The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

April 20, 2021FEDERAL BUDGET 2021-22 Canada's Federal government has tabled its 2021-22 Budget.

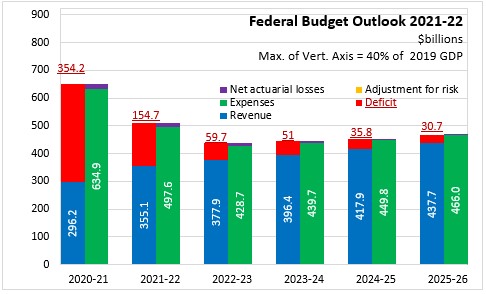

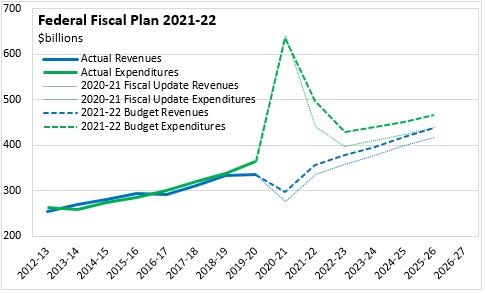

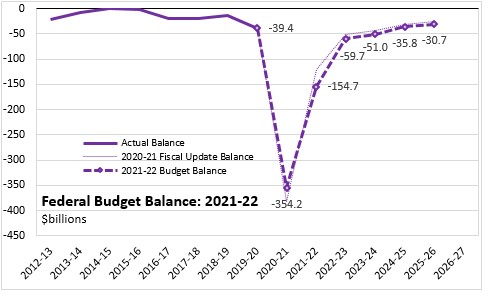

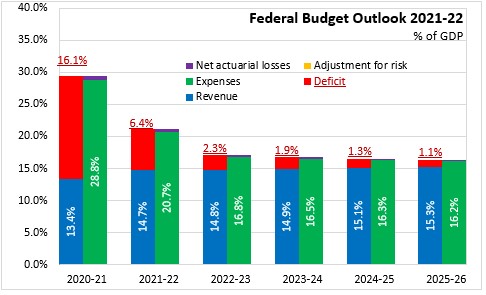

The Federal deficit for 2020-21 is now forecast to be $354.2 billion (16.1% of GDP), which is lower than the $381.6 billion deficit projected in last year's Fall Economic Statement (FES). The deficit in 2020-21 was caused by the pandemic’s impact on both revenues and expenditures. Federal revenues fell by $37.9 billion (-11.3%) to $296.2 billion in 2020-21, particularly on declines in corporate income tax, GST and Crown enterprises. Personal income tax revenues actually increased in 2020-21. Federal expenditures increased by $272 billion (+75.0%) to $634.9 billion based on the large increases for CERB, CRB, CEWS as well as increases other transfer payments and Federal government operating expenses.

For 2021-22, the Federal deficit is estimated to decline by about $200 billion to $154.7 billion (6.2% of GDP). This is larger than estimated for 2021-22 in the FES, in which the deficit was projected at $121.2 billion. Based on economic developments, the deficit would have narrowed to $105.4 billion, but new initiatives increased the deficit by $49.3 billion. In 2021-22, Federal revenues are projected grow by $58.9 billion (19.9%) to $355.1 billion in rebounding corporate income tax, GST and Crown Enterprise revenues as well as a large increase in personal income tax revenues. Federal expenditures are expected to fall by $137.3 billion (-21.6%) to $497.6 billion on declines in recovery benefits and wage subsidies, though operating expenses and other transfers remain elevated. Expenditures in 2021-22 remain $131.7 billion more than in 2019-20.

Beyond 2021-22, Federal deficits are projected to narrow significantly, but not to close:

- -$59.7 billion in 2022-23 (-2.3% of GDP)

- -$51.0 billion in 2023-24 (-1.9% of GDP)

- -$35.8 billion in 2024-25 (-1.3% of GDP)

- -$30.7 billion in 2025-26 (-1.1% of GDP)

Over the medium term, the Federal government’s revenues are projected to be higher than expected in the FES. However, expenditures are also projected to be higher (child care, operating expenses and other transfer payments) – leaving the size of medium term deficits about the same as expected in the FES.

Medium term deficits would have narrowed from the FES projections based on improved economic circumstances. The increases in the deficits reflect the Federal government’s commitment to spend $100 billion to accelerate economic recovery.

