The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

July 12, 2023BANK OF CANADA MONETARY POLICY The Bank of Canada increased its target for the overnight rate by 25 basis points to 5.0%, with the Bank rate at 5.25% and the deposit rate at 5.0%. The Bank will continue its policy of quantitative tightening.

The Bank of Canada release noted that inflation has started to slow down in many countries supported by lower energy prices, normalizing global supply chains, and tighter monetary policy. However, labour markets remain tight and measure of core inflation in many advanced economies point to persistent price pressures, especially in the services sector.

Global economic growth during the first half of the year was stronger than had been expected, supported with robust consumption growth in the United States. Global demand is expected to moderate over the next year due to monetary policy tightening and a slowdown in China.

In Canada, demand still exceeds supply and the labour market remains tight. Economic growth is expected to be subdued through the remainder of this year, with the economy moving into excess supply in the second half, and then pick up gradually through 2024. Consumer price index (CPI) inflation is expected to hover around 3.0% for the next year before gradually declining to 2.0% in the middle of 2025.

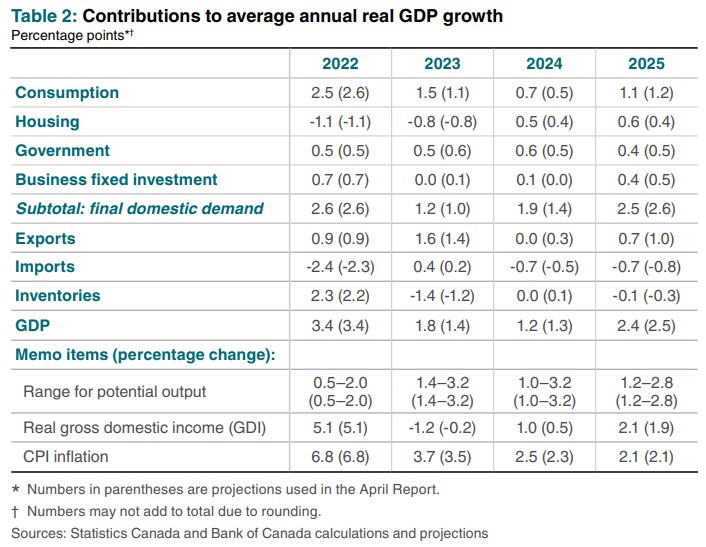

On an annual average basis, growth in gross domestic product (GDP) in Canada is projected to be 1.8% this year and 1.2% in 2024. As the economy adjusts to higher interest rates and inflation returns to the 2% target, GDP growth is projected to pick back up in 2025, reaching 2.4%.

Global Economy

Global economic growth has been stronger than anticipated supported by increased activity in the United States and a rebound of activity in China. Global growth is expected to weaken over the next year, weighed down by restrictive monetary policy in advanced economies. Global real GDP is projected to grow 2.8% in 2023, 2.4% in 2024 and 2.7% in 2025.

Inflation continues to fall globally. However, the slowdown has come from lower energy prices and less from easing underlying inflation. With the large price increases of last year now out of the annual data, it is expected that there will be less near-term downward momentum in CPI inflation. Tight labour markets, robust consumer demand and elevated inflation expectations continue to generate persistent inflation expectations in many economies.

Inflation is projected to slowdown as demand growth moderates with lower goods price inflation leading the decline while services inflation adjusts more gradually.

Economic growth in the United States has been stronger than expected during the first half of 2023 driven by robust consumption and investment spending. Growth is expected to moderate in the first half of 2024 due to restrictive monetary conditions, tighter fiscal policy and less consumption support from accumulated savings. As US economic growth slows and consumption rebalances from goods towards services, demand for imports including from Canada is expected to slow down.

In the euro area, economic growth has stalled in the first half of the year due to weak consumer sentiment, declining purchasing power and tightening monetary conditions. Lower global demand for goods is weighing down the manufacturing sector. Economic growth is projected to remain weak through mid-2024 as monetary

policy continues to dampen demand and bring inflation back toward the European Central Bank’s target.

