The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

November 25, 2022SURVEY ON BUSINESS CONDITIONS: Q4 2022 Statistics Canada has conducted its tenth iteration of the Canadian Survey on Business Conditions. In October and early November, Statistics Canada surveyed businesses to collect information on businesses' expectations, obstacles, plans and practices. Among the new questions asked during this iteration were details about international and interprovincial trade, with an emphasis on the barriers to interprovincial trade.

The results reported here are a selection of the impacts found for Nova Scotia businesses, by industry, by size of business (measured by number of employees), by age of business and by urban or rural location. There are comparisons of the Nova Scotia average (all industries, ages, sizes, locations) with the national and provincial averages. The horizontal axis in all charts measures the share of businesses reporting each outcome. The total for many outcomes does not add to 100% of respondent businesses as many replied that the outcome was not applicable in their circumstances.

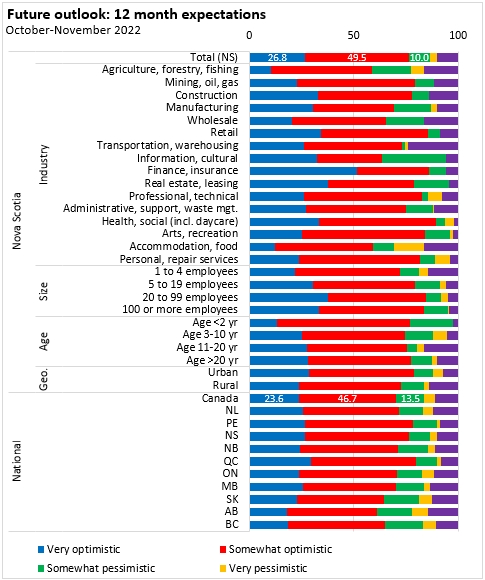

Future outlook over the next 12 months

In Nova Scotia, 26.8% of businesses were very optimistic about the next 12 months; a further 49.5% were somewhat optimistic, 10.0% were somewhat pessimistic and 3.7% were very pessimistic. Optimism was higher in Nova Scotia than the national average. Business optimism was higher in Quebec and lower in Alberta and British Columbia.

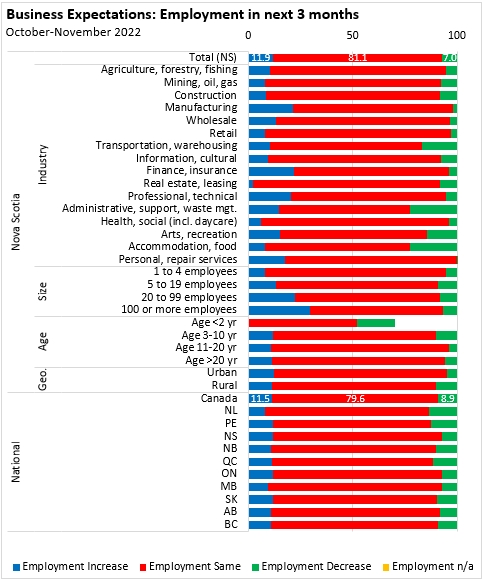

Business expectations for the next three months

The outlook for employment was stable for 81.1% of Nova Scotia businesses in the next three months. Rising employment is expected among 11.9% of Nova Scotia businesses (down considerably from earlier in the year) while declining employment is expected by 7.0% of Nova Scotia businesses.

