The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

November 16, 2023FIXED CAPITAL INVESTMENT, STOCK, AGE AND SERVICE LIFE, 2022 Statistics Canada has released estimates for investment, stock, age and remaining service life of capital investments. Data are available for residential (investment, stock) and non-residential (investment, stock, age, service life). All values in this report are stated in constant dollar terms ($2017).

Residential

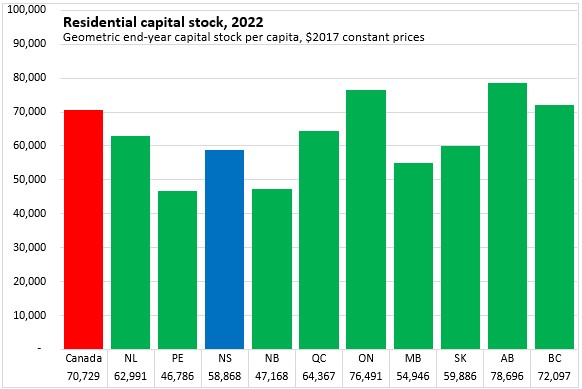

Nova Scotia real residential capital stock per capita ($2017) amounted to $58,868 or 83.2% of the national average. New Brunswick and Prince Edward Island (~2/3 of the national average) had the lowest capital stock per capita while Alberta (111.3% of the national average) and Ontario (108.1% of the national average) had the highest.

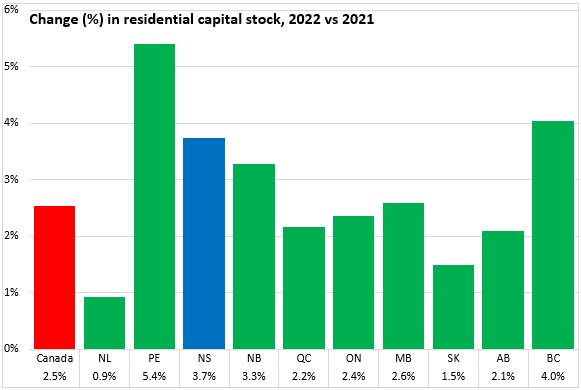

In the last year, Nova Scotia's residential capital stock (measured on a geometric end-year net basis) increased by 3.7% including the impacts of investment, demolitions and depreciation. National residential capital stock increased by 2.5% with gains in all provinces. The fastest growth was in Prince Edward Island and the slowest in Newfoundland and Labrador.

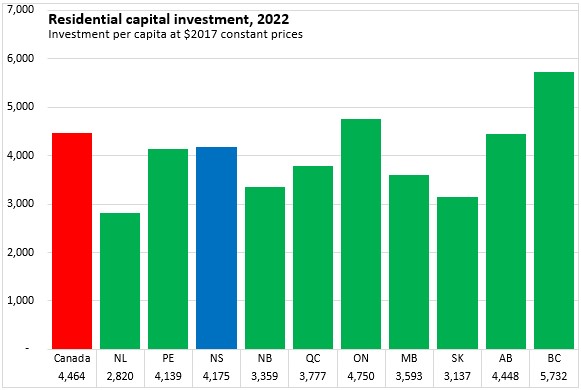

Per capita residential investment for 2022 (in real terms) was $4,175 in Nova Scotia or about 7.4% of the 2021 end year capital stock. National investment was $4,464 or 6.5% of 2021 end year capital stock. The largest investment was in British Columbia at $5,732 per capita (8.3% of 2021 capital stock) though Prince Edward Island's residential capital investment represented a larger share (9.3%) of 2021 residential capital stock.

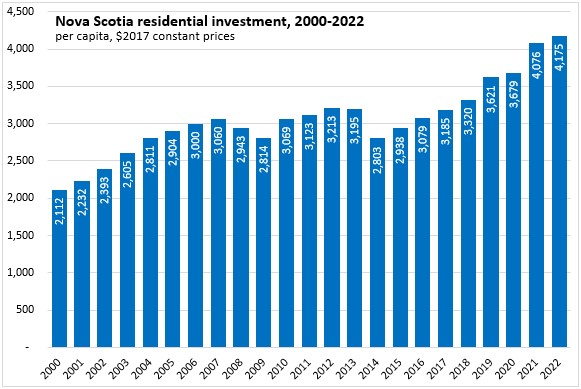

Nova Scotia's real per capita investment in residential capital has been rising in each of the last 8 years.

The real net stock of residential structures has been rising steadily in Nova Scotia.

