|

|

The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact: August 27, 2021SURVEY ON BUSINESS CONDITIONS, IMPACT OF COVID-19: Q3 2021 Because of the rapid changes in business conditions during the COVID-19 pandemic, Statistics Canada has conducted a sixth iteration of the Canadian Survey on Business Conditions. In July and August, Statistics Canada surveyed businesses to collect information on the pandemic's impact and on businesses' expectations moving forward. Additional details are available for businesses by majority ownership and international activities.

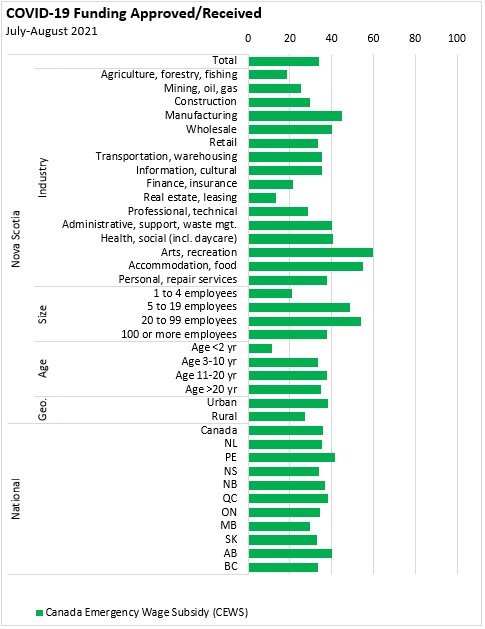

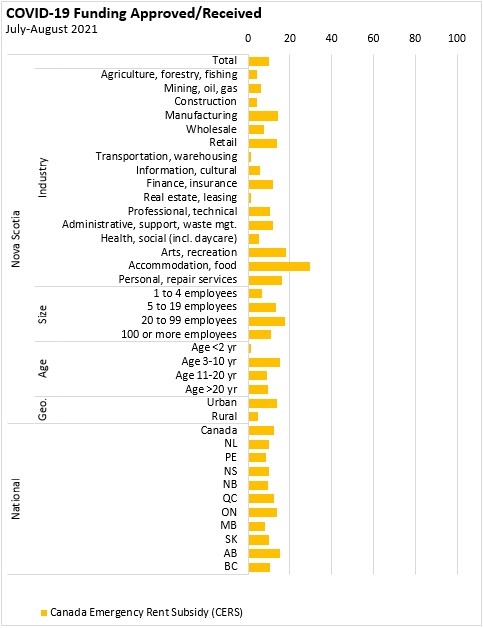

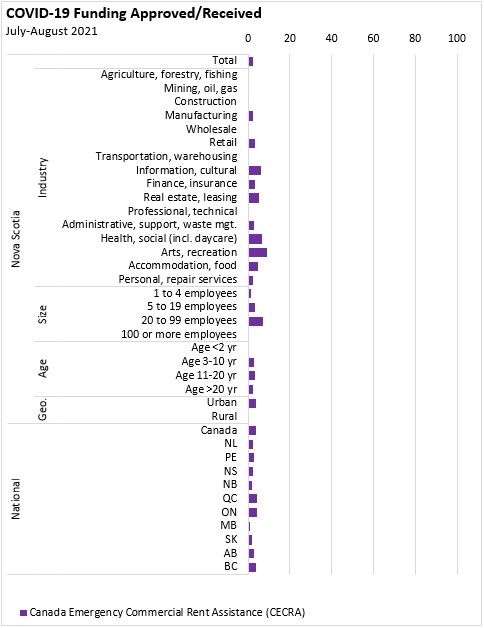

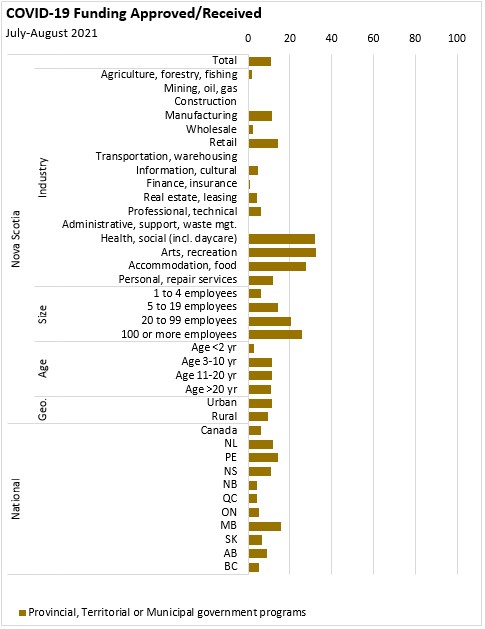

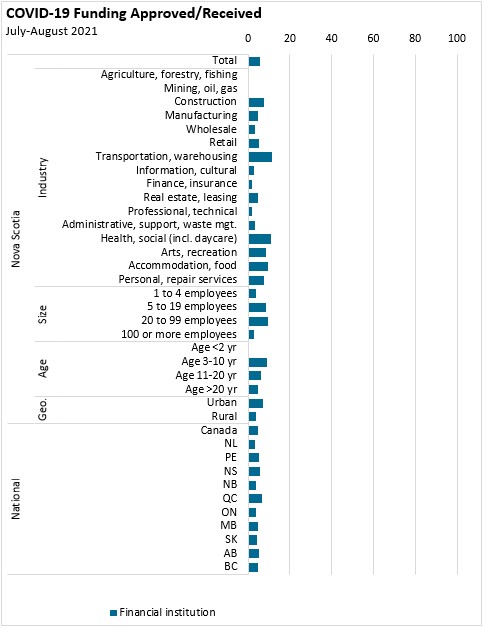

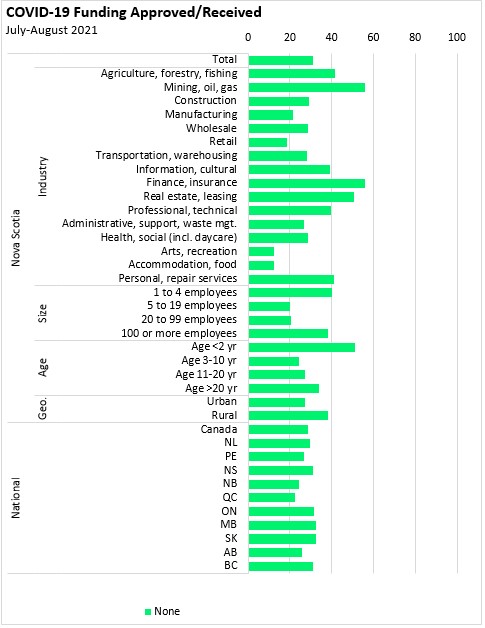

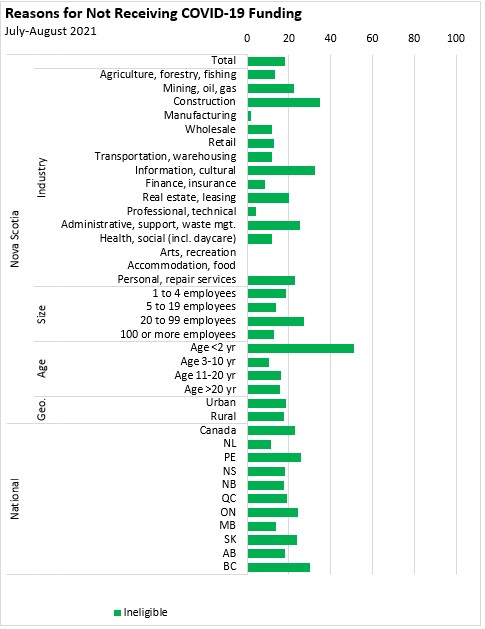

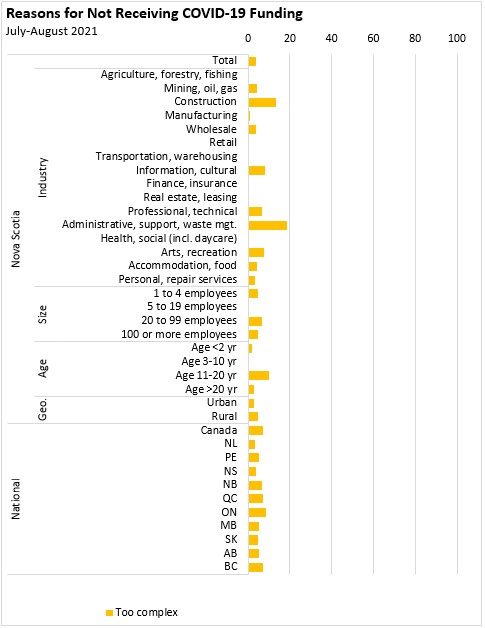

The results reported here are a selection of the impacts found for Nova Scotia businesses, by industry, by size of business (measured by number of employees), by age of business and by urban or rural