The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

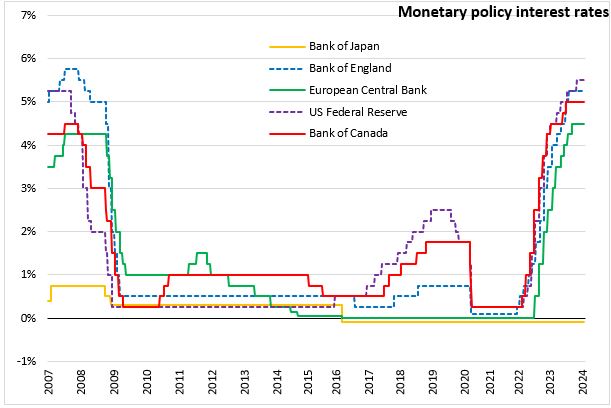

January 23, 2024BANK OF JAPAN MONETARY POLICY The Policy Board of the Bank of Japan decided to maintain a negative interest rate of 0.1% for the Policy-Rate Balances in current accounts held by financial institutions at the Bank.

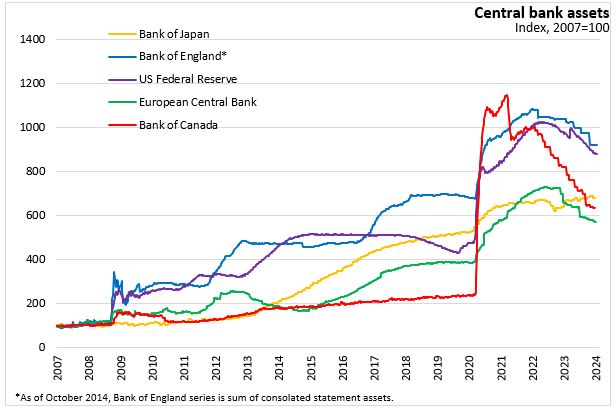

The Bank of Japan will also purchase a necessary amount of Japanese government bonds (JGBs) without setting an upper limit in order to keep the 10-year JGB yields at around zero per cent. The Bank will regard the upper bound of 1.0 per cent as a reference for its market operations. To have a yield curve that is consistent with its guidelines, the Bank will continue with large scale JGB purchases and make nimble responses for each maturity.

In addition, the Bank will purchase exchange-traded funds (ETFs) and Japan real estate investment trusts (J-REITs) as necessary so that their amounts outstanding will increase at annual paces with upper limits of about 12 trillion yen and about 180 billion yen, respectively. The Bank will maintain Commercial Paper (CP) holdings at 2 trillion yen and will purchase corporate bonds at about the same pace as before the COVID-19 pandemic with amounts outstanding gradually returning to about 3 trillion yen.

The Bank will continue with “Quantitative and Qualitative Monetary Easing (QQE) with Yield Curve Control”, aiming to achieve the price stability target of 2 per cent, as long as it is necessary for maintaining that target in a stable manner. The Bank also noted that it will continue expanding the monetary base until the year-on-year rate of increase in the observed CPI (all items less fresh food) exceeds 2 per cent and stays above the target in a stable manner to facilitate economic activity and wage growth. By a unanimous vote, the Bank decided to extend the deadline for loan disbursement by one year under the Fund-Provisioning Measure to Stimulate Bank Lending.

Japan's seasonally adjusted unemployment rate remained unchanged at 2.5% in November from October 2023. Compared with the previous month, Japan's labour force grew slightly faster (+0.43%) than employment (+0.39%).

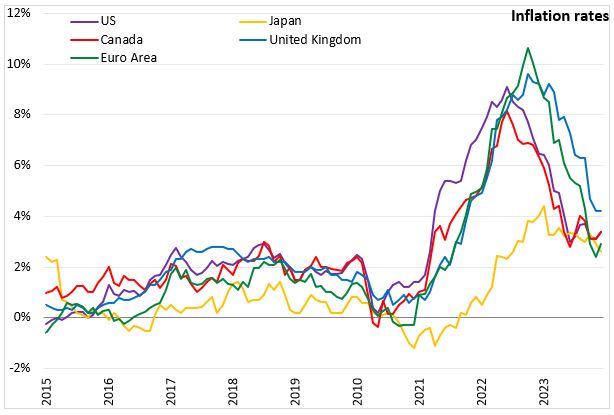

Japan’s inflation (all items, year-over-year growth in consumer price index) increased by 2.6% in December. Japan's underlying inflation (all items excluding fresh food and energy) increased to 3.7%.

The Bank of Japan noted that it will continue with monetary easing while nimbly responding to developments in economic activity and prices as well as financial conditions to achieve the price stability target of 2.0% in a sustainable and stable manner, accompanied by wage increases.

The next monetary policy meeting is on March 18 and 19, 2024.

Source: Bank of Japan, Statement on Monetary Policy (January 23, 2023)

<--- Return to Archive