The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

March 21, 2023ANALYSIS OF NOVA SCOTIA'S CONSUMER PRICE INDEX FOR FEBRUARY 2023 TRENDS – February 2023

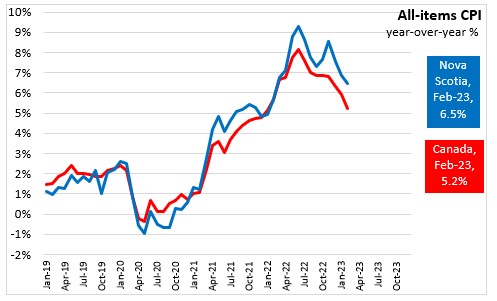

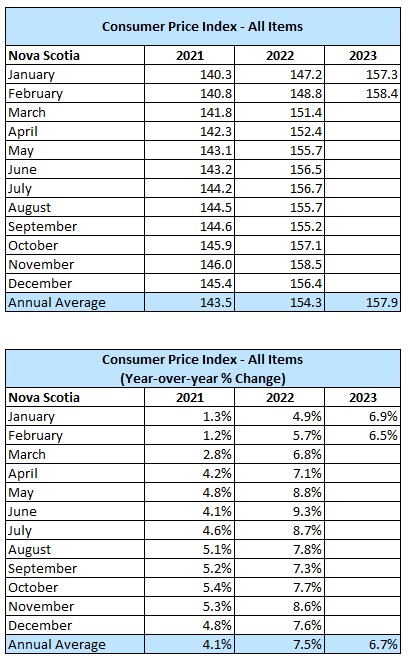

Nova Scotia’s All-Items Consumer Price Index (CPI) increased 6.5% year-over-year in February 2023. Inflation rate in Nova Scotia has been declining since peaking at 9.3% in June 2022. Nationally, consumer prices increased 5.2% year-over-year in February 2023, following a 5.9% increase in January.

Inflation was highest in Prince Edward Island (6.7%) and lowest in Alberta (3.6%).

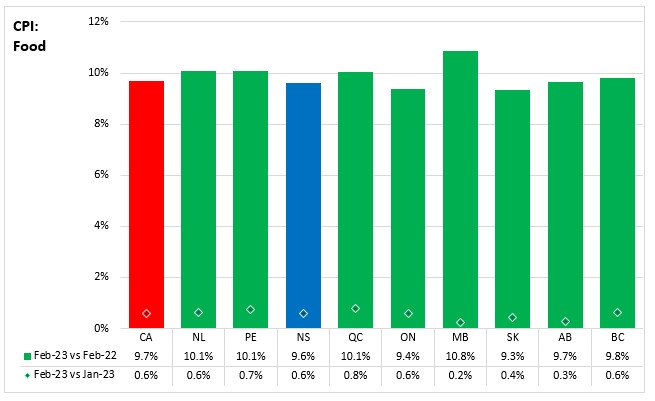

The CPI for food in Nova Scotia increased 9.6% in February, down from the 10.1% gain recorded in January 2023. All provinces recorded year-over-year increase in food prices led by Manitoba (+10.8%). The lowest food inflation was reported in Saskatchewan (9.3%).

Nationally, food prices rose (+9.7%) in February 2023 on a year-over-year basis. Supply constraints, unfavourable weather in growing regions, and high input costs such as animal feed, energy and packaging materials continue to put upward pressure on grovery prices. Food purchased from stores rose 10.6% year over year in February, posting the seventh consecutive month of double-digit increases.

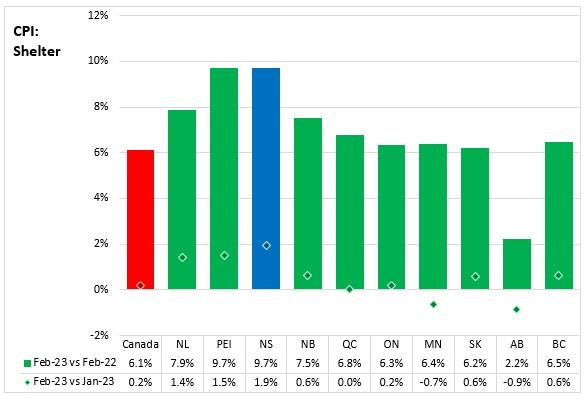

Year-over-year, shelter costs in Nova Scotia increased 9.7% in February, up from the 8.1% gain seen in January 2023.

In February, shelter prices increased 6.1% year-over-year across Canada. This was the third consecutive month where shelter costs increased at a slower pace. Homeowners' replacement cost index slowed on a year-over-year basis to 3.3% in February. Other owned accommodation expenses (+0.2%), which includes commissions on the sale of real estate, also decelerated in February. However, the mortgage interest cost index increased at a faster rate year over year in February (+23.9%) compared with January (+21.2%), the fastest pace since July 1982.

Compared to February 2022, shelter prices were up in all provinces with the largest increase in Nova Scotia and Prince Edward Island (both at +9.7%) and the smallest increase in Alberta (+2.2%).

