The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

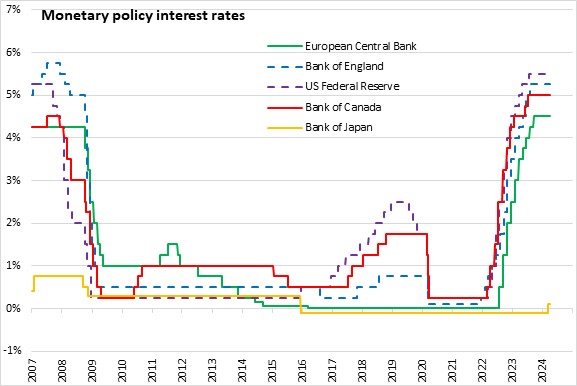

April 11, 2024EUROPEAN CENTRAL BANK MONETARY POLICY The European Central Bank (ECB) announced today that it would keep the three key ECB interest rates unchanged. The interest rates on the main refinancing operations, the marginal lending facility and the deposit facility will remain at 4.50%, 4.75% and 4.0% respectively.

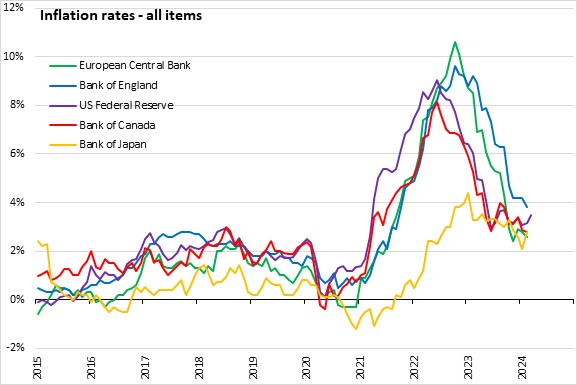

Inflation has continued to slow, edging down to 2.4% in March. Food price inflation fell again to 2.7% in March while energy prices continued their decline since May 2023. Goods price inflation fell further, and services price inflation remained high in March. Measures of underlying inflation declined further confirming the gradually diminishing price pressures. Inflation is expected to fluctuate around the current level in the short term and then decline towards the target in the next year. ECB considers that the key ECB interest rates are at levels that are making a substantial contribution to the ongoing disinflation process.

Economic activity remains weak in the first quarter. Strong spending in the services sectors were offset by weak demand for manufacturing and subdued production, especially in energy intensive sectors. The recovery in services is projected over the course of the year, supported by rising real incomes, resulting from lower inflation, increased wages and improved terms of trade. The unemployment rate remains at record lows and there is ease in labour market conditions with employers posting fewer job vacancies.

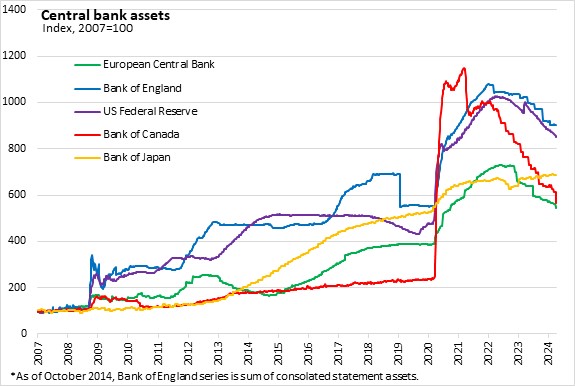

The asset purchase programme (APP) portfolio is declining at a measured and predictable pace, as the Eurosystem does not reinvest all principal payments from maturing securities. The Governing Council intends to reinvest the principal payments from maturing securities purchased under the pandemic emergency purchase programme (PEPP) during the first half of 2024. Over the second half of the year, it intends to reduce the PEPP portfolio by €7.5 billion per month on average. The Governing Council intends to discontinue reinvestments under the PEPP at the end of 2024.

The Governing Council notes that future policy rate decisions will be based on its assessment of the inflation outlook (including the dynamics of underlying inflation), incoming economic and financial data, and the strength of monetary policy transmission.

The next scheduled monetary policy meeting will be on June 6, 2024.

Source: European Central Bank: Monetary Policy Decisions, Monetary Policy Statement (Press Conference)

<--- Return to Archive