The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

March 27, 2024ONTARIO BUDGET 2024-25 The Province of Ontario has tabled its provincial budget for 2024-25.

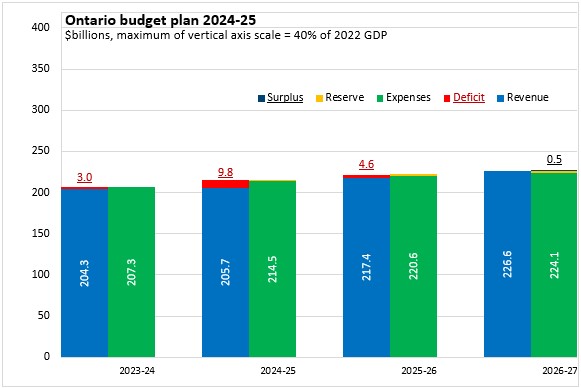

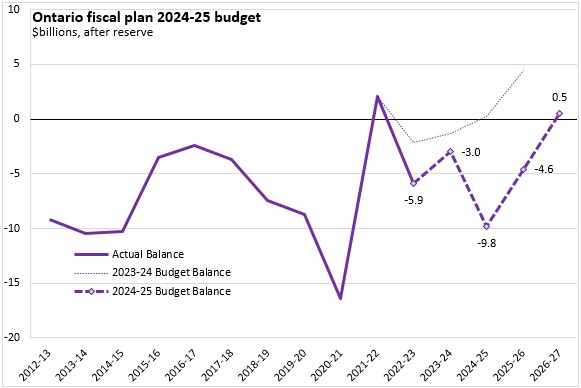

Ontario anticipates a deficit of $9.8 billion for 2024-25, rising from the deficit of $3.0 billion now expected for 2023-24. Ontario's deficit is projected to narrow to $4.6 billion in 2025-26 before returning to a surplus of $0.5 billion in 2026-27.

Ontario's revenue growth is projected to slow to 0.7% in 2024-25 (compared with the interim revenue estimate for 2023-24) while expenditures are planned to grow by 3.5%. For 2025-26, revenue growth is expected to accelerate to 5.7% while expenditure growth slows to 2.8%. In 2026-27, revenue growth of 4.2% continues to outpace expenditure increases of 1.6%.

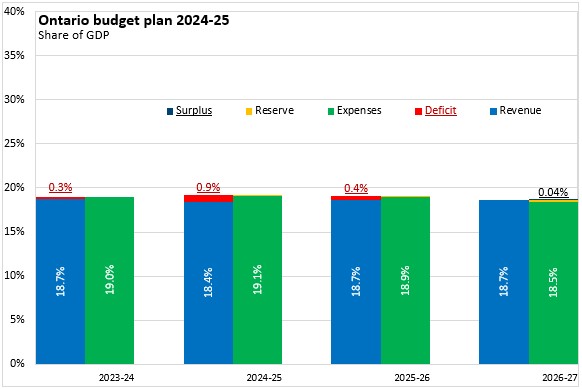

Measured as a share of GDP, the footprint of provincial government in the Ontario economy is expected to be stable - declining slowly from 19.1% of GDP in 2024-25 to 18.7% of GDP by 2026-27. Ontario's deficit for 2024-25 amounts to 0.9% of GDP.

Ontario's net debt is expected to remain fairly stable at 39.2% of GDP in 2024-25, rising slightly to 39.5% of GDP in 2025-26 and then falling back to 39.1% of GDP in 2026-27.

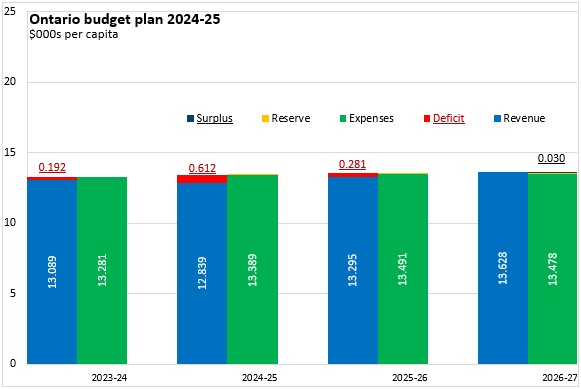

Ontario's provincial government expenditures amount to $13,389 per capita in 2024-25. By 2026-27, Ontario's per capita expenditures amount to $13,478 per capita. Ontario's deficit amounts to $612 per capita in 2024-25, falling to $281 per capita by 2025-26.

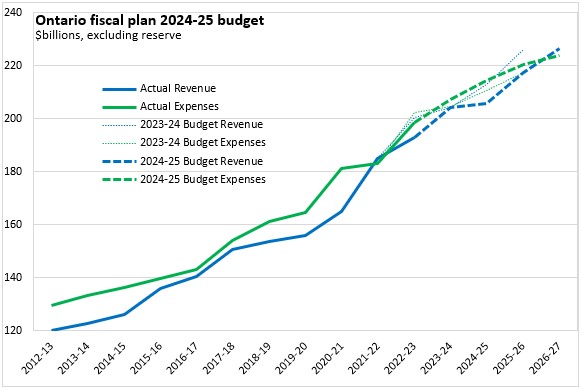

Unlike many other provinces, Ontario's revenues are not substantially higher than anticipated in the 2023-24 Budget fiscal plan. Rather - Ontario's revenues for 2024-25 are now projected to be $7.3 billion lower than in the 2023-24 fiscal plan. Ontario's expenditures for 2024-25 are now projected to be $3.7 billion higher than previously planned in the 2023-24 fiscal plan.