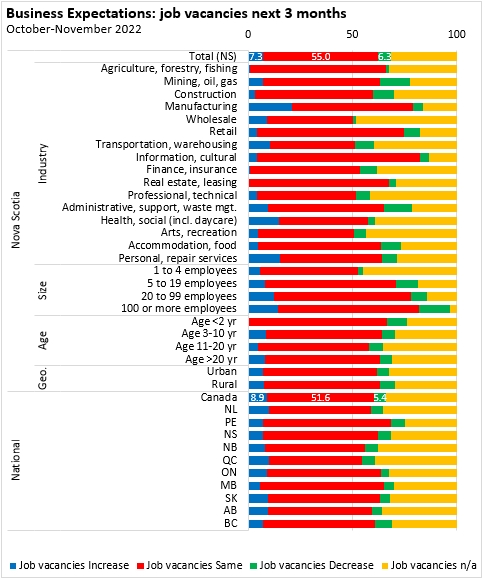

55.0% of Nova Scotia businesses expect stable job vacancies (51.6% nationally) while 7.3% expect rising job vacancies and 6.3% expect falling vacancies. Expectations of rising vacancies were more prevalent in Nova Scotia's manufacturing, health/social (including daycare), and personal/repair services industries. Across Canada, 8.9% of businesses expect rising job vacancies and 5.4% expect falling vacancies.

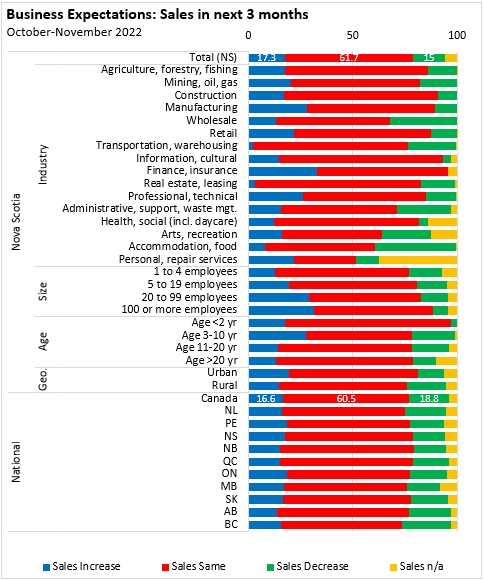

79.0% of Nova Scotia businesses expect stable or rising sales while 15.0% expect a decline. These expectations were weaker than those reported in the previous two quarters.

Rising prices were expected by 31.2% of Nova Scotia businesses while 57.7% expected stable prices. Only 5.4% expected price declines.

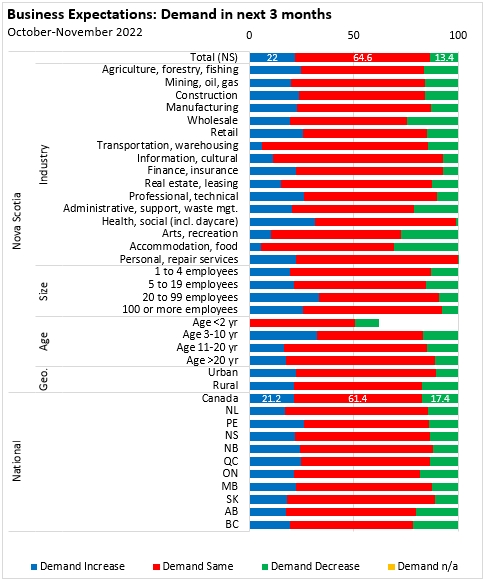

64.6% of Nova Scotia businesses expected stable demand while 22.0% expected a rise in demand and 13.4% expected a fall in demand. Rising demand is more widely expected among Nova Scotia's health/social (including daycare) professional/technical services and retail businesses. Compared with the two previous quarters, a smaller portion of Nova Scotia businesses expect rising demand while a larger share expect demand to decline.

Across Canada, rising demand is expected by 21.2% of businesses while falling demand is expected by 17.4%.

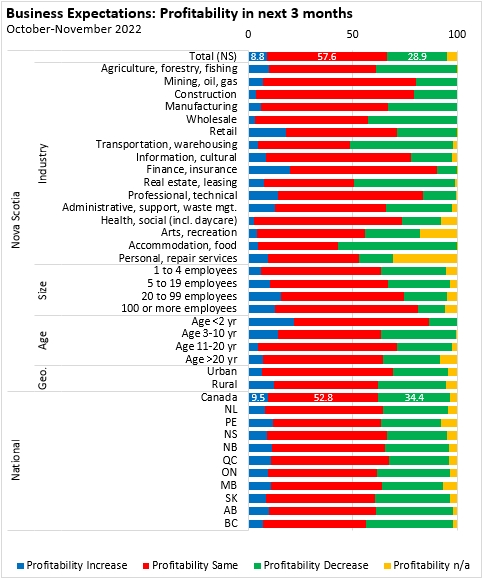

Business profitability is expected to remain the same for 57.6% of Nova Scotia businesses in the next three months while 8.8% expect rising profitability and 28.9% expect decreasing profitability. Rising profitability is expected more in Nova Scotia's finance/insurance and retail businesses. Decreasing profitability expectations were more prevalent in Nova Scotia's accommodation/food, real estate/leasing and transportation/warehousing businesses.

