The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

January 24, 2024BANK OF CANADA MONETARY POLICY The Bank of Canada maintained its target for the overnight rate at 5%, with the Bank rate at 5.25% and the deposit rate at 5%. The Bank is continuing its policy of quantitative tightening.

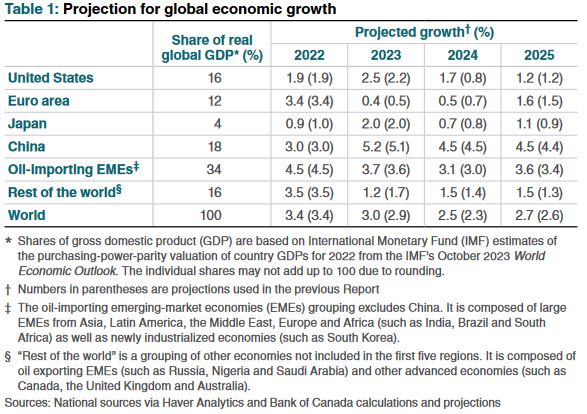

Global growth has slowed in 2023 but was stronger than anticipated due to stronger than expected strength in US economy. Growth is likely to moderate further in 2024 with slower growth in US economy and China. Euro area is experiencing a mild contraction.

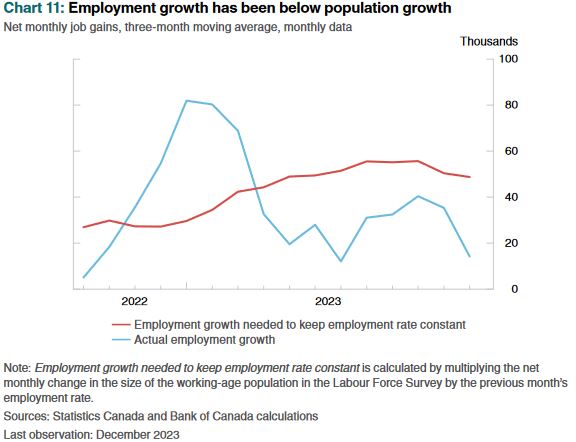

In Canada, economic activity has stalled in the middle of 2023 and growth is expected to remain around 1% in 2024. With weakness, supply has caught up with demand and now looks to be in modest excess supply. Labour market conditions have also eased and with improved balance between labour demand and supply. Wage growth remians around 4% to 5%.

Global economy

Global economy continues to slow, and inflation has eased further. After a robust 2023, growth in the United States is anticipated to slow in 2024 with weakening consumer spending and business investment. Euro area is experiencing a mild contraction and China with its low consumer confidence and policy uncertainty will likely experience restrained activity. Oil prices are $10-per-barrel lower than was assumed in the October Monetary Policy Report. The Bank now forecasts global GDP growth of 2.5% in 2024 and 2.7% in 2025, following growth of 3% in 2023. With softer growth this year, inflation rates in most advanced economies are expected to come down slowly, reaching central bank targets in 2025.

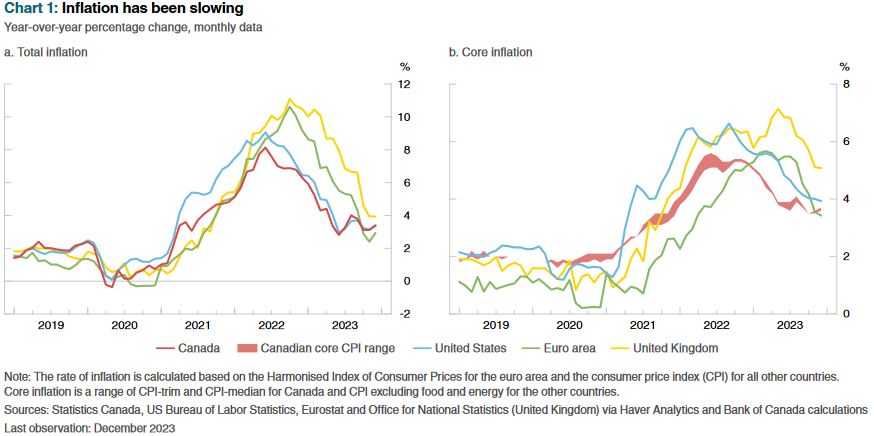

Inflation has eased around the world. Consumption has moved away from durable goods towards more services and core inflation of goods has declined. Further declines are expected as demand declines in United States and the euro area. Further disruptions in to trade through the Red Sea could reverse some of the downward pressure on inflation that has come from improvements in supply chains.

