The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

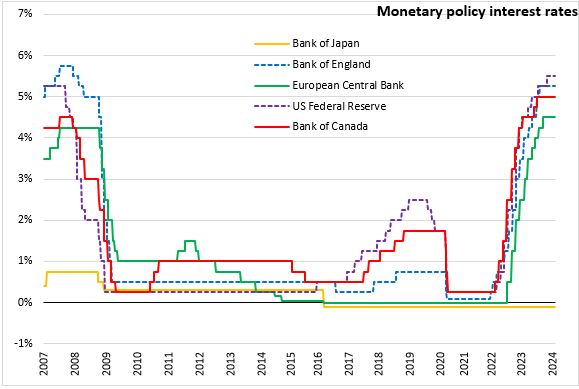

January 25, 2024EUROPEAN CENTRAL BANK MONETARY POLICY The European Central Bank (ECB) announced today that it would keep the three key ECB interest rates unchanged. The interest rates on the main refinancing operations, the marginal lending facility and the deposit facility will remain at 4.50%, 4.75% and 4.0% respectively.

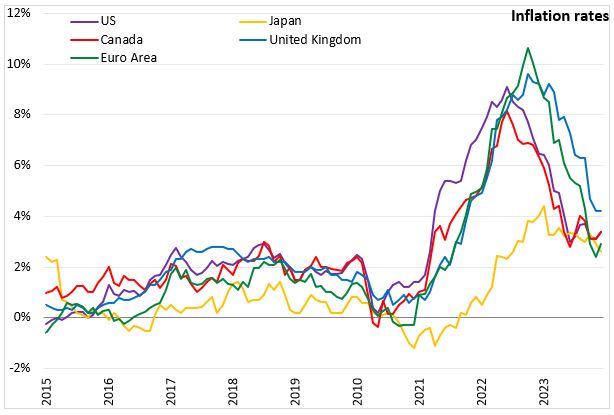

Given the outlook for inflation, the Governing Council believes that key interest rates are at a level that will make a substantial contribution to returning inflation to their 2% target.

Food price inflation dropped to 6.1% in December. Inflation excluding energy and food also declined again, to 3.4%, due to a fall in goods inflation to 2.5%. Services inflation was stable at 4.0%. Inflation is expected to ease further as supply constraints and past energy shocks ease.

Economic activity slowed in the end of 2023 and is likely to weaken in the near term. Demand for labour is slowing and job vacancies are decreasing. Unemployment rate has fallen to 6.4% in November.

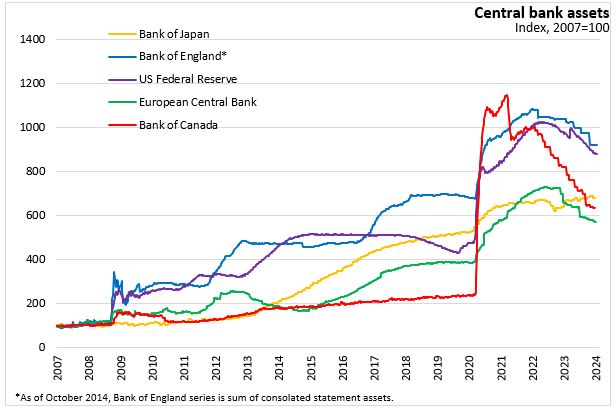

The asset purchase programme (APP) portfolio is declining at a measured and predictable pace, as the Eurosystem does not reinvest all principal payments from maturing securities. The Governing Council intends to reinvest the principal payments from maturing securities purchased under the pandemic emergency purchase programme (PEPP) during the first half of 2024. Over the second half of the year, it intends to reduce the PEPP portfolio by €7.5 billion per month on average. The Governing Council intends to discontinue reinvestments under the PEPP at the end of 2024.

The Governing Council notes that future policy rate decisions will be based on its assessment of the inflation outlook (including the dynamics of underlying inflation), incoming economic and financial data, and the strength of monetary policy transmission.

The next scheduled monetary policy meeting will be on March 3, 2024.

Source: European Central Bank: Monetary Policy Decisions, Monetary Policy Statement (Press Conference)

<--- Return to Archive