The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

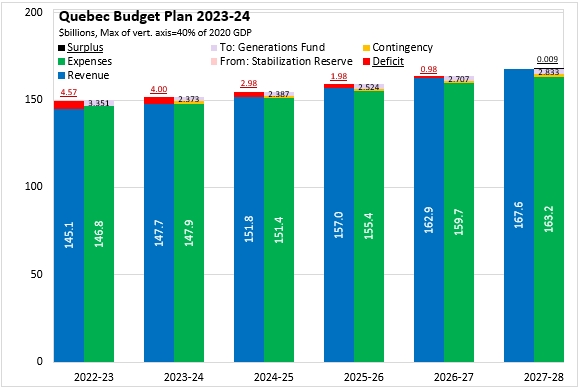

March 22, 2023QUEBEC BUDGET 2023-24 Quebec released its 2023-24 Budget on March 21. The Province of Quebec's Budget statements include required payments to the Province's Generations Fund as well as contributions from the Stabilization Reserve. The deficits shown in the first chart reflect the Quebec government's financial position after making payments to the Generations Fund and receiving funds from the Stabilization Reserve.

For 2023-24, the government of Quebec plans on a $4.0 billion deficit after making a $2.373 billion contribution to the Generations Fund (along with a contingency provision of $1.5 billion). In 2022-23, the latest forecast projects a deficit of $4.57 billion after a $3.351 billion contribution to the Generations Fund and a $449 million increase to revenues from the Stabilization Reserve. In future years, Quebec's budget deficits are projected to narrow, leading to a small surplus in 2027-28.

Quebec's revenue growth is projected to slow to 1.8% in 2023-24 while expenditures grow by 0.7%.

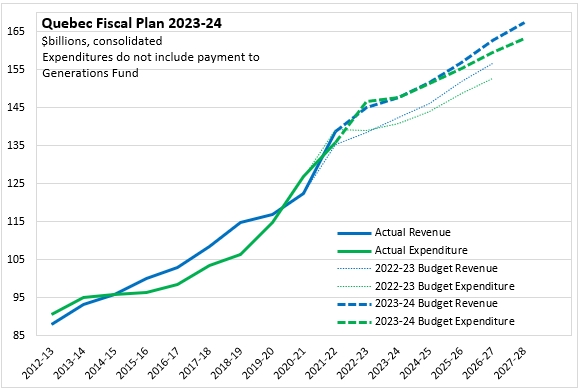

As in many provinces, Quebec's revenues for 2022-23 grew more rapidly than expected. Expenditure projections (prior to contributions to the Generations Fund) have also been revised up. For 2023-24, revenues are now projected to be $5.2 billion higher than anticipated in last year's fiscal plan. Expenditures for 2023-24 are projected to be $6.9 billion higher than in last year's fiscal plan.

Excluding the contributions to the Generations Fund, Quebec's fiscal outlook anticipates somewhat larger deficits (and smaller surpluses) than previously planned.

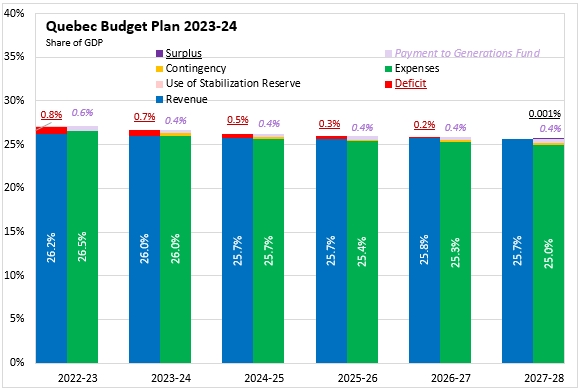

Quebec's deficit for 2023-24 amounts to 0.7% of GDP. Planned deficits in the future will be smaller as a share of GDP. Contributions to the Generations Fund amount to 0.4% of GDP in 2023-24 and each subsequent fiscal year.

The overall footprint of the Quebec government in the provincial economy amounts to 26.0% in 2023-24. Through the rest of the forecast horizon, Quebec's government footprint in the economy is expected to be stable at around 25.7% to 25.8% of GDP.