In the United States, goods price inflation has weakened as it recovers from past energy disruptions and less pressure on import prices. Inflation in shelter is still elevated but has been falling gradually and is expected to continue the decline in 2024. Shelter price inflation is projected to ease from an elevated rate due to the delayed effect from slower growth in rental prices for new tenants. Wage growth is expected to slow while productivity growth remains solid. Government spending is not expected to support growth in 2024 as it did in 2023.

China’s economy is expected to grow between 4% and 5% over the projection horizon. Ongoing issues in the property sector as well as policy uncertainty and weak consumer confidence continue to restrain activity.

Growth in the euro area remains modest with past increases in the interest rates acting as a drag on demand. Subdued foreign demand, and higher energy costs have eroded competitiveness and are slowing growth. Economic growth will pick up gradually over 2024 and 2025 with fading energy shortage and less restrictive monetary policy.

Canada

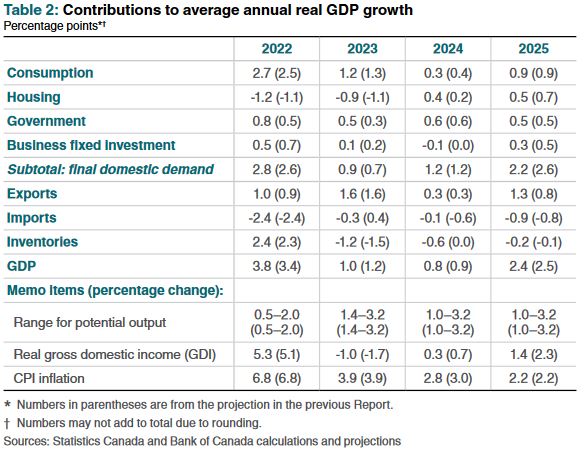

In Canada, economic activity has stalled since the middle of 2023 and growth is expected to remain around zero through the first quarter of 2024. Consumer spending and business investment have declined. Weak growth allowed supply to catch up with demand and now economy is operating in modest excess supply. Job vacancies have returned near pre-pandemic levels and new jobs are being created slower than population growth. Wage growth is still around 4%-5%. Economic growth is expected to strengthen in the middle of 2024. Overall, the Bank forecasts GDP growth of 0.8% in 2024 and 2.4% in 2025, roughly unchanged from its October projection.

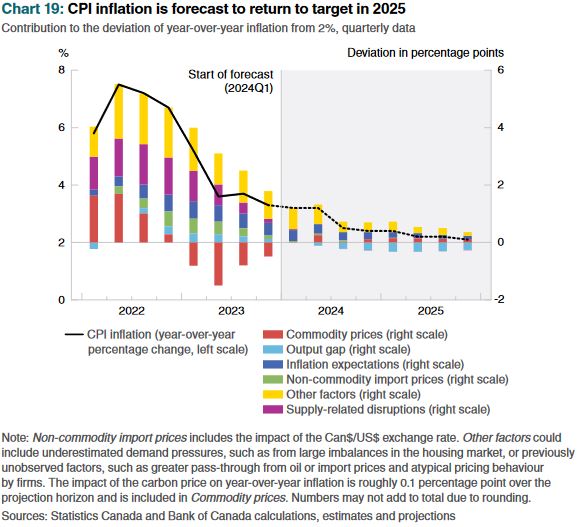

Inflation in December 2023 was 3.4% with shelter cost remaining the largest contributor. The Bank expects inflation to remain close to 3% during the first half of this year before gradually easing and returning to the 2% target in 2025. Core measures of inflation are not showing sustainable declines unlike broader measure of CPI components.

