The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

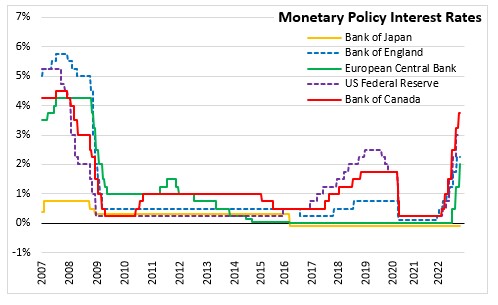

October 27, 2022EUROPEAN CENTRAL BANK MONETARY POLICY The European Central Bank (ECB) raised the three key ECB interest rates by 75 basis points. The interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will be increased to 2.0%, 2.25% and 1.50% respectively, with effect from 2 November 2022.

Based on the updated assessment of inflation risks, the Governing Council expects to raise interest rates further to dampen demand and inflation expectations. ECB interest rate decisions will continue to be data-dependent and follow a meeting-by-meeting approach.

The Governing Council intends to continue reinvesting principal payments from maturing securities purchased under the Asset Purchase Program (APP) for an extended period of time past when it starts to raise the key ECB rates. Reinvestment of the principal payments from maturing securities purchased under the Pandemic emergency purchase programme (PEPP) will continue until at least the end of 2024.

The Governing Council also decided to change the terms and conditions of the third series of targeted longer-term refinancing operations (TLTRO III). From 23 November 2022 until the maturity date or early repayment date of each respective outstanding TLTRO III operation, the interest rate on TLTRO III operations will be indexed to the average applicable key ECB interest rates over this period. The Governing Council also decided to offer banks additional voluntary early repayment dates.

In addition, the Governing Council will set the remuneration of minimum reserves at the ECB’s deposit facility rate in order to align the remuneration of minimum reserves held by credit institutions with the Eurosystem more closely with money market conditions. Severe disruptions in the supply of gas have worsened the situation further.

Following a rebound in the first half of 2022, economic activity in the Euro Area is expected to have slowed in the third quarter with further weakening in the final quarter. High inflation continues to weigh on spending and production by lowering people's real incomes and increasing costs for firms. Russia's invasion of Ukraine continues to weigh on the confidence of businesses and consumers and slow down global economic activity. With the import prices increasing faster than export prices, terms of trade in the euro area is worsening further weighing on incomes.

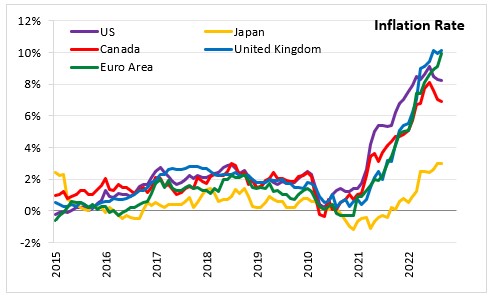

Inflation in the Euro Area increased to 9.9% in September 2022. Higher energy and food prices, supply problems and the post-pandemic recovery demand have caused an upward pressure on prices and an increase in inflation. Measures of underlying inflation have also remained at increased levels. As strong labour market supports higher wages, some catch-up in wages is expected to compensate for higher inflation. Inflation is expected to be elevated for some time, before more moderate energy costs, eased supply disruptions, and normalisation of monetary policy led to a decline. ECB projects inflation to average 8.1% in 2022, 5.5% in 2023 and 2.3% in 2024.

The next scheduled monetary policy meeting will be on December 15, 2022.

Source: European Central Bank: Monetary Policy Decisions, Monetary Policy Statement (Press Conference)

<--- Return to Archive