Obstacles for businesses

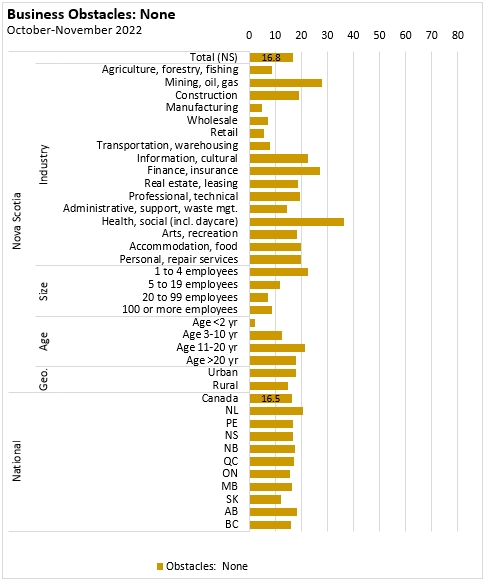

As part of the Survey of Business Conditions, businesses were asked about their obstacles. 16.8% of Nova Scotia businesses reported no substantial obstacles expected in the next three months (down from the previous quarter). Businesses in Nova Scotia's health/social and finance/insurance industries were more likely to report no substantial obstacles. Across Canada, 16.5% of businesses reported no obstacles.

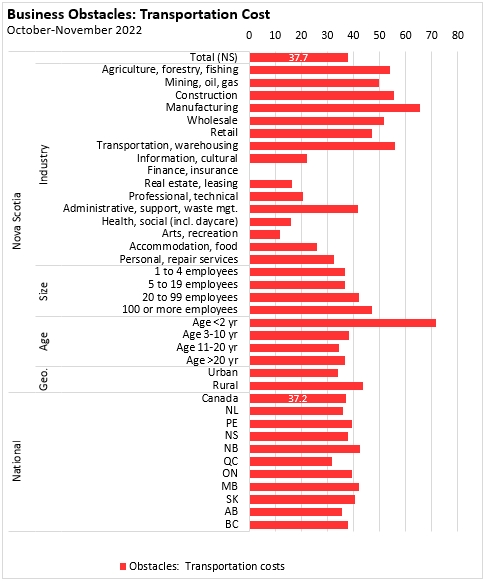

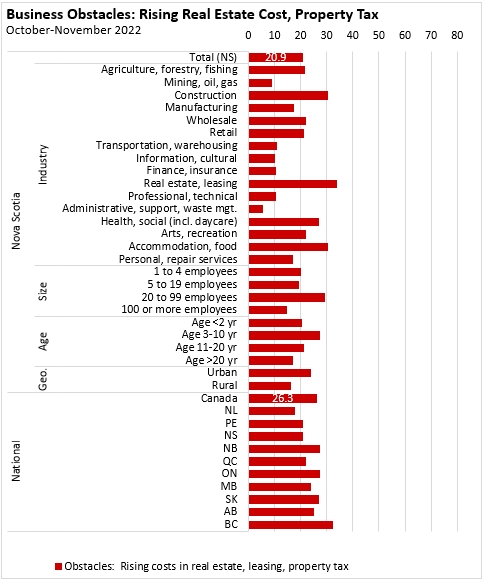

Cost factors were among the most commonly cited obstacles by Nova Scotia businesses, including rising inflation (59.5%) rising input costs (43.0%), insurance costs (33.4%), transportation costs (37.7%) and higher real estate/property tax costs (20.9%).

