The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

April 05, 2024LABOUR MARKET TRENDS, MARCH 2024 March labour force survey results reflect the period from March 10 to 16, 2024.

Ages 15+ (March 2024 vs February 2024, seasonally adjusted)

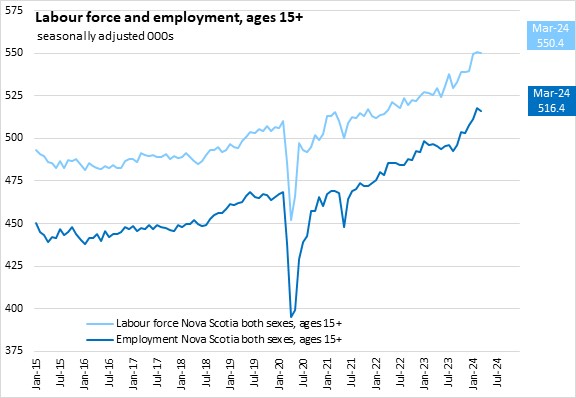

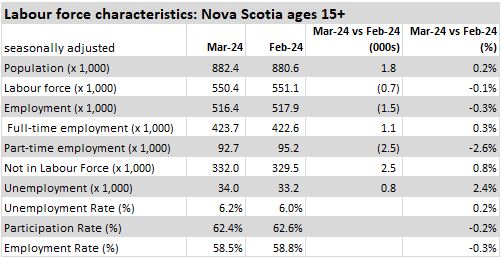

Nova Scotia's seasonally adjusted employment declined 1,500 (-0.3%) to 516,400 in March following an increase of 5,300 (+1.2%) to 517,900 in the previous month.

The change in employment was attributable to a decrease in part-time employment (-2,500) partially offset by an increase in full-time employment (+1,100). Note that changes in full-time and part-time employment can also reflect changing hours for the same job.

Nova Scotia’s labour force was down 700 (-0.1%) in to 550,400 March 2024.

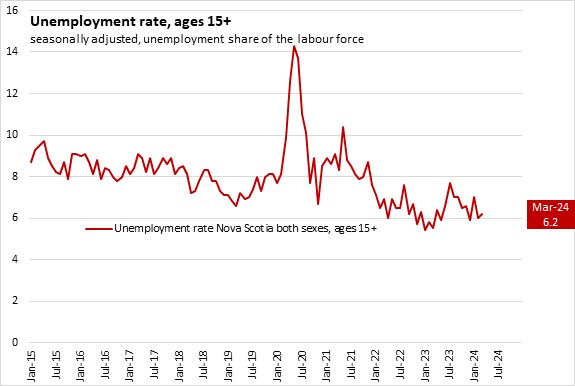

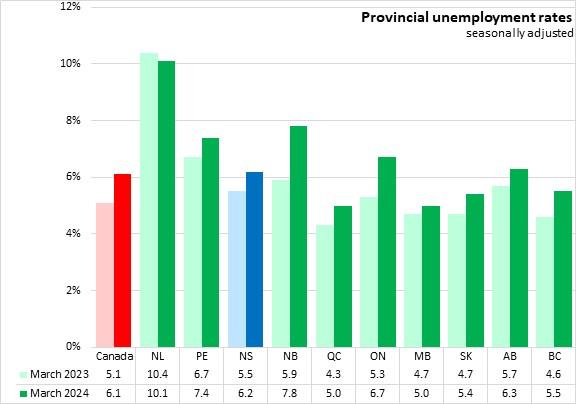

With employment falling faster than the labour force, Nova Scotia's unemployment rate increased 0.2 percentage points to 6.2% in March 2024.

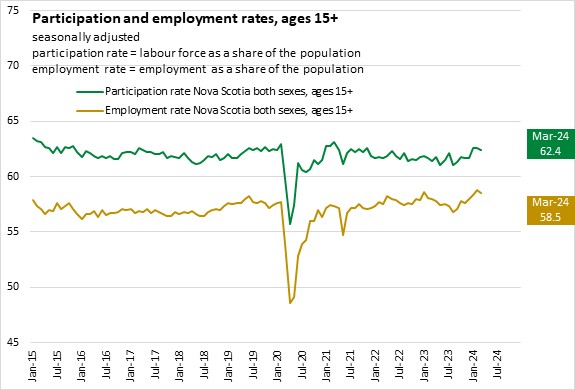

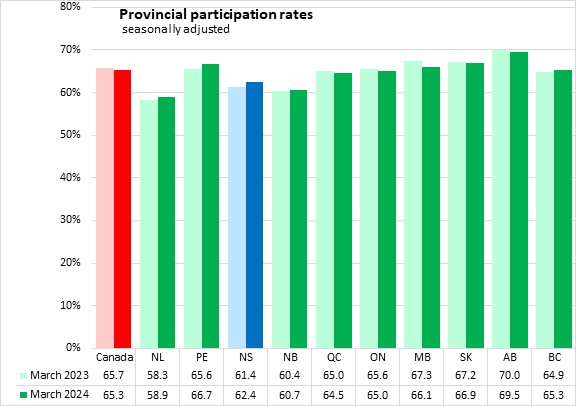

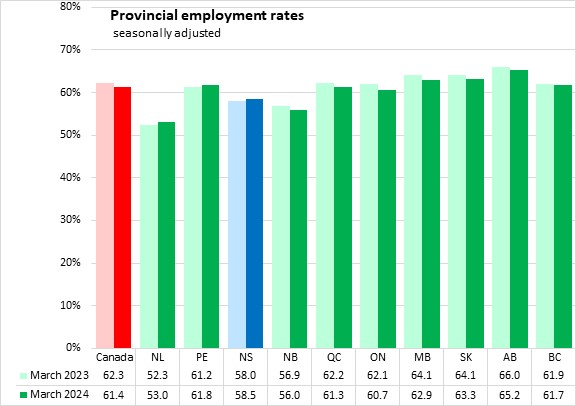

Nova Scotia's labour force participation rate declined 0.2 percentage points to 62.4% and the employment rate was down 0.3 percentage points to 58.5% in March 2024.

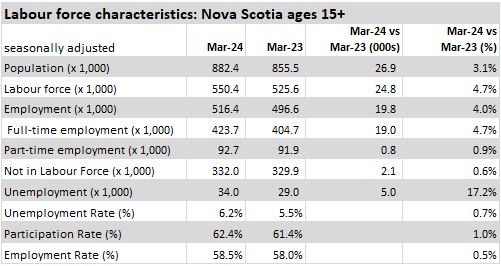

Ages 15+ (March 2024 vs March 2023, seasonally adjusted)

Compared with March 2023, Nova Scotia's population over the age of 15 increased by 26,900 (+3.1%), while the labour force grew by 24,800 (+4.7%), and employment increased by 19,800 (+4.0%). The unemployment rate was up 0.7 percentage points with the participation rate up 1.0 percentage points and the employment rate up 0.5 percentage points.