The Federal Budget presents alternative scenarios for the economic recovery. In the slower growth scenario (interruptions in vaccine rollout, new variants), the deficit increases by about $14.6 billion in 2021-22 and by $3-4 billion per year thereafter. In the faster growth scenario (successful vaccination, lower hospitalization and death, US stimulus spending, easing of border restrictions) the deficit shrinks by $10.4 billion in 2021-22 and by $7-8 billion/year thereafter.

The combination of a sharp rise in pandemic-related expenditures and business/household support programs along with shrinking nominal GDP resulted in a Federal government expenditure that amounted to 28.8% of GDP in 2020-21. This was far higher than in previous years (15.7% in 2019-20). However, by 2022-23 the wind-down of temporary pandemic-related spending reduces the Federal government's footprint in the Canadian economy back to 16.8% of GDP. This is projected to fall further to 16.2% by 2025-26.

Canada's net debt is projected to rise from $812.9 billion (35.2% of GDP) at the end of the 2019-20 fiscal year to $1,333.6 billion (55.4% of GDP) by the end of the 2021-22 fiscal year. Over the medium term, the Federal net debt to GDP ratio is projected to decline slowly.

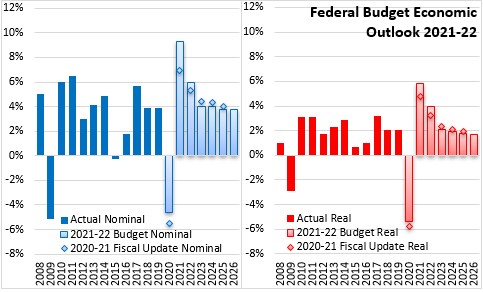

Canada’s real GDP declined 5.4% in 2020 during the most severe lockdowns of the COIVD-19 pandemic. Economy activity has already rebounded from these depths, but remains around 3% below pre-pandemic levels.

Canada's economic recovery is expected to be stronger than previous projections. Real GDP is expected to expand 5.8% in 2021 (vs the 4.8% projected in the FES) and 4.0% in 2022 (FES 3.2%). Real GDP is expected to reach pre-pandemic level over course of 2021, earlier than previously expected, but uncertainty of exact timing remains. Nominal GDP is projected to expand 7.0% in 2021 (FES 6.9%) and 5.3% in 2022 (FES 5.3%). CPI inflation is expected to be modest at 2.2% in 2021 and 2.0% in 2022.

Canada's economic recovery depends on controlling spread of the virus and completing a successful vaccine rollout. Release of pent-up demand and US fiscal stimulus could translate into temporary boost in economic activity. However, labour market recovery will lag real GDP recovery; the unemployment rate will be around 7% at end of 2021 and 6.3% by end of 2022. The national unemployment rate only returns to 6% by 2024.

Economic recovery has so far been uneven with youth, women and older Canadians, and low-wage workers disproportionally impacted. This is still the case during the third wave. The Budget makes investments to “secure the recovery” with time-limited measures and to “build a stronger economy” with investment. The Budget's approach to economic recovery draws on lessons learned from the 2008-09 recession. Canada's Federal government seeks to avoid a prolonged downturn and economic “scarring”. Budget 2021 prioritizes: breaking down barriers that prevent people from joining labour force, creating opportunities for young workers, helping workers match skills and jobs, restarting the immigration system, investing to fight climate change and develop the green economy, incentives for business to adapt technology.

Key Measures and Initiatives

Canada's 2021-22 Federal Budget includes a large number of new initiatives and changes. These focus on: keeping Canadians healthy during the last part of the pandemic; supporting households and businesses through to the recovery; creating new employment and skill development opportunities; helping businesses grow and succeed; creating a healthy environment to support economic recovery; strengthening cities and communities; building a more equal Canada; supporting strong Indigenous communities; protecting shared values of justice, security and international cooperation; and, improving government operations and tax fairness.

Key initiatives include:

- $30 billion over 5 years (+$8.3 billion/year thereafter) to establish Canada-wide child care with fees reduced to $10/day. An additional $2.5 billion over 5 years will support early learning and child care systems for Indigenous families.

- $3 billion over 5 years to build national standards for seniors in long term care

- extending pandemic supports to September 25, including the wage subsidy (an added $10.1 billion) and the rent subsidy (+$1.9 billion)

- adding 12 weeks to the Canada Recovery Benefit (max: 50 weeks paid at $500/week for 4 weeks, then $300/week for 8 weeks) as well as 4 weeks for the Canada Recovery Caregving Benefit (to 42 weeks at $500/week). These extensions are expected to cost $2.5 billion.

