The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

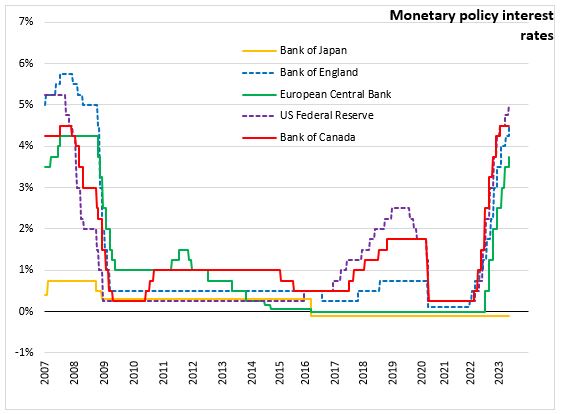

May 11, 2023BANK OF ENGLAND MONETARY POLICY The Monetary Policy Committee (MPC) of the Bank of England voted to increase the Bank Rate by 0.25 percentage points to 4.50%.

Global economic activity is more positive in the near-term although risks remain, recent global banking developments are only expected to have a small impact on UK GDP from tighter credit conditions. Inflation rates are falling in US and euro area but core inflation remains elevated. UK GDP is expected to be flat over the first half of 2023 before resuming growth.

The MPC will continue to monitor closely indications of persistent inflationary pressures, including the tightness of labour market conditions and the behaviour of wage growth and services inflation. The Bank notes that further tightening in monetary policy would be required should the economy feel more persistent pressures. Stronger global growth, lower energy prices, and fiscal support improved the GDP outlook compared to previous projections. There are signs that labour market is starting to loosen but the unemployment rate is expected to remain below 4% until the end of 2024 before rising to 4.5%.

Inflation has been higher than expected, up 10.2% in Q1 2023. Inflation is expected to fall sharply starting in April 2023 as base period effects drop out of annual comparison and an extended Energy Price Guarantee program will contribute to lower household energy bills. Food price inflation is now expected to decline more slowly. The MPC projections expect CPI inflation to decline to below target at a little above 1% at the 2-3 year horizon, although there remains considerable uncertainty, skewed to the upside, around pace at which CPI inflation sustainably returns to 2% target.

Source: Bank of England, Monetary Policy Summary

<--- Return to Archive