location. There are comparisons of the Nova Scotia average (all industries, ages, sizes, locations) with the national and provincial averages. The horizontal axis in all charts measures the share of businesses reporting each outcome. The total for many outcomes does not add to 100% of respondent businesses as many replied that the outcome was not applicable in their circumstances.

Business expectations

Looking forward over the next 12 months

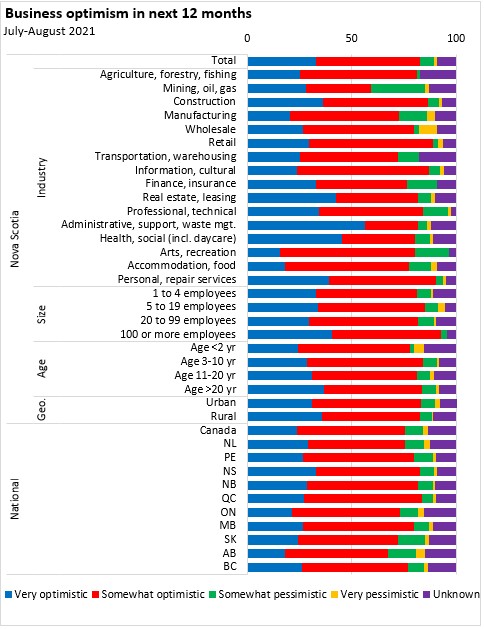

- 82.8% of Nova Scotia business respondents felt very or somewhat optimistic about business conditions while 8.1% were not optimistic. Only Quebec businesses reported more optimism.

- Nova Scotia business optimism was stronger in retail, construction, information/culture, personal/repair services, health care/social assistance (including daycare), professional/technical services, real estate/leasing as well as administrative support/waste management (includes call centres). Pessimism among Nova Scotia businesses was more prevalent in mining/oil/gas, manufacturing, wholesale, arts/recreation and finance/insurance industries.