- keeping uniform access to EI benefits (420 hours, 14 week minimum), common earnings threshold for fishing benefits, simplifying rules at a cost of $3.9 billion over 3 years. Enhanced sickneww benefits (to 26 weeks from 15) at a cost of $3 billion over 5 years.

- doubling Canada Student Grants ($3.1 billion over 2 years), extend the interest waiver ($0.4 billion in 2022-23), ease repayment thresholds ($0.2 billion over 4 years) and extend disability supports ($0.4 billion over 4 years)

- $1.7 billion over 3 years for training, apprenticeships and literacy/numeracy

- $8.9 billion over 6 years for an expanded Canada Workers Benefit (higher income levels for roll-off covers full time minimum wage earners)

- setting a $15/hour minimum wage for Federally-regulated sectors of the economy

- Establishing a new Canada Recovery Hiring Program to encourage hiring workers as COVID-related business supports wind down ($0.6 billion in 2021-22) as well as $0.7 billion over 5 years to create 85,000 more MITACS work-integrated learning placements.

- $4 billion for technology adoption by businesses as well as $2.2 billion in tax relief to allow Canadian controlled private corporations to immediately expense up to $1.5 million in eligible investments such as digital assets and intellectual property.

- $0.4 billion over 10 years to advance an artificial intelligence strategy

- $5.0 billion over 7 years for investments by large emitters to decarbonize their production as well as $0.2 billion over 5 years to reduce taxes for businesses that manufacture clean technologies or invest in clean energy equipment or carbon capture/storage.

- Consulting on border carbon adjustments

- $4.4 billion over 5 years for home retrofits

- $1.4 billion over 12 years for Disaster Mitigation and Adaptation as well as $1.9 billion over 5 years to support provincial disaster response and recovery

- $3.3 billion over 5 years to conserve lands and oceans

- $2.5 billion over 7 years for rapid housing, affordable housing innovation and the Canada Housing Benefit

- $14.9 billion over 8 years for a permanent Public Transit Fund

- $1.2 billion over 3 years for regional development agencies to promote conversion to a clean economy as well as community infrastructure.

- $0.3 billion in 2021-22 to build sustainable funding for Black youth and social purpose organizations, combat anti-Black racism and improve social and economic outcomes in Black communities.

- $0.2 billion over 5 years to improve data collection about diverse populations, racism, gender gaps.

- $2.7 billion over 10 years for long-term stabilized program supports for eligible First Nations

- $1.2 billion in 2021-22 to support health in Indigenous communities (First Nations, Inuit, Metis Nation as well as urban/off-reserve) along with $1.4 billion over 5 years for essential health care services in First Nations communities

- $0.6 billion over 3 years for a First Nations mental wellness strategy

- $1.0 billion over 5 years for First Nations communities to assist in keeping families together

- $1.2 billion over 5 years to support on reserve education, including supports during the COVID pandemic.

- $6.0 billion over 5 years to build, operate and maintain Indigenous community infrastructure.

- $0.3 billion over 5 years to preserve Indigenous languages

- $0.2 billion over 5 years for provinces/territories to help reduce the overrepresentation of Indigenous people, Black Canadians and other racialized groups in youth justice systems.

- $0.9 billion over 5 years for military initiatives to eliminate sexual misconduct and gender based violence, modernize NORAD and add 6 fighters plus a frigate to the NATO Readiness Initiative

- $0.5 billion over 3 years for international humanitarian assistance and responding to the Rohhingya crisis in Myanmar.

- raising revenues of $3.4 billion over 5 years from a Digital Services Tax

- starting a luxury tax on cars and personal aircraft valued over $100,000 and boats valued over $250,000 ($0.6 billion in revenues over 5 years)

- implementing a national tax on under-utilized or vacant real estate held by non-residents ($0.7 billion in revenues over 4 years)

- introducing taxation for vaping products along with a $4/carton increase in tobacco taxes ($2.1 billion in revenue over 5 years for tobacco tax)

- limiting interest deductions for certain businesses ($5.3 billion in revenue over 5 years)

- preventing cross border tax avoidance schemes ($0.8 billion in revenue over 4 years)

- $0.3 billion over 5 years for Canada Revenue Agency initiatives to tackle tax avoidance and evasion

- Spending reductions of $1.1 billion over 5 years through use of greater digital and visual interaction by Federal departments with high travel costs

- $0.1 billion over 6 years for enhancements to Statistics Canada's collection of health care data as well as quality of life indicators

Canada's Federal Budget 2021-22

<--- Return to Archive