The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

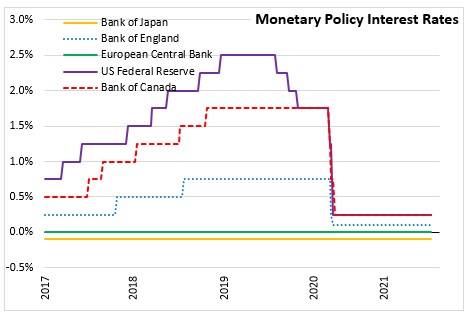

November 04, 2021BANK OF ENGLAND MONETARY POLICY The Bank of England Monetary announced that it would maintain the Bank Rate at 0.1% at its Monetary Policy Committee (MPC) meeting.

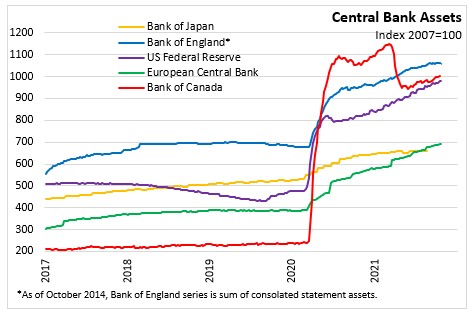

In addition, the MPC decided to maintain the stock of non-financial investment-grade corporate bond purchases, financed by the issuance of central bank reserves, at £20 billion and the target for the stock of government bond purchases at £875 billion. The total target stock of asset purchases will be maintained at £895 billion. The judgment of the MPC is that if the economy evolves as expected then some modest tightening of monetary policy over the forecast period will be necessary to meet inflation target in the medium term.

Gross Domestic Product (GDP) both in UK and world increased in Q3 2021, albeit at a slow pace than projected in the MPC's August Monetary Policy Report. Economic growth is restrained by supply chain disruptions. While UK consumption demand is also showing some signs of slow down, the MPC projects UK GDP to get back to its Q4 2019 level in Q1 2022. The MPC projects UK GDP to increase 7.0% in 2021, 5.0% in 2022 and 1.5% in 2023.

The unemployment rate declined to 4.5% in the three months to August 2021 and just over a million jobs are expected to have been furloughed immediately before the Coronavirus Job Retention Scheme closed at end-September.

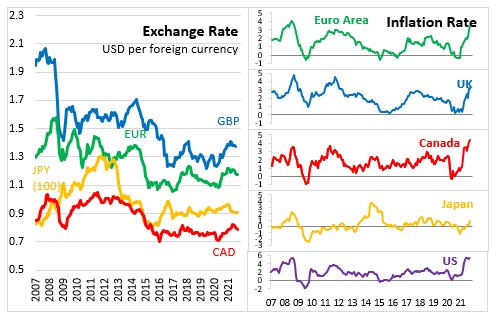

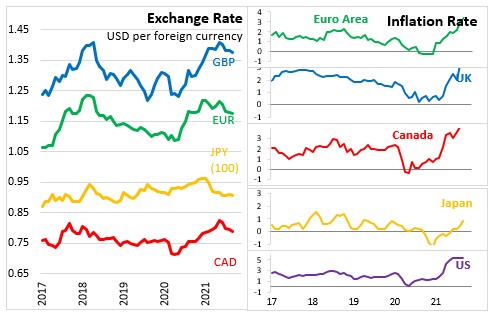

Twelve-month CPI inflation declined from 3.2% in August to 3.1% in September. The MPC expects inflation to increase to just under 4.0% in October due to the impacts of high wholesale gas prices on utility bills. CPI inflation is projected to rise to 4.5% in November and stay at that level through the winter due to further increases in core goods and food price inflation. The MPC expects CPI inflation to peak at around 5.0% in April 2022, higher than expected in the August MPR Report.

As the supply chain disruptions ease, energy prices stop rising and global demand rebalances, the upward pressure on CPI inflation is expected to dissipate over time. The CPI inflation is expected to decline starting the second half of next year. CPI inflation is projected to average 4.25% in 2021, and than fall to 3.5% in 2022 and 2.25% in 2023. Given the large lag between monetary policy and inflation effects the MPC views it as appropriate to focus on medium-term prospects rather than temporary factors.

Source: Bank of England, Monetary Policy Summary, Bank of England Monetary Policy Report November 2021

<--- Return to Archive