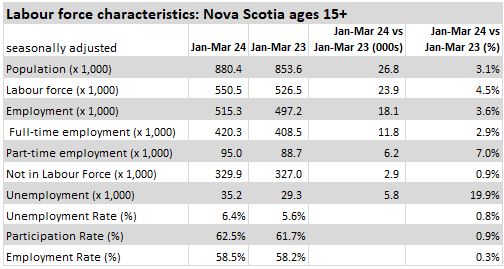

Ages 15+ (January-March 2024 vs January-March 2023, seasonally adjusted)

Compared with January-March 2023, Nova Scotia's population over the age of 15 increased by 26,800 (+3.1%), while the labour force grew by 23,900 (+4.5%), and employment increased by 18,100 (+3.6%). The unemployment rate was up 0.8 percentage points with the participation rate up 0.9 percentage points and the employment rate up 0.3 percentage points.

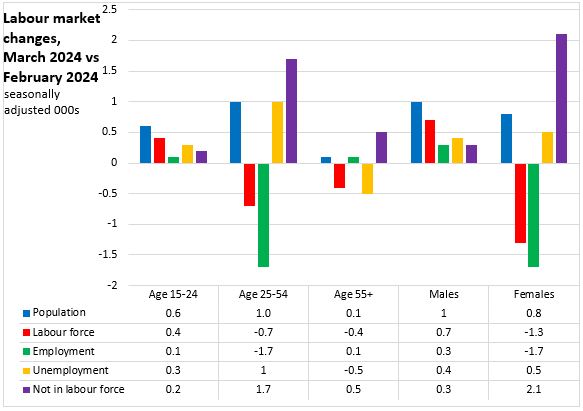

Age Cohorts (March 2024 vs February 2024, seasonally adjusted)

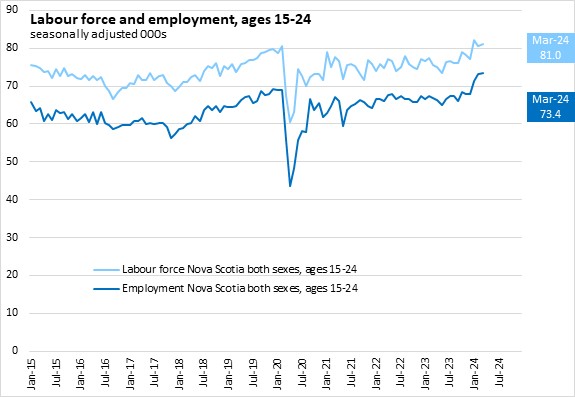

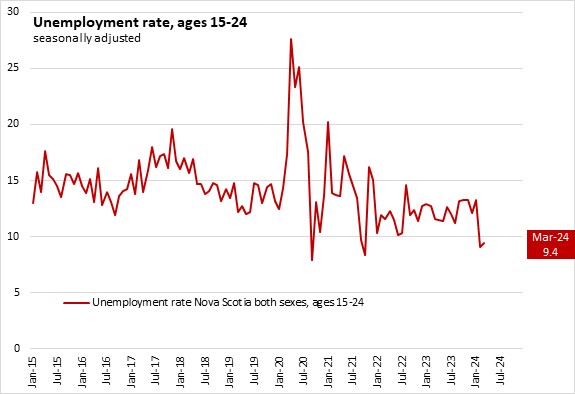

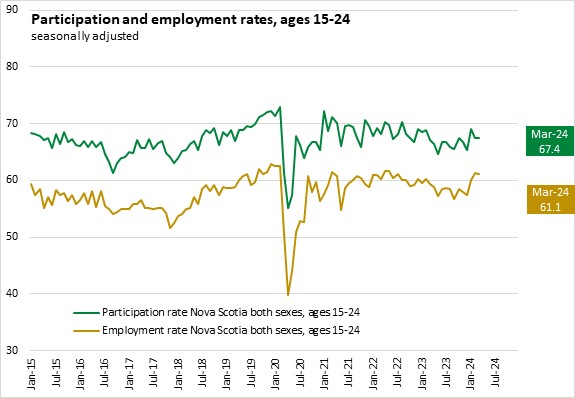

Among youth (ages 15-24), employment increased by 100 (+0.1%) while the labour force increased by 400 (+0.5%). With faster growth in labour force than employment, the youth unemployment rate rose 0.3 percentage points to 9.4% in March. The youth participation rate was unchanged at 67.4% and the youth employment rate was down 0.2 percentage points to 61.1%.

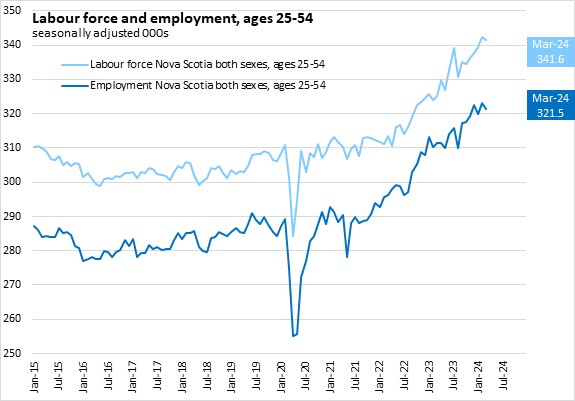

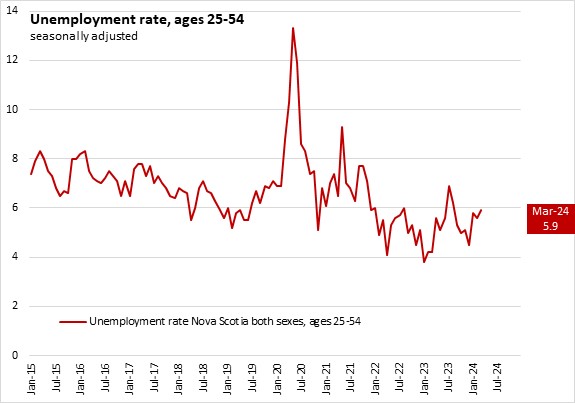

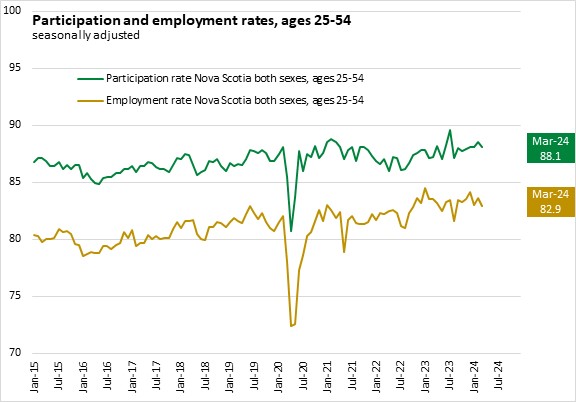

The population aged 25-54 makes up the largest part of the labour force. In the core age group, employment was down 1,700 (-0.5%) while the labour force was down 700 (-0.2%). With employment falling faster than labour force, the core aged unemployment rate was up 0.3 percentage points to 5.9% in March 2024. The core aged participation rate was down 0.4 percentage points to 88.1% and the core aged employment rate was down 0.7 percentage points to 82.9%.