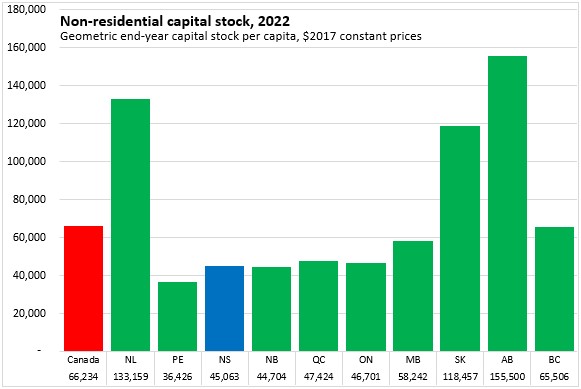

Non-residential capital stock and investment

The amount of non-residential capital stock varies considerably across Canada. Notably, provinces with higher natural resource endowments (Alberta, Newfoundland and Labrador and Saskatchewan) have considerably higher amounts of non-residential capital stock per capita than other provinces. Nova Scotia's net capital stock per capita was just over one quarter (29.0%) of the value in Alberta. Outside resource-producing regions, net non-residential capital stock per capita was similar for Nova Scotia, New Brunswick, Quebec and Ontario; slightly higher for Manitoba and British Columbia and lower for Prince Edward Island.

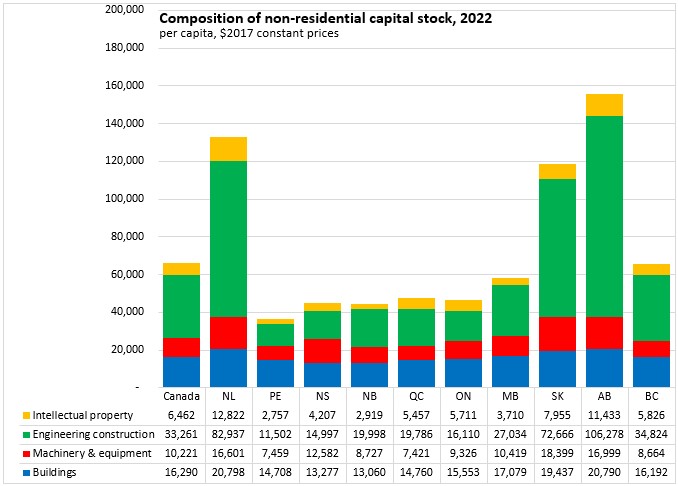

The composition of capital stock by type of asset shows that high quantities of engineering construction assets (including oil and gas production facilities) explain much of the high levels of non-residential capital stock in resource-producing regions. However, resource-producing regions also have higher amounts of machinery and equipment, non-residential buildings and intellectual property assets (including information generated through resource exploration).

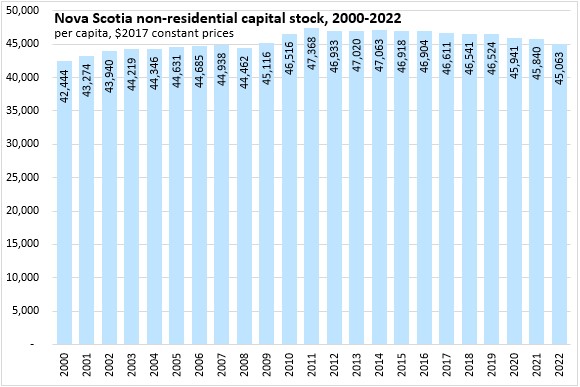

The size of Nova Scotia's real capital stock of non-residential assets increased by 0.8% in 2022, including the effects of investment and depreciation. This was slower than the 1.0% national increase. British Columbia reported the largest gains while Newfoundland and Labrador, New Brunswick and all three prairie provinces reported decreases.

Nova Scotia's non-residential capital stock has been declining in real per capita terms since 2014.

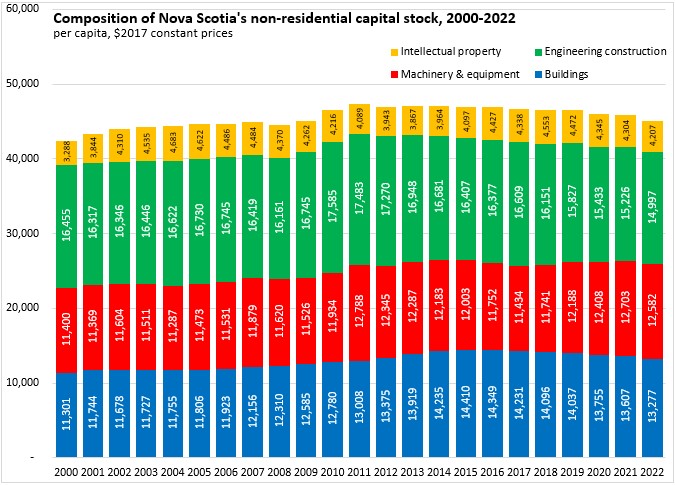

Nova Scotia's declining non-residential capital stock since 2014 can be attributed to falling levels of engineering construction and buildings capital stock.

