The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

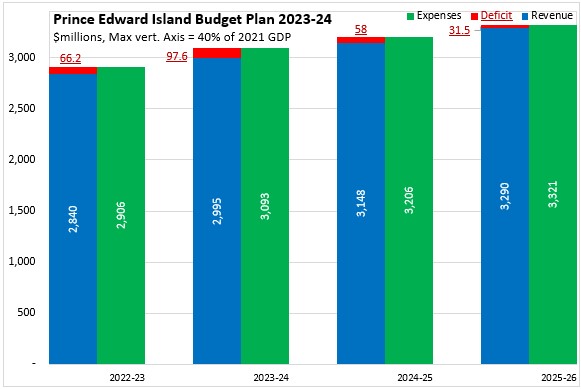

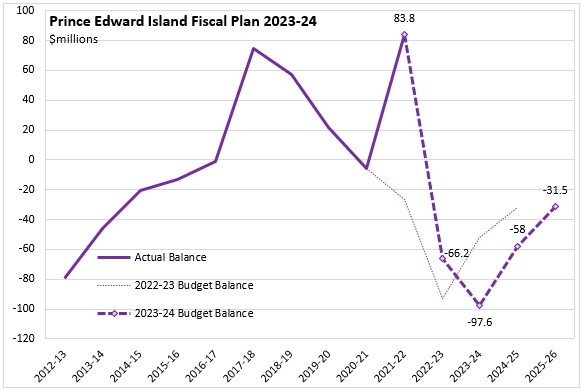

May 26, 2023PRINCE EDWARD ISLAND BUDGET 2023-24 The Province of Prince Edward Island released it's 2023-24 Budget on May 25 (following a provincial election). The 2023-24 deficit is expected to widen to $97.6 million, before narrowing in each of the two subsequent fiscal years.

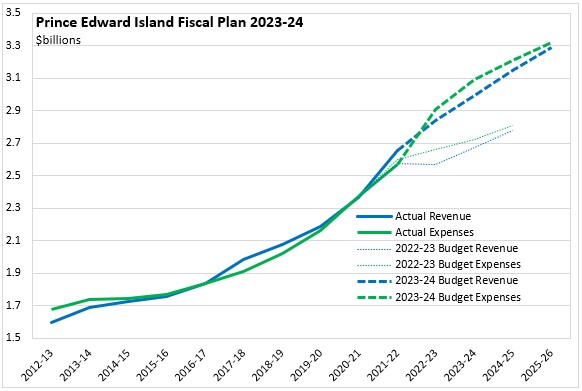

Prince Edward Island's provincial government revenues are projected to rise by 5.5% in 2023-24 while expenditures grow by 6.4%. In 2024-25, revenues are projected to grow 5.1%, outpacing the 3.7% rise in expenditures.

As in many provinces, Prince Edward Island's 2022-23 revenues are now forecast to be higher than expected in the 2022-23 Budget plan. Expenditures were also increased above the levels projected in the 2022-23 Budget plan.

Prince Edward Island's provincial government ran an unexpected surplus of $83.8 million in 2021-22. The current fiscal plan anticipates deficits in each year from 2022-23 to 2025-26.

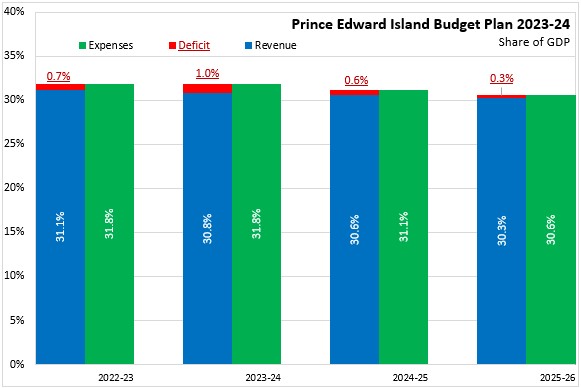

Prince Edward Island's government deficit in 2023-24 is projected to amount to 1.0% of nominal GDP, up from a deficit amounting to 0.7% of GDP in 2022-23. Prince Edward Island's government deficits are projected to contract as a share of GDP in each of the subsequent two fiscal years.