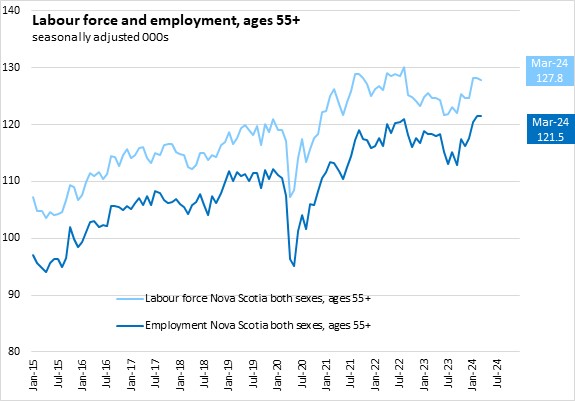

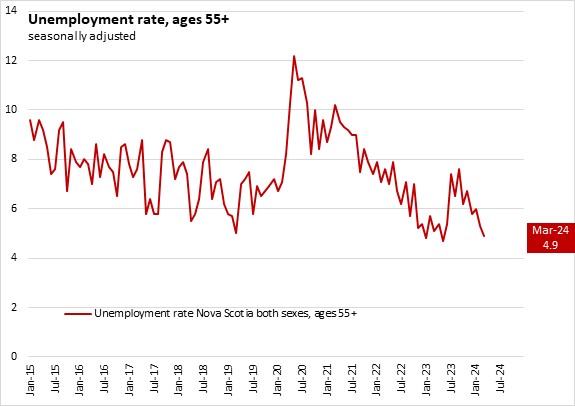

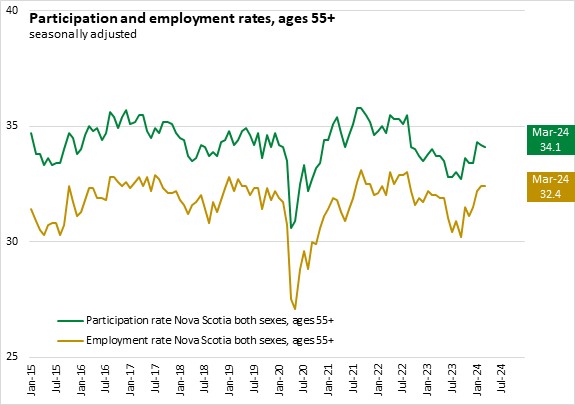

Older workers (aged 55+) reported the labour force decreased by 400 (-0.3%) and while employment grew by 100 (+0.1%). With a smaller labour force and higher employment, the older worker unemployment rate declined by 0.4 percentage points to 4.9%. The older worker participation rate declined 0.1 percentage points to 34.1% and the employment rate for older workers was unchanged at 32.4%.

Males and Females (Ages 15+, March 2024 vs February 2024, seasonally adjusted)

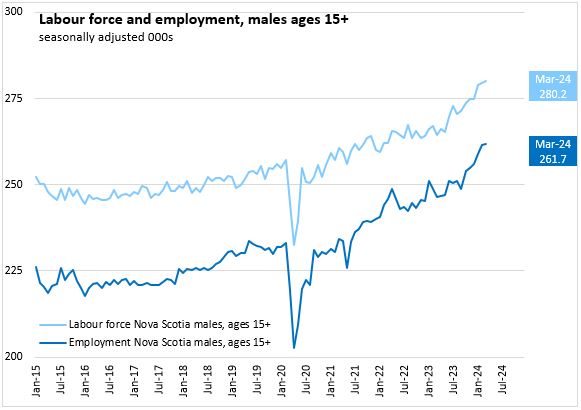

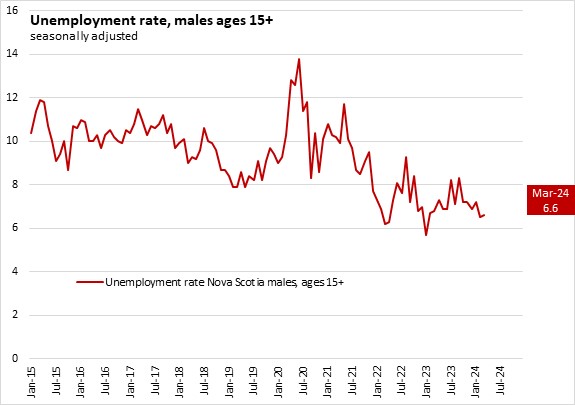

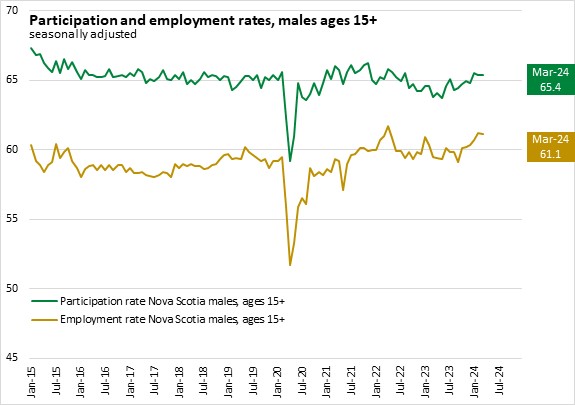

Monthly employment increased by 300 (+0.1%) for males while the labour force increased by 700 (+0.3%). With a larger increase in labour force than employment, the male unemployment rate edged up 0.1 percentage points to 6.6% in March. The male participation rate was unchanged at 65.4% and the male employment rate declined 0.1 percentage points to 61.1%.