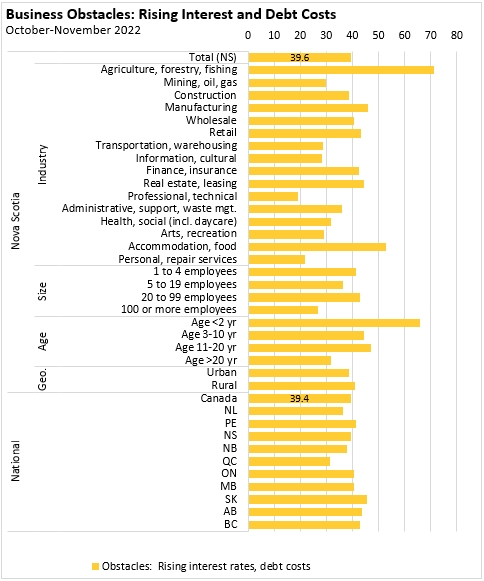

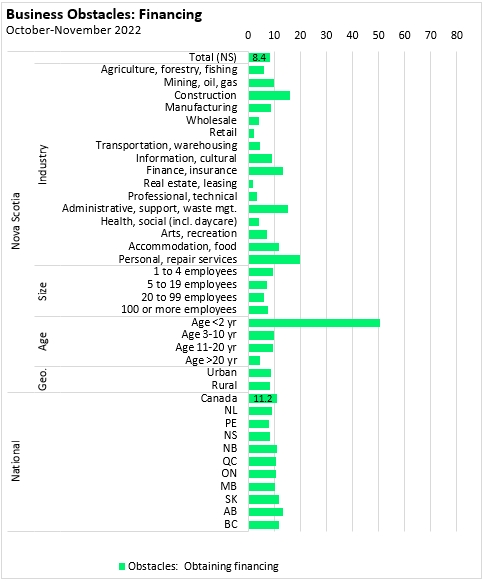

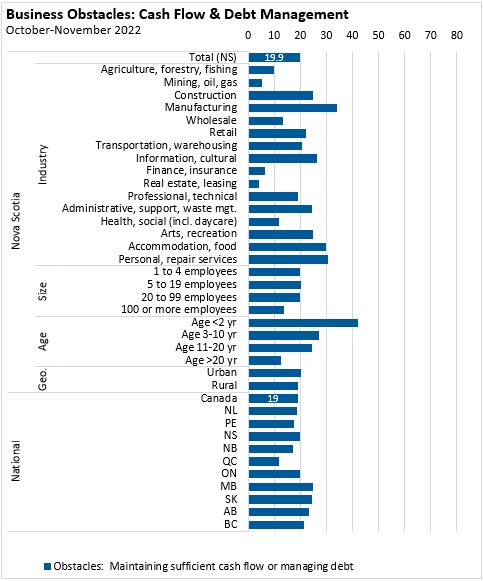

Rising interest rates and debt costs were cited as an obstacle by 39.6% of Nova Scotia businesses (39.4%) nationally. This obstacle was more widely cited by agriculture/forestry/fishing businesses as well as accommodation/food. Despite more obstacles from rising interest rates and debt service costs, financing was cited as an obstacle by just 8.4% of Nova Scotia businesses (primarily those that were under 2 years in operation). Managing cash flow was an obstacle noted by 19.9% of Nova Scotia businesses - particularly among those in manufacturing, accommodation/food and personal/repair services.