Looking over the next three months:

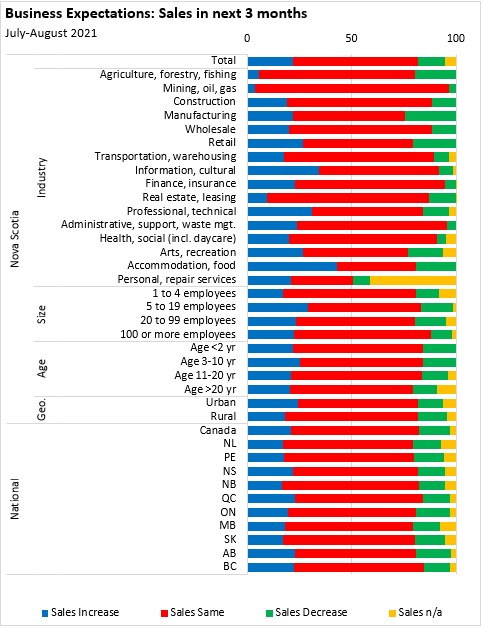

- 81.6% of Nova Scotia businesses expect stable or rising sales while 12.9% expect a decline. Rising sales were noted particularly for many service industries. Across Canada, businesses in Nova Scotia, Quebec, Alberta and British Columbia were more likely to report expectations for rising sales.

- Business profitability is expected to remain the same for 55.7% of Nova Scotia businesses in the next three months while 15.0% expect rising profitability and 23.9% expect decreasing profitability. Rising profitability is expected more in Nova Scotia's information/culture, professional/technical and administrative/support businesses. Decreasing profitability is expected more in Nova Scotia's arts/recreation, accommodation/food and manufacturing businesses. Across Canada the outlook for profitability is stronger in Nova Scotia, Quebec and British Columbia.

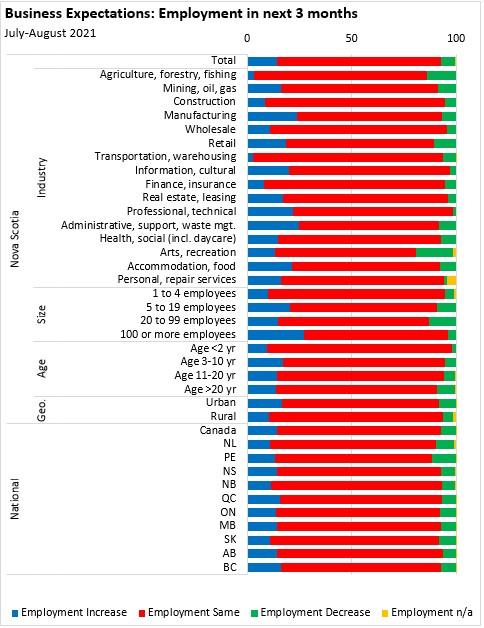

- The outlook for employment is stable for 78.4% of Nova Scotia businesses in the next three months. Rising employment is expected among 14.2% of Nova Scotia businesses while declining employment is expected by 6.9% of Nova Scotia businesses. Rising employment is notably more prevalent among many services industries while little employment increase is expected in resource industries. Across Canada, employment expectations are stronger in Nova Scotia, Quebec, Alberta and British Columbia.

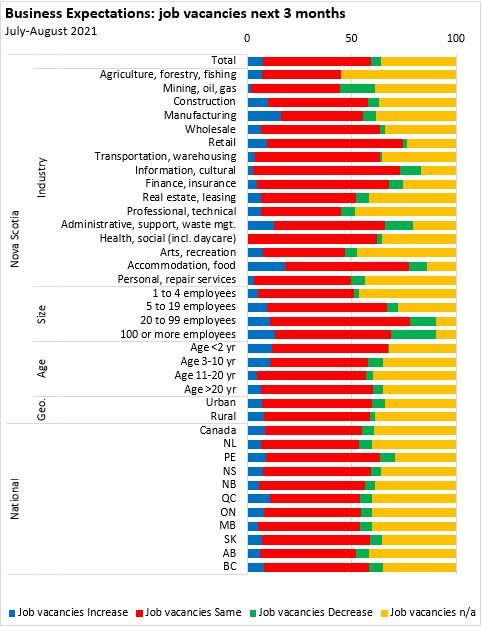

- Job vacancies are expected to rise for 7.5% of Nova Scotia businesses while 51.9% expect job vacancies to be stable and 4.7% expect job vacancies to decline. Larger and newer businesses report an expectation of rising job vacancies. The largest share of Quebec businesses report expectations of rising job vacancies.

Obstacles for businesses

As part of the Survey of Business Conditions, businesses were asked about their obstacles.

