The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

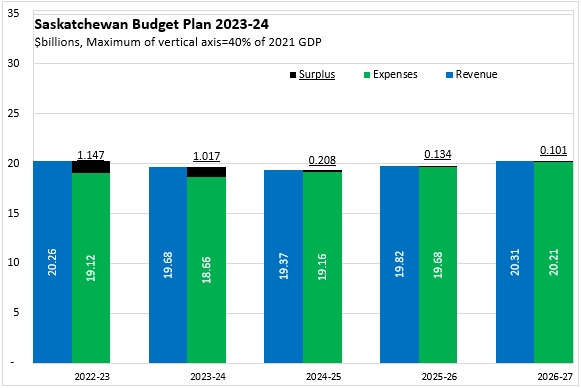

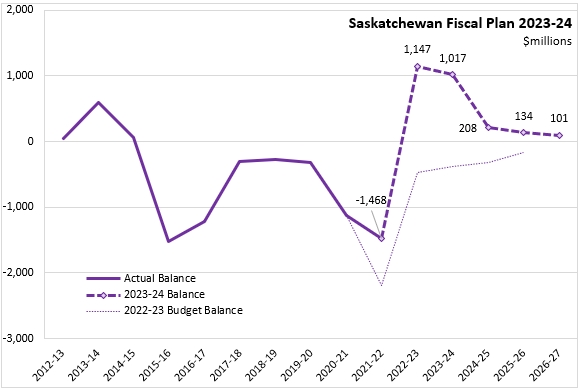

March 23, 2023SASKATCHEWAN BUDGET 2023-24 Saskatchewan released its 2023-24 Budget on March 22. For 2023-24, the government of Saskatchewan anticipates a surplus of $1.017 billion. In 2022-23, the latest forecast projects a surplus of $1.147 billion. Projections for future surpluses are much smaller through the remainder of the forecast horizon.

In 2023-24, Saskatchewan's revenues are projected to contract by 2.9% while expenses are reduced by 2.4%.

As in many provinces, Saskatchewan's revenues grew much more rapidly in 2022-23 than expected. Saskatchewan's revenues were up for both non-renewable resource revenues as well as tax revenues. Although the 2023-24 Budget fiscal plan still anticipates lower expenditures (as was expected in last year's fiscal plan), the magnitude of reductions is smaller, bringing provincial spending in line with revenues to generate small surpluses.

Saskatchewan's surpluses in 2022-23 and 2023-24 are expected to diminish in the medium term fiscal projections.

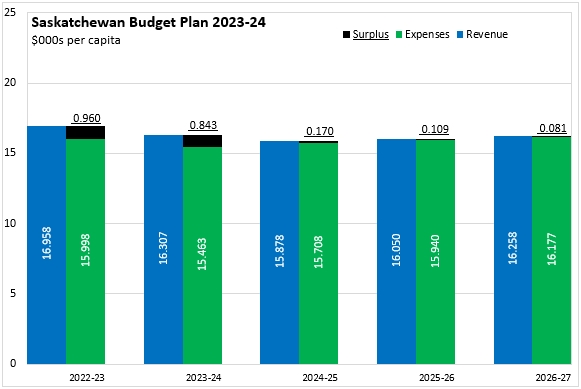

Saskatchewan's surplus for 2023-24 is about 1.0% of the province's GDP (similar to the size of the surplus in 2022-23). Subsequent surpluses fall to below 0.2% of Saskatchewan's GDP.

The overall footprint of the Saskatchewan government in the provincial economy amounts to 18.4% of GDP in 2023-24. In future years, the Saskatchewan government's footprint in the provincial economy is projected to fall to 17.8% of GDP.

Saskatchewan's net debt to GDP ratio is estimated at 14.1% as of the end of the 2022-23 fiscal year, falling to 13.2% by the end of the current fiscal year. By the end of the 2027-28 fiscal year, this ratio is projected to rise slightly to 13.6%.

Saskatchewan's provincial Budget projects expenditures of $15,463 per capita in 2023-24, rising to $16,177 per capita by 2026-27.

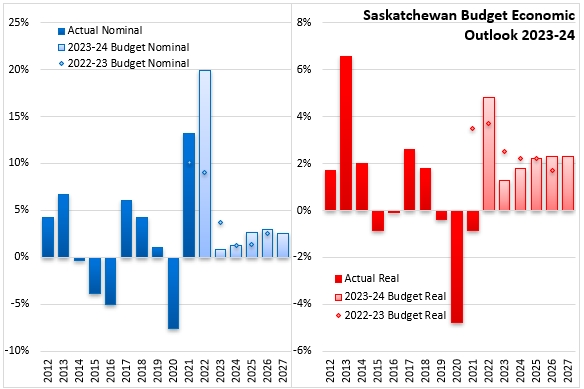

Saskatchewan's economy grew very rapidly in 2022, reaching almost 20% in nominal terms (4.8% in real terms) as commodity prices increased dramatically, crop production rebounded, the labour market strengthened and investment grew. For 2023, economic growth is expected to slow as higher interest rates reduce growth in consumption and investment. Saskatchewan's real GDP is projected to rise by 1.3% (0.8% in nominal terms as commodity prices come down). Over the medium term, the Saskatchewan Budget assumes that non-residential investment for natural resources as well as manufacturing and processing will drive real GDP growth averaging 2.3% annually.

Key Measures and Initiatives

The Saskatchewan Budget for 2023-24 has neither new taxes nor tax increases. It prioritizes health care, education, social safety nets, protection of people and property, and investing in the economy. The Budget also features $3.7 billion in planned capital investments (including Crown agencies). Included in these priorities are:

- Health care:

- A $98.8 million health recruitment and training plan

- 550 new seats for 18 health training programs

- $42.5 million to reduce surgical wait times

- Adding 64 acute care beds in Regina and Saskatoon

- Education

- Starting a Saskatchewan Distance Learning Corporation

- Increasing seats for training in skilled trades, particularly construction

- Social safety nets

- Increasing benefits for Saskatchewan Income Supports; basic, shelter and heating benefits each increase by $30 per month

- Saskatchewan Assured Income for disabilities will also be increased by $30 per month, along with up to $400 per month for a Personal Care Home Benefit for SAID clients who live in personal care homes

- Completing planned increases in the Senior's Income Plan, increasing by $30 per month

- Indigenous-led pilots for supportive housing and wrap-around services for those experiencing homelessness in Saskatoon and Regina

- Increasing funding for community-based organizations that support people with disabilities, children at risk, as well as youth and families

- Protection of persons and property

- Supports for survivors of interpersonal violence

- Increasing policing capacity, particularly in rural and remote areas

- Adding to the Warrant Enforcement and Suppression Team that targets offenders representing a significant threat to the public

- Establishing a 10th Crime Reduction Team (this one in the Battlefords) to target street gangs and prolific offenders

- Investing in the economy:

- Opening a trade office in Germany

- Expanding the Targeted Mineral Exploration Incentive and increasing the Mineral Exploration Tax Credit (up from 10% to 30%)

Saskatchewan Budget 2023-24

<--- Return to Archive