The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

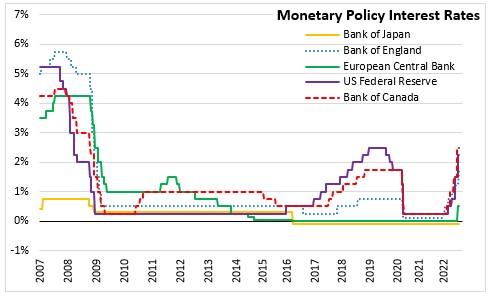

August 04, 2022BANK OF ENGLAND MONETARY POLICY The Bank of England Monetary Policy Committee (MPC) voted by 8-1 to increase the Bank Rate by 0.5 percentage points to 1.75%. The minority in the vote preferred to increase the Bank Rate to 1.5%. The MPC noted that the scale, pace and timing of any further changes in Bank Rate will reflect the Committee’s assessment of the economic outlook and inflationary pressures.

GDP growth in the United Kingdom has been slowing reflecting the impacts of higher energy and gas prices, and a deterioration in the outlook for activity in the United Kingdom and the rest of Europe due to the war in Ukraine. Following a 0.8% growth in Q1 2022, UK GDP is expected to have fallen by 0.2% in 2022 Q2. The slowdown in the second quarter primarily reflects a fall in government output due to the scaling back of Test and Trace activity, and some temporary weakness associated with the additional Platinum Jubilee bank holiday.

Labour and goods shortages, softening real income and consumer demand are expected to weigh on output in the coming months. UK GDP is expected to fall in each quarter from 2022 Q4 to 2023 Q4 and be in a recession by the end of the year. Real GDP is expected to grow 3.5% in 2022. The Bank expects UK economic activity to decline 1.5% in 2023 and 0.25% in 2024. Unemployment rates are projected to rise from current 3.75% to 5.75% in 2024.

The pickup in global energy and tradable goods prices has led to a marked squeeze on household real incomes. Retail sales declined in May and June. Consumer confidence also declined reflecting increasing concerns about rising cost pressures. The Government announced an additional £15 billion Cost of Living Support package during May. Bank staff estimate that the Cost of Living Support package will raise the level of GDP by a peak of around ½% in 2022 Q4 and 2023 Q1 before fading.

Consumer Price Inflation (CPI) increased to 9.4% in June 0.3 percentage points above the May Report projection due to higher fuel, food and, to a lesser extent, services prices. Core inflation declined to 5.8% in June, around 0.5 percentage point below the May Report projection driven mainly by a deceleration in core goods prices. Inflation is expected to increase 13% in 2022 before moderating to 5.5% in 2023 and to 1.5% in 2024.

The next scheduled monetary policy meeting will be held on September 15, 2022. An updated Monetary Policy Report will be provided at the November 3rd meeting.

Source: Bank of England, Monetary Policy Summary, Monetary Policy Report - August 2022

<--- Return to Archive