The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

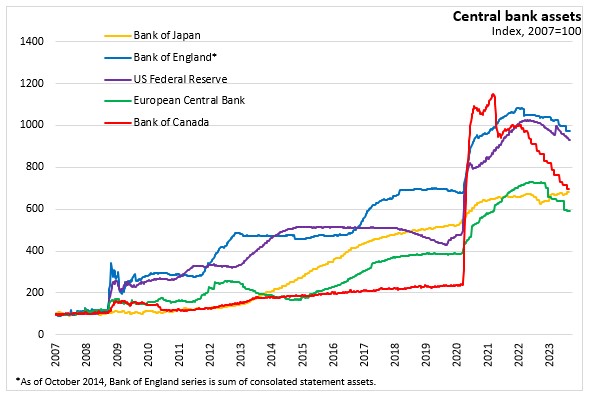

September 06, 2023BANK OF CANADA MONETARY POLICY The Bank of Canada maintained its target for the overnight rate at 5%, with the Bank rate at 5.25% and the deposit rate at 5%. The Bank is continuing its policy of quantitative tightening.

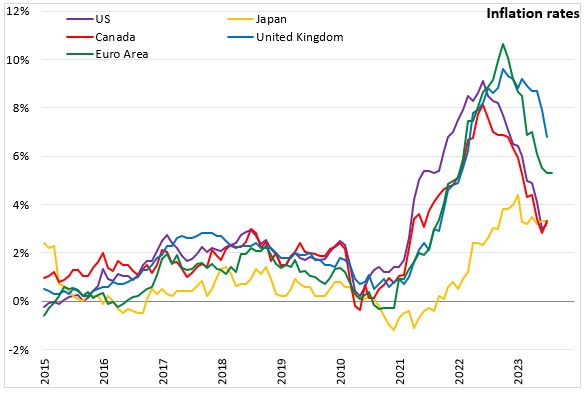

Global growth slowed down in the second quarter of 2023, mainly reflecting significant deceleration in China due to ongoing weakness in the property sector. Economic activity in the United States was stronger than expected driven by robust consumer spending. In Europe, strong growth in the services sector offset continuing contraction in manuafcturing sector. While headline inflation has started to come down in advanced economies, measures of core inflation still remain elevated.

In Canada, real GDP contracted 0.2% in the second quarter of 2023 following a 2.6% growth in the first quarter. The slowdown in economic activity reflected weakening consumption growth and a decline in housing activity. The tightness in the labour market has continued to ease gradually with wage growth remaining around 4% to 5%.

Inflation increased to 3.3% in July following a slowdown to 2.8% in June. This spike in July was mainly due to base year effects in gasoline prices, as a large monthly drop in July 2022 is no longer included in the 12-month calculations. The Bank expects inflation to remain higher in the near term due to recent increase in gas prices before easing again. Recent indicators in core inflation signal there has been little recent downward momentum in underlying inflation.

The Governing Council decided to maintain the policy interest rate and continue to normalize the Bank's balance sheet given the lagged effects of monetary policy and recent evidence of easing excess demand in the economy. Governing Council noted that The Bank remains concerned about the persistence of underlying inflationary pressures, and is prepared to increase the policy interest rate further if needed. Governing Council will continue to assess the dynamics of core inflation and the outlook for CPI inflation, and is committed to restoring price stability.

The next scheduled date for announcing the overnight rate target is October 25, 2023. The Bank will publish its next full outlook for the economy and inflation, including risks to the projection at the same meeting.

Bank of Canada: Rate Announcement

<--- Return to Archive