The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

November 22, 2021GOVERNMENT FINANCIAL STATISTICS, 2020 Statistics Canada has published the latest Consolidated Government Finance Statistics (CGFS) for 2020 including consolidated results for provincial-territorial plus local governments. Statistics Canada's data allows for comparability across jurisdictions, as well as consistency with the government consumption and investment data reported in macroeconomic accounts.

These data are based on the international government financial statistical standard and, as such, may differ in their presentation from similar concepts reported in Public Accounts and other financial statements. CGFS data differ from reports published by governments due to differences in institutional coverage, accounting rules, timing and integration with the Canadian macroeconomic accounts.

The following analysis compares the per capita results for consolidated provincial-and-local governments. Local governments are consolidated into the analysis because each provincial government may assign different responsibilities to municipal or local governments.

Revenues and Taxes

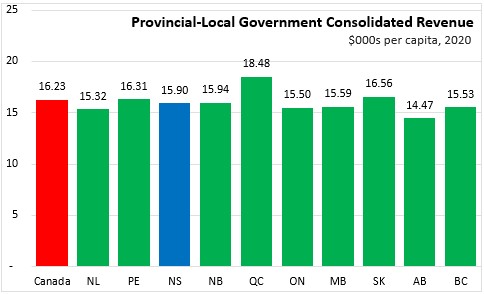

Total revenues per capita vary across the country, with Nova Scotia's provincial-local government revenues amounting to $15,903 per capita in 2020. This was lower than the Canadian average of $16,232 per capita. The highest per capita revenues were in Quebec ($18,478), where the government offers a different mix of public services, including delivering some services that are otherwise delivered by the Federal government (the value of the Quebec abatement to Federal taxes was $676 per capita and is included in revenue figures presented here). The lowest per capita revenues were in Alberta ($14,468).

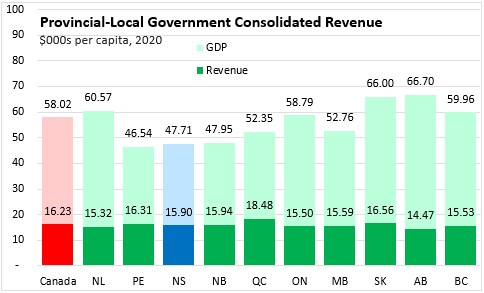

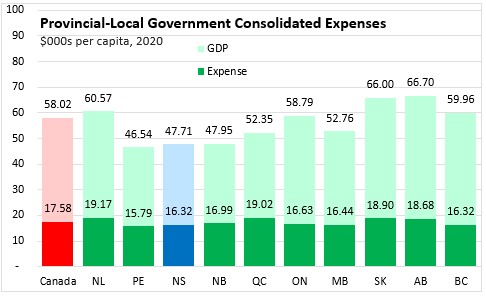

Although Nova Scotia's provincial-local government revenues were 98% of the national per capita average, Nova Scotia's nominal GDP per capita was 82% of the national average. Thus, provincial-local government revenues amounted to a larger portion of Nova Scotia's comparatively smaller GDP per capita.

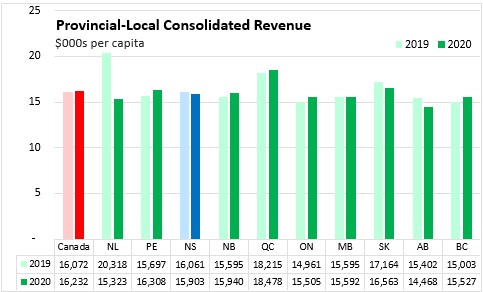

Nova Scotia's consolidated provincial-local revenues declined during the COVID-19 pandemic, falling by $158 per capita. Across Canada, consolidated provincial-local government revenues increased by $160 per capita with increases in British Columbia, Ontario, Quebec, New Brunswick and Prince Edward Island. Newfoundland and Labrador reported the largest decline in provincial-local government revenues after a one-time payment from the Federal government made in 2019.

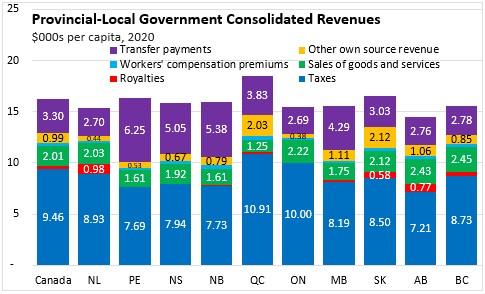

Taxes and transfers made up the largest portions of provincial-local consolidated government revenues in 2020.