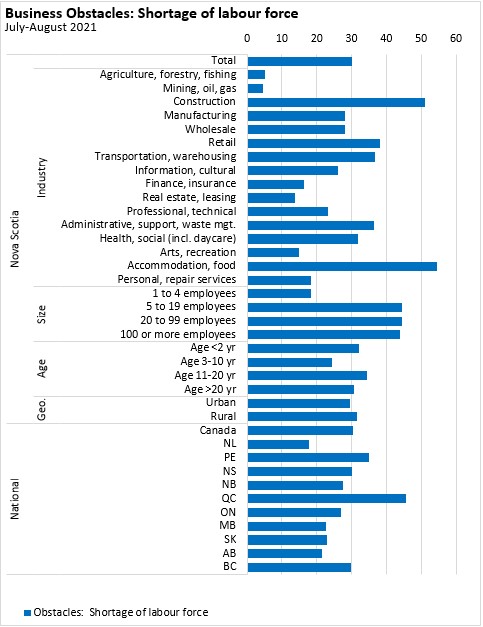

- 30.2% of Nova Scotia businesses report shortages of skilled labour. This was more acute in construction, retail, transportation/warehousing, administrative/support, health/social and accommodation/food. Across Canada, Quebec, Prince Edward Island, Nova Scotia and British Columbia businesses report greater obstacles from labour shortage.

- 32.0% of Nova Scotia businesses report obstacles from recruiting skilled labour. The obstacle was more sizable for construction, administrative/support and accommodation/food businesses as well as among larger Nova Scotia businesses. Across Canada, recruitment of skilled labour was an obstacle for more businesses in Quebec, British Columbia and the Maritimes.

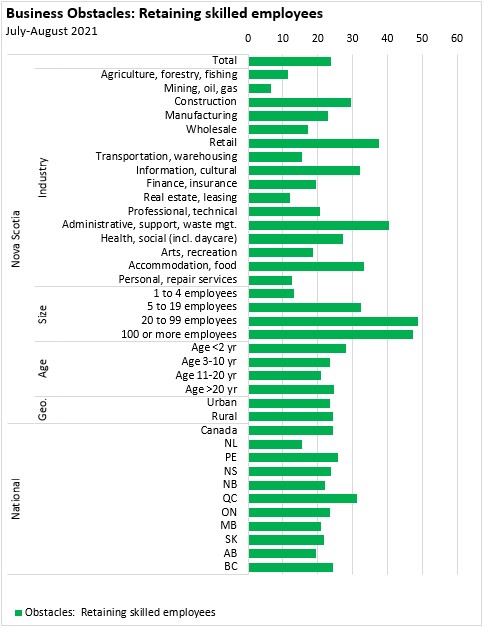

- 23.8% of Nova Scotia businesses report obstacles from retaining skilled labour, more so among larger businesses as well as in retail, administrative/support, information/culture and accommodation/food. Retention of skilled labour was a more common business obstacle in Quebec, British Columbia and the Maritimes.

- Rising input costs were cited as an obstacle for 34.4% of Nova Scotia businesses. This was particularly prevalent among goods-producing industries as well as in wholesale, retail and accommodation/food. Across Canada, Saskatchewan and Alberta reported notably higher obstacles from rising input costs.

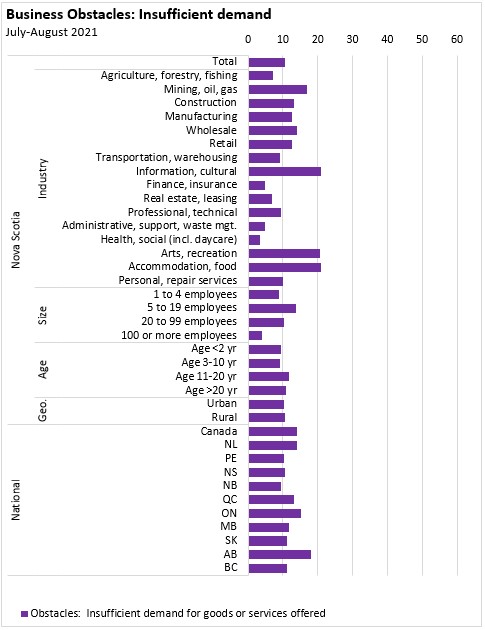

- 10.5% of Nova Scotia businesses report obstacles from insufficient demand, but more of an obstacle for information/culture, arts/recreation and accommodation/food businesses. Insufficient demand was a more commonly noted business obstacle in Alberta, Newfoundland and Labrador, Ontario and Quebec.

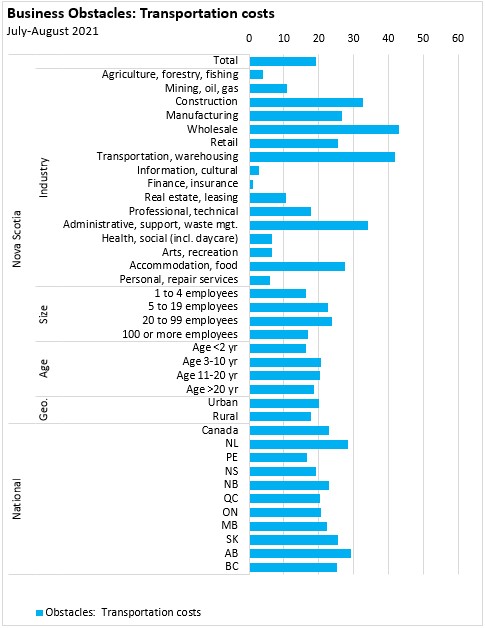

- Transportation costs were an obstacle for 19.2% of businesses in Nova Scotia. This was more common among goods-producing businesses as well as in wholesale, retail, administrative/support and accommodation/food businesses. Transportation costs were larger business obstacles for Newfoundland and Labrador, Alberta, Saskatchewan and British Columbia.

