The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

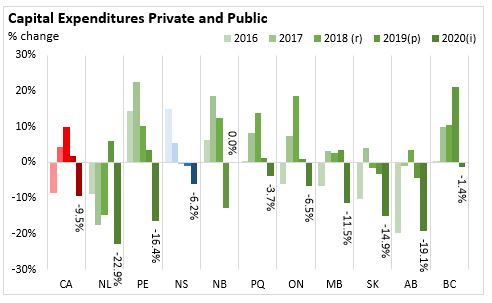

August 11, 2020CAPITAL AND REPAIR EXPENDITURES SURVEY, 2019 (PRELIMINARY) AND 2020 (INTENTIONS) [UPDATE] Statistics Canada has revised the 2020 capital expenditure intentions from annual survey of capital expenditures for non-residential construction and machinery and equipment. The previous estimate for 2019 were preliminary and are unchanged. The COVID-19 pandemic has slowed economic activity and altered capital plans for Canadian companies. The revised intentions for 2020 are based on a sample survey of 7,000 private and public organizations conducted over June and July 2020. Nova Scotia's previous capital expenditure intentions for 2020 were for an increase of 1.4 per cent to $4,202 million; the revised intentions are a decline of 6.2 per cent to $3,888 million. The following article has been updated with the revised 2020 intentions data.

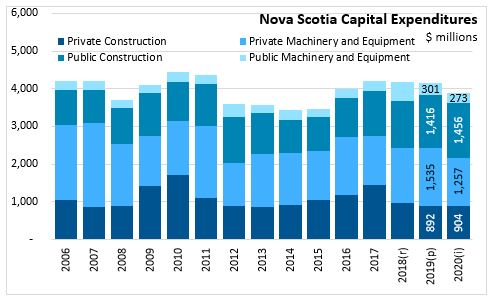

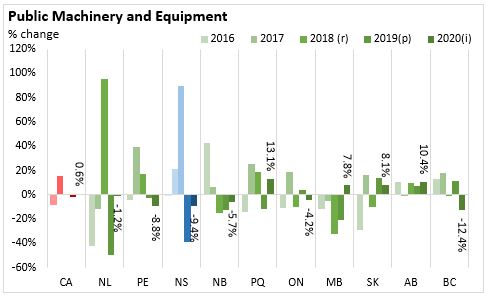

Capital expenditures include both non-residential capital construction and machinery and equipment spending. After increasing 5.4 per cent in 2017 and declining 0.4 per cent in 2018, capital expenditures declined 0.9 per cent in 2019 in Nova Scotia. The decline in 2019 was due to a decrease in public machinery and equipment(-39.2%, -$194.1 million) and private construction (-6.9%, -65.9 million). Increases in private machinery and equipment (+4.1%,+$61.0 million) and public construction(+12.9%, +$161.9 million) offset most of the decline so that total capital expenditures fell $37 million to $4,144 million in 2019. The decline in 2019 was less than the intentions estimate for 2019 (-5.8%, -$240 million).

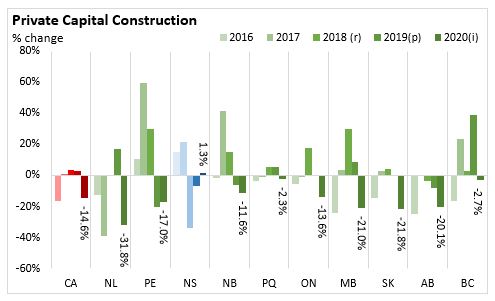

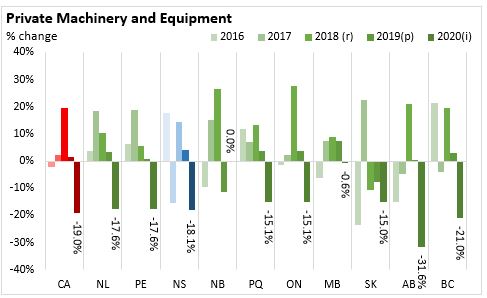

Capital expenditure intentions for 2020 are for a decrease of 6.2 per cent or by $255.4 million to $3,888 million. Private construction (+1.3, +$11.5 million) is expected to increase while private machinery and equipment spending (-18.1%, -$278.3 million) is expected to be down. Public capital construction is expected to increase 2.8 per cent or $39.8 million. Intentions for public machinery and equipment spending (-9.4%, -$28.4 million) are a return to historical levels after higher expenditures in the past 2 years.