In 2022, Nova Scotia real investment per capita in non-residential capital stock was less than half that reported in Alberta. As with capital stock, resource-producing regions invested in much more non-residential assets per capita than did central Canada, Manitoba and the Maritime provinces.

Higher levels of investment reported in resource-producing regions are particularly concentrated in engineering construction assets with higher investments in machinery and equipment as well as intellectual property.

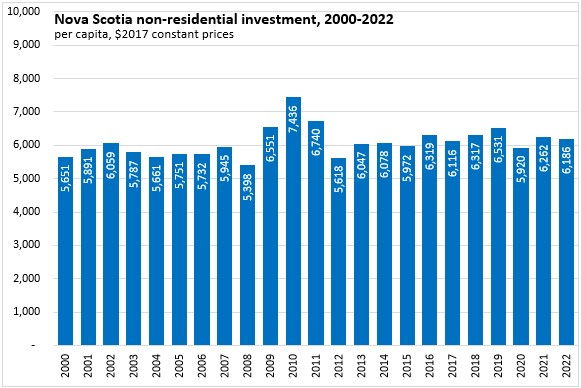

Nova Scotia's pace of real investment in non-residential assets slowed in 2020 and had not yet recovered to 2019 levels by 2022.

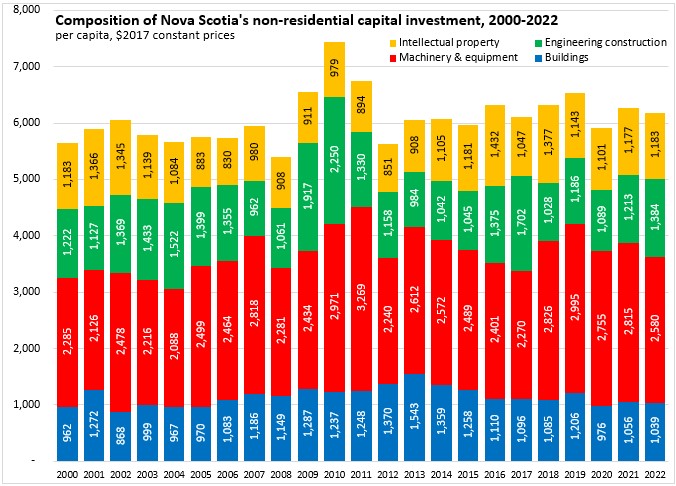

Nova Scotia's investment in non-residential assets is generally concentrated in machinery and equipment.

Asset age and remaining service life

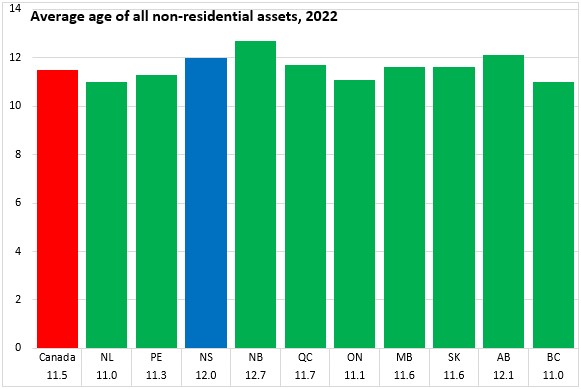

Nova Scotia's non-residential assets had an average age of 12.0 years (at current prices). This was the third oldest average age of assets after New Brunswick and Alberta. The newest average ages for non-residential assets were reported in Ontario, British Columbia and Newfoundland and Labrador.

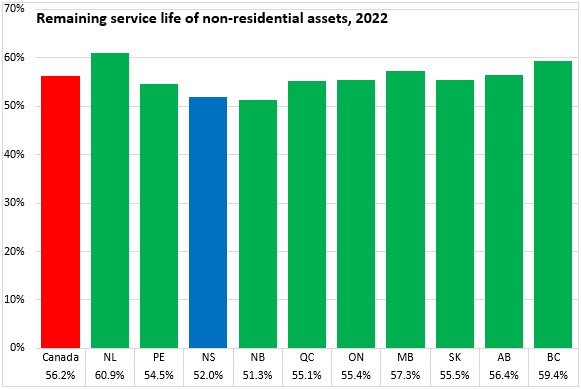

Nova Scotia reported the second lowest amount of remaining service life in their stocks of non-residential assets (52.0%, at current prices), just ahead of New Brunswick. The longest remaining service life of non-residential assets was reported in Newfoundland and Labrador.

Source: Statistics Canada. Table 36-10-0098-01 Flows and stocks of fixed non-residential capital for all industries, by type of asset, provinces and territories (x 1,000,000); Table 36-10-0099-01 Flows and stocks of fixed residential capital by type of asset, provincial and territorial (x 1,000,000); Table 34-10-0166-01 Average age measures of non-residential capital stock by industry, by asset, Canada, provinces and territories

<--- Return to Archive