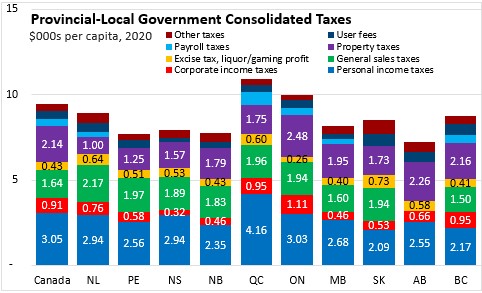

Taxes are typically the largest source of consolidated provincial-local government revenues. Nationally, provincial-local consolidated tax revenues amounted to amounting to $9,457 per capita across Canada. Nova Scotia's tax revenues are $1,513 per capita lower than the national average at $7,944 per capita. The highest provincial-local tax revenues are in Quebec at $10,907 (before the $676 per capita Quebec abatement of Federal taxes).

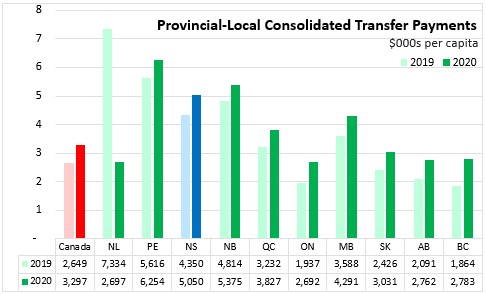

Beyond taxes and user fees, consolidated provincial-local governments generate revenues from workers compensation premiums, fiscal transfer payments, interest/dividend income, royalties and sales of goods/services. Those provinces that are Equalization recipients report higher fiscal transfer revenues per capita, particularly in the Maritimes and Manitoba.

Provinces with substantial oil and gas sectors (and to a lesser extent hydroelectricity and forestry) report stronger royalty income. Saskatchewan and Quebec also report substantially higher revenues from other sources, though this may include specific items that cannot be classified with others. In Statistics Canada's data, consolidated revenue from sales of goods and services includes tuition fees.

Per capita taxes fell in all provinces except Newfoundland Labrador from 2019 to 2020. Saskatchewan reported the largest decline in tax revenues.

Tax revenues break down into 8 major categories, including personal income taxes, corporate income taxes, general sales taxes, excise taxes/profits of fiscal monopolies, payroll taxes, property taxes, user fees and other taxes. The amount of revenues generated by these taxes reflects both the tax system itself (tax rates, deductions, credits, number of taxes levied) as well as overall economic conditions.

There are also differences in specific taxes across Canada. Alberta has no general sales tax. Alberta relies more on property taxes and user fees for revenues than most other provinces. Only Newfoundland and Labrador, Quebec, Ontario, Manitoba and British Columbia generate revenue from payroll taxes. Corporate income taxes per capita were higher in British Columbia, Ontario and Quebec.

Over the course of the COVID-19 pandemic, Canada's Federal government increased transfers to the provinces to assist with responding to the public health emergency. This generated higher transfers for all provinces except for Newfoundland and Labrador (whose transfers were elevated by a one-time payment in 2019).

Expenses

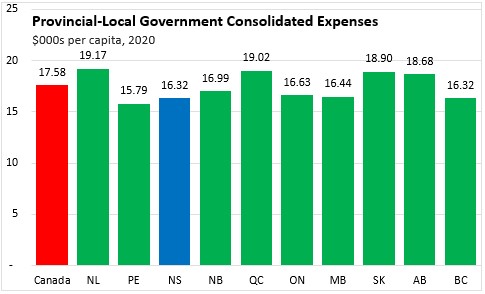

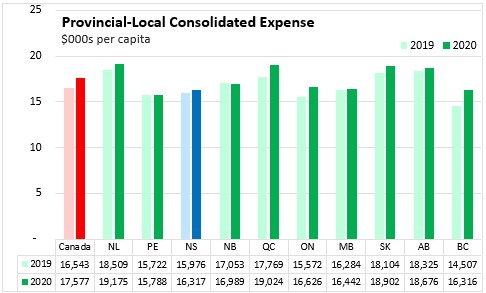

Consolidated provincial-local government expenditures in Canada were $17,577 per capita. Nova Scotia's consolidated provincial-local government expenditures were lower at $16,317 per capita. The highest expenditures were in Newfoundland and Labrador ($19,175) and Quebec ($19,024) while the lowest were in Prince Edward Island ($15,788).

