The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

August 09, 2022FAMILY INCOME AND INDIVIDUAL INCOME, T1 FAMILY FILE, 2020 Statistics Canada has released estimates of family and individual income generated from 2020 T1 personal income tax returns. This data shows how income is changing over time for particular types of families as well as how it compares by type of income and geography.

During the initial waves of the COVID-19 pandemic, income data were distorted by large job losses as well as by Federal income support programs. Some results from 2020 are transitory deviations from previous trends.

The data shows median incomes for families (which often include more than one earner) as well as for persons within families (which allows for comparison with those who are not in census families). There are data available for provinces, for Census Metropolitan Areas (CMA), Census Agglomerations (CA) and areas outside CMA and CA communities. Within Statistics Canada’s estimates, there are income results for those who are in census families (couples and lone-parent families) as well as for those who are not in census families.

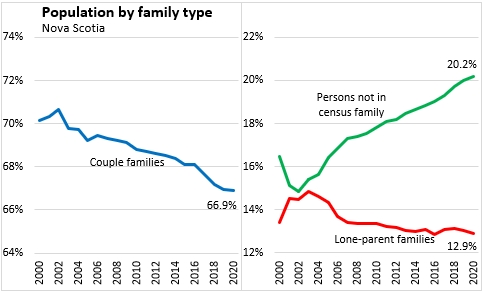

For Nova Scotia, the T1 records indicate a total of 939,440 persons (totals will not align with official population estimates). Of these, 66.9% were in couple families – the lowest such proportion among the provinces while there were 12.9% in lone-parent families (second highest among provinces) and 20.2% not in any form of census family (second highest among provinces).

Within Nova Scotia, the portion of couple families is lower in New Glasgow and the Cape Breton Regional Municipality, where there are more lone-parent families as well as persons not in a census family.

Over time, the share of Nova Scotia's population in census families has declined as has the share in lone-parent families. The population's share of persons not in a census family is rising (concentrated among older residents).

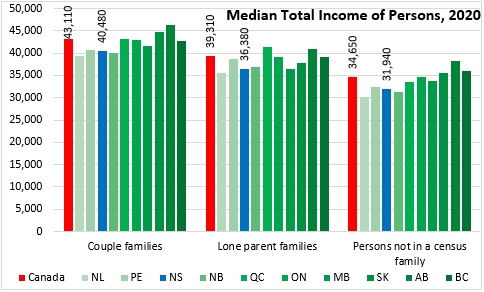

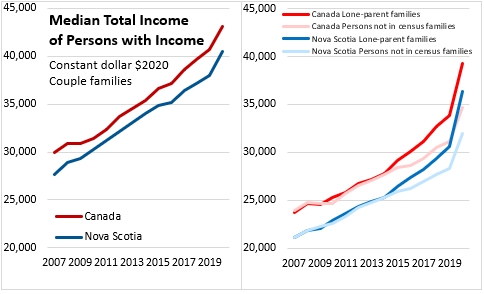

Median total income (among those who had income) for persons in couple families was $40,480 in Nova Scotia in 2020, which was 93.9% of the national average ($43,110). Median income from all sources among persons in lone-parent families who had income in Nova Scotia during 2020 was $36,380, 92.5% of the national median ($39,310). Median income from all sources among persons not in census families who had income was $31,940 or 92.2% of the national median ($34,650).

Note: median income of persons in couple families treats each person with income separately.

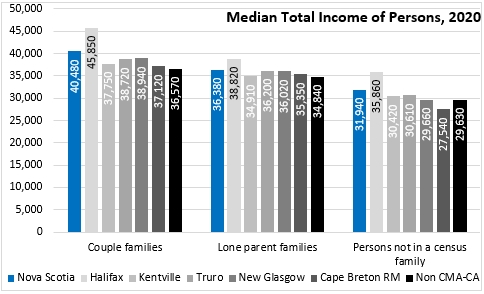

Within Nova Scotia, the Halifax CMA had higher median total income among couple families, lone-parent families, and persons not in families while areas outside of Halifax had lower median incomes across all family types. Median incomes were lowest for couple and lone-parent families in rural areas. Median incomes for persons not in a census family were lowest in the Cape Breton Regional Municipality.