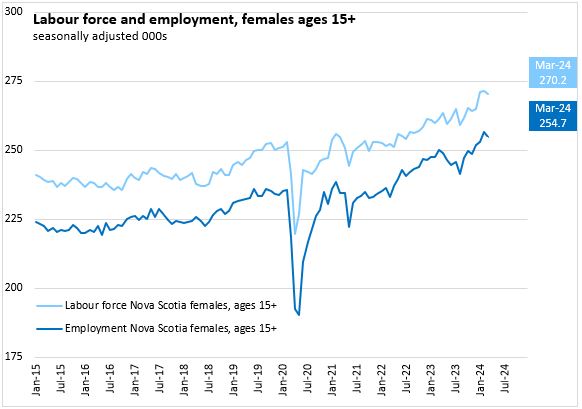

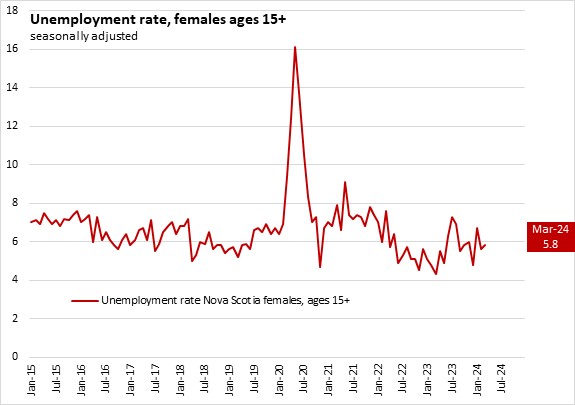

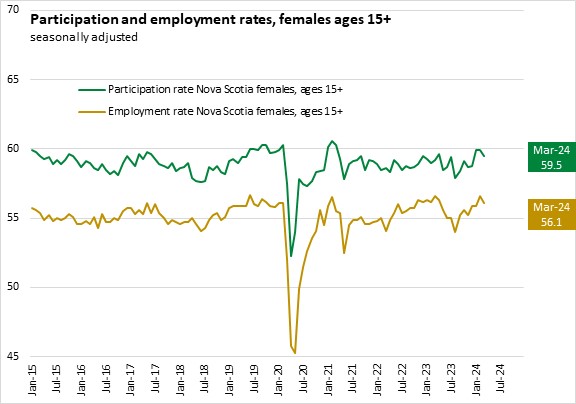

Females reported a decline in employment of 1,700 (-0.7%) and the labour force fell by 1,300 (-0.5%). With employment falling faster than labour force, the female unemployment rate rose by 0.2 percentage points to 5.8% in March. Female participation rates declined 0.4 percentage points to 59.5% and the female employment rate declined 0.5 percentage points to 56.1%.

March's decline in employment was due to the decline in core aged workers and females, partially offset by increases for youth, older workers and males. The monthly labour force decline was due to declines for core and older workers and females.

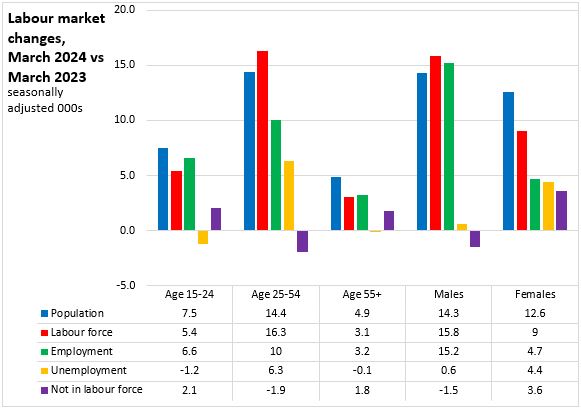

Age and sex cohorts (March 2024 vs March 2023, seasonally adjusted)

Compared with March 2023, labour force and employment growth was highest among core aged workers (whose population has also grown the most over this period). The next highest labour force and employment gains were among youth (15-24). Only the youth cohort had an increase in employment that outpaced labour force gains on a year-over-year basis. Male population, labour force, and employment have increased more than females compared to March 2023.

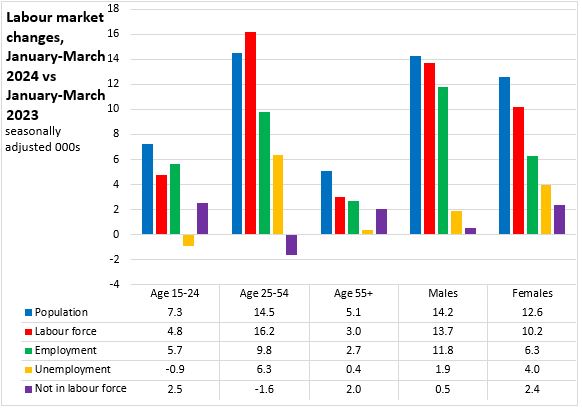

Age and sex cohorts (January-March 2024 vs January-March 2023, seasonally adjusted)

Compared with January-March 2023, labour force and employment growth was highest among core aged workers (whose population is also growing more than others). Youth workers had a faster increase in employment while older workers had a faster increase in labour force (as did the core aged cohort). Male population, labour force, and employment have increased more than females compared to January-March 2023.

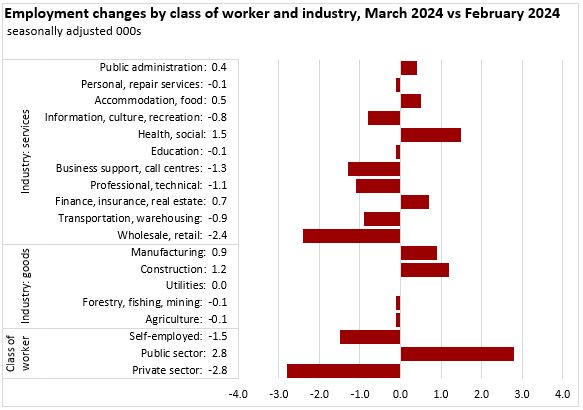

Class of Worker and Industry (March 2024 vs February 2024, seasonally adjusted)

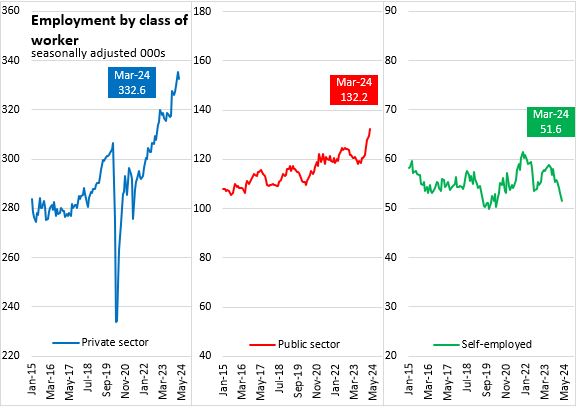

The March 2024 employment change reflected an increase in public sector workers (+2,800 or +2.2%), offset by decreases in private sector workers (-2,800 or -0.8%) and self-employed (-1,500 or -2.8%).