Ontario's slower revenue growth and higher expenditure outlook have led to an erosion of the province's planned fiscal position. The 2024-25 deficit is a $10 billion deterioration from last year's fiscal plan while the 2025-26 outlook for the deficit is a $9 billion deterioration.

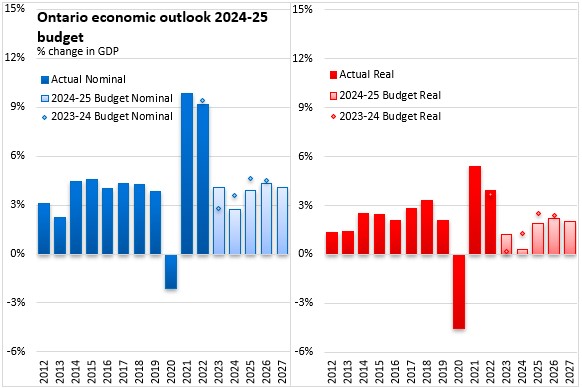

Although supply chain pressures and commodity prices have eased, Ontario's economic growth is still hindered by high interest rates intended to cool inflation. High interest rates have weighed particularly on housing construction. Ontario's real GDP growth is projected to slow from an estimated 1.2% in 2023 to 0.3% in 2024. Ontario's labour market growth is also expected to slow in 2024, with employment gains of just 0.8% (down from 2.4% in 2023). For 2025, Ontario's real GDP growth is projected to get back on trend with a 1.9% gain, accompanied by rebounding housing construction, employment growth and consumer spending.

Key Measures and Initiatives

Ontario's 2024-25 Budget focuses on building housing and infrastructure, enhancing skills, relieving cost pressures and improving services. Key measures include:

Building infrastructure and housing

- Investing more than $190 billion (10 years) for highways, transit, homes, high-speed internet and other infrastructure

- $1 billion for housing-enabling municipal infrastructure projects

- Rewarding municipalities that achieve their housing targets with funding from the $1.2 billion (3 year) Building Faster Fund

- Advancing critical highway projects

- Improving GO train and GO bus services, connecting light rail transit, advancing four priority subway projects and restoring passenger rail service to Northern Ontario.

- $200 million Community Sport and Recreation Infrastructure Fund

- Building Ontario’s end-to-end electric vehicle (EV) and battery supply chain

- $8 billion in cost savings and support for businesses in 2024 ($3.7 billion for small businesses)

- $50 billion (10 years) for building new health infrastructure

- $620 million (10 years) to address urgent health infrastructure renewal

- Continuing to build 58,000 new or upgraded long-term care beds

- $155 million in 2024–25 to fast-track construction of long-term care homes

- $23 billion (10 years) for schools and child care facilities

- $100 million for the Invest Ontario Fund (total: $600 million) to attract investments and jobs in key sectors

- Investing an additional $15 million (3 years) in the Critical Minerals Innovation Fund

- Increasing the Northern Energy Advantage Program (NEAP) to $167 million in 2024–25 to help large industrial operators manage electricity costs

Skills enhancement

- $100 million in 2024–25 in the Skills Development Fund Training Stream

- $16.5 million annually for 3 years through the Skilled Trades Strategy

Relief from cost pressures

- Extending cuts to the gasoline tax rate by 5.7 cents per litre and the diesel tax rate by 5.3 cents per litre until December 31, 2024

- Expanding the Ontario Guaranteed Annual Income System (GAINS) program for seniors and indexing the benefit to inflation

- Increasing income eligibility thresholds for the Ontario Electricity Support Program up to 35 per cent effective March 1, 2024

- Reducing transit costs through One Fare transfer system between GO Transit, the TTC and other GTA transit systems

- Banning new tolls on new and existing provincial highways and freezing fees on driver’s licences and photo cards

- Modernizing auto insurance to provide more affordable options and improved access to benefits

- Extending authority to all single- and upper-tier municipalities to impose a municipal tax on vacant homes

- Strengthening Ontario’s Non-Resident Speculation Tax $152 million (3 years) for supportive housing initiatives to support vulnerable people

- Legislation for government to ask voters, via a referendum, before implementing any carbon pricing program

Service enhancements

- Establishing a medical school at York University primarily focused on training family doctors

- New and expanded interprofessional primary care teams with a total additional investment of $546 million over three years, starting in 2024–25.

- $2 billion to support expansion and increase compensation for frontline workers in home and community care

- $743 million (3 years) to address immediate health care staffing needs

- $30 million for the expanded Ontario Learn and Stay Grant for health care in underserved communities

- $50 million (3 years) to recruit and retain health care workers in Northern communities

- $94 million (3 years) for culturally responsive health care for Indigenous and Northern communities

- $396 million (3 years)for addictions and mental health services

- $172 million for targeted math and reading supports and an updated kindergarten curriculum

- $120 million for the Ontario Autism Program

- $46 million (3 years) to improve community safety in the GTA

- $49 million (3 years) for policing auto thefts

- $13.5 million (3 years) to enhance support for women, children, youth and others at increased risk of violence or exploitation

Ontario Budget 2024-25

<--- Return to Archive