The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

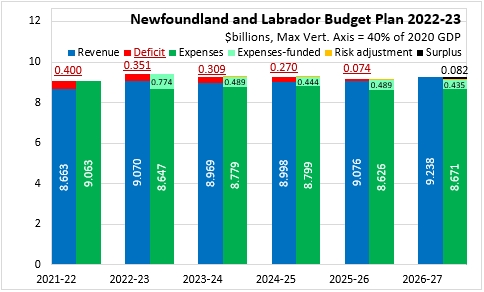

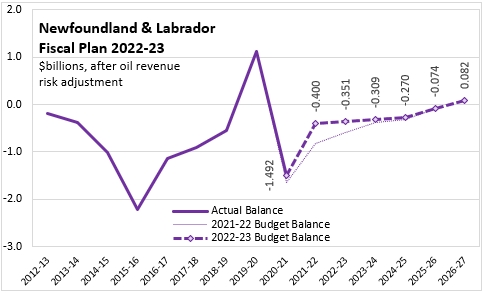

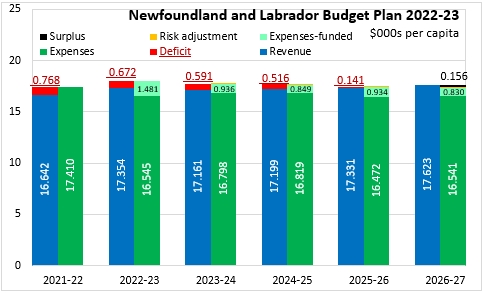

April 08, 2022NEWFOUNDLAND AND LABRADOR BUDGET 2022-23 The Province of Newfoundland and Labrador has tabled its 2022-23 Budget. Newfoundland and Labrador anticipates a deficit of $351 million in the 2022-23 fiscal year, following a $400 million deficit now estimated for the 2021-22 fiscal year. Newfoundland and Labrador's deficits are projected to decline in the following four fiscal years, returning to surplus ($82 million) in 2026-27.

The Newfoundland and Labrador Budget reports separately expenditures whose funding is delivered through cost-shared programs. However, these still contribute to provincial expenditures.

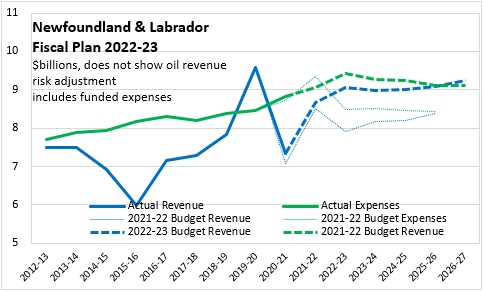

As in many other provinces, Newfoundland and Labrador's 2021-22 revenues were considerably higher ($145 million) than anticipated in the 2021-22 Budget. Expenditures were $281 million below amounts projected in the 2021-22 Budget. Rather than declining as expected in the 2021-22 fiscal plan, the Newfoundland and Labrador Budget expects revenues (+$407 million) and expenditures (+$358 million) to rise in 2022-23. Revenues are then projected to stabilize over subsequent fiscal years while expenditures fall to bring the budget back to surplus.

Newfoundland and Labrador's deficit peaked at $1.492 billion in 2020-21. Deficits for 2021-22 and 2022-23 are considerably narrower than expected in last year's fiscal plan. However, projected deficits beyond this fiscal year are largely the same as previously planned.

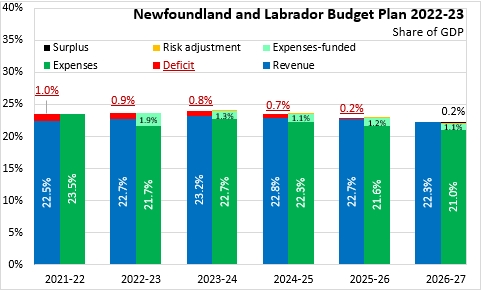

Measured as a share of GDP, the footprint of provincial government amounts to 23.5% of the provincial economy for 2021-22. This is projected to rise to 23.6% in 2022-23 and 24.0% in 2023-24. By 2026-27, the footprint of provincial government in the Newfoundland and Labrador economy is projected to then contract to 22.3% of GDP.