China's economic growth has started to slow following strong activity earlier in the year due to the rebound in services activity following the lifting of COVID-19 restrictions. Export growth is limited by slower global demand. Property sector remains weak due to past overbuilding. Economic activity is expected to be supported by policy easing in 2024 but slow in 2025 due to declining workforce and slowing business investment.

Reflecting market concerns that weak global industrial activity will restrain demand, oil prices has declined further over the past three months with the price of Bent oil generally around US$75 per barrel. The value of the Canadian dollar is broadly unchanged against the US dollar, stable around 74 US cents since the April MPR.

Canadian Economy

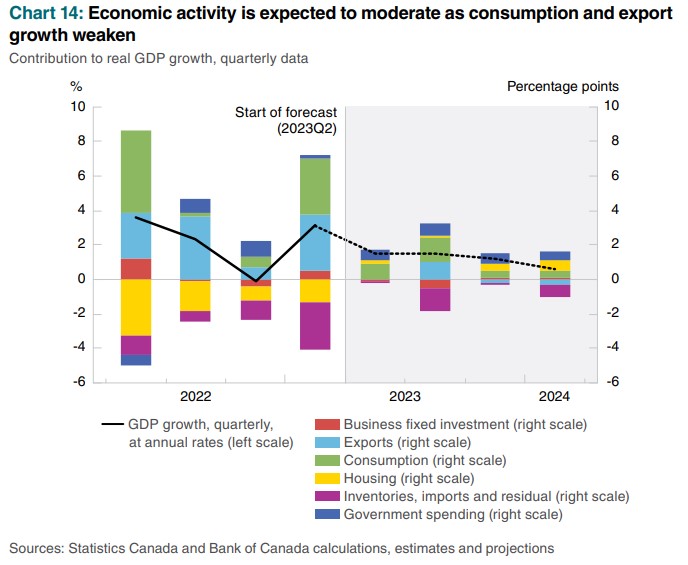

Supported by tight labour markets, rapid population growth and high level of accumulated savings, economic activity in Canada has been stronger than expected. The strength in activity was observed both in goods and services sectors. Economic growth is expected to moderate to an average of 1.0% through the rest of the year and the first half of 2024 as the effects of higher interest rates impact household spending and business investment.

Canada GDP is expected to increase 1.8% in 2023 and moderate to 1.2% in 2024. Economic growth is expected to pick up in 2025 and reach 2.4% as foreign demand strengthens and the effects of past monetary policy tightening fade. Consumer price index (CPI) inflation is forecast to average 3.7% in 2023, 2.5% in 2024 and 2.1% in 2025.

Economic activity was robust in the first quarter of 2023, and growth over the first half of the year will likely surpass expectations at the time of the January MPR Report.

Strong activity in household spending reflect several factor including a tight labour market, population growth supported by immigration, accumulated household savings, pent-up demand for services and fiscal measures in recent federal and provincial budgets.