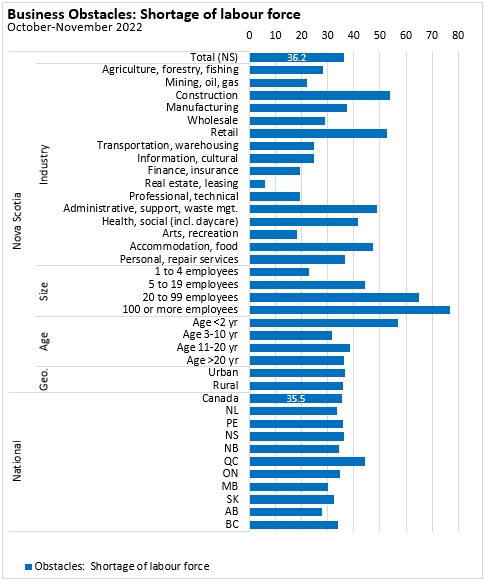

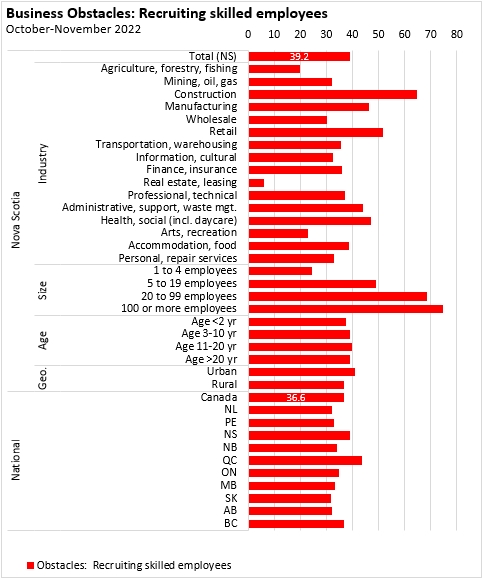

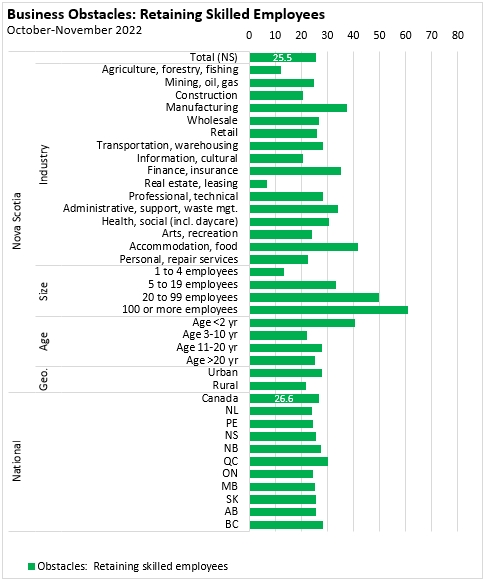

Labour shortages were noted as obstacles for 36.2% of Nova Scotia businesses. Recruiting skilled employees (39.2%) was a more commonly-noted obstacle than retaining skilled employees (25.5%).