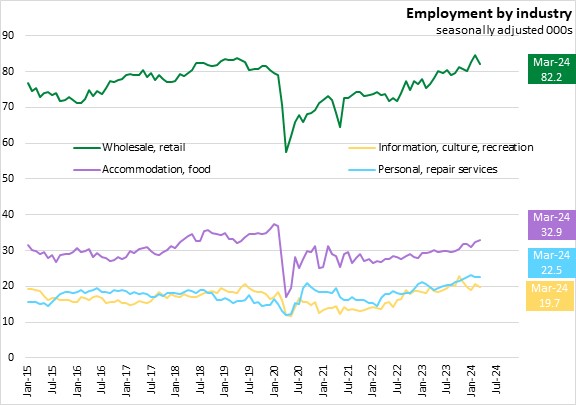

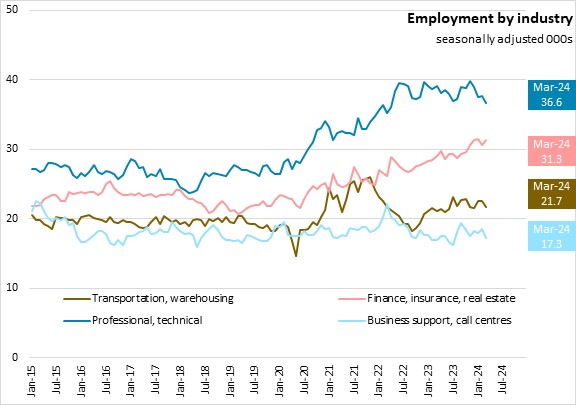

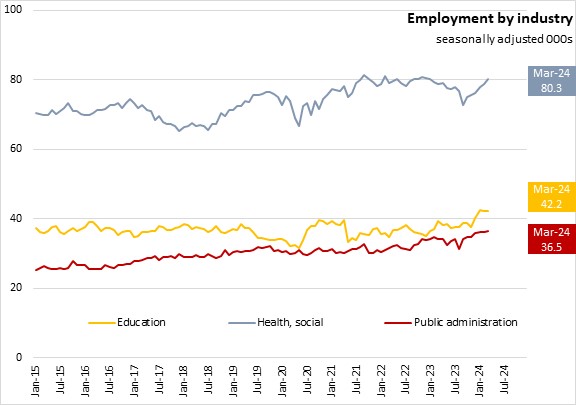

Classified by industry, the largest employment declines from February to March were in wholesale/retail trade, business support (includes call centres) and professional/technical services. The largest increase in employment in March was in health care and social assistance (includes daycares).

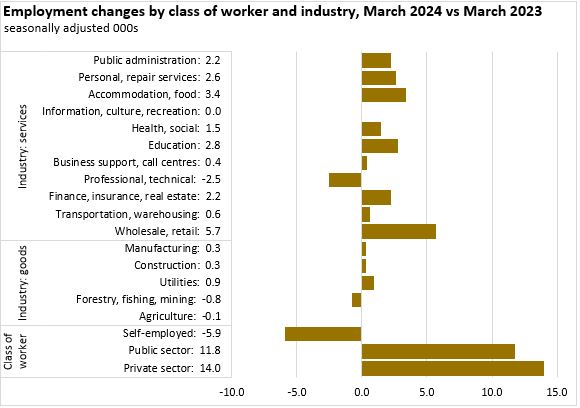

Class of Worker and Industry (March 2024 vs March 2023, seasonally adjusted)

Compared to March 2023, there were gains in employment for private sector workers (+14,000 or +4.4%) and public sector workers (+11,800 or +9.8%), and a decline in self-employed (-5,900 or -10.3%).

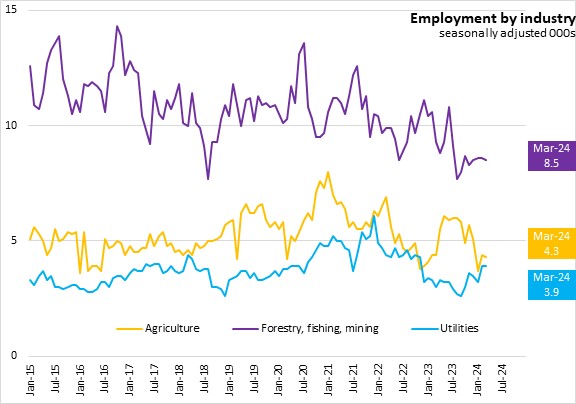

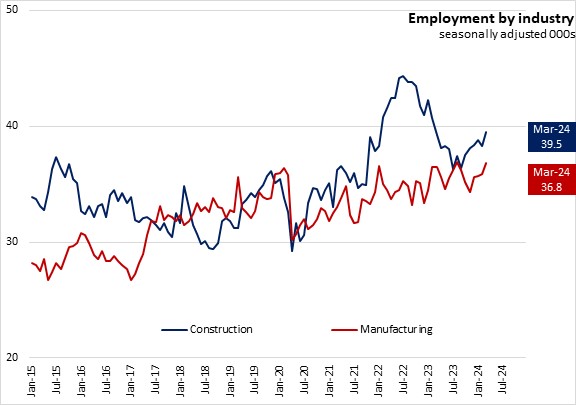

Over the last 12 months, employment was up in most sectors with the largest gains in wholesale/retail trade and accommodation/food. The only declines were reported in professional/technical, forestry/fishing/mining and agriculture.

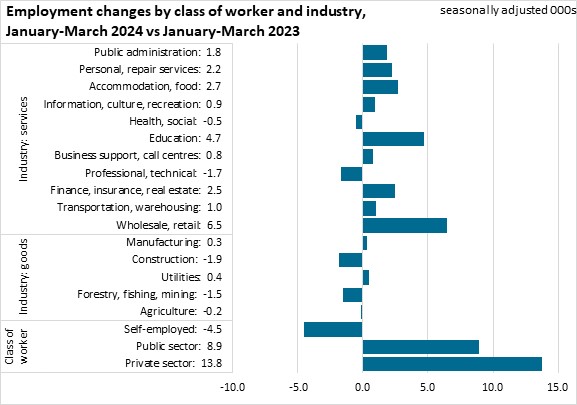

Class of Worker and Industry (January-March 2024 vs January-March 2023, seasonally adjusted)

Compared to January-March 2023, gains were strongest for private sector workers (13,800 or +4.3%) followed by public sector workers (+8,900 or +7.4%). The number of self employed declined (-4,500 or -7.8%) in January-March 2024.

Gains in employment were strongest in wholesale/retail and education while the largest declines were in construction, professional/technical and forestry/fishing/mining in the first three months of 2024.

