The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

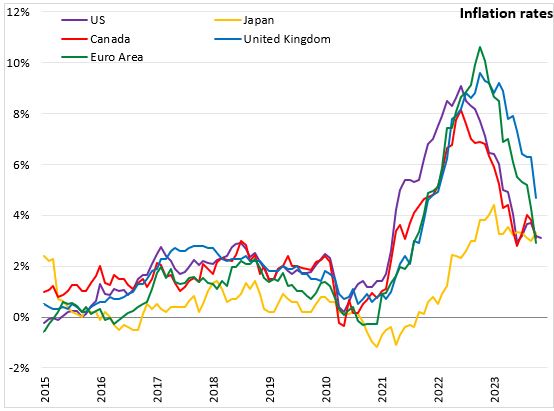

December 14, 2023BANK OF ENGLAND MONETARY POLICY The Monetary Policy Committee (MPC) of the Bank of England voted to maintain Bank Rate at 5.25%. In the MPC’s November Monetary Policy Report projections, market conditions are directing a path for a bank rate to remain around 5.25% until Q3 2024 and then decline gradually to 4.25% by the end of 2026. GDP is forecasted to be flat in the first half of their forecast period. In the most likely scenario, CPI inflation is projected to return to 2% target by the end of 2025 and fall below target in the years following.

Global GDP is expected to have grown 0.5% in 2023 Q3, slightly stronger than November projections, with advanced economies diverging where US has grown stronger than Euro Area. US GDP had grown by 1.3% in 2023 Q3, stronger than had been expected in the November Report, but was projected to slow markedly in the fourth quarter. Euro-area GDP had contracted by 0.1% in the third quarter, just above the November Report projection, and was expected to be flat in 2023 Q4.

According to the flash estimate, annual euro-area headline HICP inflation had fallen to 2.4% in November. Energy and food prices had contributed to the decline, and core goods and services price inflation had also declined such that core inflation had fallen to 3.6%. In the United States, headline CPI inflation had fallen to 3.1% in November, with energy price deflation contributing to the decline. Core CPI inflation had remained more stable in recent months, at 4.0%, as core services price inflation had eased more slowly.

The experimental estimate of the unemployment rate, based on the LFS data for June projected forward in line with the claimant count, had remained flat at 4.2% in the three months to October. The vacancies-to-unemployment ratio had fallen to 0.66 in the three months to October, slightly above the levels seen just prior to the pandemic, accounted for mainly by a fall in vacancies.

The MPC will continue to monitor for persistent inflationary pressures, including tightness of labour market conditions, behaviour of wage growth and services inflation. The Bank notes that further tightening in monetary policy would be required should the economy feel more persistent inflationary pressures.

The next scheduled monetary policy meeting will be on February 1, 2024.

Source: Bank of England, Monetary Policy Summary

<--- Return to Archive