The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

July 13, 2022BANK OF CANADA MONETARY POLICY The Bank of Canada today increased its target for the overnight rate by 100 basis points to 2.5%, with the Bank rate at 2.75% and the deposit rate at 2.5%. The Bank will continue its policy of quantitative tightening.

Global economic growth is slowing reflecting the impacts of Russian’s invasion of Ukraine and continued supply chain disruptions. Inflation continues to increase quickly due to increases in energy and food prices. High inflation combined with monetary policy tightening in some countries are beginning to moderate demand.

In Canada, removal of most public health restrictions supported economic activity in hard to distance service sectors. The Bank notes that the Canadian economy is now in excess demand. While high inflation in Canada is largely the result of international factors, domestic demand pressures are becoming more prominent, and price pressures have broadened.

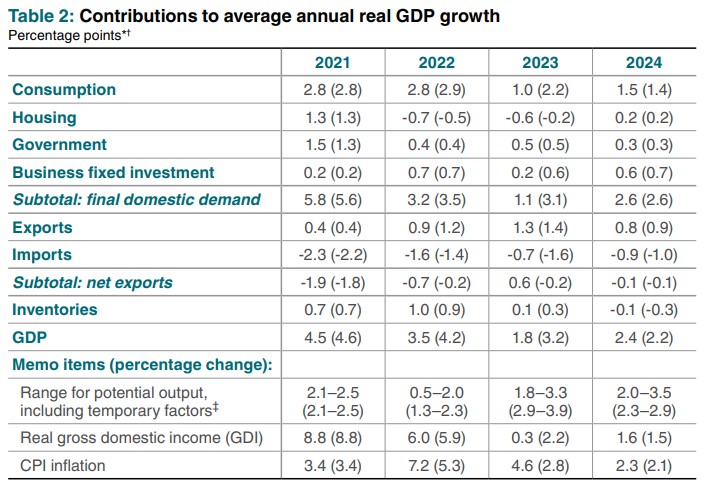

With global growth moderating and higher interest rates dampening domestic spending, growth in Canada is projected to slow from 3.5% in 2022 to 1.75% in 2023 and 2.5% in 2024. Inflation in Canada is anticipated to decrease to around 3% by the end of 2023 and return to the 2% target by the end of 2024

Global Economy

Global economic activity is estimated to have declined in the first quarter of 2022 due to the negative impacts of the war in Ukraine and lockdowns in some major cities in China. Inflation continues to increase with higher energy and food prices. This combined with supply chain disruptions is contributing to broadening inflationary pressures while demand is recovering from the impacts of the pandemic.

The Bank of Canada has lowered its global economic outlook from the April Monetary Policy Report (MPR), mainly due to tighter monetary policy.

Global growth is projected to moderate from about 7.0% in 2021 to 3.3% in 2022 and 2.0% in 2023. As the initial impacts of the Russia-Ukraine war subsides, global growth is expected to strengthen to 3.0% in 2024.

Because the United States is a net exporter of petroleum products and has limited trade exposure to Russia and Ukraine, the negative impact of the war on the US economy is expected to be moderate. With the unemployment rate close to being at a 40-year low level, wage growth has been increasing quickly over the past year. However, softer demand due to high inflation and increasing interest rates are expected to cool down consumption and housing activity.

Total and core measures of US personal consumption expenditures (PCE) inflation have continued to increase. US real Gross Domestic Product (GDP) is projected to moderate to 1.9% in 2022, 1.1% in 2023 and 2024 as the government withdraws fiscal and monetary policy stimulus.

In the Euro Area, household and business confidence are being hit hard by the increased uncertainty caused by the war in Ukraine, higher energy prices and continuing supply challenges. Both core and total inflation have risen more quickly than anticipated in recent months and are now well above target. High inflation is lowering household purchasing power and hurting consumer confidence.

The European Central Bank ended its net asset purchases and announced plans to raise its policy rates in the coming months. Economic growth in the Euro Area is expected to moderate to 2.7% in 2022 and 1.0% in 2023 before recovering 2.5% in 2024.

Lockdowns in important manufacturing and trading centers in China to combat COVID-19 outbreaks have weighted on production and trade. Mobility restrictions combined with the ongoing correction in the property market is weighing on China's economic growth. While the government has introduced several policies to stimulate growth, uncertainty remains high. China's economic growth is expected to moderate to 3.6% in 2022 before recovering to 5.4% in 2023 and 5.2% in 2024.

