The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

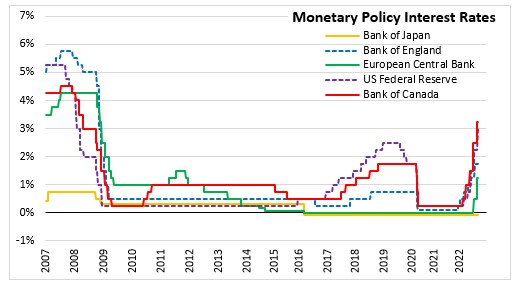

September 21, 2022US MONETARY POLICY At its scheduled Federal Open Market Committee (FOMC) meeting, the Federal Reserve announced that it will raise the target range for the federal funds rate by a three quarters of a point to 3.0 to 3.25 per cent. The Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities. As of June, Treasury securities will be reduced by up to $30 billion per month for 3 months prior to an increase to $60 billion per month and agency debt and agency mortgage-backed securities will be reduced up to $17.5 billion per month for 3 months before increasing to $35 billion per month.

Recent economic indicators point to modest growth in spending and production supported by strong employment levels and low unemployment rate. The war in Ukraine continues to put upward pressure on inflation and weigh on global economic activity.

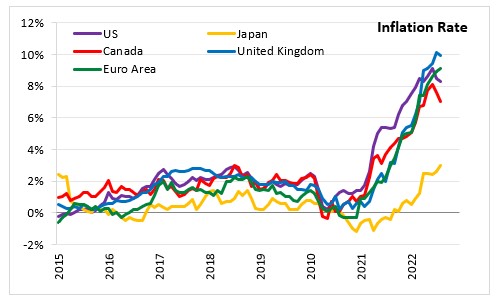

Inflation remains elevated reflecting supply and demand imbalances related to the pandemic, higher food and energy prices, and broader price pressures. The United States Consumer Price Index for All Urban Consumers increased 8.3 per cent year-over-year in August 2022.

The FOMC median projection for US real GDP growth in 2022 was lowered to 0.2% (previously 1.7% in June 2022). Projections for growth in 2023 and 2024 were also lowered to 1.2% and 1.7%, respectively. Inflation projections are higher for each of the next three years, at 5.4% in 2022, 2.8% in 2023 and 2.3% in 2024. The Federal funds rate median projection is for 4.4% at the end of 2022. The year end rate for 2023 and 2024 is projected for 4.6% and 3.9%, respectively, above the longer-run 2.5% projection for the Federal Funds rate.

The Committee anticipates that ongoing increases in the target range will be appropriate. The Committee will continue to monitor economic developments and is prepared to adjust the monetary policy measures as appropriate. The next scheduled FOMC meeting will be held on November 1/2, 2022. A summary of updated Economic Projections will be provided at the December 13/14 meeting.

Source: US Federal Reserve, FOMC Statement, Summary of Economic Projections (September 21, 2022)

<--- Return to Archive