The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

October 25, 2023BANK OF CANADA MONETARY POLICY Today, the Bank of Canada maintained the target for the overnight rate at 5.0%, with the Bank rate at 5.25% and the deposit rate at 5.0%. The Bank is continuing its policy of quantitative tightening.

The Bank notes that the global economy is slowing and growth is forecast to moderate further amidst tight monetary policy, persistent inflation, higher than expected oil prices, and new geopolitical uncertainty. The United States (US) economy is stronger than previously expected, while economic activity in China is weaker. Euro area growth has further slowed.

In Canada, past interest rate increases appear to be relieving price pressures. Weak demand combined with high borrowing costs are weighing on business investment. Population growth is easing labour market pressures in some sectors, while also increasing housing demand and consumption. The labour market remains tight as wage pressures persist.

Global Economy

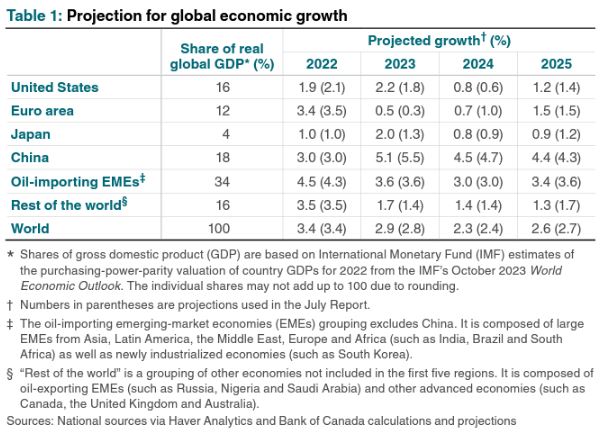

Global economic growth has been slowing and is forecast to ease further. The economic growth forecast for the US is expected to be stronger than previously forecast due to robust consumption and investment. Growth for China has been revised down due to renewed financial strain on property developers. Global real GDP is projected to grow 2.9% in 2023, followed by 2.3% in 2024 and 2.6% in 2025.

Inflation continues to ease in most economies. In the first half of 2023, falling energy prices were driving lower inflation rates in most regions. More recently, lower price growth for non-energy goods and shelter has been contributing more to declining inflation. Supply and demand factors, including alleviation of supply chain bottlenecks, past increases in interest rates and shifting spending patterns back to high-contact services, are easing inflation of non-energy goods. Prices of services are expected to adjust gradually amidst strong demand, tight labour markets and businesses’ inflation expectations. Inflation is expected to return to target in most advanced economies in 2025.

Global financial conditions have tightened as yields on long-term bonds have risen sharply since the July report. The Canadian dollar has been broadly stable against the US dollar this year while appreciating against other currencies.

The US economy has seen consumption supported by a strong labour market, and households spending the savings accumulated during the COVID-19 pandemic. Strong consumer demand coupled with easing supply constraints has boosted business investment. Due to previous interest rate increases and tighter financial conditions, growth is expected to decelerate and remain weak in 2024. Growth will then pick up in 2025 as the impact of past monetary tightening eases.

Growth in China has slowed sharply in the second quarter of 2023 as the effects of reopening dissipated. Uncertainty and lower business sentiment in the property sector have weighed on growth. Export demand is growing at a slower pace than previously expected, and export prices have fallen.

Growth in the Euro area remains weak. The impact of past interest rate increases and tighter financial conditions are weighing on growth. Growth is expected to pick up gradually in 2024 and 2025.

Oil prices have fluctuated at a higher level than previously expected, as prices rose sharply after Saudi Arabia and Russia reduced production and exports. The war in Israel and Gaza has raised new concerns about oil supplies. Non-energy commodity prices are lower than assumed previously given lower agricultural and lumber prices.

Canada

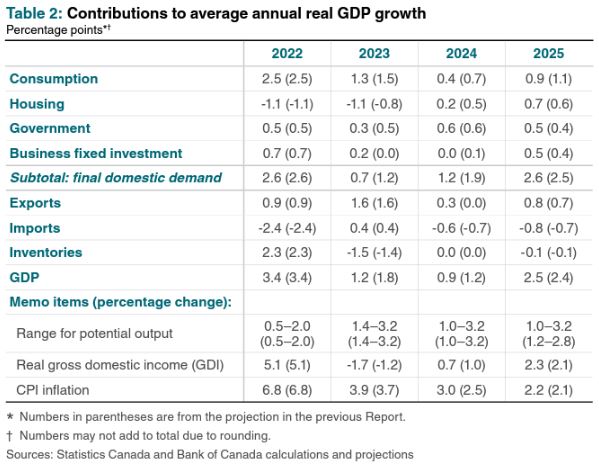

As with most major economies, previous interest rate increases are slowing demand and gradually reducing price pressures. GDP growth has averaged 1.0% over the past year, which is below potential output growth. Inflation has declined but is doing so at a slower pace than previously expected. However, businesses are still able to pass on cost increases and wage growth remains strong.

