The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

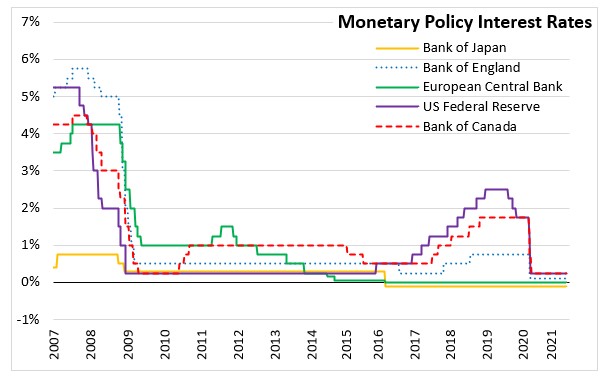

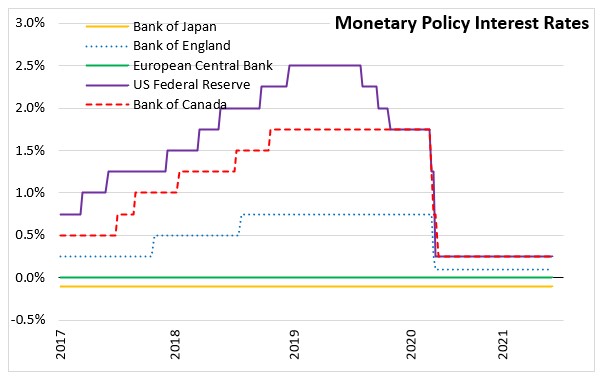

September 09, 2021EUROPEAN CENTRAL BANK MONETARY POLICY The European Central Bank announced that key interest rates would remain unchanged at their current levels. The interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged at 0.00%, 0.25% and -0.50% respectively. The Bank noted that favourable financing conditions can be maintained with a moderately lower pace of net asset purchases under the pandemic emergency purchase programme (PEPP) than in the previous two quarters.

In support of the new symmetric 2.0% inflation target and in line with the monetary policy strategy, the key interest rates are expected to remain at their present or lower levels until inflation reaches 2.0% well ahead of the end of the projection horizon and durably for the rest of the projection horizon. The ECB noted that current inflation levels are consistent with inflation stabilising at 2.0% over medium term, and there could be a transitory period where inflation exceeds the target for some time.

Economic activity increased 2.2% in the second quarter of 2021 as the rapid and successful vaccination rollout allowed lifting of restrictions. This was 0.8 percentage points above the growth expected in the Bank's June projections but remains 2.5% below its level in Q4 2019. The services sector benefited from people resuming their spending habits and a rebound in travel and tourism. Improving labour market conditions are expected to lead to higher income and spending.

With further loosening of restrictions, economic recovery is expected to continue in the second half of 2021. As the uncertainty around the path of the pandemic declines and global recovery strengthens, Euro Area real GDP is expected to grow in 2022 before gradually slowing down to a more normal rate in 2023. With fiscal stimulus support from the Next Generation EU package, real GDP is projected to exceed its pre-COVID level in Q4 2021. This is one quarter earlier than the Bank's June projections.

Over the medium term, the Bank expects robust global and domestic demand along with accommodative monetary and fiscal policy measures to support economic growth in the euro area. The real GDP is projected to grow 5.0% in 2021, 4.6% in 2022 and 2.1% in 2023. Compared with the Bank's June staff projections, the outlook has improved for 2021 and is broadly unchanged for 2022 and 2023.

Euro area inflation increased 3.0% in August, highest annual rate in the last decade. The spike in annual inflation reflects mainly temporary factors such as rebound in energy prices, the reversal of the temporary VAT reduction in Germany, higher input prices due to supply chain disruptions. Inflation is expected to continue to increase until the end of 2021 and start to gradually decline in the first half of 2022 as the impacts of these transitionary factors start to fade out.

The ECB staff projections are for annual inflation of 2.2% in 2021, 1.7% in 2022, and 1.5% in 2023. Compared with the June 2021 projections, the projection for HICP inflation has been revised upward by 0.3 percentage points for 2021, by 0.2 percentage points for 2022 and by 0.1 percentage points for 2023.

Against this background, the Governing Council reconfirmed its accommodative policy stance. The measures in place include:

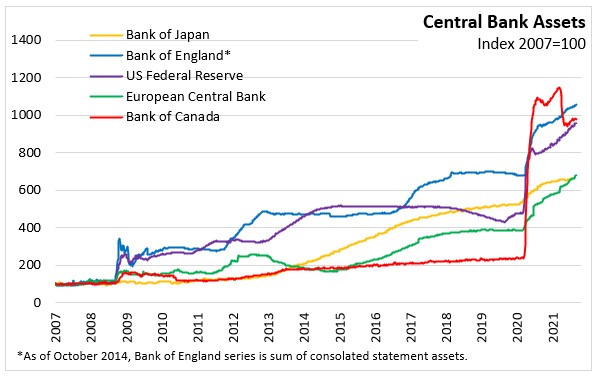

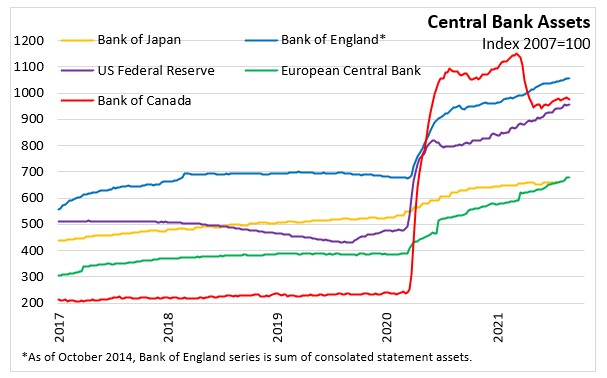

- Continuation of net asset purchases under the pandemic emergency purchase programme (PEPP) with a total envelope of €1,850 billion until at least the end of March 2022. Given the inflation outlook and financing conditions, the Governing Council judges that favourable financing conditions can be maintained with a moderately lower pace of net asset purchases under the PEPP than in the previous two quarters.

- Continuation of the reinvestment of principal payments from maturing securities purchased under the PEPP until at least the end of 2023.

- Continuation of net purchases under asset purchase programme (APP) at a monthly pace of €20 billion. Monthly net asset purchases are expected to run for as long as necessary to reinforce the accommodative impact of the policy rates, and shortly before any increase in the key ECB interest rates.

- Continuation of the third series of targeted longer-term refinancing operations (TLTRO III). These conditions will be offered only to banks that achieve a new lending performance target in order to sustain the current level of bank lending.

The Governing Council reconfirmed their stance to adjust the monetary policy instruments as needed to ensure that inflation moves toward the target rate in a sustained manner. The next scheduled monetary policy meeting of the Governing Council is on October 28, 2021.

Source: European Central Bank: Monetary Policy Decision, Remarks, Eurosystem staff macroeconomic projection September 2021

<--- Return to Archive