The footprint of the provincial government in Prince Edward Island's economy is projected to by 31.8% of GDP in 2023-24 (the same as in the last year). This is projected to contract to 30.6% of GDP by 2025-26.

Prince Edward Island's net debt to GDP ratio is currently estimated at 27.6% of GDP for 2022-23. This is projected to rise to 28.8% of GDP in 2023-24 and to 29.3% of GDP by 2025-26.

Prince Edward Island's provincial Budget projects expenditures of $17,393 per capita in 2023-24, rising to $17,968 per capita by 2025-26.

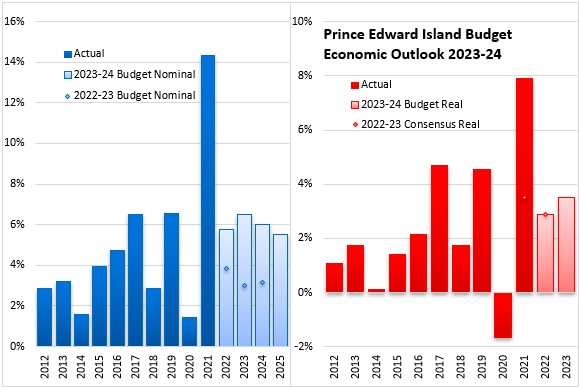

Although nominal GDP growth is projected to slow from the 14% gain in 2021, the Prince Edward Island Budget assumes strong and steady growth over the subsequent four years. Prince Edward Island's real GDP is estimated to have grown by 2.9% in 2022 and is forecast to accelerate to 3.5% in 2023. Prince Edward Island's population growth is expected to remain strong, driving labour markets, construction and other domestic demand.

Key Measures and Initiatives

Prince Edward Island's Budget highlights expenditures that prioritize: health, homes, affordability, people, future and communities. Key initiatives include:

- Health

- Adding 100 front line positions and establish new medical homes

- Introducing new Flexible Assertive Community Treatment Teams and the new Emergency Department and Short Stay unit at the Queen Elizabeth Hospital to assist with complex mental health needs

- Treating 32 common ailments at 48 community pharmacies

- Introducing $5 co-pays for over 150 medications

- Adding new drugs to the formulary

- Establishing a Faculty of Medicine at the University of Prince Edward Island

- Homes

- Launching a Rent-to-Own program with financing options for first-time homeowners to rent a property with the intent to purchase

- Creating a Closing Cost Housing Support program to provide first-time home buyers with closing costs for purchasing their first home

- Creating opportunities for tiny home communities in rural areas

- Launching a low-income home repair grant

- Providing private developers with two percent financing for projects that are construction ready to spur immediate development

- Funding to develop construction ready lots outside the capital area

- Affordability

- Continuing with free heat pump and property tax freeze

- Legislating a reset in assessment rates to 2020 levels to prevent increased property assessments in 2024

- Increasing the basic personal amount for income taxes to $13,500 by 2024

- Increasing the income threshold for the low-income tax reduction by $750 in both 2023 and 2024

- Implementing a five bracket income tax system in 2024

- Expediting the reduction in child care fees to $10/day in 2023

- Future

- Exploring controlled-environment farming and indoor farming

- Establishing the BioAccelerator and developing the clean tech sector

- Establishing a Portable Health Benefits program, as well as other supports for arts and culture

- Encouraging employers to retrofit workplaces to make them more accessible for workplace participation of those with physical and intellectual disabilities

- Growing tourism into a four-season industry

- People

- Adding 100 new positions to the education system

- Increasing the non-repayable bursary for resident students to $3,000 per student

- Providing a primary caregiver grant for those who care for loved ones at home

- Expanding the Seniors Independence Initiative, the Seniors Safe at Home, the Seniors Home Repair and the Seniors Hearing Aid rebate programs

- Establishing an infrastructure fund for creating child care spaces

- Exploring a universal school breakfast program

- Communities

- Increasing nursery tree production

- Expanding support for victims of family violence

- Supporting participation of newcomers (especially health professionals) in the labour market

- Increasing access to justice supports and legal aid

- Increasing funding for provincial wildland firefighters

- Beginning implementation of an Anti-Racism Action Plan

Prince Edward Island Budget 2023-24

<--- Return to Archive