The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

July 15, 2020BANK OF CANADA MONETARY POLICY The Bank of Canada maintained its target for the overnight rate at the effective lower bound of 0.25 percent. The Bank Rate is correspondingly 0.5 per cent and the deposit rate is 0.25 per cent. The Bank of Canada continues with its quantitative easing (QE) program of at least $5 billion per week purchases of Canadian bonds. Short-term liquidity program use has declined with reduced financial market stress. Provincial and corporate bond purchase programs are continuing as announced.

The Bank of Canada provided forward guidiance in terms of policy, "The Governing Council will hold the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved. In addition, to reinforce this commitment and keep interest rates low across the yield curve, the Bank is continuing its large-scale asset purchase program at a pace of at least $5 billion per week of Government of Canada bonds."

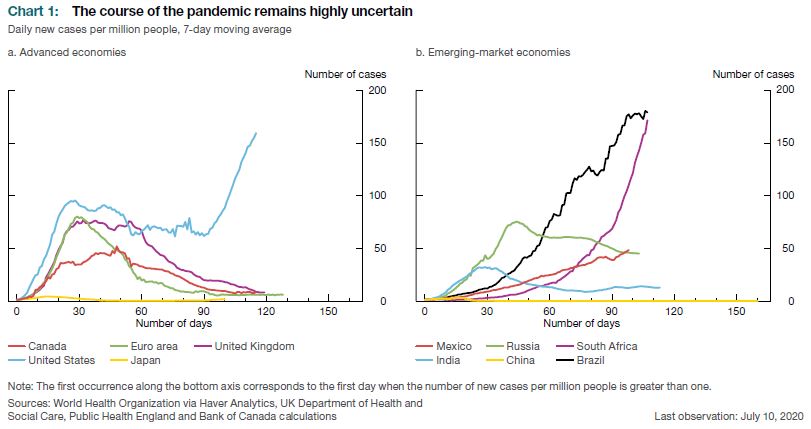

The Bank of Canada noted that the course of the pandemic is inherently unknowable. New cases in China are at very low levels, but other emerging market economies are seeing rapid increases in cases. Some advanced economies have seen slowing in new cases and are reopening their economies. US infections have reached new highs. Canadian cases have fallen sharply form highs in April and economic recovery has begun across many sectors in all provinces and territories. The Bank of Canada expects that economic output will not immediately be returning to pre-COVID levels and that business and workers can expect a period of difficulty.

The estimates presented in the Monetary Policy Report – July 2020 are a central scenario for the economy rather than economic projections as they highly conditional on the assumptions about the virus. The assumptions about the virus include that there will not be broad-based second wave in Canada or globally; large scale containment measures will be gradually lifted; and the pandemic will largely be over by mid-2022 with a vaccine or treatment available.

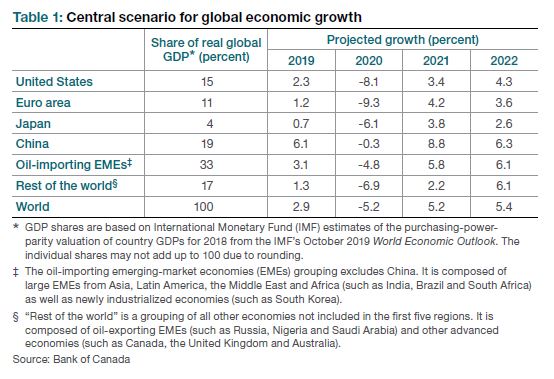

Global Economy

Following the historic decline in the first half of 2020, global economic activity has begun to pick up. The increase in global demand has partially rebounded commodity prices and some financial assets. Fiscal and monetary support have positioned consumers and business to resume activity as containment measure are relaxed. The central scenario has the second half of 2020 rebounding, but the effects of ongoing physical distancing and uncertainty continuing to restrain activity through 2022. Global output is estimated to decline 5.2 per cent in 2020 followed by growth of 5.2 per cent in 2021 and 5.4 percent in 2022. Global output at the end of 2022 would be 4 percent below the projected level from January 2020. The risk to the outlook is tilted to downside because of the potential for second wave of virus.

Containment measures affected labour-intensive activity with a greater impact in services than manufacturing. The situation led to a sharp decline in business and consumer confidence and a host of behavioural changes. Inflation fell in major economies with lower gasoline prices in March and April but have stabilized in May. Overall, disinflationary pressure from falling demand has outweighed upward pressures from supply disruptions.