Labour markets have eased further, and job vacancy rates have declined to near pre-pandemic levels. Unemployment rate was 5.8% in December, but labour shortages have declined and are reported as being close to historical averages. Labour supply and demand are coming to a balance.

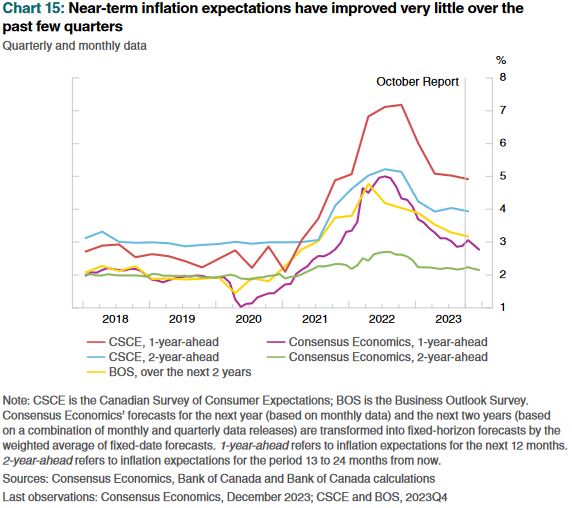

There has been a modest decline in near-term inflation expectations of businesses and households. Inflation for the next two years is still expected to average between 3% and 3.5%. Consumers’ inflation expectations have not declined significantly. There is elevated uncertainty about the path of inflation over the next few years, but long-term inflation is still consistent with the 2% target. Wage growth is currently higher than growth in productivity. If this persists then inflationary pressures may increase.

Largely unchanged from the October report, economic growth is expected to be subdued. Past interest rate policies continue to restrain consumption and business investment. Weak foreign demand will weigh on exports through the rest of the year. Government spending mainly contributes to growth in 2024 while strong population growth props up overall economic activity, with declining GDP per capita in the short term. Growth is forecasted to pick up in middle of 2024 and rise to approximately 2.4% in 2025 with a pickup in foreign demand.

Consumer spending is expected to remain weak until the end of 2024. Increasing population will support consumption growth, but on per capita basis, it is projected to decline through 2024. Households are cutting back on their spending and delaying their purchases especially on durable goods. In 2025, consumer spending is expected to recover. Households are expected to have higher mortgages rates when renewing them. 2024 is expected to bring higher residential investment with growth in population and easing effects of interest rates. Resale activity is projected to increase from its current low levels. House price growth is expected to be moderate over the projection horizon.

CPI inflation is expected to remain close to 3% over the first half of 2024. Elevated shelter price inflation and food price inflation are contributing to keep the level of inflation high. Price inflation excluding food and energy is expected to decline. Food prices inflation is expected to slow due to lower global prices for agriculture products. Most businesses expect input price growth to ease over the next 12 months. Inflation in prices for services excluding shelter is anticipated to pick up modestly over the near term, largely due to less downward pressure from telecommunications prices.

Shelter price inflation remains elevated for some time. Growth in mortgage interest costs remains high as households continue to face higher rates at renewal and new mortgages are issued at rates above the average of the existing stock. Rental price inflation is also expected to moderate due to a slowdown in population growth and an expected increase in new housing construction. House prices are expected to contribute only modestly to overall shelter price inflation.

The Governing Council decided to maintain the policy interest rate and continue to normalize the Bank's balance sheet given the lagged effects of monetary policy and recent evidence of easing excess demand in the economy. Governing Council noted that The Bank remains concerned about the persistence of underlying inflationary pressures, and is prepared to increase the policy interest rate further if needed. Governing Council will continue to assess the dynamics of core inflation and the outlook for CPI inflation, and is committed to restoring price stability.

The next scheduled date for announcing the overnight rate target is March 6, 2024. The Bank will publish its next full outlook for the economy and inflation, including risks to the projection in the MPR on April 10, 2024.

Bank of Canada: Rate Announcement, Monetary Policy Report (January 2024)

<--- Return to Archive