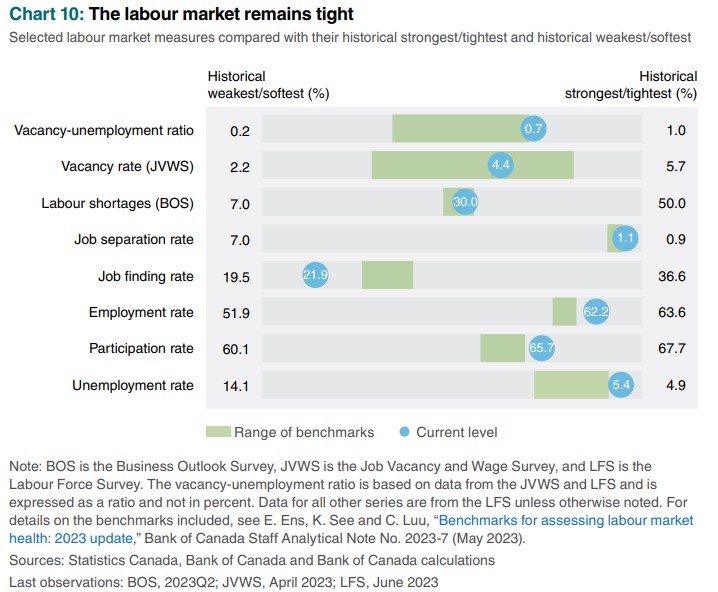

A broad range of indicators still suggest that the labour market remains above maximum sustainable employment level. The unemployment rate has edged up but remains low by historical standards. Wage growth has been in a range of about 4% to 5%. At the same time, tighter monetary policy appears to be moderating labour demand.

Consumer spending is anticipated to be subdued beginning in the second half of 2023 and into 2024 as the effects of the tightening in monetary policy work their way through the economy. Income growth is also expected to slow as the labour market comes into balance and weigh on consumption spending growth.

Growth in residential investment is anticipated to continue supported by strong migration to Canada. Recent strength in house prices is expected to continue over the short term before annual price growth slows to a range of 2.0% to 3.0% range.

Following an increase in the start of the year, exports are expected to decline as the impacts of higher policy rates, especially in the United States weigh on demand for imports from Canada. Additionally, the effects of some of the factors temporarily supporting export growth—such as the recovery of motor vehicle production with the resolution of supply chain issues—is anticipated to fade.

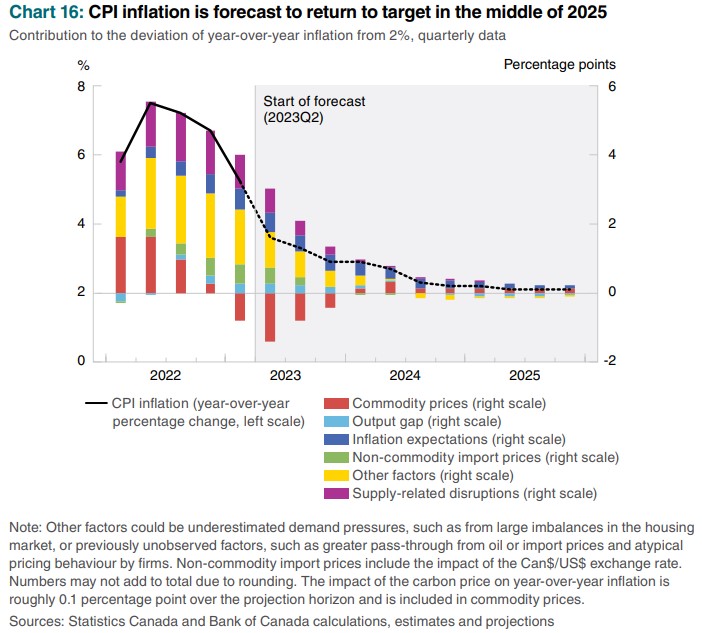

Consumer prices in Canada declined to 3.4% in May 2023 and is expected to remain around 3.0% for about a year. The slowdown in inflation from a peak of 8.1% in June 2022 reflected large declines in oil prices, lower inflation in other goods prices and base-year effects as large past increases in these prices fall out. While these factor will continue to contribute to slowing inflation over the next two years, their impacts will be limited.

The Bank expects the next stage in the decline of inflation toward target is expected to take longer and is more uncertain due to elevated services inflation.

In the July MPR projection, inflation is projected to remain around 3% over the next year. As excess demand dissipates and labour market conditions ease, inflation gradually returns to the 2% target in the middle of 2025. This is about two quarters later than forecast in the January and April MPR reports.

The next scheduled date for announcing the overnight rate target is September 6, 2023. The Bank will publish its next full outlook for the economy and inflation, including risks to the projection, in the MPR on October 25, 2023.

Bank of Canada: Rate Announcement, Monetary Policy Report – July 2023

<--- Return to Archive