Canadian GDP is expected to increase 1.2% in 2023, slowing to 0.9% in 2024. Growth is expected to pick up to 2.5% in 2025. The CPI forecast has been revised to reflect more slightly higher inflation over the projection horizon, with 3.9% average inflation in 2023 falling to 3.0% in 2024 and 2.2% in 2025.

Temporary factors such as wildfires and public sector strikes weighed on economic activity in the second quarter of 2023. Higher interest rates have softened the demand for housing and many durable goods. Household credit growth has also slowed. Measures of financial stress have risen, largely for non-mortgage holders.

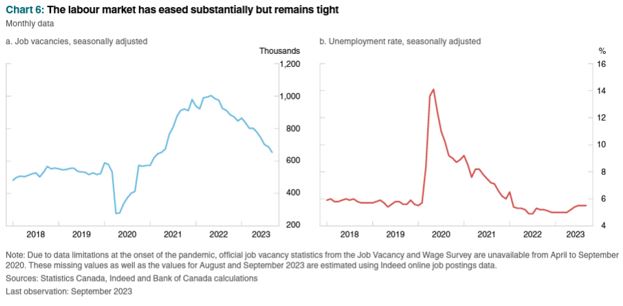

Labour markets remain relatively tight. Job gains slowed below labour force growth during the third quarter of 2023 while businesses have reported fewer capacity pressures. Job vacancies have eased over the past year but have not yet returned to pre-pandemic levels. The unemployment rate remains low. There continues to be upward pressure on wages and widespread reports of skilled worker shortages.

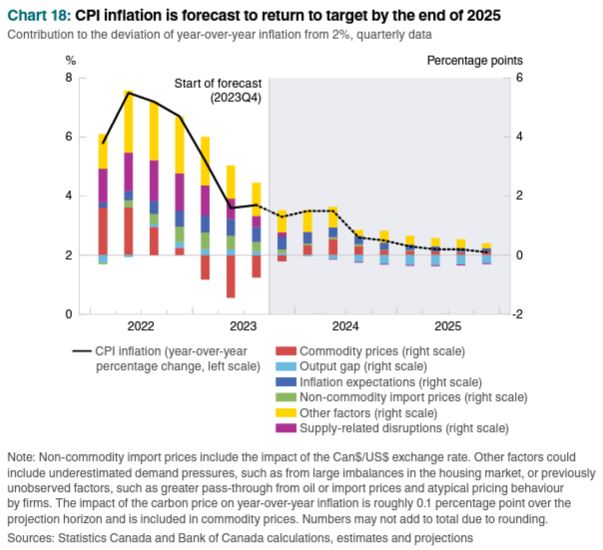

CPI inflation has been volatile in recent months, after declining from its peak of 8.1% in 2022. Higher interest rates have helped to balance supply and demand factors. Recently, higher oil prices have increased energy price inflation, and shelter price inflation has also increased on rent and other accommodation expenses. Underlying inflation is still elevated but some subcomponents have been improving in recent months. Inflation for goods excluding food and energy and inflation for services excluding shelter have declined due to softer demand.

Inflation is expected to slow as excess demand eases. As inflation expectations fall, business pricing behaviour is expected to normalize and wage growth should moderate. Progress in these areas has been slower previously anticipated. Businesses continue to increase prices more frequently and by a larger amount than normal. Near-term inflation expectations remain elevated above the Bank’s inflation forecast. Businesses’ expectations are averaging between 3% and 3.5% over the next two years, and consumers’ expectations are averaging 5% and 4%, respectively. High inflation expectations could also impact wages.

Economic growth is expected to remain subdued over the next several quarters as tighter global financial conditions and the effects of previous interest rate increases weigh on consumer demand and business investment. Slowing foreign demand is also expected to be a drag on export growth. Government spending will be a significant contributor to growth over this period.

Growth is expected to pick up at the end of 2024 as excess supply is reduced. Consumer spending is expected to be weak through 2024 but will strengthen as the effects of monetary tightening fade. Residential investment is expected to start recovering late in 2023 as construction demand outweighs the effect of interest rate hikes. Business investment is expected to be weak through the rest of 2023 but pick up in 2024 as demand improves. Export growth will be soft through 2024 and then supported by the recovery in foreign demand in 2025.

Consumer price inflation is expected to persist around 3.5% until the middle of 2024. Energy prices are expected to be an upward contributor to inflation. Higher mortgage interest rates, rent and other housing costs are expected to keep shelter price inflation elevated. High rent and other housing costs are partially due to strong population growth and lack of housing stock driving up housing demand. The upward contributions from energy and shelter are expected to be partially offset by the easing of excess demand, weaker pressure from input costs and further disinflation in globally traded goods. Inflation is projected to fall to around 2.5% during the second half of 2024 and fall further through 2025, when the Bank expects inflation to fall back to the 2% target.

The next scheduled date for announcing the overnight rate target is December 6, 2023. The Bank will publish its next full outlook for the economy and inflation, including risks to the projection, in the MPR on January 24, 2024.

Bank of Canada: Rate Announcement, Monetary Policy Report – October 2023

<--- Return to Archive