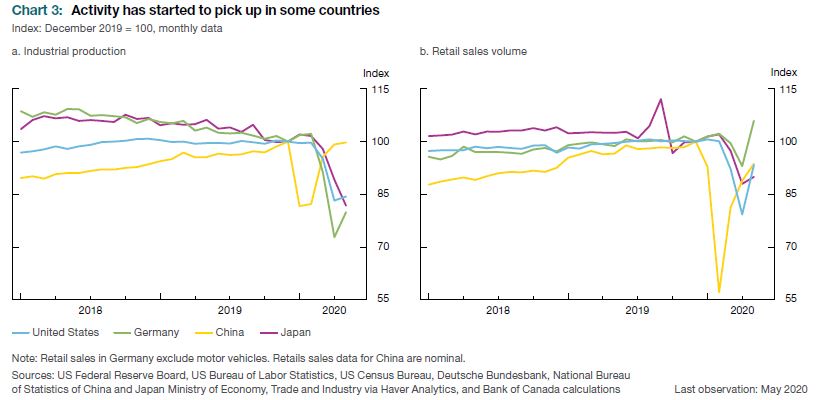

China’s reopening, amid strict infection control measures, has industrial production returning to pre-lockdown levels and retail sales rebounding but remaining at lower levels. Manufacturing investment remains weak with the uncertainty of the pandemic and trade tensions with the United States.

Advanced economies had activity pick up in May and June. Production, employment, and household spending increased in the US, but states are scaling back reopening plans amid new COVID-19 cases.

In the Bank of Canada’s central scenario, economic activity reaches pre-COVID-19 levels around the end of 2021. Supply-side adjustment will be made for physical distancing and companies may re-evaluate vulnerabilities of cross-border trade and supply chains. Demand is likely to continue to be restrained with precautionary physical distancing and economic uncertainty scaling back investment projects.

Extraordinary policy action to provide income support will assist the recovery as activity is able to resume. Some Emerging Market Economies have had only modest fiscal support as they already faced elevated debt levels. Central banks took decisive measures to stabilize the financial system with lower policy rates and expanded asset purchases. Global financial conditions have improved since April with markets reacting positively to monetary measures. Equity prices have recovered, credit spreads have narrowed, and volatility is down. The US dollar has depreciated since April with less demand of safe-haven assets. The Canadian dollar has also been supported with a partial recovery in commodity prices.

Oil prices have recovered with the increase in global oil consumption and reduced production among OPEC and in North America, but remain 30 per cent below pre-pandemic levels. Non-energy commodity prices have recovered the price decline from February to April with base metal prices rising with industrial production and infrastructure spending. Lumber prices have increased with closures of sawmills due to COVID-19.

Canadian Economy

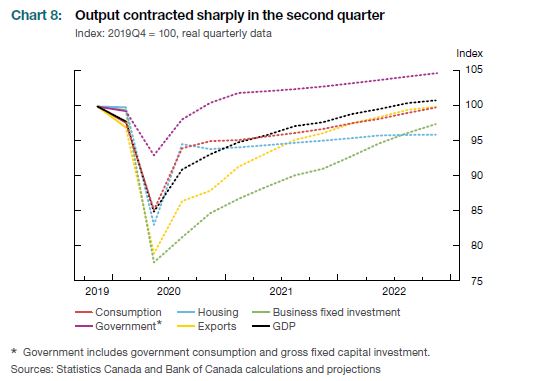

The Bank of Canada noted that human and economic costs would be considerably worse if containment measures had not succeeded in flattening the curve. In Q2 with the most restrictive measures were in place, economic activity is estimated to be 15 percent below Q4 2019. The economic contraction and recovery is expected to look different than typical business cycles. Some jobs continued with little disruption with online and remote work. The service sector, including travel, hospitality, and personal services, was impacted very hard. Employment losses have been larger for younger workers, recent immigrants, and women.

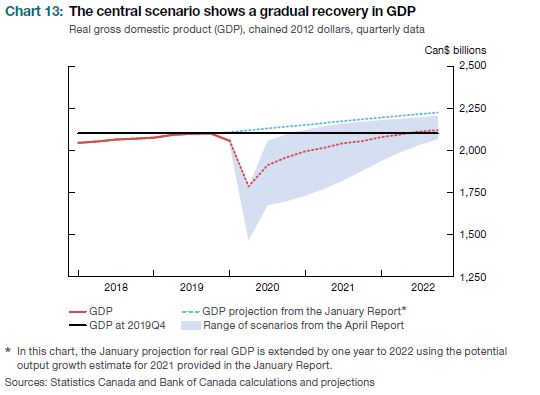

Policy measures should provide a solid foundation for the recovery, however uncertainty around the virus and job security will persist. Household spending will remain subdued, particularly activities that involve in-person interaction. Shifts in preferences and behaviours could continue and lead to structural change in the economy over long-term. The Bank of Canada central scenario estimates Canada real GDP to decline 7.8 per cent in 2020 and grow 5.1 per cent in 2021 and 3.7 per cent in 2022.

The Bank of Canada noted that the federal government launched unprecedented fiscal policy action to replace lost household income and help businesses retain workers during the lockdown. Around one-quarter of respondents in the Business Outlook Survey reported that the CEWS help to avoid or reduce layoffs. The Bank of Canada reduced policy rates to effective lower bound (0.25 per cent) and introduced liquidity facilities and asset purchase programs.

