The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

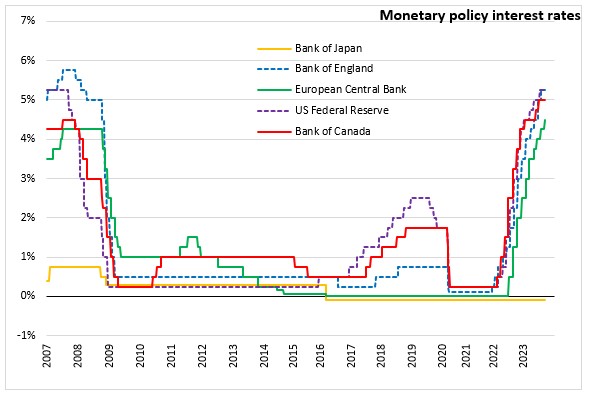

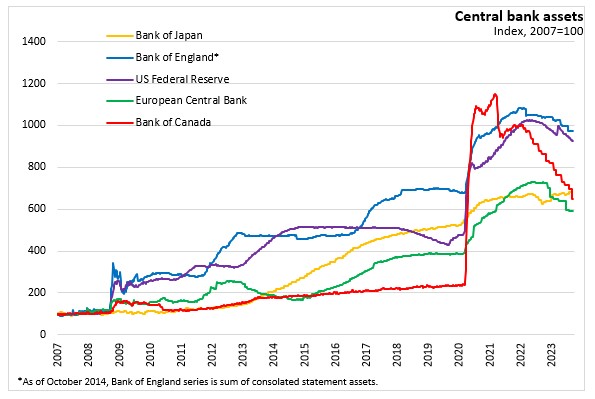

September 21, 2023BANK OF ENGLAND MONETARY POLICY The Monetary Policy Committee (MPC) of the Bank of England voted to maintain Bank Rate at 5.25%. The Committee also decided to reduce the stock of UK government bond purchases held for monetary policy purposes, and financed by the issuance of central bank reserves, by £100 billion over the next twelve months, to a total of £658 billion.

Global economic activity has evolved in line with the Committee's August projections through there were some differences across the regions. In the United States, GDP has increased by 2.1% (seasonally adjusted annualized rate) in the second quarter of 2023 reflecting gains in consumer spending, state/local spending, defence spending, and non-residential investment. Euro-area GDP had increased by 0.1% in 2023 Q2 but was expected to contract in Q3, weaker than expected in the August Report.

According to the first quarterly estimates, real Gross Domestic Product (seasonally adjusted annualized rate) grew 0.2% in the second quarter of 2023, marginally stronger than had been expected in the August Monetary Policy Report. Household consumption and business investment growth was stronger than expected in the August Report, but housing investment continued to decline. The Bank expects GDP to increase 0.1% in the third quarter as the weakness in housing sector continues and the impacts of monetary policy tigthening pass through the economy.

The Labour Force Survey (LFS) unemployment rate increased to 4.3% in the three months to July 2023. The UK unemployment rate is rising because employment declined faster than a decline in the labour force (comparing May-Jul against Apr-Jun).

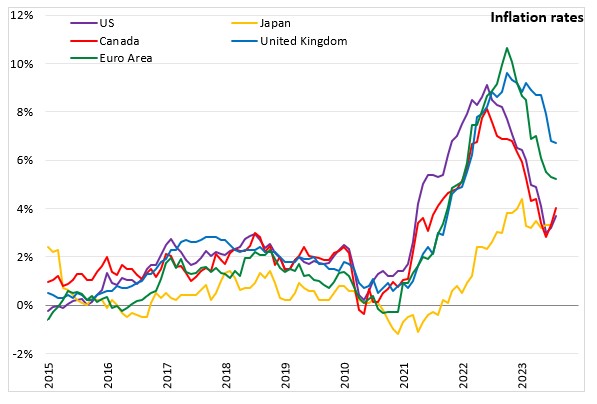

CPI inflation was 6.7% in August 2023, down from the 11.1% peak in October 2022, and lower than the projections in the August Monetary Policy Report. The decline was mostly driven by lower fuel prices up to July 2023. The deccline in August was a combination of past falls in petrol pump prices dropping out of the annual comparison and increases on the month had resulted in a higher rate of energy price inflation in August.

The MPC will continue to monitor for persistent inflationary pressures, including tightness of labour market conditions, behaviour of wage growth and services inflation. The Bank notes that further tightening in monetary policy would be required should the economy feel more persistent inflationary pressures.

The next scheduled monetary policy meeting will be on November 2, 2023. An updated Monetary Policy Report is expected to be published at the same meeting.

Source: Bank of England, Monetary Policy Summary, Monetary Policy Report - August 2023

<--- Return to Archive