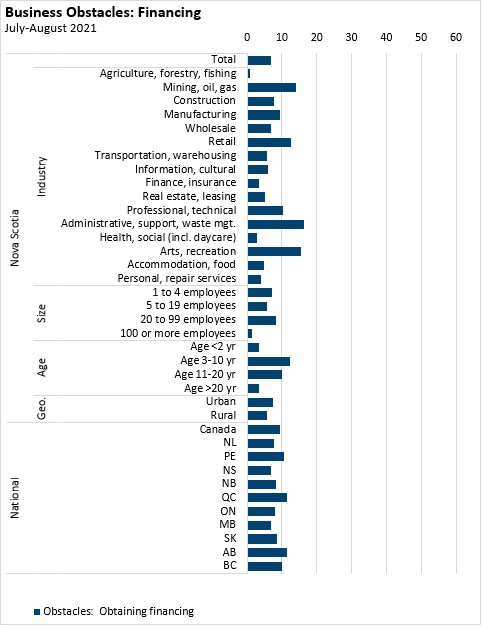

- Financing was an obstacle for only 6.8% of businesses in Nova Scotia. Financing obstacles were higher for mining/oil/gas, retail, administrative/support and arts/recreation businesses. Across Canada, financing obstacles were larger for Alberta, Quebec and Prince Edward Island.

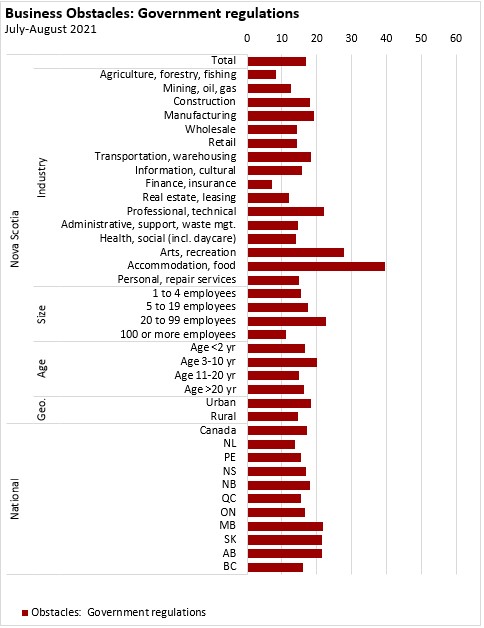

- 16.9% of businesses in Nova Scotia report that government regulations were an obstacle. This was higher among businesses in accommodation/food, arts/recreation and professional/technical services. Across Canada, government regulations were more of an obstacle for businesses in New Brunswick, Ontario and the Prairie provinces.

- Travel restrictions were an obstacle for 22.0% of Nova Scotia businesses, with a greater share in retail, arts/recreation and accommodation/food businesses. Across Canada, travel restrictions were an obstacle for fewer businesses in Quebec as well as in Newfoundland and Labrador.

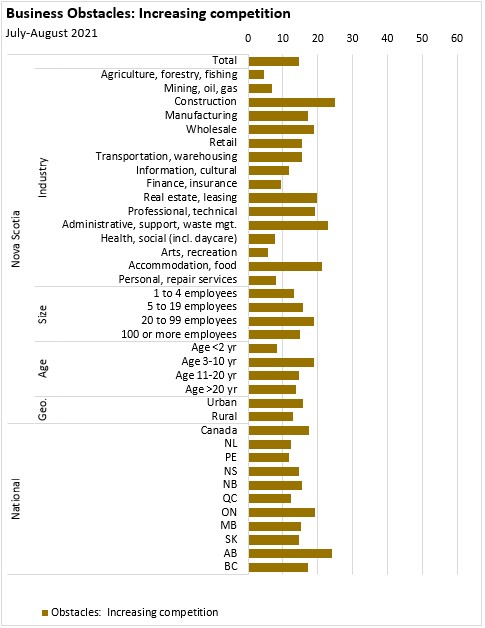

- Rising competition was an obstacle for 14.7% of Nova Scotia businesses, and this somewhat more prevalent for construction, real estate/leasing, administrative/support and accommodation/food businesses. A higher portion of businesses in Alberta, Ontario and British Columbia noted competition as a business obstacle.

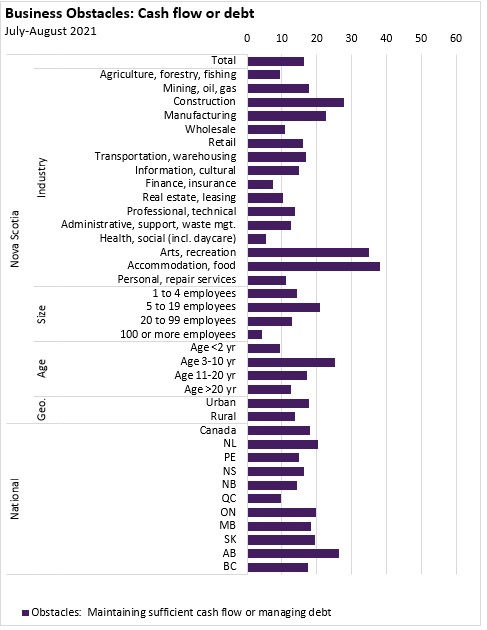

- 16.2% of Nova Scotia businesses reported cash flow and debt management as an obstacle, particularly in accommodation/food, arts/recreation and construction businesses. Smaller businesses also face obstacles from cash flow/debt management. Across Canada, cash flow/debt management obstacles were more common in Alberta, Newfoundland and Labrador and Ontario.

