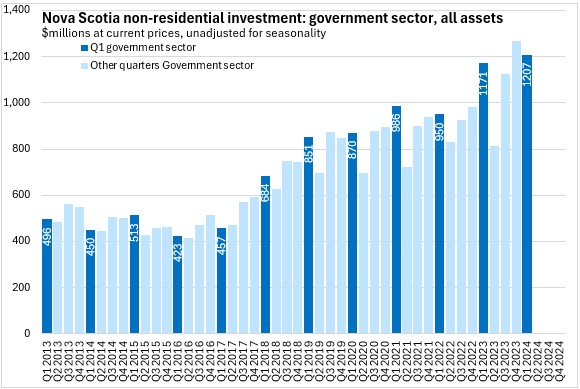

Government fixed capital investment increased 3.1% in Nova Scotia from Q1 2023 to Q1 2024, the smallest gain among the provinces. Across Canada, government investment (which includes all orders of government) was up 4.7% with gains in all provinces, led by Newfoundland and Labrador and British Columbia.

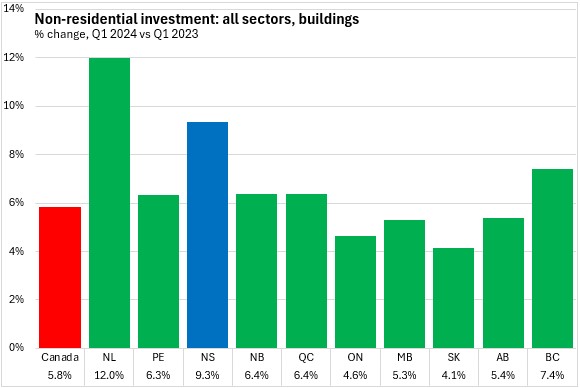

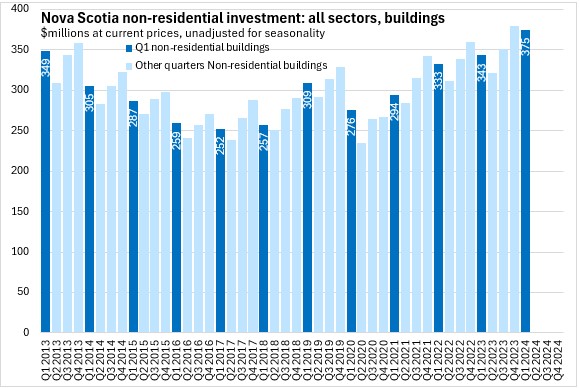

Nova Scotia non-residential building investment was up 9.3% compared to Q1 2023, the second fastest increase among provinces. Nationally, non-residential building investment was up 5.8% with gains in all provinces. The fastest growth was in Newfoundland and Labrador and slowest in Saskatchewan.

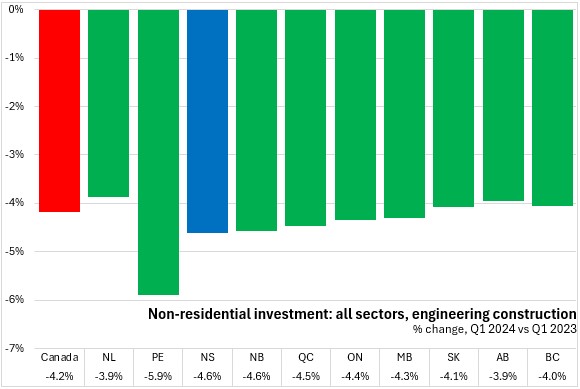

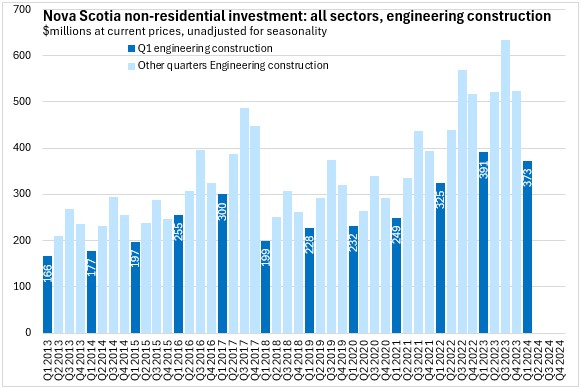

Engineering construction investment was down 4.6% in Nova Scotia and 4.2% across Canada. All provinces reported lower investments in engineering construction with the steepest decline in Prince Edward Island. Newfoundland and Labrador, Saskatchewan, Alberta and British Columbia all reported marginally slower declines.