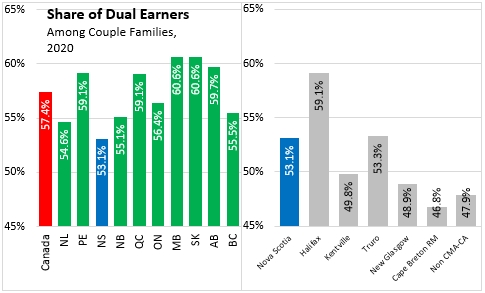

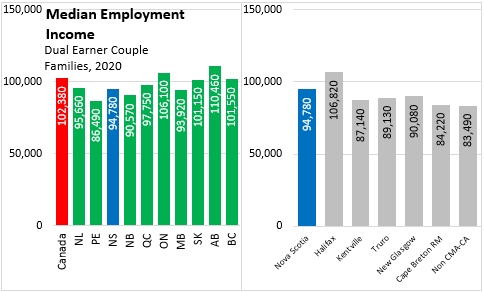

Couple families typically report higher incomes, particularly for those that have two persons earning employment income. Nova Scotia reports the lowest proportion of dual earners among couple families at 53.1%. The share of dual earners among couple families is notably lower in Kentville, New Glasgow, Cape Breton Regional Municipality and rural Nova Scotia (outside of Halifax and the Census Agglomeration areas).

Among dual earner couples, Nova Scotia's median total earnings (combining the incomes of both earners) were $94,780 in 2020 (92.6% of the national median). Dual earner couples' income was notably higher in Halifax than across the rest of the province.

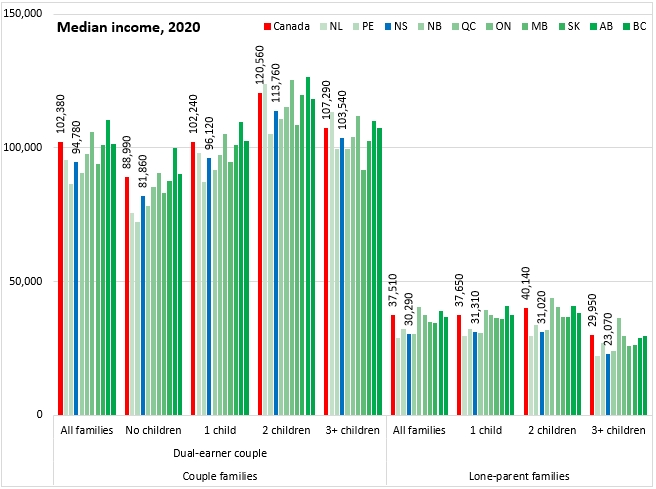

When looking at median incomes by family (including all earners in the family), couple families have higher median incomes, particularly for those with 2 children. In comparison, lone-parent families have substantially lower median incomes (less than one-third of earnings of dual earner couples).

Among couple families with only one earner, median incomes were notably higher for those families where the single earner is male as opposed to female.

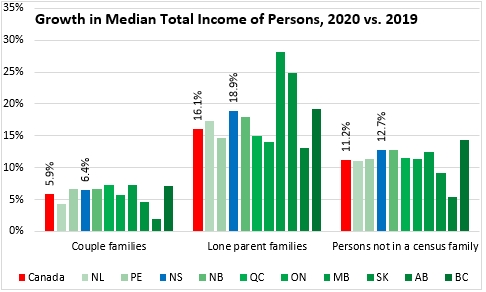

Growth in median incomes in 2020 was notably distorted by extraordinary government transfers.

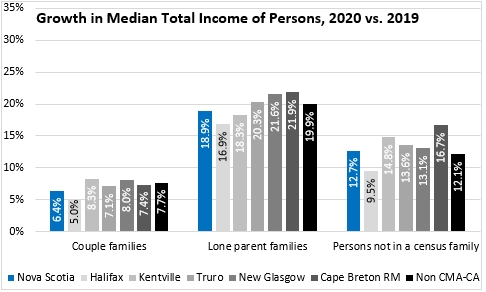

Nova Scotia's median income of persons in couple families grew by 6.4% from 2019 to 2020, faster than the national pace of 5.9%.

Income growth for Nova Scotia lone-parent families was 18.9% in 2020, faster than the national growth of 16.1%.

Among Nova Scotia's persons not in a census family, 2020 median income was 12.7% higher than in 2019, faster than the national median for this group (11.2%).

