The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

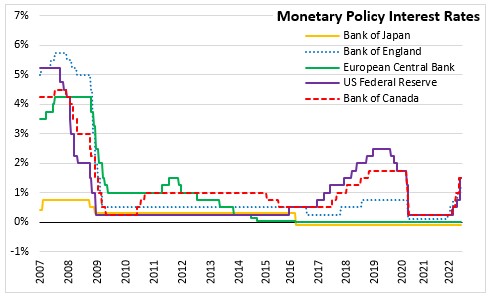

June 16, 2022BANK OF ENGLAND MONETARY POLICY The Bank of England Monetary Policy Committee (MPC) voted by 6-3 to increase the Bank Rate by 0.25 percentage points to 1.25%. The minority in the vote preferred to increase the Bank Rate to 1.5%.

Russia's invasion of Ukraine intensified global inflationary pressures and had led to a deterioration in the UK and global economic outlooks.

UK GDP in April was weaker than expected in the May Monetary Policy Report, reflecting a further decline in Test and Trace activity. The Bank of England expects economic activity to decline 0.3% in the second quarter of 2022. While there was a decline in consumer confidence, other indicators of household spending appear to have help up.

In the three months to April, the unemployment rate was 3.8% and employment increased by 0.5%. Recruitment difficulties have remained elevated and labour demand has remained strong. Underlying nominal earnings growth has also remained strong. These developments still point to a tight labour market.

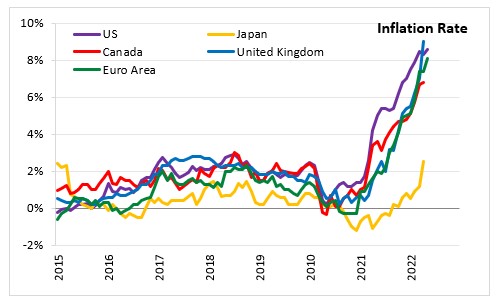

Consumer Price Inflation (CPI) increased to 9.0% in April. The Bank noted that inflation's overshoot of the 2% target mainly reflects the previous large increases in global energy and other tradable goods prices. Higher energy prices has been exacerbated by the war in Ukraine and also increased the wholesale price of many agricultural commodities. Higher prices of other tradable goods reflects the impact of the pandemic, which shifted demand towards goods but also impaired and disrupted supply chains. However, a tight labour market and firms' pricing strategies have also contributed to excess inflation. The Bank notes that consumer services price inflation, which is more influenced by domestic costs than goods price inflation, has strengthened in recent months. CPI inflation is expected to be over 9% during the next few months and to rise to slightly above 11% in October.

The Bank notes that the scale, pace and timing of any further increases in Bank Rate will reflect the Committee’s assessment of the economic outlook and inflationary pressures.

The next scheduled monetary policy meeting will be held on August 4, 2022. An updated Monetary Policy Report will be provided at the same time.

Source: Bank of England, Monetary Policy Summary

<--- Return to Archive