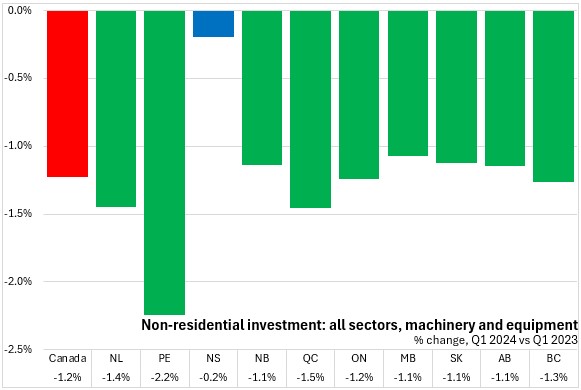

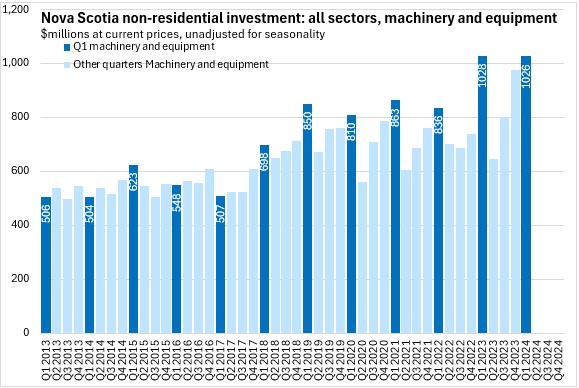

Machinery and equipment investment was down 0.2% in Nova Scotia, a slower decline that in any other provinces. Nationally, machinery and equipment investment was down 1.2% with declines in all provinces led by Prince Edward Island.

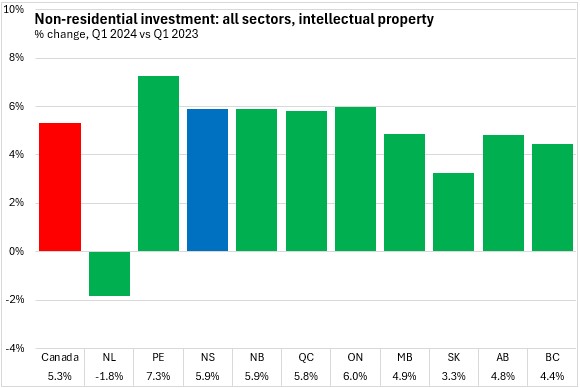

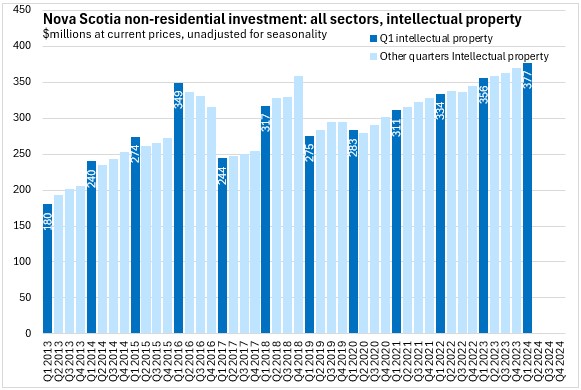

Intellectual property investment was up 5.9% in Nova Scotia compared to Q1 2023. Nationally, intellectual property investment was up 5.3% with gains in all provinces except Newfoundland and Labrador. The fastest growth was in Prince Edward Island.