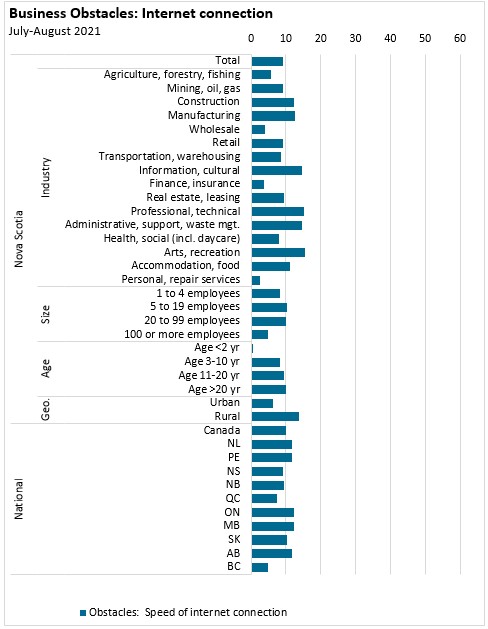

- 9.0% of Nova Scotia businesses face obstacles from internet connections, more so in rural businesses. Nationally, 9.9% of businesses report obstacles from internet connections with higher shares in Newfoundland and Labrador, Prince Edward Island, Ontario and the prairie provinces. Internet connections are a notably smaller obstacle for businesses in British Columbia.

Temporary closures and re-openings, plans for sale/closure

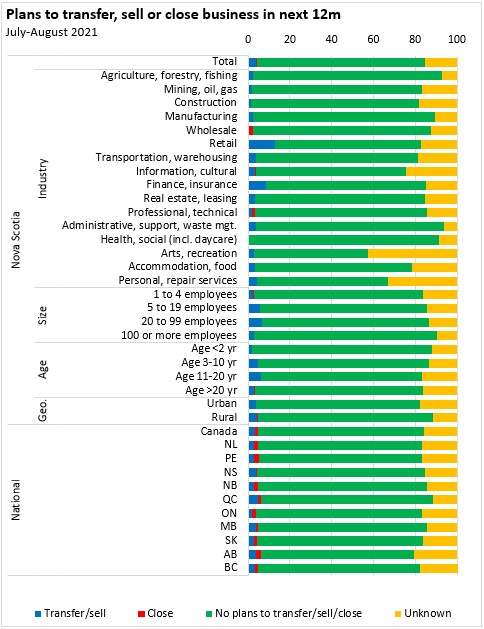

Over 80% of Nova Scotia businesses have no plans to sell, transfer or close their business in the next 12 months while 4.1% plan to sell, transfer or close the business (15.4% have unknown plans about sale/transfer/closure). Sale/transfer and closure plans were more common among businesses in retail and finance/insurance. Across Canada a higher portion of Quebec businesses plan to sell, transfer or close while a lower portion of Ontario businesses plan to sell, transfer or close.

Sources of additional funding or credit

During the pandemic, businesses have sought additional funding from government supports as well as private financing. Among Nova Scotia businesses:

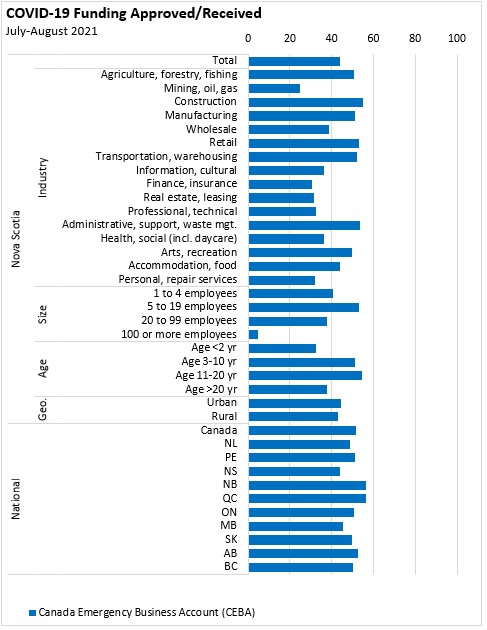

- 44.0% used the Canada Emergency Business Account (this was the lowest uptake among provinces)

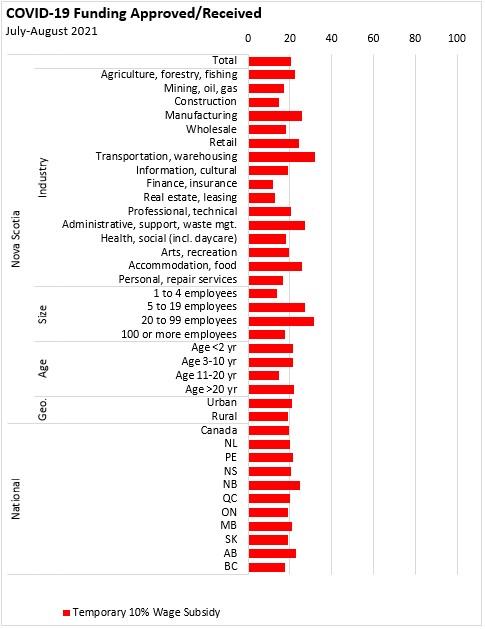

- 20.3% used the temporary 10% wage subsidy

- 34.0% used the Canada Emergency Wage Subsidy

- 10.2% used the Canada Emergency Rent Subsidy

- 2.5% used the Canada Emergency Commercial Rent Assistance

- 10.7% used Provincial/Municipal support programs (concentrated in health/social/daycare, arts/recreation, accommodation/food)