As with consolidated provincial-local government revenues, modest differences in per capita expenditures appear larger when measured relative to GDP per capita, which remained substantially larger in resource-producing provinces.

Consolidated provincial-local government expenditures increased in all provinces except New Brunswick from 2019 to 2020.

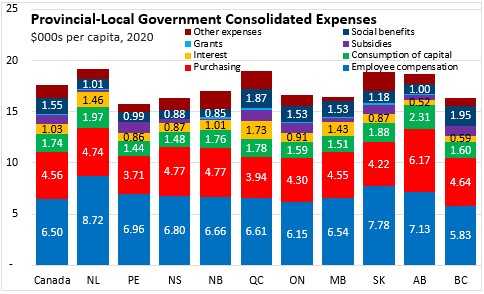

Employee compensation is the largest component across national consolidated provincial-local expenditures, amounting to $6,501 per capita. The highest employee compensation expenditures per capita were found in Newfoundland and Labrador and Saskatchewan. The lowest are reported in Ontario and British Columbia. Nova Scotia's per capita employee compensation expenditures were $6,803.

Purchases of goods and services was the next largest expenditure category with an average provincial-local government expenditure of $4,563 per capita. Nova Scotia provincial-local purchases of goods and services were $4,772 per capita. Expenditures on goods and services were highest in Alberta and lowest in Prince Edward Island.

Interest expenses depend on net financial liabilities and costs of funds. Across Canada, provincial-local expenditures on interest payments averaged $1,030 per capita while interest costs were $870 per capita in Nova Scotia. The highest interest expenditures were in Quebec, Newfoundland and Labrador and Manitoba. The lowest interest expenditures were in British Columbia and Alberta.

Subsidies (particularly in agriculture) are uneven across the country, with an average of $857 per capita. The highest per capita subsidy payments were in Quebec and Prince Edward Island. The lowest subsidies were paid in Newfoundland and Labrador and New Brunswick. Nova Scotia's subsidies per capita were $376 in 2020.

Social assistance and family/employment benefit expenditures per capita were $1,552 per capita across Canada, including notably higher expenditures in Quebec, Ontario and Manitoba. New Brunswick, Prince Edward Island and Nova Scotia ($879 per capita) reported the lowest social benefit expenditures.

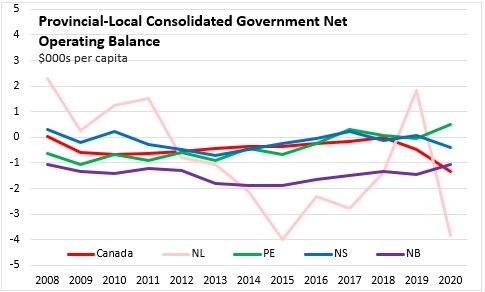

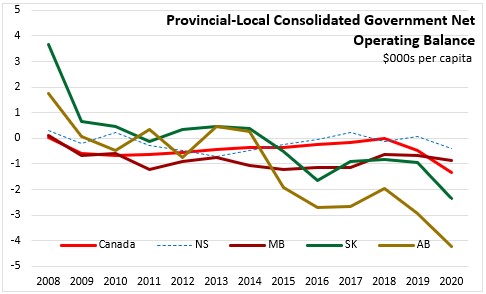

Net Operating Balance

The net operating balance of the consolidated provincial-local government sector reflects the difference between revenues and expenses. As this includes local governments, colleges, universities, workers' compensation boards and other entities, it is not comparable to statements of surplus or deficit for Provincial governments as reported in their respective Public Accounts.