Median income growth was notably faster among lone parent families and persons not in a census family around the province. Income growth was slower for couple families. Income growth among each family type was slowest in Halifax.

In 2020, there were notably sharp increases in incomes for lone-parent families and persons not in a census family. There was also modest acceleration in the pace of growth in couple family median incomes.

The Annual T1 Family File provides breakdowns of family income by income range.

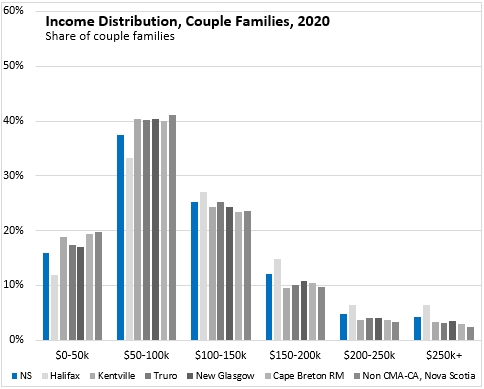

Among couple families in 2020, there was a higher share of Nova Scotia families reporting less than $100,000 in income than the national average. The share of Nova Scotia couple families reporting incomes between $100,000 and $150,000 was slightly above the national share, while there were smaller portions of Nova Scotians with incomes above $150,000.

Across Nova Scotia, the share of couple families with total income over $100,000 was higher in Halifax than in the rest of the province.

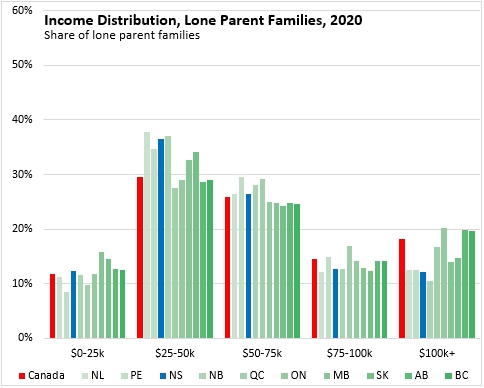

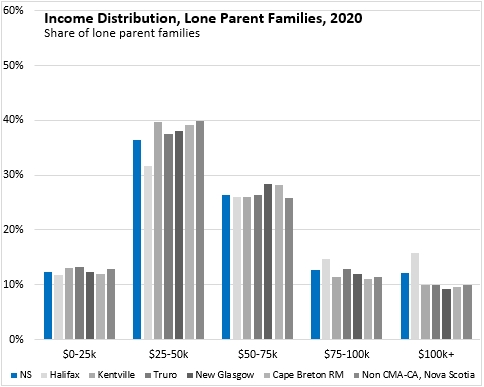

A larger portion of Nova Scotia lone parent families have total income under $75,000, compared with the national average. A smaller portion of Nova Scotia lone parent families report incomes in excess of $75,000.

Across the province, a larger portion of lone parent families report income over $75,000 in Halifax (compared to the provincial average). Outside the city a larger portion of lone parent families report incomes under $75,000.

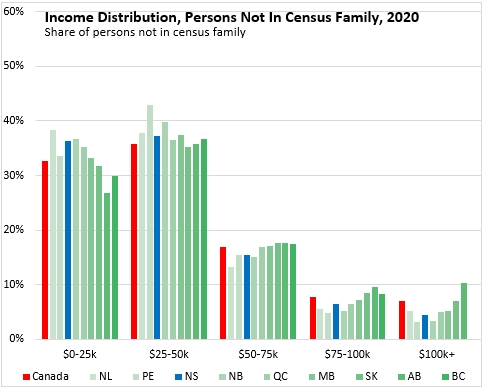

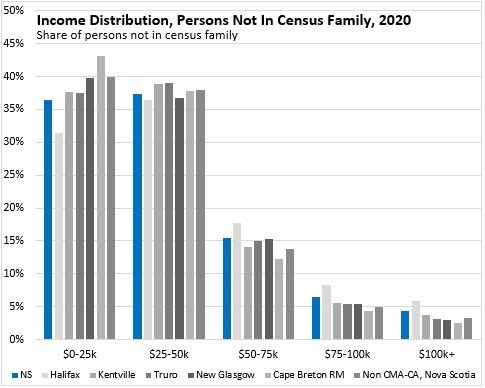

A higher portion of Nova Scotians not in a census family report incomes less than $50,000 (compared to the national average) while a lower portion report incomes in excess of $50,000.