- 5.8% received additional funds from a financial institution

- 31.2% received no additional funding

- Of those that received no additional funding, 68.5% did not need additional funding while 18.1% were ineligible for additional funding, 6.7% were unaware of additional funding and 3.8% found the application too complicated

- 80.3% of businesses in Nova Scotia report having sufficient cash or liquid assets to support operations while 6.9% have insufficient cash or liquid assets (12.6% answered unknown)

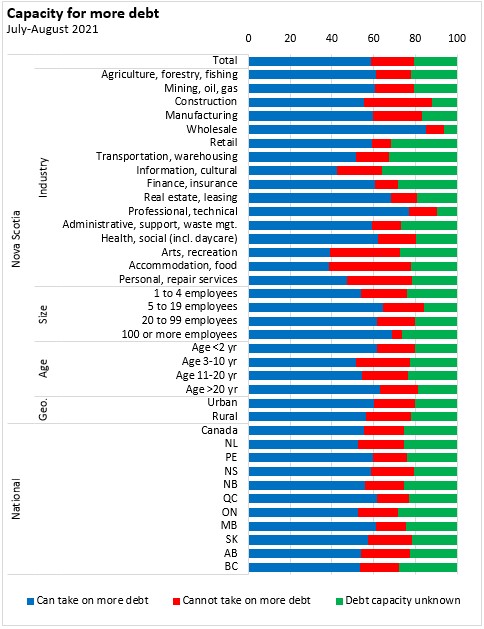

- 58.5% of Nova Scotia businesses report being able to take on more debt while 20.6% report being unable to take on more debt. The capacity to take on more debt was unknown for 20.8% of Nova Scotia businesses.

Adopting new practices after COVID-19

Businesses in the Survey on Business Conditions were asked whether they had or were planning to adopt certain new practices coming out of the pandemic.

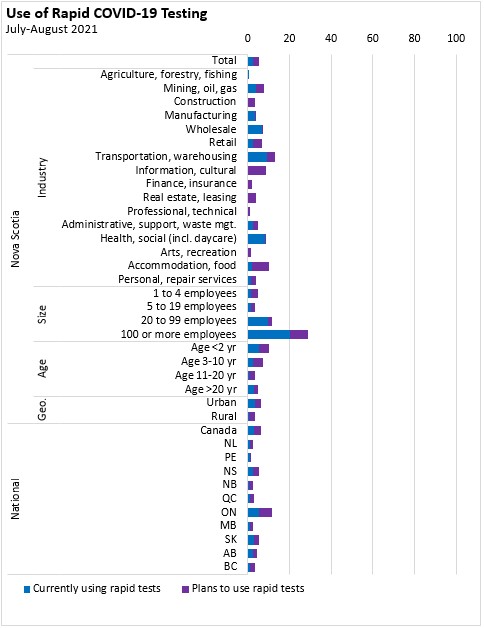

- Only 2.5% of Nova Scotia businesses reported using rapid testing for COVID-19 while a further 2.7% reported plans to adopt it in the next three months. Rapid testing use or plans were more common among transportation/warehousing, information/culture, health/social and accommodation/food businesses as well as among larger businesses and newer businesses. Rapid testing was more commonly used/planned among Ontario businesses.

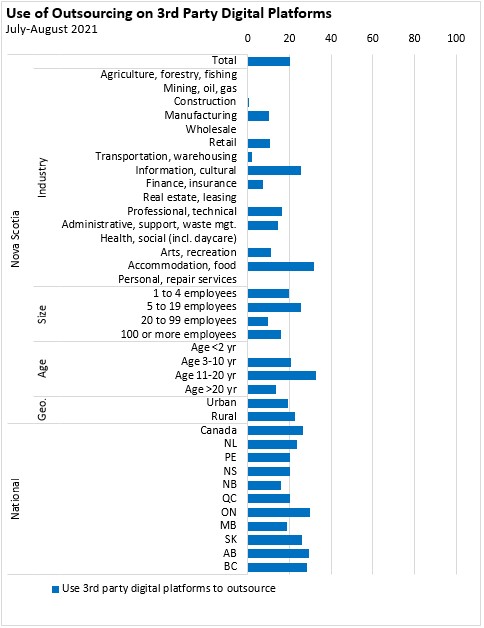

- 20.3% of Nova Scotia businesses reported outsourcing some tasks to third party digital platforms or websites. Many industries had insufficient results to report, but accommodation/food, information/culture, professional/technical and administrative support businesses reported a higher use of third party digital platforms for outsourcing.