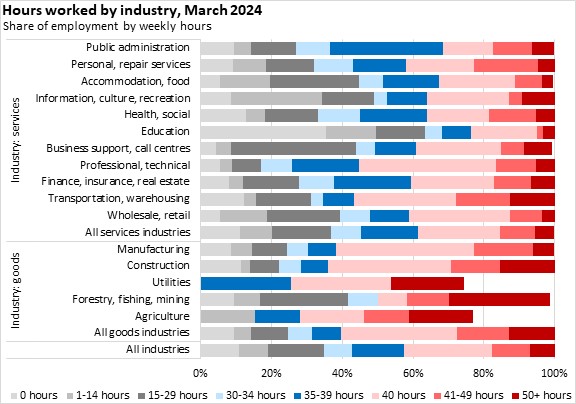

Hours worked and employment (March 2024, unadjusted)

Compared to the provincial average, a larger share of workers in forestry/fishing/mining, agriculture, construction, transportation/warehousing, personal/repair services, manufacturing, utilities and health/social worked more than 40 hours per week in March 2024.

Note that some data on those working few hours in utilities and agriculture were suppressed.

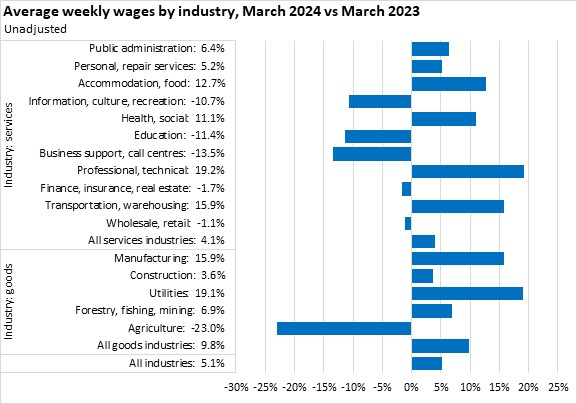

Average weekly earnings (unadjusted, both full time and part time, March 2024 vs March 2023)

Average weekly earnings increased by 5.1% from March 2023 to March 2024. The fastest gains in average weekly earnings were in professional/technical services, and utilities. Agriculture registered the fastest decline in average weekly earnings from March 2023, followed by business support including call centres, education and information/culture/recreation.

The increase in Nova Scotia's all items consumer price index was 2.8% from February 2023 to February 2024.

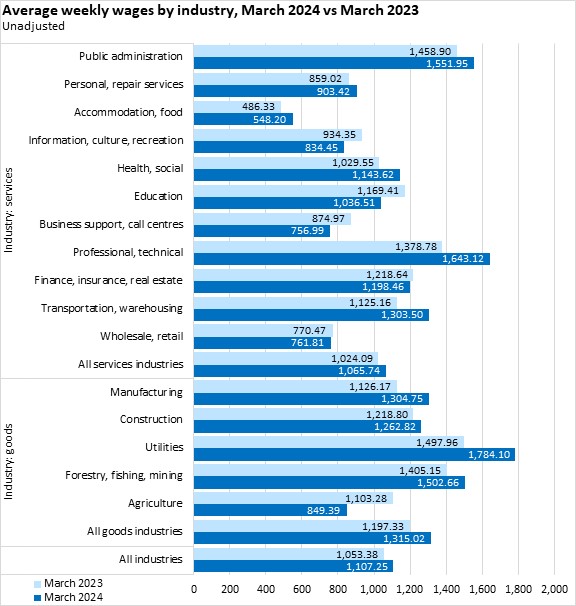

Average weekly earnings across all employees were $1,107.25 in March 2024. The highest average weekly earnings (both full and part time employees) were reported in utilities, professional/technical services, and public administration. The lowest average weekly earnings were in accommodation/food services, business support services including call centres and wholesale/retail trade.

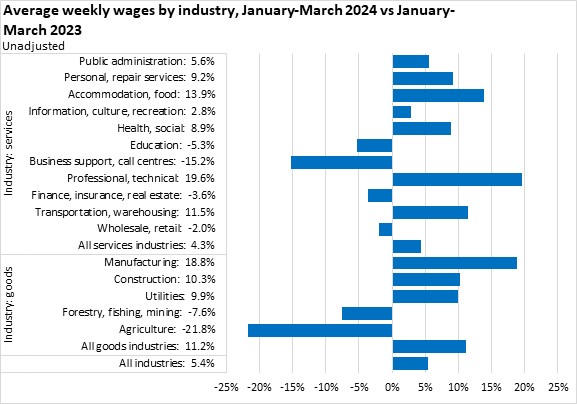

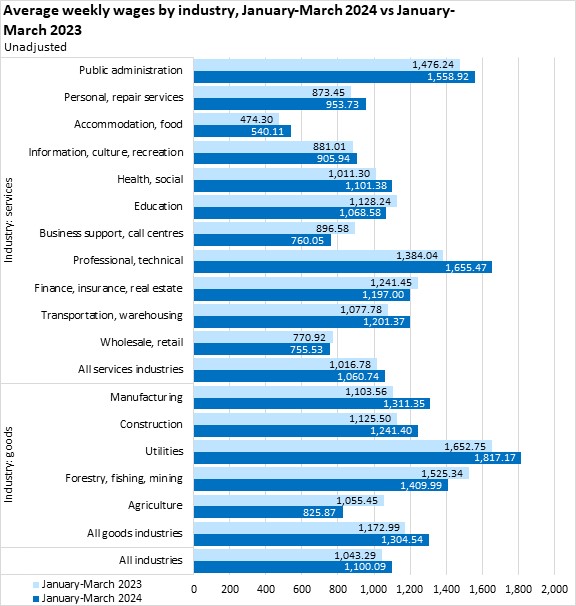

Average weekly earnings (unadjusted, both full time and part time, January-March 2024 vs January-March 2023)

Average weekly earnings increased 5.4% in the first three months of 2024 compared to the same period of 2023. The fastest gains in average weekly earnings were in professional/technical services, manufacturing and accommodation/food services. Agriculture and business support (including call centres) registered the fastest declines in average weekly earnings in January-March 2024.

Average weekly earnings in the first three months of 2024 were highest in utilities, professional/technical services, and public administration. The lowest average weekly earnings were in accommodation/food services, wholesale/retail trade and business support services (including call centres) in January-March 2024.