Across the province, a higher portion of Halifax's persons not in a census family report incomes in excess of $50,000 (compared to the provincial average) while a higher portion of persons not in a census family outside the city report incomes under $50,000.

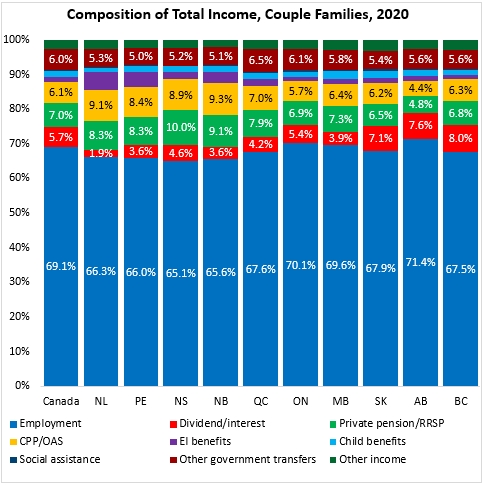

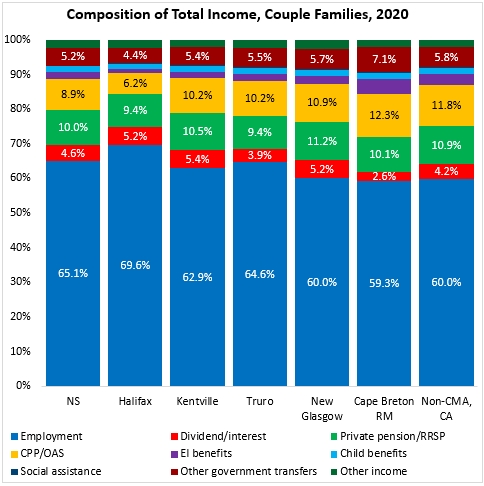

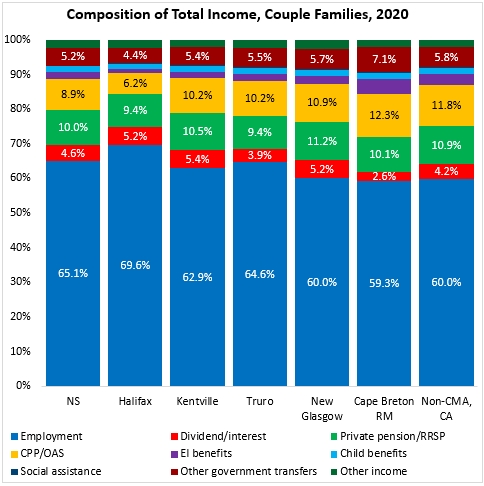

Nova Scotia couple families had the smallest share of total income from employment income in 2020 at 65.1%. Nationally, 69.1% of total income reported by couples was derived from employment income with the highest share in Alberta (71.4%).

Note that the share of income from other government transfers was notably higher in 2020 as a result of COVID-related support payments. Nova Scotia's couple families reported 5.2% of income from other government transfers. Nationally, 6.0% of income was from other government transfers with the highest shares in Ontario and Quebec and the lowest shares in Atlantic Canada.

Nova Scotia couples report the highest share of income from pension sources (private pensions, RRSPs, CPP and OAS). Incomes from interest and dividends are higher in British Columbia, Alberta and Saskatchewan.

Across Nova Scotia, employment makes up a larger share of couple family income in Halifax (69.6%). Other government transfers made up a higher portion of incomes in Cape Breton Regional Municipality (7.1%). CPP/OAS/pensions make up a larger share of income in outside Halifax.