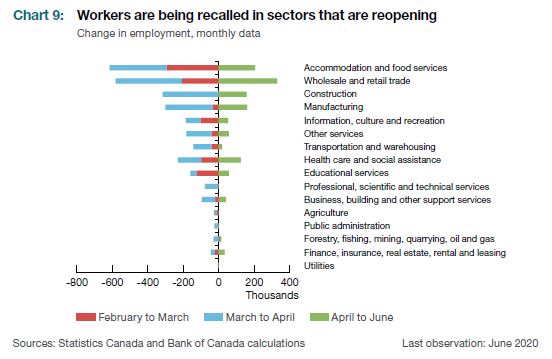

Labour market indicators suggest activity began to recover in May and June. Recovery will be a gradual and uneven process. Motor vehicle sales and housing have begun to recover while some of hardest-hit business (restaurants, travel, personal care) have only started to see improvement in recent weeks and continue to face challenges going forward.

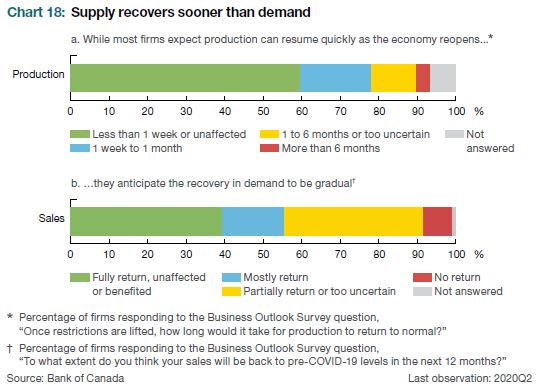

After a bounce back period, the recovery will be more gradual. Ongoing physical distancing, slow foreign demand, and elevated uncertainty will keep the pace of recovery moderate. Restructuring the economy after business closures and bankruptcies while new firms scale up will take time. Service sector growth, typically quick to rebound, faces ongoing challenges in a world with physical distancing practices.

In the central scenario, household spending picks up as containment measures are lifted and confidence improves. Cautious behaviour will persist and the saving rate will remain higher than recent years. Household individual situation will differ with some lower-income workers facing a period of income lose after support programs are ended. Households that have been less affected have accumulated savings and may have pent-up demand that would boost aggregate spending. Shifts in household spending patterns changed during the lockdown period and these may last to varying degrees. The downturn and lower immigration will hold down housing activity over the next few years in the central scenario.

Uncertainty about future demand, higher debt levels and financial stress are expected to dampen business investment. Recovery in business investment is expected to be slow as capacity pressures are limited and other business have permanently closed. Digital technology trends are expected to accelerate with firms offering more online options and enabling staff to work from home. The energy sector continues to face challenges and restructuring.

The central scenario has exports recovering at a moderate pace as borders reopen, supply-chains re-establish, and foreign demand picks up. Travel, motor vehicles, and energy exports continue to weigh on growth.

CPI

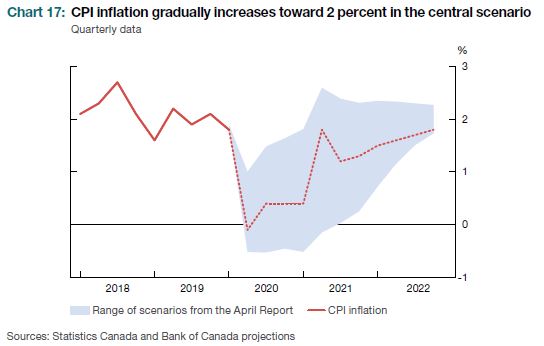

Prices for gasoline, travel services and clothing and footwear have fallen sharply because of the pandemic and containment measures. Price declines in these areas have outweighed prices increases for higher demand items (cleaning supplies and non-perishable food) and from the supply disruption to meat. CPI inflation fell close to zero per cent in April and May. Core inflation measures ranged from 1.4 to 1.9 per cent with the most volatile price movements filtered out. Firms have discounted some products to clear out built up inventories. Currently, there is only limited evidence of firms raising prices to cover increased costs of doing business during the pandemic and survey respondents indicate less intend to raise prices and would operate with smaller margins to remain competitive.

CPI inflation over short-term will largely reflect energy price developments. Afterwards, inflation strength depends on demand and supply recovery. Firms report capacity could return quickly but less certain about sales recovery. Demand held back with households opting for higher precautionary savings, slow foreign demand with trading partners taking longer to contain virus, postponed or cancelled business investment. These downward pressures on prices expected to take time to unwind. Consumers' expectation for inflation over the next two years have remained firm.

Bank of Canada: Rate announcement, Monetary Policy Report – July 2020

The Bank of Canada's next scheduled date for announcing the overnight rate target is September 9, 2020. The next full update of the Bank’s outlook for the economy and inflation, including risks to the projection, will be published in the MPR on October 28, 2020

<--- Return to Archive