The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

September 10, 2021CANADA NATIONAL BALANCE SHEET ACCOUNTS, Q2 2021

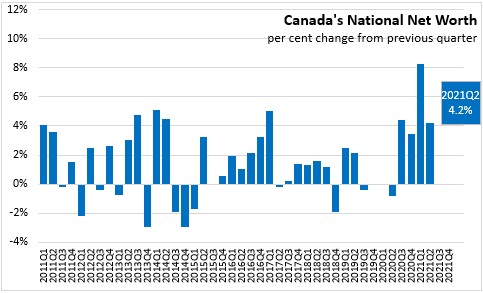

In the second quarter of 2021, Canadian national wealth increased 4.2% (or +$569.0 billion) to $14,147.3 billion. This follows a revised increase of 8.3% in the first quarter of 2021. As with the previous quarter, the growth was largely attributable to an increase in the value of residential real estate by 2.7%, the fourth consecutive quarterly increase. Natural resource asset values increased for the fourth consecutive quarter on higher energy prices. Net foreign assets increased for the fifth consecutive quarter as foreign equity prices continued to increase in Q2 2021.

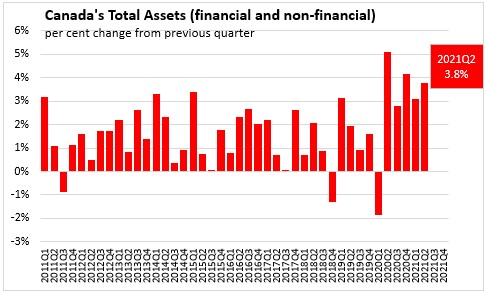

Total assets, including financial and non-financial assets increased by 3.8% to $54,451 billion at the end of Q2 2021, following a 3.1% increase in Q1 2021.

Household sector

In Q2 2021, Canada’s household sector net worth increased $513.4 billion to $14,230.8 billion. Financial assets increased $380.1 billion, with its main contributors were pension and mutual fund shares. The Toronto Stock Exchange Composite Index increased 7.8% and international markets also posted strong gains as the Standard and Poor’s 500 increased 8.2%. Financial liabilities increased $72.4%.

The value of residential real estate grew 2.6% in Q2 2021, largely attributable to higher home prices of new and existing houses. The national average selling price of a home edged up in Q2 2021, while it decreased from its March peak.

Real estate as a percentage of disposable income increased to 501.3% from 487.4% in Q1 2021. Homeowners’ equity as a percentage of real estate edged down from 76.5% to 76.3% in Q2 2021.

Household borrowing double to $63.8 billion in Q2 2021 compared to Q1 2021. Non-mortgage lending increased to $6.6 billion. Mortgage lending increased to $57.2 billion, with mortgage rules tightened in June and mortgage rates at historical levels.

Household saving rate was 14.2% in Q2 2021, up from 13.0% in Q1 2021. It has remained at double digit levels since Q2 2020.

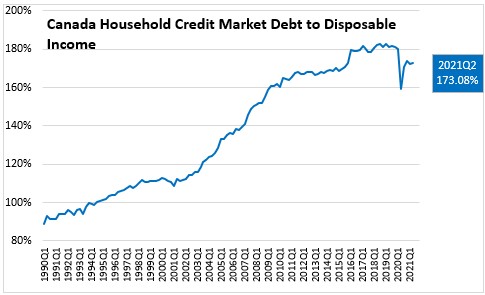

Household credit market debt as a proportion of household disposable income increased to 173.08% in Q2 2021.

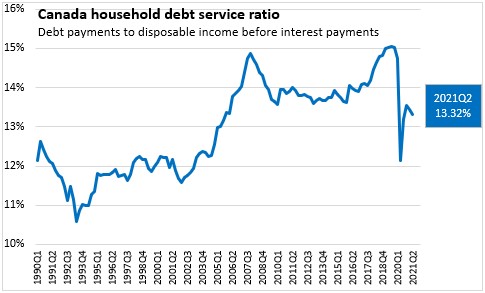

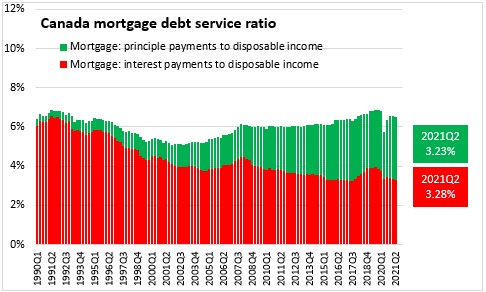

In Q2 2021, household debt payments decreased from 13.45% to 13.32% of disposable income. Even with the growth in borrowing for mortgages, interest payments declined while principal payments grew in the quarter.

Government sector

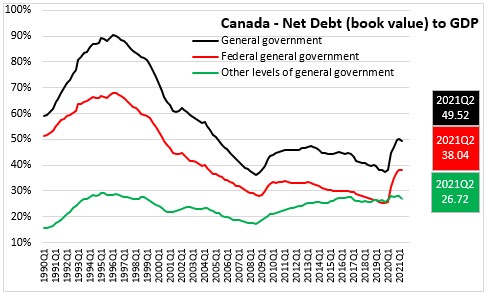

At the end of Q2 2021, general government net debt (book value) decreased to 49.52% of GDP. The federal government's net debt to GDP ratio edged down to 38.04%, as federal government net debt increase was impacted by COVID-19. Net debt of other levels of government decreased to 26.72% of GDP.

Corporate sector

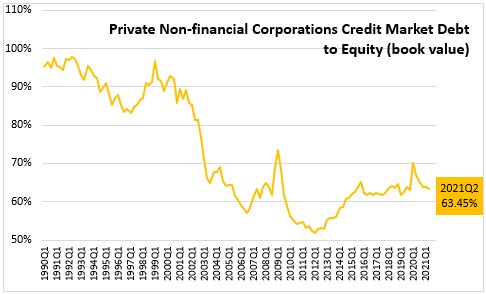

The credit market debt to equity ratio of non-financial private corporations decreased to 63.45 cents of credit market debt for every dollar of equity in Q2 2021, down from 63.84 cents (revised) in Q1 2021.

Statistics Canada: Daily

Table 11-10-0065-01 Debt service indicators of households, national balance sheet accounts

Table 36-10-0580-01 National Balance Sheet Accounts (x 1,000,000)

Table 38-10-0235-01 Financial indicators of households and non-profit institutions serving households, national balance sheet accounts

Table 38-10-0236-01 Financial indicators of corporate sector, national balance sheet accounts

Table 38-10-0237-01 Financial indicators of general government sector, national balance sheet accounts

Table 38-10-0238-01 Household sector credit market summary table, seasonally adjusted estimates

<--- Return to Archive