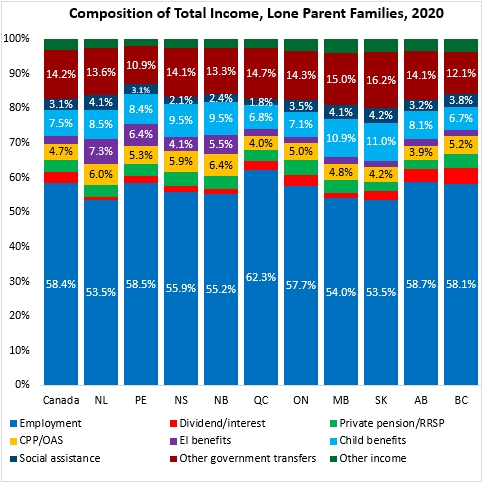

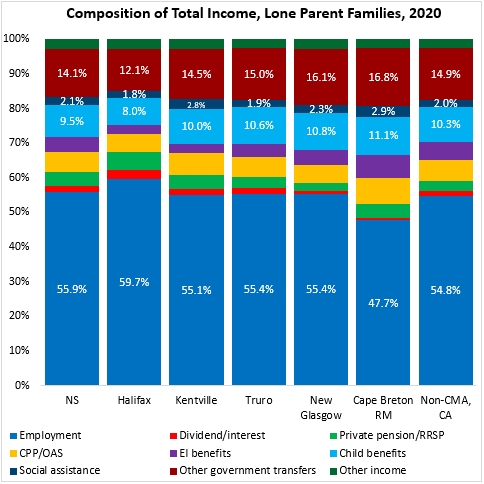

Employment income was 55.9% of the income for Nova Scotia's lone parent families in 2020 (58.4% nationally). Child benefits accounted for 9.5% of the income of lone-parent families in the province (vs 1.6% of income for Nova Scotia couple families). Other government transfers made up 14.1% of Nova Scotia lone parent family incomes in 2020 (14.2% nationally).

Within Nova Scotia, lone parents in Halifax reported a higher share of income from employment (59.7%) and a lower share from government transfers. Lone parents in the Cape Breton Regional Municipality reported a lower portion of income from employment (47.7%) and higher portions from child benefits, Employment Insurance and other government transfers.

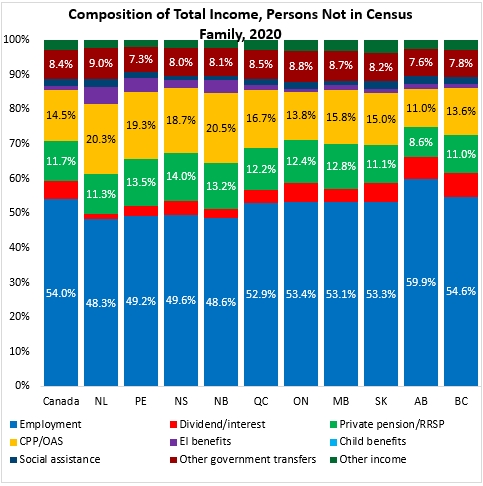

Persons not in a census family draw a much larger portion of their income from pension sources: private pensions, RRSPs, CPP and OAS. This is particularly the case in Atlantic Canada, where older populations reduce the share of the population generating income from employment.

Pension income is particularly important as a source of income in communities outside of Halifax.

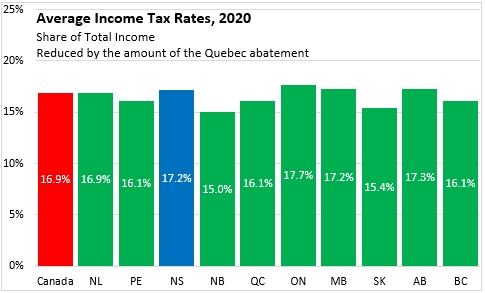

Measuring total income taxes paid to Provincial and Federal governments (and removing the Quebec abatement on Federal income taxes), the average national income tax rate was 16.9% of total national income in 2020. Nova Scotia's average income tax rate is 17.2% of total income. The highest average income tax rates were in Ontario and Alberta. The lowest average income tax rates were in Saskatchewan and New Brunswick.

Average income tax rates were higher in Halifax than across the rest of the province. The lowest average income tax rates were in Cape Breton Regional Municipality.

Statistics Canada Notes:

In this release, income levels have been adjusted for inflation as measured by the Consumer Price Index, and are expressed in 2020 constant dollars.

Total income includes employment income, dividend and interest income, government transfers, pension income and other income. In accordance with international standards, capital gains are excluded from total income.

This release uses the census family concept. A census family refers to a married or a common-law couple, with or without children at home, or a lone-parent family. Results also include persons not in a census family.

Statistics Canada. Table 11-10-0009-01 Selected income characteristics of census families by family type ; Table 11-10-0014-01 Sources of income by census family type ; Table 11-10-0034-01 Tax filers and dependants with income by sex, income taxes, selected deductions and benefits

<--- Return to Archive