The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

February 02, 2023BANK OF ENGLAND MONETARY POLICY The Monetary Policy Committee of the Bank of England voted to increase the Bank Rate by 0.5 percentage points to 4.0%.

According to the first estimates, UK Gross Domestic Product (GDP) had fallen by 0.3% in the third quarter of 2022 in the Quarterly National Accounts. Based on official data available to November 2022, it is expected that UK GDP has grown 0.1% in the fourth quarter of 2022. Household consumption and business investment both reported declines. The small rise in headline GDP in Q4 in part reflects some temporary factors such as the recovery in activity following the Queen’s state funeral in September. In the first quarter of 2023 reflecting the past sharp rise in energy prices weighing on real incomes and household spending. Following an estimated 4.0% growth, the Bank projects UK GDP to decline 0.5% in 2023 and 0.25% in 2024 before increasing 0.25% in 2025.

The UK labour market remains tight however the Bank noted that the conditions appear to pass its peak tightness. Unemployment rate remained at 3.7% in the three months to November 2022 while employment growth has slowed in the second half of 2022. Employment growth is still expected to be positive in 2023. The labour market had remained tight by historical standards; however, there were signs that the labour market had started to loosen and some survey indicators of wage growth had eased.

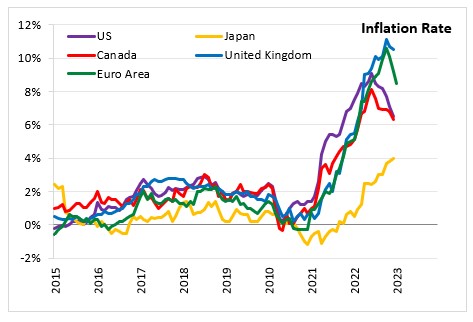

As set out in the accompanying February Monetary Policy Report, the MPC’s updated projections showed CPI inflation falling back sharply from its current very elevated level of 10.5% in December, in large part owing to past increases in energy and other goods prices falling out of the calculation of the annual rate. Core CPI inflation, excluding energy, food, beverages and tobacco, had remained unchanged at 6.3%. Core goods inflation had fallen by more than had been anticipated, to 5.8%, but services inflation had surprised to the upside, rising to a 30-year high of 6.8%. The Bank projects CPI inflation to decline from 10.75% in 2022 to 4.0% in 2023 and 1.5% in 2024 and 2025.

The Committee noted that further increases in the Bank Rate may be required to return inflation to target should the economy feel more persistent pressures.

The Monetary Policy Committee of the Bank of England will announce its next interest rate decision on March 23, 2023.

Source: Bank of England, Monetary Policy Summary, Monetary Policy Report, February 2023

<--- Return to Archive