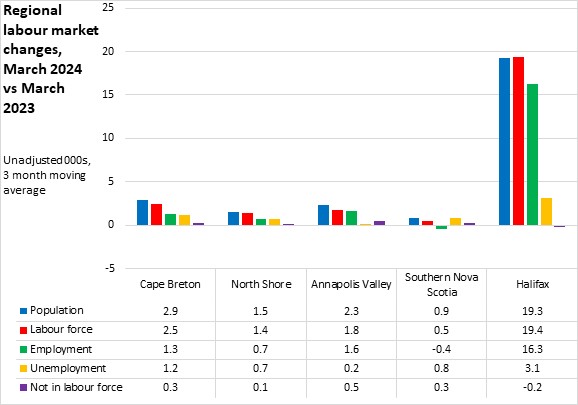

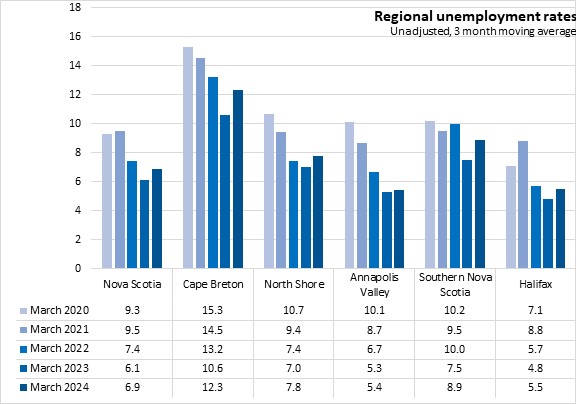

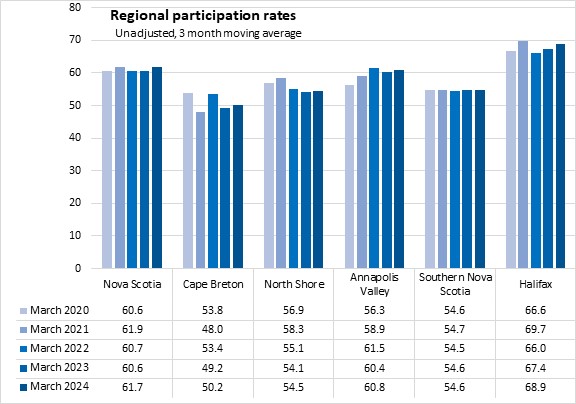

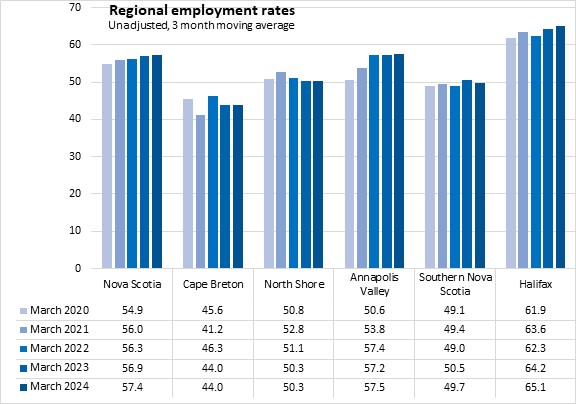

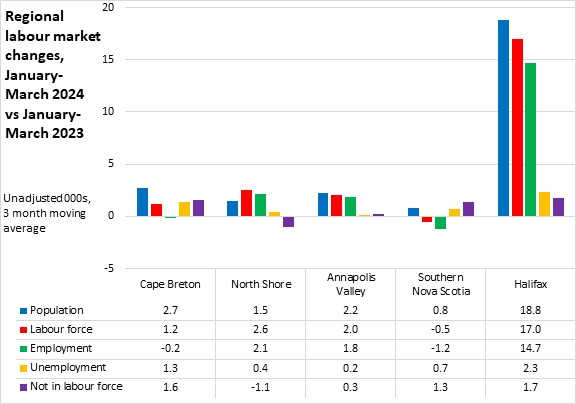

Regions (March 2024 vs March 2023, unadjusted 3 month moving average)

Compared with March 2023, labour force and employment increases were concentrated in Halifax. All regions reported larger gains in labour force than employment. Southern Nova Scotia was the only region to report an employment decline compared to March 2023. As labour force gains outpaced employment, there was growth in unemployment for all regions compared to one year ago. The participation rate was up for all regions except Southern Nova Scotia (unchanged). Employment rates were up in Halifax and Annapolis Valley, unchanged in Cape Breton and North Shore, and down in Southern Nova Scotia compared to one year ago.

Regions (January-March 2024 vs January-March 2023, unadjusted 3 month moving average)

Compared with the first quarter of 2023, all regions except Southern Nova Scotia reported higher labour force. Employment declined in Cape Breton and Southern Nova Scotia. Unemployment increased in all regions.

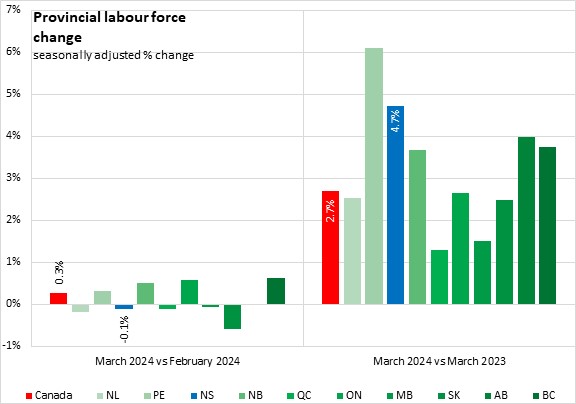

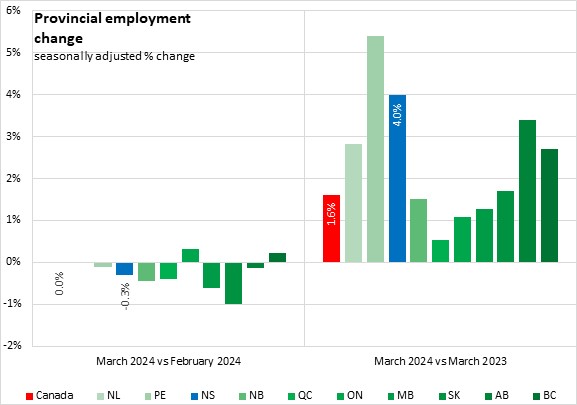

Provincial Comparisons (seasonally adjusted)

Canada's labour force was up 0.3% from February, while Nova Scotia's labour force declined 0.1%. Four provinces reported increases in labour force in March 2024, with the largest percentage increase in British Columbia. The largest decline in labour force was in Saskatchewan.

Compared with March 2023, the national labour force was up 2.7% (+4.7% in Nova Scotia). The fastest increase was in Prince Edward Island while the slowest growth was in Quebec.

Canada's employment was virtually unchanged from February to March, with all provinces except Newfoundland and Labrador, Ontario and British Columbia reporting declines. Compared with March 2023, Nova Scotia's employment was up 4.0%, faster than the national gain of 1.6%. The largest increase in percentage terms was in Prince Edward Island while the slowest growth was in Quebec.