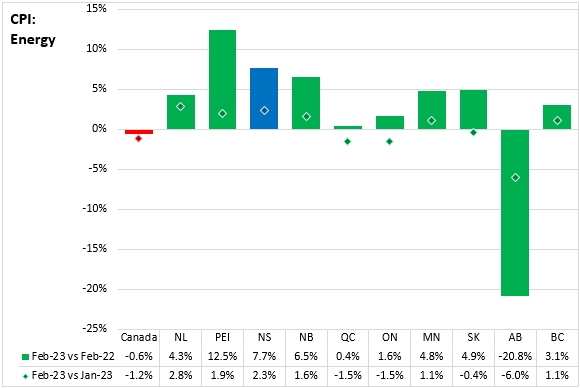

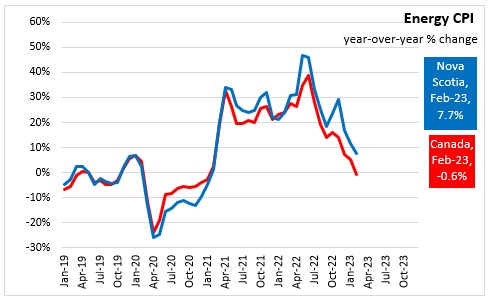

Nova Scotia's consumer price inflation (year-over-year growth in CPI) for energy was 7.7% in February 2023, down fom the 11.7% gain recorded in January.

Nationally, energy prices declined 0.6% year over year in February, following a 5.4% increase in January. The decline was mainly driven by lower gasoline prices (-4.7%) which recorded the first yearly decline since January 2021. The year-over-year decrease in gasoline prices is partly the result of a base-year effect, as prices began to rise rapidly in the early months of 2022 during the Russian invasion of Ukraine.

Prince Edward Island (+12.5%) posted the largest year-over-year increase in energy prices in February. Alberta (-20.8%) was the only province reporting a year over year decline in the energy index in February.

Compared to January 2023, energy prices were higher in six provinces lef by Newfoundland and Labrador (+2.8%). Nationally, consumers paid 1.0% less for gasoline in February amid higher crude oil inventory levels within the United States.

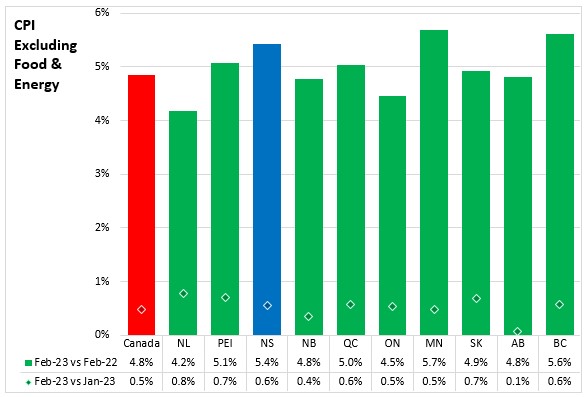

Nova Scotia’s consumer price inflation (year-over-year) excluding food and energy increased 5.4% in February 2023. Consumer prices excluding food and energy were up in all provinces led by Manitoba (+5.7%) and British Columbia (+5.6%). Newfoundland and Labrador had the smallest increase at 4.2%.

For Canada, consumer price inflation excluding food and energy increased 4.8% year-over-year in February.

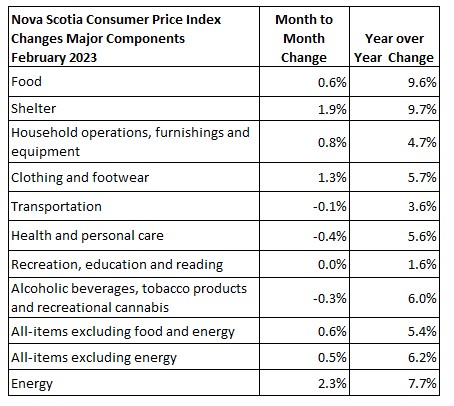

Major Components for February 2023

The following table shows the price increases specific to Nova Scotia for the major components of the CPI this month.

The main contributors to the monthly change (February 2023 vs January 2023) in Nova Scotia CPI were:

- Rent (+3.8%)

- Fuel oil and other fuels (+9.8%)

- Telephone services (+7.2%)

- Internet access services (200112=100) (-12.9%)

- Fresh or frozen pork (-22.0%)

- Home entertainment equipment, parts and services (-7.3%)

The main contributors to the yearly change (February 2023 vs February 2022) in Nova Scotia CPI were:

- Fuel oil and other fuels (+37.4%)

- Rent (+9.3%)

- Mortgage interest costs (no % change but upward pressure)

- Home entertainment equipment, parts and services (-15.3%)

- Child care and housekeeping services (-17.1%)

- Internet access services (100112=100) (-9.8%)

