The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

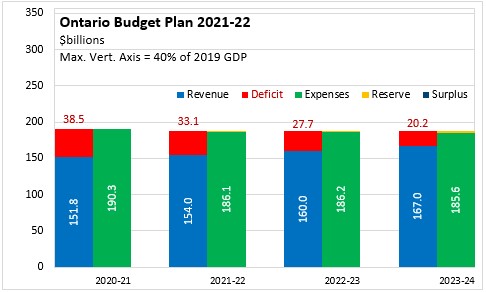

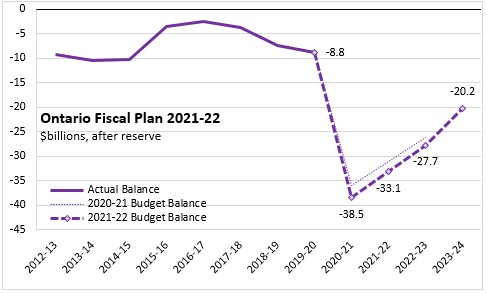

March 26, 2021ONTARIO BUDGET 2021-22 Ontario released its 2021-22 Budget on March 24. Ontario's budget deficit for 2021-22 is projected to be $33.1 billion, down from a forecast of a $38.5 billion deficit for 2020-21. Ontario is expected to remain in deficit (after contingency reserve) for each the following two fiscal years. By 2023-24, Ontario's deficit is projected to decline to $20.2 billion.

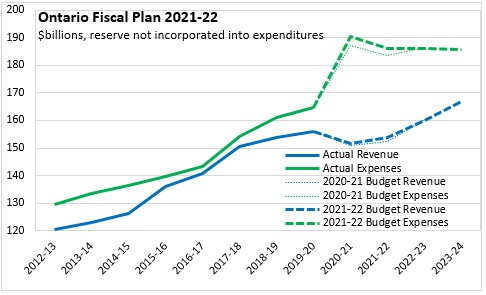

Ontario did not release its 2020-21 Budget until well after the declaration of the COVID-19 pandemic. As a result, Ontario's previous fiscal plan had incorporated the pandemic's effects on revenues and expenditures. The revised fiscal plan shows somewhat higher expensis and revenues than were projected in the previous fiscal plan.

Ontario's planned deficits have been revised since 2020-21 and are now projected to be slightly larger over the coming fiscal years. The government has noted that its deficits fall under the 'extraordinary circumstances' in its Fiscal Sustainability, Transparency and Accountability Act, 2019. This includes a recovery plan that identifies 2029-30 as the date for returning to balance. However, there are scenarios under which the return to balance could be accelerated to 2027-28 or delayed to 2031-32.

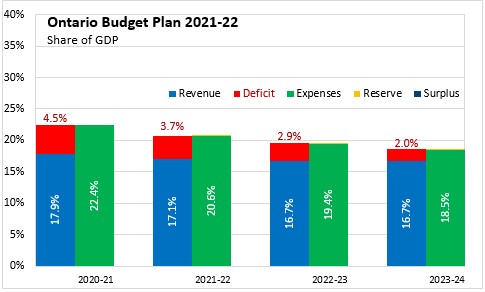

Ontario's deficit is projected at 4.5% of GDP for 2020-21. Subsequent deficits decline as a share of GDP, falling to 3.7% in 2021-22, 2.9% in 2022-23 and 2.0% in 2023-24. The footprint of the provincial government in the Ontario economy is projected to decline from 22.4% in 2020-21 to 18.5% in 2023-24.

Ontario's net debt to GDP ratio is projected to be rise from 39.6% in 2019-20 to 48.8% in 2021-22. The net debt to GDP ratio is projected to rise in each of the next two fiscal years, reaching 50.2% by 2023-24.

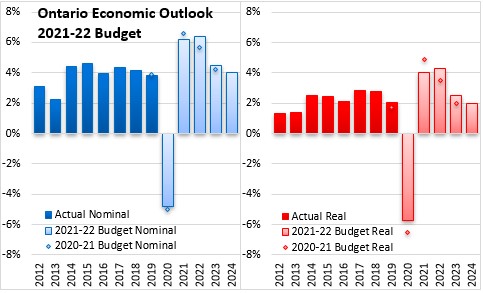

Ontario's economy has faced one of the larger shocks as a result of the COVID-19 outbreak and efforts to contain it. Real GDP is estimated to have declined by 5.7% in 2020 (-4.8% in nominal terms). As of February, employment was still 4.1% below pre-pandemic levels. Ontario's economy is projected to rebound with real GDP growth of 4.0% in 2021, 4.3% in 2022, 2.5% in 2023 and 2.0% in 2024.

Key Measures and Initiatives

Ontario's Budget emphasizes protection of health and protection of the economy. Some of the highlight initiatives in Ontario's 2021-22 Budget

- $1 billion for a provincewide vaccination plan

- $2.3 billion for testing and contact tracing

- $1.4 billion for personal protective equipment

- $5.1 billion to support hospitals since the pandemic began, creating more than 3,100 additional hospital beds. This includes $1.8 billion in 2021–22 to continue providing care for COVID‑19 patients, address surgical backlogs and keep pace with patient needs.

- An additional $933 million over four years, for a total of $2.6 billion, to support building 30,000 new long-term care beds.

- $246 million over the next four years to improve living conditions in existing homes, including air conditioning

- $4.9 billion over four years to increase the average direct daily care to four hours a day in long-term care and hiring more than 27,000 new personal support workers and nurses.

- Hospital expansion and construction projects

- Additional funding of $175 million in 2021–22 for mental health care

- An additional $2.1 million over three years to support victims of domestic violence and other violent crime

- Investments of $1.6 million over two years to support the Anti-Racism and Anti-Hate Grant program,

- A new Ontario Jobs Training Tax Credit for 2021, providing up to $2,000 per recipient for 50% of eligible expenses ($260 million)

- A third round of payments to support parents through the Ontario COVID‑19 Child Benefit (total: $1.8 billion since last March). The payment will be doubled to $400 per child and $500 for each child with special needs

- A 20% enhancement of the CARE tax credit for 2021 (increasing support from $1,250 to $1,500)

- Introduced the Seniors’ Home Safety Tax Credit for 2021

- Providing a second round of Ontario Small Business Support Grant payments (an additional $1.7 billion) of a minimum of $10,000 and up to $20,000

- An additional $400 million over the next three years in new initiatives to support tourism, hospitality and culture industries.

- $2.8 billion to connect homes, businesses, and communities to broadband

- A temporary enhancement to the Regional Opportunities Investment Tax Credit

- Making up to $50 million available for grants to eligible faith-based and cultural organizations

- Providing almost $1 billion in additional financial relief for municipalities in 2021

Ontario Budget 2021-22

<--- Return to Archive