The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

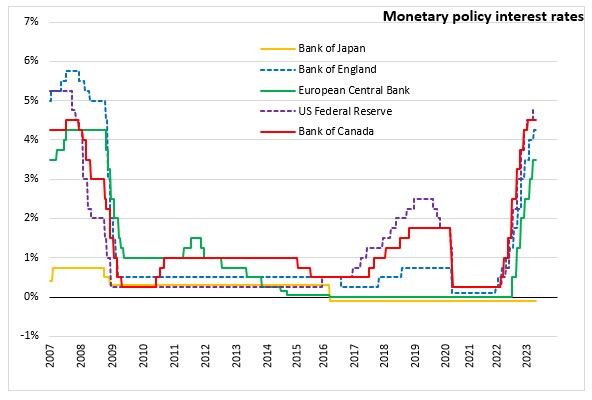

April 28, 2023BANK OF JAPAN MONETARY POLICY The Policy Board of the Bank of Japan decided to maintain a negative interest rate of 0.1% for the Policy-Rate Balances in current accounts held by financial institutions at the Bank. This was the first monetary policy meeting under the new Governor Kazuo Ueda.

The Bank noted that achieveing price stability has been a challenge for a long period of 25 years for Japan since the late 1990s when the economy fell into deflation. Against this backdrop, the Bank of Japan decided to conduct a broad review of monetary policy and its easing measures with a planned timeframe around one to one and a half years.

The Bank of Japan will also purchase a necessary amount of Japanese government bonds (JGBs) without setting an upper limit in order to keep the 10-year JGB yields at around zero per cent. The Bank will continue to allow 10-year JGB yields to fluctuate in the range of around plus and minus 0.5 percentage points from the target level, and will offer to purchase 10-year JGBs at 0.5 percent every business day through fixed-rate purchase operations, unless it is highly likely that no bids will be submitted.

In addition, the Bank will purchase exchange-traded funds (ETFs) and Japan real estate investment trusts (J-REITs) so that their amounts outstanding will increase at annual paces with upper limits of about 12 trillion yen and about 180 billion yen, respectively. The Bank will maintain Commercial Paper (CP) holdings at 2 trillion yen and will purchase corporate bonds at about the same pace as before the COVID-19 pandemic with amounts outstanding gradually returning to about 3 trillion yen.

The Bank will continue with “Quantitative and Qualitative Monetary Easing (QQE) with Yield Curve Control”, aiming to achieve the price stability target of 2 per cent, as long as it is necessary for maintaining that target in a stable manner. The Bank also noted that it will continue expanding the monetary base until the year-on-year rate of increase in the observed CPI (all items less fresh food) exceeds 2 per cent and stays above the target in a stable manner.

Japan's economic activity has picked up after pandemic restrictions eased. Exports and industrial production have remained flat as easing supply chain constraints were offset by slowing global demand. Corporate profits have been at high levels on the whole with business fixed investment increasing moderately.

The employment and income situation has seen moderate improvements despite some continued weakness in some sectors. Private consumption has also increased despite price rises. Housing investment has been relatively weak.

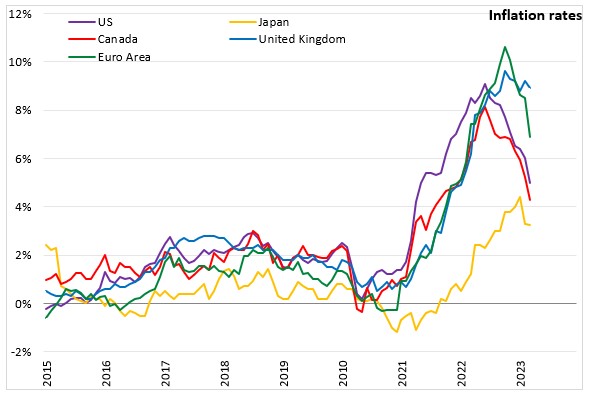

The year-on-year inflation in the consumer price index (CPI, all items) slowed down to 3.2% in March 2023, mainly due to the effects of pushing down energy prices through the government's economic measures. The year-on-year rate of change in the CPI (all items less fresh food) had been increasing since last year due to the effects of the pass-through to of cost increases led by import prices. As the rate of increase has slowed down recently, it is expected that the year-on-year rate of increase in the CPI (all items less fresh food) will decelerate by the middle of 2023. The Bank expects Japan's inflation to average 1.8% in 2023, 2.0% in 2024 and 1.6% in 2025. Inflation projections are revised up for 2023 and 2024 from the January 2023 Outlook.

Japanese revovery has also been slowed by high comodity prices. As the negative impact of high commodity prices wanes and a virtuous cycle from income to spending intensifies gradually, Japan's economy is projected to continue growing at a pace above its potential growth rate.

As of its April Outlook for Economic Activity and Prices, the Bank expects real GDP to increase 1.4% in 2023, 1.2% in 2024 and 1.0% in 2025. These represent a downgrade for this year and a slight upgarde for 2024 from the January 2023 Outlook.

Source: Bank of Japan, Statement on Monetary Policy (April 28, 2023), Outlook for Economic Activity and Prices (April 2023)

<--- Return to Archive