The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

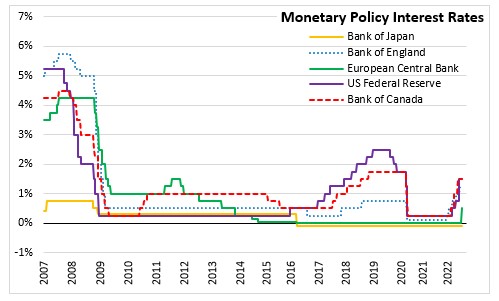

July 21, 2022EUROPEAN CENTRAL BANK MONETARY POLICY The European Central Bank (ECB) raised the three key ECB interest rates by 50 basis points and approved the Transmission Protection Instrument (TPI). The interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will be increased to 0.50%, 0.75% and 0.00% respectively, with effect from 27 July 2022.

Based on the updated assessment of inflation risks, the Governing Council decided to take a larger first step on its policy rate normalization path and noted that further normalization will be appropriate. The TPI is expected to support the return of inflation to the Governing Council’s medium-term target by strengthening the anchoring of inflation expectations and by ensuring that demand conditions adjust to deliver its inflation target in the medium term. The TPI will also ensure that the monetary stance is transmitted smoothly across all Euro Area countries. The front loading today of the exit from negative interest rates is expected to allow ECB to make a transition to a a meeting-by-meeting approach to interest rate decisions.

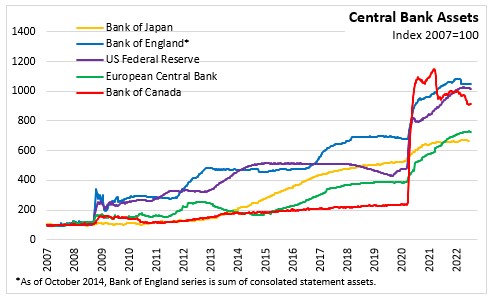

The Governing Council intends to reinvest principal payments from maturing securities purchased under the Asset Purchase Program (APP) for an extended period of time past when it starts to raise the key ECB rates. Reinvestment of the principal payments from maturing securities purchased under the Pandemic emergency purchase programme (PEPP) will continue until at least the end of 2024. The Governing Council will continue to monitor bank funding conditions and ensure that the maturing of operations under the third series of targeted longer-term refinancing operations (TLTRO III) does not hamper the smooth transmission of its monetary policy.

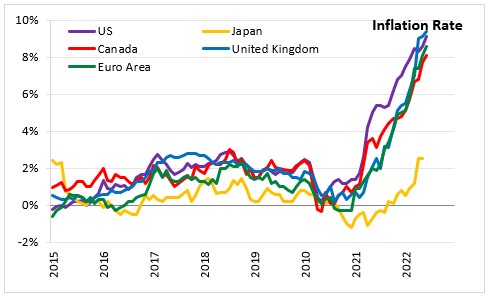

Russia's invasion of Ukraine continues to slow down economic activity in the Euro Area. High inflation is weighing down households' purchasing power while continuous supply chain constraints and increased uncertainty are having a dampening effect on the economy.

The reopening of the economy, strong labour market and fiscal policy support continues to boost economic activity. As restrictions ease and people start to travel, tourism is expected to help the economy in the third quarter of 2022. Consumption is being supported by the excess savings households build up during the pandemic.

Inflation in the Euro Area increased to 8.6% in June 2022, mainly driven by higher energy prices. Reflecting the large share of Ukraine and Russia in agricultural goods production, food prices also rose further to 8.9% in June. Persistent supply bottlenecks for industrial goods and recovering demand, especially in the services sector, are also contributing to the current high rates of inflation. Price pressures are becoming more widespread. Inflation is expected to be elevated for a some time, before more moderate energy costs, eased supply disruptions, and normalisation of monetary policy led to a decline.

The next scheduled monetary policy meeting will be on September 8, 2022.

Source: European Central Bank: Monetary Policy Decisions, Monetary Policy Statement (Press Conference)

<--- Return to Archive