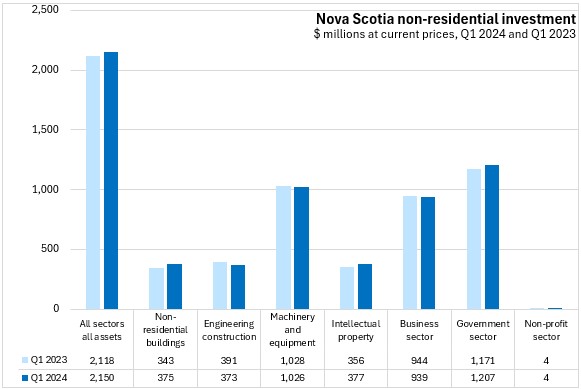

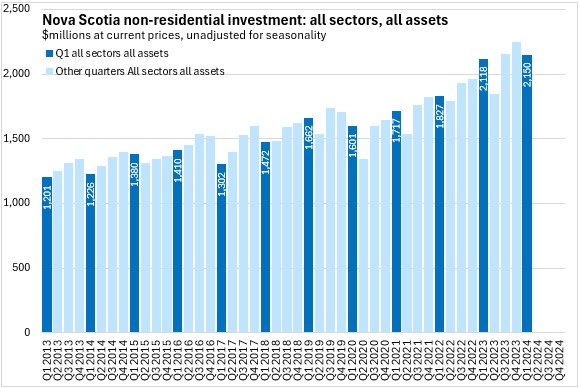

Nova Scotia's investments in fixed non-residential capital were larger in government investment ($1,207 million) than business investment ($939 million). Machinery and equipment made up the largest asset category of investment ($1,026 million). Investments in non-residential buildings ($375 million) were similar to engineering construction investments ($373 million) and to intellectual property investments ($377 million).

Growth was stronger for non-residential building investment in Nova Scotia. Engineering construction posted the sharpest percentage decline.

Trends

Nova Scotia's non-residential investment has generally trended up on a year-over-year basis (except 2020). In the most recent data, the pace of year-over-year investment growth has slowed.

Business sector non-residential investment trended downward over 2016 to 2020, before trending upwards over 2021-2023. However, business sector investment has stalled in Q1 2024, edging down from the Q1 2023 value.

Government sector was mostly flat from 2014 through 2017, then trended upwards from 2017 to 2023.

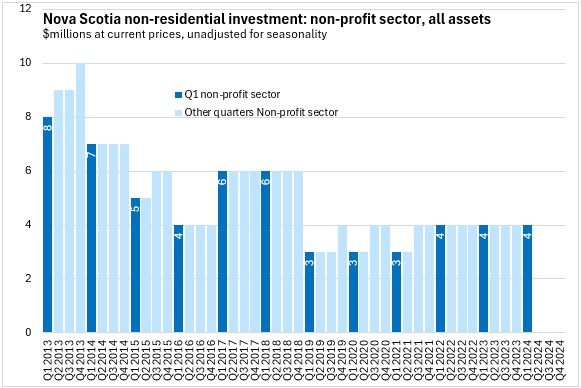

Non-profit institution serving households was little changed (at a low value) from 2019 through 2024.

Nova Scotia's investments in non-residential buildings declined from 2013 to 2017 and rose in 2018 and 2019. After a dip in 2020, Nova Scotia's investment in non-residential buildings recovered to its rising trend from 2021-2024.

Nova Scotia's investments in engineering construction assets have trended up since 2018, though the latest quarterly result is a decline from the same quarter a year ago.

Nova Scotia's investments in machinery and equipment assets have been stronger in the last year.

Nova Scotia's investments in intellectual property products has mostly trended up since 2013 with occasional spikes associated with specific offshore exploration projects.

Statistics Canada. Table 34-10-0163-01 Flows and stocks of fixed non-residential and residential capital, by sector and asset, provincial and territorial (x 1,000,000)

<--- Return to Archive