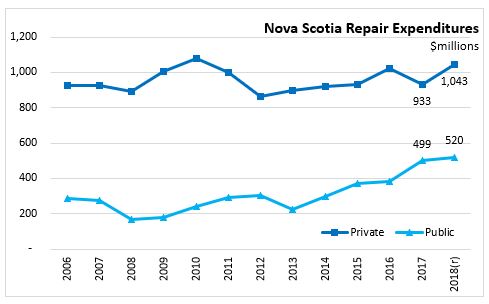

Repair expenditures increased 9.1 per cent in 2018, a pick up from the 1.9 per cent in 2017. Repair expenditures increased for structures (+29.8%) and declined for machinery and equipment (-6.5%). Repair expenditures increased for both private (11.7%) and public (+4.2%) in 2018.

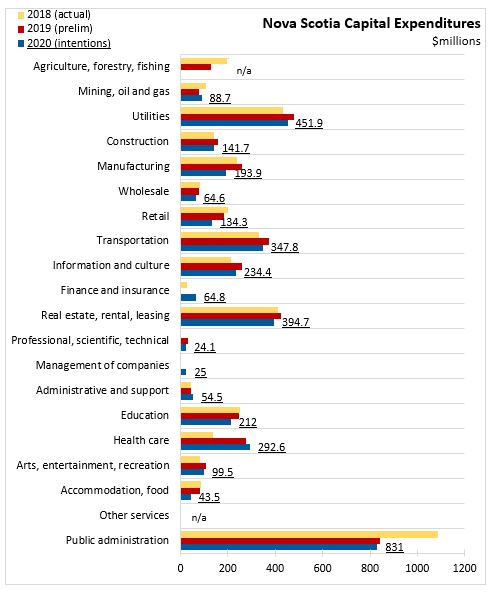

On an industry basis, the $37 million decrease in capital expenditures occurring in 2019 was due to declines in agriculture, forestry, fishing and hunting (-$78 million),mining and oil and gas extraction (-$28 million), wholesale (-$4 million), retail trade (-$14 million), education services (-$6 million), accommodation and food services (-$4 million) and public administration (-$246 million). Increase in capital expenditures occurred with utilities (+$46 million), construction (+$16 milling), manufacturing(+$21 million) transportation/warehousing (+$42 million), information/cultural (+$46 million), real estate/rental (+$11 million), administration services (+$1 million), health care (+$139 million) and arts, entertainment and recreation (+$27 million)

For 2020, total capital expenditures are expected to decrease by 6.2 per cent or $255 million. Capital intentions for 2020 are higher only for Mining, quarrying and oil and gas extraction (+$10 million) and Administration and support, waste management, remediation services (+$9 million). The largest percentage declines in capital spending are expected in manufacturing (-25.4%, -$66 million), retail trade (-27.4%, -$51 million), professional services (-27.8%, -$9 million), accommodation and food services (-48.2%, -$41 million). The other sectors all declined except for agriculture, forestry, fishing and hunting; finance and insurance, and other services as data is not available.

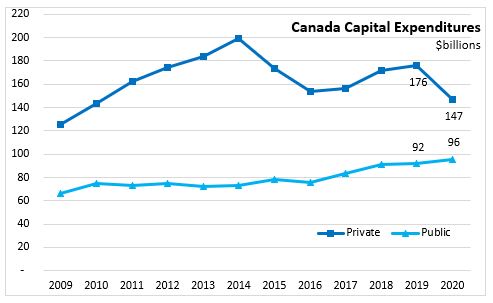

Canada is expected to see decrease of 9.5 per cent in capital expenditures in 2020 (previous intentions were +2.8 per cent) following on increases of 1.7 per cent in 2019 and 9.8 per cent in 2018. Anticipated spending is much lower in oil and gas extraction and accommodation and food service sector. Manufacturing capital spending anticipated to decline 18.5 per cent with notable declines in chemical manufacturing and transportation equipment. Only three industrial sectors have revised upward capital plans: health care, information and cultural (including telecommunication), and educational services.

All provinces have lower total capital expenditure intentions in 2020. The largest declines are in Newfoundland and Labrador (-22.9%) and Alberta (-19.1%). British Columbia capital expenditure intentions have the smallest decline (-1.4%). Nova Scotia is the only province with growth in private capital construction intentions in 2020 (+1.3%).

Non-residential capital and repair expenditures, 2018 (revised), 2019 (preliminary) and 2020 (intentions)

Non-residential capital and repair expenditures, 2020 (revised intentions)

<--- Return to Archive