The national unemployment rate was 6.1% in March 2024, up from 5.1% in March 2023. Manitoba and Quebec had the lowest unemployment rate while Newfoundland and Labrador reported the highest unemployment rate in March 2024.

The national participation rate was 65.3% in March 2024. The highest participation rate was in Alberta while the lowest was in Newfoundland and Labrador.

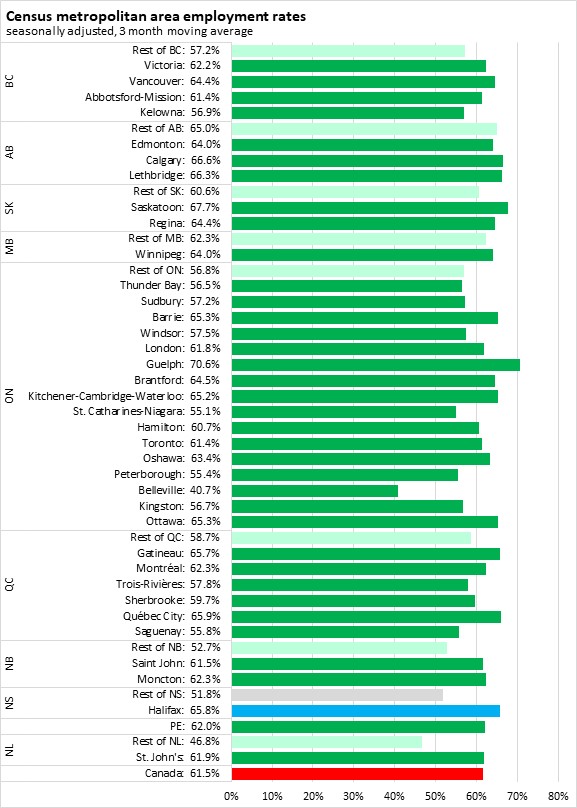

The national employment rate was 61.4% in March 2024. Alberta reported the highest employment rate while Newfoundland and Labrador reported the lowest.

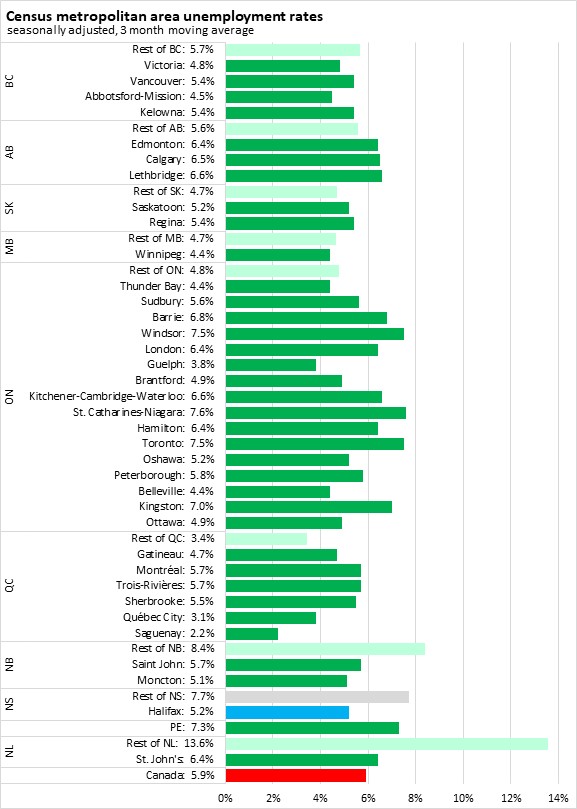

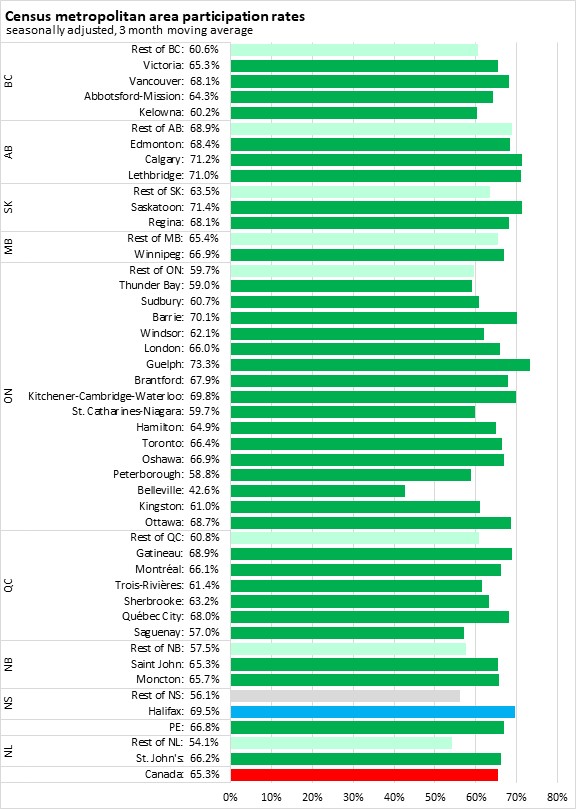

Census Metropolitan Areas (March 2024, seasonally adjusted 3 month moving average)

The Halifax unemployment rate was 5.2% in the seasonally adjusted March 2024 three month moving average. Outside of Halifax the unemployment rate was 7.7%. In central and western provinces, unemployment rates in Census Metropolitan Areas are similar to or higher than unemployment rates outside CMAs. In the Atlantic Provinces unemployment rates are typically higher outside CMAs.

Halifax's participation rate was 69.5% in the seasonally adjusted March 2024 three month moving average, while participation rates were 56.1% across the rest of the province.

Halifax reported an employment rate of 65.8% in the seasonally adjusted March 2024 three month moving average, while the employment rate was 51.8% outside the city.

Sources: Statistics Canada. Table 14-10-0036-01 Actual hours worked by industry, monthly, unadjusted for seasonality; Table 14-10-0063-01 Employee wages by industry, monthly, unadjusted for seasonality; Table 14-10-0287-01 Labour force characteristics, monthly, seasonally adjusted and trend-cycle, last 5 months; Table 14-10-0380-01 Labour force characteristics, three-month moving average, seasonally adjusted; Table 14-10-0387-01 Labour force characteristics, three-month moving average, unadjusted for seasonality, last 5 months; Table 14-10-0355-01 Employment by industry, monthly, seasonally adjusted and unadjusted, and trend-cycle, last 5 months (x 1,000); Table 14-10-0288-01 Employment by class of worker, monthly, seasonally adjusted and unadjusted, last 5 months (x 1,000); Table: 14-10-0380-02 Labour force characteristics, three month moving average, seasonally adjusted (x 1,000)

<--- Return to Archive