Quebec's net debt to GDP ratio is projected to rise slightly to 37.7% of GDP in 2023-24. Thereafter, the net debt to GDP ratio is projected to decline, falling to 35.8% by 2027-28. The Quebec government is targeting a net debt amounting to 27.5% to 32.5% of GDP within the next 15 years (median target: 30%).

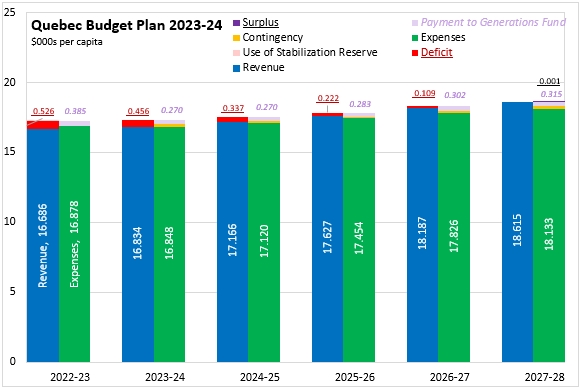

Quebec's Budget projects expenditures of $16,848 per capita in 2023-24, rising to $18,133 per capita by 2027-28.

Quebec's economic outlook anticipates continued slowing of real GDP growth due to the Bank of Canada's monetary tightening. Quebec's real GDP growth is projected to slow to 0.6% as the economy transitions in 2023. By 2024, real GDP growth is projected to return to trend with growth of 1.4%, particularly as export demand recovers after inflationary pressures are tamed. Domestic demand is expected to be the main driver of Quebec's growth in 2023 and 2024 with slowing household consumption and residential investment because of higher interest rates. Business investment also faces headwinds, but is expected to get a lift from automation investments to mitigate labour shortages. Although the outlook does not assume a recession in Quebec, this is an area of uncertainty.

Key Measures and Initiatives

The Quebec Budget for 2023-24 prioritizes: growing Quebec's wealth, developing the potential of youth, making the health care system more effective and more humane and supporting Quebecers

- Growing Quebec's wealth, including:

- reducing the rates for the bottom two tax brackets by one percentage point each this year - from 15% to 14% for the bottom bracket (also reducing the conversion rate for personal income tax credits) and from 20% to 19% for the second bracket

- raising the housing component of the solidarity tax credit by $78

- replacing the tax holiday for large investment projects (>$100 million) - expanding to a wider range of sectors with additional incentives (up to 25% of project value) depending on location of investment

- supporting innovation: innovation zones, transportation projects, merit scholarships, clean energy projects, life sciences supports, FinTech supports

- promoting business growth, digitization and exports: expansion of the Contrecoeur terminal, enhancement of cybersecurity, export marketing, increasing productivity in construction

- contributing to regional prosperity: bio-food sector, development of tourist attractions, development of forestry and mineral sectors, enhancing connectivity

- addressing the labour shortage: integration of immigrants, supporting business search for workers

- Developing the potential of youth, including:

- improving student retention and success, improving data access, making vocational training more attractive, maintaining schools

- increasing participation in recreational/sport activities while strengthening integrity in sports, developing the National Trail

- supporting higher education students financially, increasing graduation rates and adopting technological advances

- Making the health care system more effective and more humane, including:

- adapting to post-pandemic health needs and practices (vaccination, testing), updating emergency preparedness and reducing wait list for surgeries\

- opening front-line access clinics, adding nurse practitioners, developing online appointment bookings, establishing helicopter transportation and improving management of rare/chronic diseases

- decentralizing health and social services

- increasing home support services, adding housing adapted for seniors, offering free vaccination against shingles, ensuring sustainability of services in private seniors residences

- increasing supports to community organizations, increasing mental health, homelessness and addictions services, creating respite care spaces for families of children with disabilities, strengthening care and services for youth in difficulty

- Supporting Quebecers, including:

- promotion of Quebec culture and the French language

- developing 5,250 social and affordable housing units, allocation of 2,000 units under the Rent Supplement Program

- converting 5,000 non-subsidized child care spaces into subsidized spaces

- supporting public transit recovery and diversifying transport for people with reduced mobility

- improving local road networks, encouraging use of rail network

- improving food bank storage infrastructure

- combating sexual/domestic violence, homophobia/transphobia and racism

Quebec Budget 2023-24

<--- Return to Archive