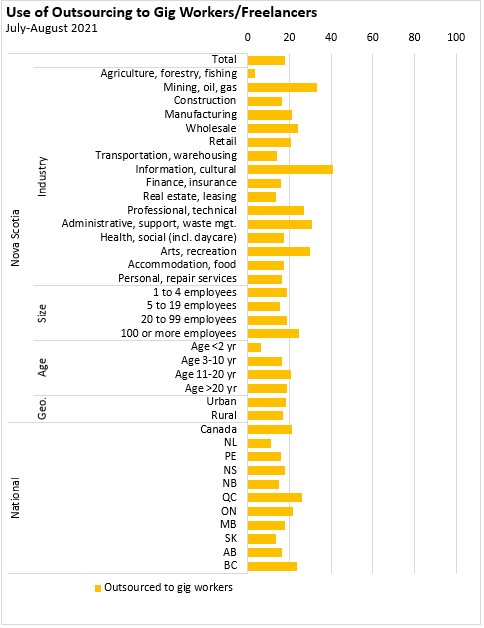

- The use of freelance or 'gig' workers for outsourcing was reported by 17.9% of Nova Scotia businesses, with greater use among information/culture, mining/oil/gas, professional/technical, administrative/support, arts/recreation, wholesale and manufacturing businesses. Gig workers were more commonly used by businesses in Ontario, Quebec and British Columbia.

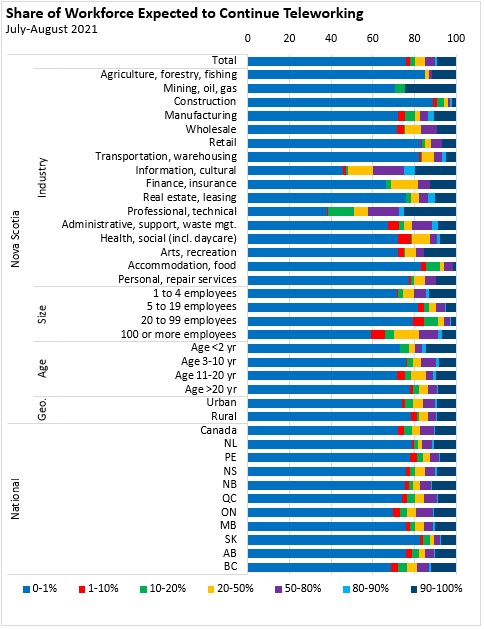

- Over three quarters (75.7%) of Nova Scotia businesses expect to have less than 1% of staff working remotely by telework once the COVID-19 pandemic has ended while 9.1% expect to have 90-100% of staff working by telework. Plans for continued teleworking were notably higher in information/culture, professional/technical, finance/insurance, arts/recreation, health/social, wholesale, manufacturing and mining/oil/gas. There was also a substantially larger expected use of telework for larger businesses. Across Canada, telework plans are more common among businesses in Ontario and British Columbia.

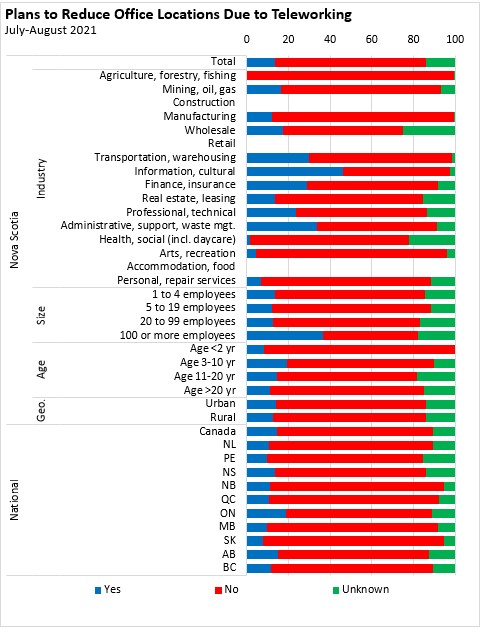

- Just 13.5% of Nova Scotia businesses anticipate reducing office locations as a result of telework, though this was much more likely among information/culture, transportation/warehousing, administrative/support and professional/technical services. Across Canada, 18.9% of Ontario businesses anticipate reducing office locations as a result of ongoing telework, a notably higher share than in other provinces.

Sources: Statistics Canada. Table 33-10-0393-01 Future outlook over the next 12 months, third quarter of 2021; Table 33-10-0363-01 Business or organization expectations over the next three months, third quarter of 2021; Table 33-10-0364-01 Business or organization obstacles over the next three months, third quarter of 2021; Table 33-10-0366-01 Plans to transfer, sell, or close business in the next 12 months, third quarter of 2021; Table 33-10-0378-01 COVID-19 Rapid Test kit usage over the last month, third quarter of 2021; Table 33-10-0381-01 Business or organization plans to start using COVID-19 Rapid Test kits to test on-site employees for COVID-19 infection in the next three months, third quarter of 2021; Table 33-10-0383-01 Sources of funding approved or received due to the COVID-19 pandemic, third quarter of 2021; Table 33-10-0384-01 Reasons business or organization did not access any funding or credit due to the COVID-19 pandemic, third quarter of 2021; Table 33-10-0385-01 Liquidity and access to liquidity over the next three months, third quarter of 2021; Table 33-10-0386-01 Ability for the business or organization to take on more debt, third quarter of 2021; Table 33-10-0387-01 Outsourcing of tasks, projects or short contracts to freelancers or "gig" workers by the business or organization in the last 12 months; Table 33-10-0388-01 Business or organization usage of third-party digital platforms, applications or websites to outsource tasks, projects or short contracts in the last 12 months; Table 33-10-0391-01 Percentage of workforce anticipated to continue to primarily telework once the COVID-19 pandemic is over; Table 33-10-0392-01 Businesses or organizations anticipated to shrink office locations due to the workforce teleworking

<--- Return to Archive

|

|