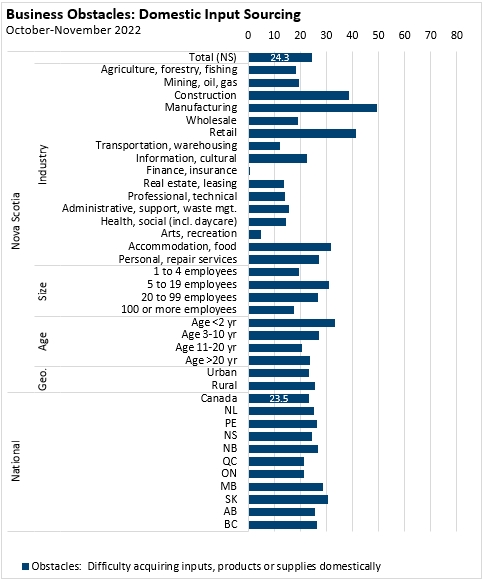

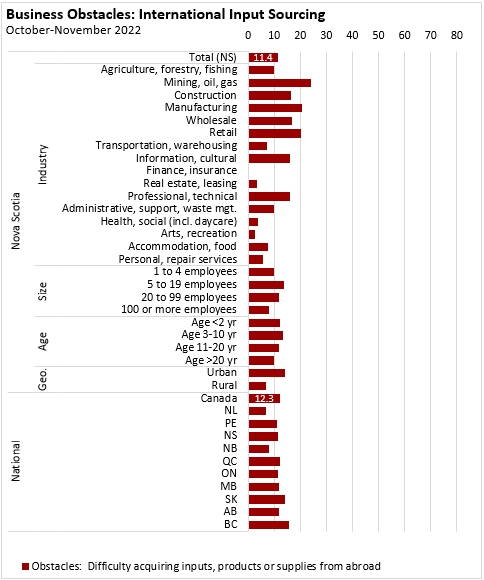

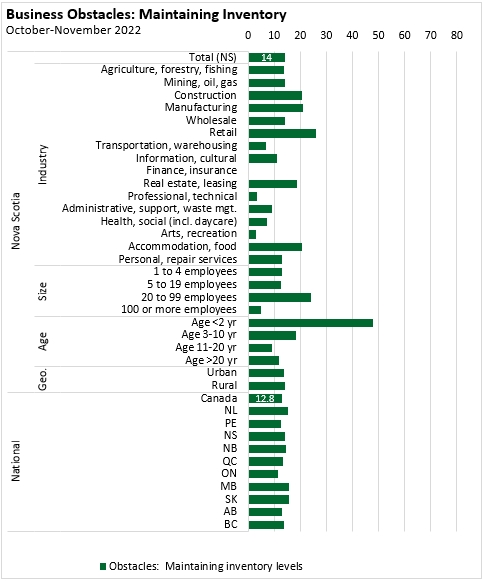

Supply chain issues were noted as an obstacle by 31.5% of Nova Scotia businesses (29.8% nationally). Domestic input sourcing was noted as a challenge for 24.3% of Nova Scotia businesses while international input sourcing was an obstacle for 11.4%. Maintaining inventory levels was an obstacle for 14.0% of Nova Scotia businesses (notably retail, construction, manufacturing and accommodation/food).

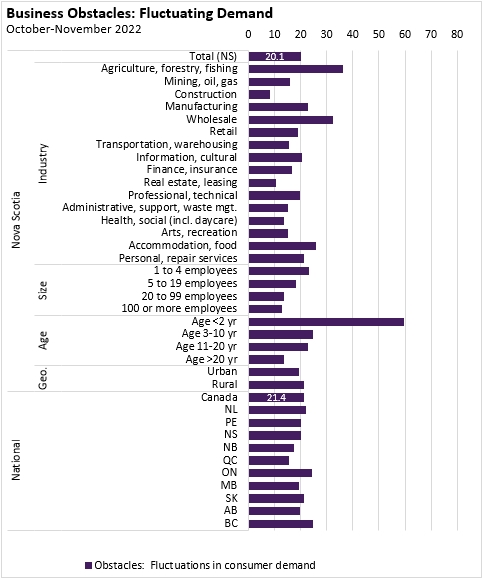

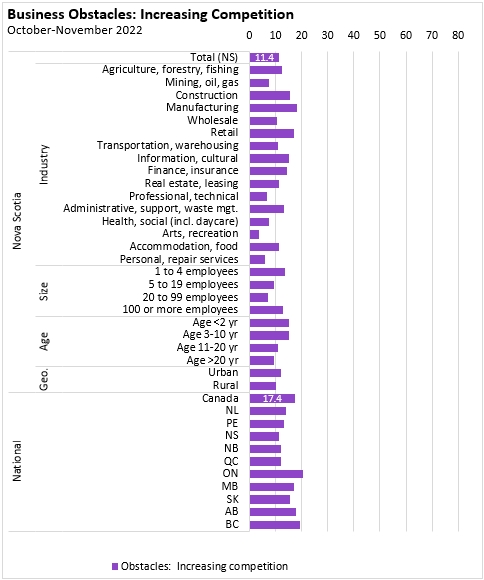

Insufficient demand (11.0%) and increasing competition (11.4%) were less commonly cited as obstacles for Nova Scotia businesses than fluctuating demand (20.1%).

Source: Statistics Canada. Table 33-10-0630-01 Future outlook over the next 12 months, fourth quarter of 2022; Table 33-10-0602-01 Business or organization expectations over the next three months, fourth quarter of 2022; Table 33-10-0603-01 Business or organization obstacles over the next three months, fourth quarter of 2022

<--- Return to Archive