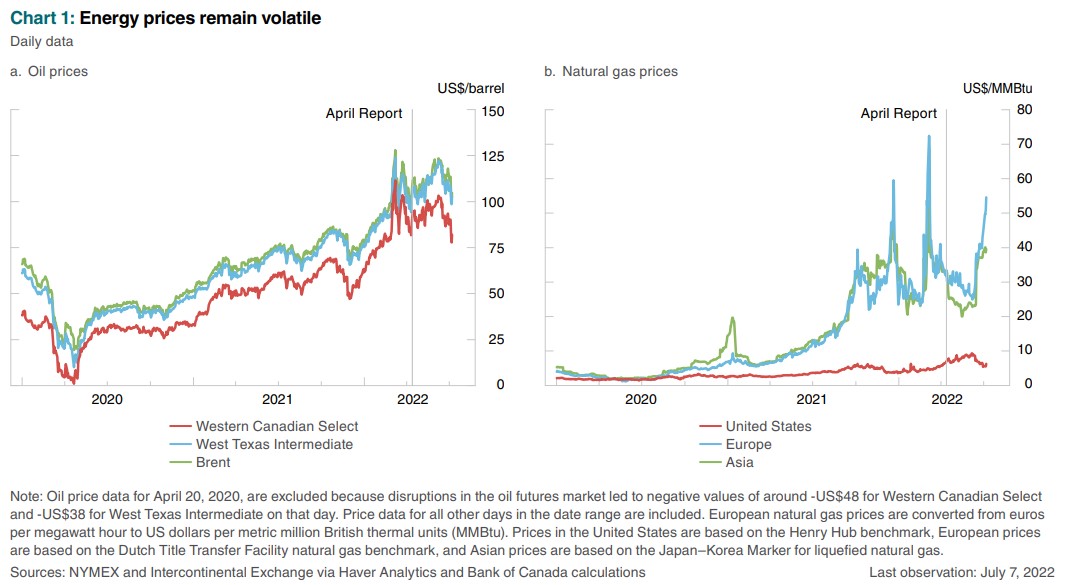

energy prices remained elevated and volatile. With reduced demand from China, oil prices fell in early May. Supply concerns, including the European Union’s ban on Russian oil imports, subsequently pushed prices up. Over the past month, prices have fallen due to concerns about a significant slowdown in global growth.

The Bank assumes that the price of Brent crude oil will slowly fall to US$100 by the end of 2024. West Texas Intermediate and Western Canadian Select crude oil prices are assumed to follow similar patterns, remaining US$5 and US$20, respectively, below Brent prices.

Canadian Economy

the Canadian economy continues to show strong growth, supported by the removal of public health restrictions, solid foreign demand and higher commodity prices. Economic growth is expected to pick up to about 4.0% in the second quarter of 2022 from a solid pace of 3.0% in the first quarter.

Strong housing market, high commodity prices and the easing of public health measures have supported a robust economic activity over the last year. However, the impacts of higher inflation and interest rates have started to weigh on household spending and are expected to slow down economic growth. In addition to global factors, excess demand in the Canadian economy is causing widespread cost pressures.

Canada GDP is expected to increase 3.5% in 2022 and moderate to 1.8% in 2023 and 2.4% in 2024. Consumer price index (CPI) inflation is forecast to average around 8% in the middle quarters of 2022. As the impacts of higher energy and food prices dissipate and monetary policy accommodation is removed, CPI inflation is anticipated to ease to about 3.0% by the end of 2023 and return to target by the end of 2024. The Bank noted that the inflation outlook is both higher and more persistent than in the April Report.

Housing activity is slowing down from its high pace during the pandemic. Reflecting high borrowing rates and lower consumer confidence, resales are declining across most regions and prices are decreasing in some markets. Residential construction, including renovations, is also predicted to drop over the next year. Housing activity and prices are forecast to stabilize later in the projection horizon as both population and income growth boost housing demand.

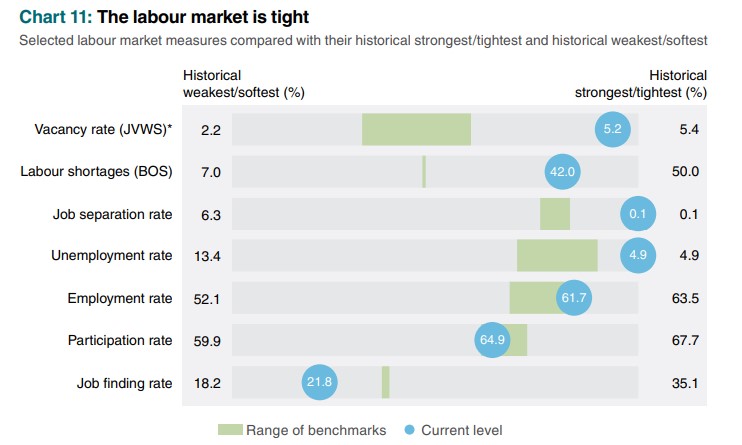

The labour market is tight along all dimensions. The Bank noted that most indicators suggest the labour market has surpassed maximum sustainable employment including the unemployment rate. Tight labour market conditions are pushing wages higher.