Newfoundland and Labrador's deficit amounts to 1.0% of GDP in 2021-22 and 0.9% of GDP in 2022-23. In subsequent fiscal years, the deficit shrinks as a share of GDP.

Newfoundland and Labrador's net debt is projected to rise from $16.513 billion (42.9% of projected 2021 nominal GDP) to $17.054 billion (42.7% of projected 2022 nominal GDP).

Newfoundland and Labrador's provincial government revenues amount to $17,354 per capita in 2022-23 while the deficit is $672 per capita. Total expenditures amount to $18,026 per capita (included funded expenditures).

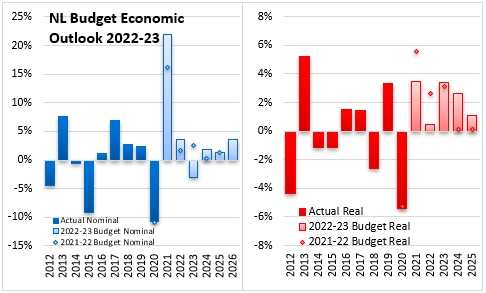

Newfoundland and Labrador's real GDP is forecast to increase by 0.5% in 2022, on higher capital spending, rising exports as well as gains in mining and tourism, offset by falling oil production. The Newfoundland and Labrador economy continues to recover from the pandemic-related shock albeit at a slower pace than currently estimated for 2021. With a population rise of 0.4% expected this year, Newfoundland and Labrador's employment is projected to rise by 2.6% in 2022, driving household income up by 3.2% and retail sales up by 3.5% (with a lift from inflation expected for the first half of 2022).

Key Measures and Initiatives

The Newfoundland and Labrador Budget for 2022-23 focuses on three priorities: cost of living, supporting industry/business and supporting health/education.

Cost of Living

- Elimination of the retail sales tax on home insurance for one year

- 50% off the cost of registering passenger vehicles, light trucks and taxis for one year.

- No provincial tax or fee increases.

- Estimated $7 million for the Physical Activity Tax Credit, which provides families with a refundable tax credit of up to $2,000.

- Boosting the Pre-natal Infant Nutrition Supplement, formerly the Mother Baby Nutrition Supplement, to $150 per month for low income pregnant people and families with children under age one (up from $100 per month) along with a one-time payment of $150 during the month of the baby’s birth

- A 10% increase in the Income Supplement to $73 million

- A 10% increase for the Seniors' Benefit to $61 million (up to $1,444 annually)

- An additional $1.9 million for electric vehicle charging infrastructure

- $2,500 rebate for purchase or lease all-electric vehicles; $1,500 rebate for purchase or lease of plug-in hybrid vehicles

- $2 million more to help transition homes from oil heat to electricity (up to $5,000)

- Transit passes for low income seniors and youth-in-care in St. John’s, Mount Pearl and Paradise

Supporting Industry and Business

- Green technology tax credit of 20% for capital costs of green activities (equipment for energy conservation, clean energy generation, efficient use of fossil fuels)

- New 10% Manufacturing and Processing Investment Tax Credit will support the manufacturing, fishery, farming, and forestry sectors to invest in capital equipment

- New All Spend Film and Video Production Tax Credit worth 30% of total qualified production costs (maximum credit of $10 million annually per project)

- New $2.6 million film and production program at College of the North Atlantic

- $20 million in new funding for tourism, hospitality, arts and cultural industries

Supporting Health and Education

- $14 million to improve access to primary health care.

- $3 million to increase the number of seats in Memorial University’s Nursing Program by 25%

- $2.5 million to increase the number of seats in the personal care attendant, practical nursing, paramedicine and other health programs at the College of the North Atlantic

- $1.8 million to continue Health Hubs in Grand Falls-Windsor and Gander

- $3 million for a virtual emergency room in the central region

- $3.3 million more for the air ambulance program.

- $10 million investment supporting 39 positions in cancer care at the new regional hospital in Corner Brook

- $2.5 million for a new Alcohol Action Plan

- $2.5 million for a new Life Promotion Suicide Prevention Action Plan

- $3.1 million in additional funding for teaching services to meet the rising student population

- $4 million to maintain guidance counsellor and administrator positions added during the pandemic.

Newfoundland and Labrador Budget 2022-23

<--- Return to Archive