The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

March 23, 2023BANK OF ENGLAND MONETARY POLICY The Monetary Policy Committee (MPC) of the Bank of England voted to increase the Bank Rate by 0.25 percentage points to 4.25%.

According to the first quarterly estimates, real Gross Domestic Product (GDP) had been flat in the last quarter of 2022, slightly weaker than expected in the February Monetary Policy Report (MPR). Household consumption was up by 0.1% while business investment had been projected to increase by almost 5.0%.

The Labour Force Survey (LFS) unemployment rate had remained at 3.7% in the three months to January, 0.1 percentage points below the expectation at the time of the February Monetary Policy Report. LFS employment had grown by 0.2% in the three months to January, slightly stronger than had been expected at the time of the February Report.

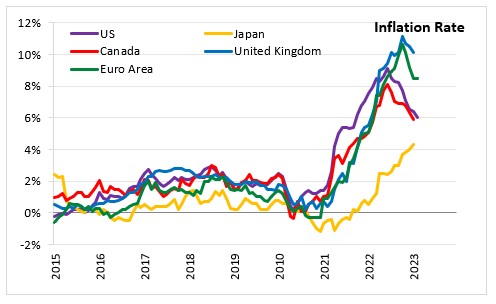

Following a slowdown in January, CPI inflation increased to 10.4% in February 2023. This was 0.6 percentage points higher than expected in the February Monetary Policy Report. The increase was mainly driven by higher prices in clothing and footwear, and food and non-alcoholic beverages. Core CPI inflation, excluding energy, food, beverages and tobacco, increased to 6.2% in February from 5.8% in January, and had been 0.3 percentage points higher than the expectation made at the time of the February Monetary Policy Report.

The MPC will continue to monitor closely indications of persistent inflationary pressures, including the tightness of labour market conditions and the behaviour of wage growth and services inflation. The Bank notes that further tightening in monetary policy would be required should the economy feel more persistent pressures.

The Monetary Policy Committee of the Bank of England will announce its next interest rate decision on May 11, 2023. An updated Monetary Policy Report will be provided at the same meeting.

Source: Bank of England, Monetary Policy Summary

<--- Return to Archive