The Bank estimates that the output gap—the difference between GDP and supply—has risen further into positive territory in the second quarter of 2022, to between 0.5% and 1.5%. This is up from the estimate of -0.25% to 0.75% for the first quarter. With economic growth anticipated to be roughly in line with supply growth in the third quarter, the economy likely remains in excess demand.

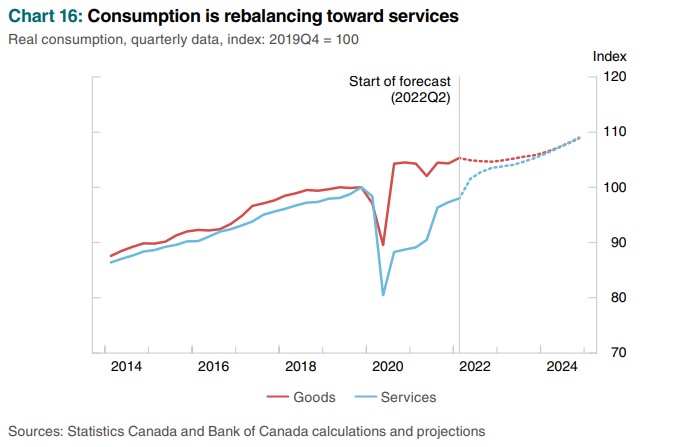

With increased spending on travel and other hard to distance service sectors, consumer consumption is expected to balance between the goods and services sectors. However, higher inflation and increasing interest rates are expected to slow down consumption from its current strong pace.

Export growth is expected to be strong over the second half of the year, boosted by elevated commodity prices and solid foreign demand coupled with easing supply constraints. High energy prices and increased transportation capacity will support energy exports. As global supply chain disruptions dissipate, non-energy goods exports are expected to grow. Services exports and imports are anticipated to strengthen as travel recovers, but the recovery is expected to take time given the slow return of international tourism.

Investment in the oil and gas sector is expected to be robust because of high energy prices. Producers of conventional oil and natural gas are expected to focus on expanding production capacity in fields where infrastructure is readily available. Outside the oil and gas sector, investment will be supported by robust demand, solid business confidence and a push to alleviate capacity constraints.

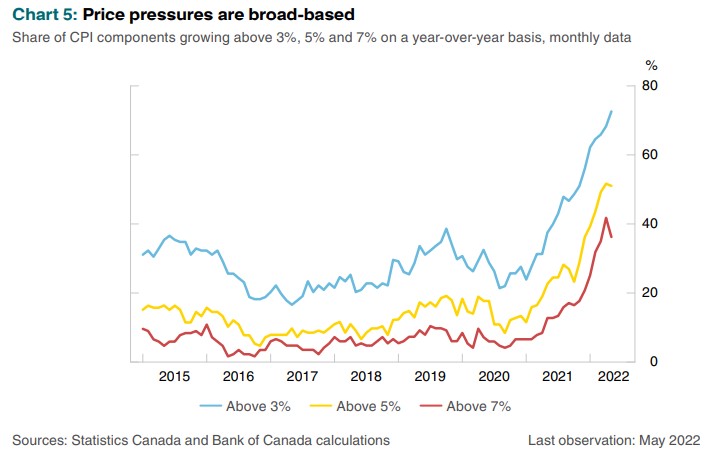

Consumer prices in Canada increased 7.7% in May 2022. Global factors including the war in Ukraine, higher freight costs remain the main drivers of higher inflation in Canada. On the domestic front, the change in consumer preferences pushed goods prices higher. With the recent removal of health restrictions, prices for hard-to-distance services, such as traveller accommodations, have also been increasing.

Measures of core inflation have increased further since the April Report. CPI-trim, CPI-median and CPI-common are at 5.4%, 4.9% and 3.9%, respectively. The Bank noted that the rise in CPI-common which puts more weight on services and domestic conditions reflects growing excess demand in Canada.

The boost from higher gasoline prices is expected to fade over the next quarter. With the anticipated easing of inflationary pressures, consumer price inflation in Canada is expected to average 7.2% in 2022 and slow down 4.6% in 2023 and 2.3% in 2024. All years projected higher compared to the April MPR of 5.3% in 2022, 2.8% in 2023 and 2.1% in 2024.

The next scheduled date for announcing the overnight rate target is September 7, 2022. The Bank will publish its next full outlook for the economy and inflation, including risks to the projection, in the MPR on October 26, 2022.

Bank of Canada: Rate Announcement, Monetary Policy Report – July 2022

<--- Return to Archive