The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

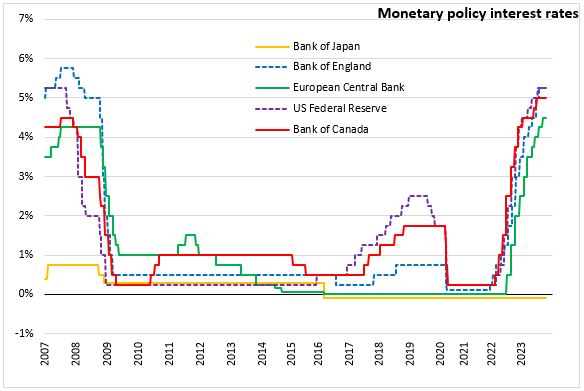

October 26, 2023EUROPEAN CENTRAL BANK MONETARY POLICY The European Central Bank (ECB) announced today that it would keep the three key ECB interest rates unchanged. The interest rates on the main refinancing operations, the marginal lending facility and the deposit facility will remain at 4.50%, 4.75% and 4.0% respectively. Given the outlook for inflation, the Governing Council believes that key interest rates are at a level that will make a substantial contribution to returning inflation to the 2% target, provided they are maintained at this level for a sufficient duration.

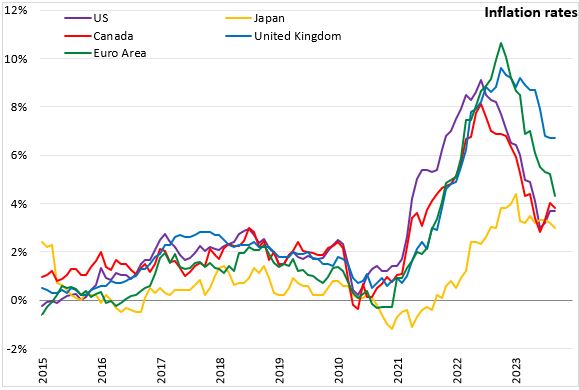

In its medium term outlook for inflation the ECB expects that it will remain "too high for too long", though most measures of underlying inflation are easing. Previous interest rate increases continue to constrict financing conditions, which weighs on demand and helps to push down inflation.

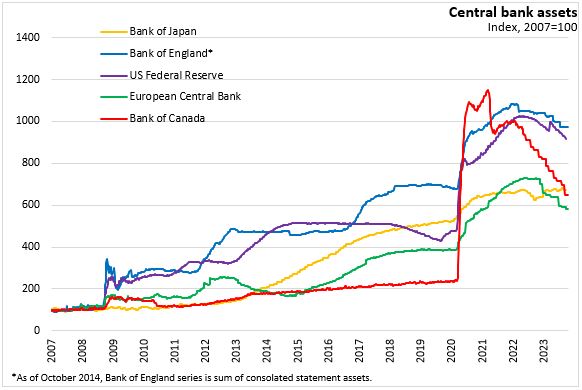

The asset purchase programme (APP) portfolio is declining at a measured and predictable pace, as the Eurosystem does not reinvest all principal payments from maturing securities. The Governing Council intends to reinvest the principal payments from maturing securities purchased under the pandemic emergency purchase programme (PEPP) until at least the end of 2024. The Governing Council noted that the future roll-off of the PEPP portfolio will be managed to avoid interference with the appropriate monetary policy stance.

Economic activity in the euro area remains weak. Manufacturing output has fallen, the services sector is weakening, foreign demand is weak, and financing conditions are weighing on investment and consumer spending. The economy is likely to remain weak for the remainder of the year. However, as inflation declines, household real incomes and foreign demand are expected to recover, strengthening the economy in the years ahead.

The labour market remains strong, though signs of weakness are emerging. The unemployment rate remained at its historical low of 6.4% in August 2023. Job creation has slowed, notably in services, consistent with the cooling economy.

Inflation dropped to 4.3% in September, nearly a full percentage point lower than the previous month. The decline was broad based, including lower inflation for food and energy. Energy prices have recently risen again and are less predictable in light of new geopolitical tensions. Most measures of underlying inflation continue to decline. However, domestic price pressures are still strong which reflects the growing importance of rising wages.

The Governing Council notes that future policy rate decisions will be based on its assessment of the inflation outlook (including the dynamics of underlying inflation), incoming economic and financial data, and the strength of monetary policy transmission.

The next scheduled monetary policy meeting will be on December 14, 2023. An updated summary of economic projections is expected to be published then.

Source: European Central Bank: Monetary Policy Decisions, Monetary Policy Statement (Press Conference)

<--- Return to Archive