The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

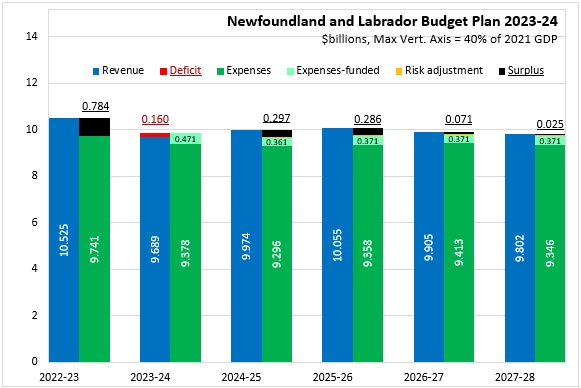

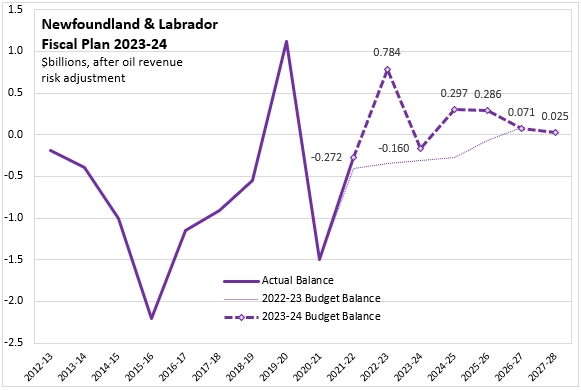

March 24, 2023NEWFOUNDLAND AND LABRADOR BUDGET 2023-24 The Province of Newfoundland and Labrador released its 2023-24 Budget on March 23. For 2023-24, Newfoundland and Labrador anticipates a deficit of $160 million. In 2022-23, the latest forecast projects a surplus of $784 million. After 2023-24, Newfoundland and Labrador anticipates returning to surpluses in each fiscal year.

In 2023-24, Newfoundland and Labrador's revenues are projected to contract by 7.9% while expenses are grow by 1.1%.

As in many provinces, Newfoundland and Labrador's revenues in 2022-23 were considerably larger than anticipated. Revenues are projected to decline sharply in 2023-24 before rising and falling. Newfoundland and Labrador's revenues are particularly sensitive to assumptions about resource investment, production and prices. Newfoundland and Labrador's expenditures were also higher than planned in 2022-23 and are expected to decline slightly over subsequent fiscal years. The previous fiscal plan had also anticipated falling expenditures, but the 2023-24 Budget expenditure outlook declines from a higher initial level.

With the exception of 2023-24, Newfoundland and Labrador's fiscal outlook now anticipates surpluses throughout the medium term. The previous plan only anticipated a return to balance by 2026-27.

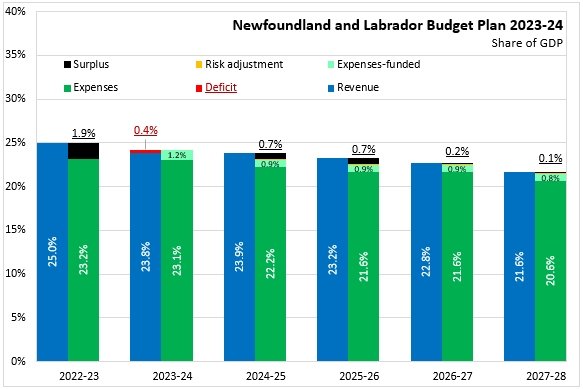

The Newfoundland and Labrador government deficit for 2023-24 amounts to 0.4% of provincial GDP. Surpluses anticipated in subsequent fiscal years are no larger than 0.7% of GDP.

The overall footprint of the Newfoundland and Labrador government in the provincial economy amounts to 24.3% of GDP in 2023-24. With rising nominal GDP and stable expenditures, Newfoundland and Labrador's government shrinks to 21.6% of GDP by 2027-28.

Newfoundland and Labrador's net debt to GDP ratio is approximately 37%, falling from over 50% in 2020.