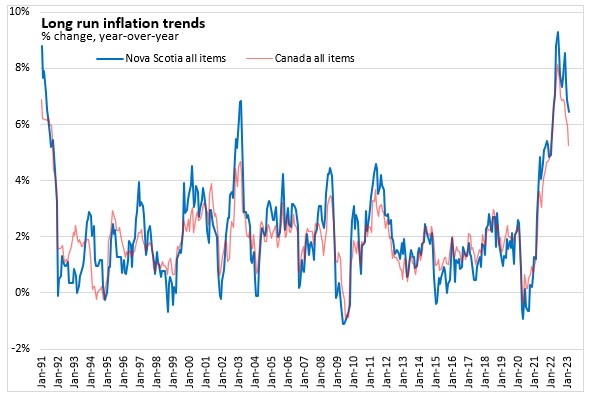

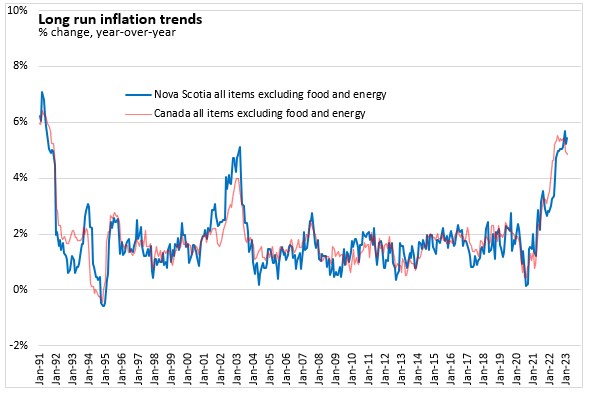

Long Run Trends

Since the start of the Bank of Canada’s inflation-targeting regime, there have been several periods during which year-over-year price growth was well above 2% and several periods during which it was below 2%. Because the share of Nova Scotia’s household consumption spent on fuel oil for heating is larger than the national average, the province is more exposed to fluctuations in global oil prices. As a result, Nova Scotia’s inflation is usually larger than the national average during periods of rising global oil prices and below the national average when oil prices are falling.

In February 2023, the all-items CPI year-over-year inflation rate for Nova Scotia was 6.5%, above the national inflation rate of 5.2%.

Food and energy prices set on global markets explain most periods of elevated inflation since the early 1990s. Excluding the impacts of volatile food and energy prices, there have been only two periods of sustained inflation above 2% during the inflation targeting era: 2001-2003 and 2022-2023.

Nova Scotia’s CPI excluding food and energy increased 5.4% year over year in February 2023, above the national average increase of 4.8%.

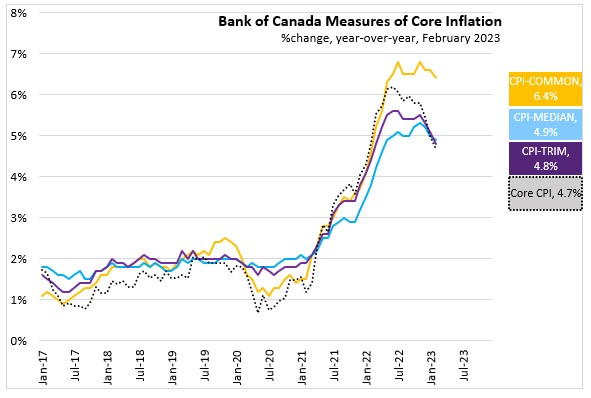

Bank of Canada's preferred measures of core inflation

Compared to February 2022, CPI-Common increased 6.4%, CPI-Median increased 4.9% and CPI-Trim was up 4.8% in Canada. All-items CPI excluding eight of the most volatile components as defined by the Bank of Canada and excluding the effect of changes in indirect taxes (formerly referred to as CPIX), rose 4.7% year-over-year. The change in the core inflation measures was down 0.1 percentage points for CPI-Trim, 0.2 percentage points for CPI-Common, and 0.3 percentage points for CPI-Median from the previous 12-month period.

Appendix Tables and Charts

Basket Update - May 2022

As part of schedule update, Statistics Canada has updated the basket weights based on 2021 expenditures. A used vehicle price was introduced into the CPI Compared to the previous basket reference year of 2020 for Nova Scotia, increase weight for transportation (+2.04 percentage points) and clothing and footwear (+0.52 percentage points) were offset by lower weights for food (-0.5 percentage points), shelter (-0.53 percentage points), health and personal care (-0.65 percentage points) and recreation, education and reading (-0.5 percentage points). Statistics Canada noted that at national level the headline CPI growth rate would be the same using the previous weights. For full details on the weight update, see An Analysis of the 2022 Consumer Price Index Basket Update, Based on 2021 Expenditures.

Source: Statistics Canada. Table 18-10-0004-01 Consumer Price Index, monthly, not seasonally adjusted; Table 18-10-0256-01 Consumer Price Index (CPI) statistics, measures of core inflation and other related statistics - Bank of Canada definitions

<--- Return to Archive