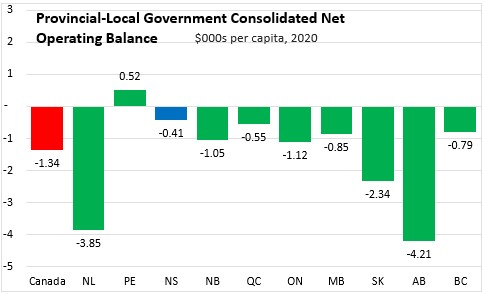

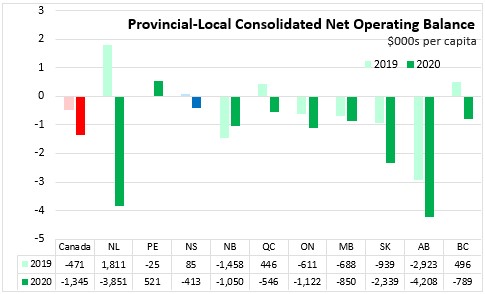

In 2020, only Prince Edward Island's consolidated provincial-local governments had a positive net operating balance in 2020 ($521 per capita). Nova Scotia's consolidated provincial-local government sector reported a net operating balance of -$413 per capita in 2020, the smallest of the negative net operating balances. The largest net operating deficits were reported in Alberta (-$4,208) and Newfoundland and Labrador (-$3,851). The consolidated provincial-local government sector reported a deficit of $1,345 per capita across Canada.

The consolidated provincial-local government sectors in all provinces except for Prince Edward Island and New Brunswick reported deterioration in net operating balances from 2019 to 2020.

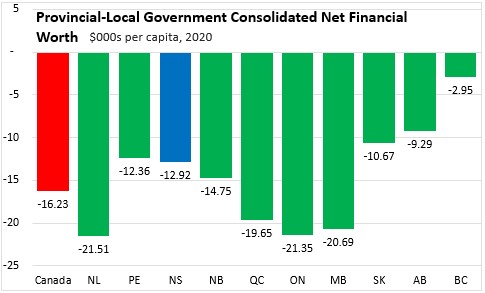

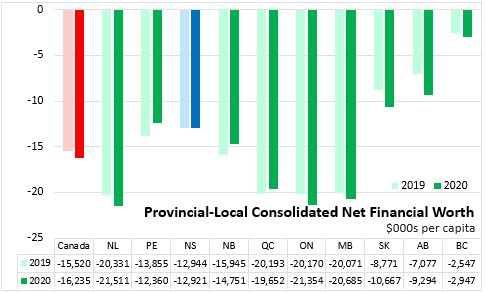

Net Financial Worth

As with net operating balance, the net financial worth of the consolidated provincial-local government sector includes different entities and accounting treatments than reported by Provincial governments in Public Accounts.

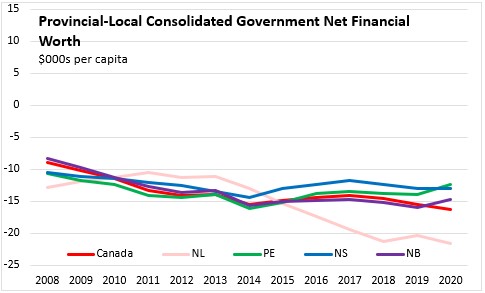

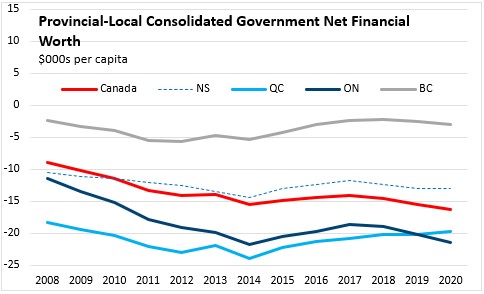

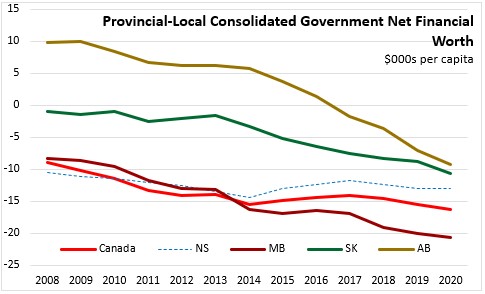

All provinces report negative net financial worth of consolidated provincial-local governments, with an average of -$16,235 per capita across Canada. The three westernmost provinces had the smallest negative net financial worth in 2020, followed by Nova Scotia at -$12,921 per capita. The highest per capital values of negative net financial worth were reported in Newfoundland and Labrador, Ontario and Manitoba.

Net financial worth per capita improved in Quebec and in each of the Maritime provinces in 2020. All other provinces reported a deterioration in net financial worth per capita.

Statistics Canada. Table 10-10-0147-01 Canadian government finance statistics (CGFS), statement of operations and balance sheet for consolidated governments (x 1,000,000); Table 17-10-0009-01 Population estimates, quarterly; Table 36-10-0222-01 Gross domestic product, expenditure-based, provincial and territorial, annual (x 1,000,000)

<--- Return to Archive