Newfoundland and Labrador's provincial Budget projects expenditures of $17,658 per capita in 2023-24. These are projected to fall to $17,470 per capita in 2024-25, before rising in 2025-26 and 2026-27 and then falling again in 2027-28.

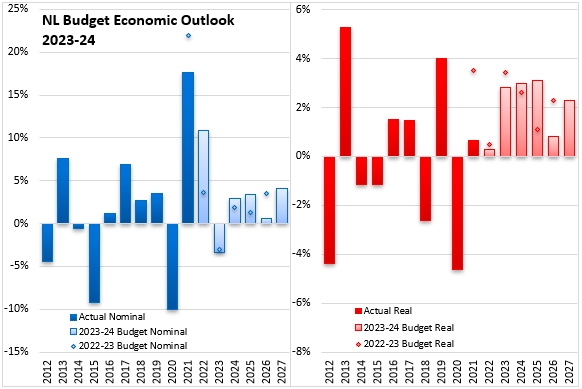

Newfoundland and Labrador's economy is highly sensitive to investment, prices and production of resource industries (especially oil). Large volatility in both real and nominal GDP are attributable to fluctuations in the oil industry. For 2023, Newfoundland and Labrador's real GDP is projected to grow by 2.8%, primarily due to mineral production and investments. Newfoundland and Labrador's other economic sectors are expected to slow (though not decline). Newfoundland and Labrador's Budget assumes that inflation slows to 3.2% in 2023 as tighter monetary conditions slow domestic demand. Newfoundland's real GDP growth is expected to be steady through 2025 before slowing considerably in 2026, when the West White Rose project is completed and enters production.

Key Measures and Initiatives

Newfoundland and Labrador's Budget for 2023-prioritizes: health care and well-being, social determinants of health and economic health. There are a number of initiatives under each priority area, including:

- Health Care

- More than $21 million for 10 new Family Care Teams across the province, giving access to primary care for up to 80,000 people

- $15 million for a new health information system.

- $9 million to begin to consolidate 60 separate road ambulance services into a single, integrated service with centralized dispatch.

- $5 million for a new virtual care program.

- More than $23 million for recruitment and retention of health care professionals.

- Increasing capacity in Memorial University’s Medicine Programs

- $4.4 million for Flexible Assertive Community Treatment teams to assist those with mental health needs.

- Addition of 12 new drugs to the provincial drug program.

- $3 million for a Cardiovascular and Stroke Institute.

- Approximately $1.8 million for travelling orthopaedic teams and same day hip and knee replacement surgeries.

- $7.7 million this year and increasing to $9.3 million next year for health care professionals who support self-managed care in the home.

- $7.5 million annual increase for community care home professionals.

- $6.1 million annual increase for personal care home professionals.

- Helping with the High Cost of Living

- Elimination of the retail sales tax on home insurance.

- 8.05 cent per litre (includes HST) reduction on the price of gasoline and diesel – the second lowest rate among provinces.

- Doubling of the Physical Activity Tax Credit.

- 5% increase for the Income Supplement

- 5% increases for the Seniors’ Benefit

- More than $140 million for housing, including construction of more than 850 rental homes.

- Continuing the 50 per cent off the cost of registering passenger vehicles, light trucks, and taxis for another year.

- Maintaining the home heating supplement that provides up to $500 to residents who currently rely on furnace or stove oil

- $1.3 million to cover the cost of driver medicals for people 75 years of age and older.

- Supporting Industry and Business

- Increasing the exemption threshold of the Health and Post-Secondary Education Tax from $1.3 million to $2 million.

- Expanding the All-Spend Film and Video production Tax Credit to 40 per cent.

- Increasing commission discounts to wine, spirit and cider producers in the province.

- Manufacturing and processing and green technology tax credits

- $1.5 million to improve air access.

- Supporting Education

- $64 million to increase wages for early childhood educators

- $12 million increase to add more teaching units

- Communities

- $19.2 million for settlement supports, including those for Ukrainians.

- $2.2 million to accelerate progress to reach immigration targets.

Newfoundland and Labrador Budget 2023-24

<--- Return to Archive