The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

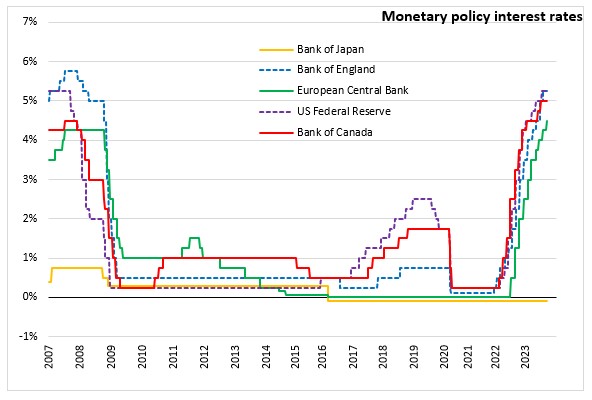

September 14, 2023EUROPEAN CENTRAL BANK MONETARY POLICY The European Central Bank (ECB) raised the three key ECB interest rates by 25 basis points as the inflation outlook continues to be too high for too long. The interest rate on the main refinancing operations, the interest rates on the marginal lending facility and the deposit facility will be increased to 4.50%, 4.75% and 4.0% respectively, effective 20 September 2023.

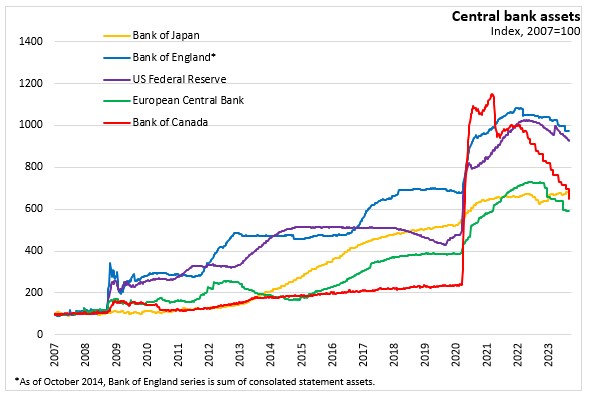

As announced in the February Monetary Policy Meeting, the asset purchase programme (APP) portfolio is declining at a measured and predictable pace, as the Eurosystem does not reinvest all principal payments from maturing securities.

The Governing Council intends to reinvest the principal payments from maturing securities purchased under the pandemic emergency purchase programme (PEPP) until at least the end of 2024. The Governing Council noted that the future roll-off of the PEPP portfolio will be managed to avoid interference with the appropriate monetary policy stance.

Economic activity in the euro area has stagnated over the first half of the year and is expected to remain weak in the third quarter as activity in the manufacturing sector remains weak. Growth is being held back by lower demand for the euro area's exports and the impacts of tight financing conditions on demand and investment. The momentum in the services sector recovery is also slowing. Over time, economic momentum is expected to pick up as real incomes are expected to increase supported by falling inflation, rising wages and a strong labour market.

The labour market remains strong with the unemployment rate at its historical low of 6.4% in July 2023. While employment grew by 0.2 per cent in the second quarter, momentum is slowing.

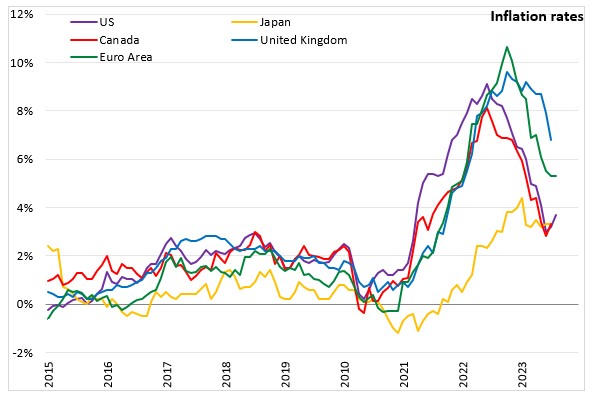

According to Eurostat’s flash estimate, inflation dropped to 5.3% in August 2023. The slowdown in inflation was paused due to an increase in energy prices compared with July and still elevated food prices. Inflation is expected to decline in the coming months as the base effects of the sharp price increases seen in the autumn of 2022 drop out of the annual inflation calculations.

Most measures of underlying inflation are starting to fall as demand and supply have become more aligned and the contribution of past energy price increases is fading out. At the same time, domestic price pressures remain strong. The Governing Council noted that as the energy crisis fades, governments should roll back the related support measures promptly and in a concerted manner to avoid driving up medium-term inflationary pressures, which would call for a stronger monetary policy response.

The Governing Council notes that past interest rate increases continue to be transmitted into the economy, and tighter financing conditions are increasingly dampening demand and helping bring down inflation back to target range. According to the September macroeconomic projections, Eurosystem staff expect headline inflation to average 5.6% in 2023, 3.2% in 2024 and 2.1% in 2025. This represents an upward revision for 2023 and 2024 due to a higher path for energy prices, and a downward revision for 2025.

With increasing impact of tighter financing conditions on domestic demand and slowing international trade, the euro area economy is expected to grow 0.7% in 2023, 1.0% in 2024 and 1.5% in 2025, representing a slight downgrade compared to June projections.

The Governing Council noted based on its current assessment, the key ECB interesr rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target. Future policy rate decisions will be based on a data-dependent approach and its assessment of the inflation outlook in light of the incoming economic and financial data, the dynamics of underlying inflation, and the strength of monetary policy transmission.

The next scheduled monetary policy meeting will be on October 26, 2023. An updated summary of economic projections is expected to be published in December 2023.

Source: European Central Bank: Monetary Policy Decisions, Monetary Policy Statement (Press Conference)

<--- Return to Archive