The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

July 14, 2020SURVEY ON BUSINESS CONDITIONS, IMPACT OF COVID-19: MAY 2020 Because of the rapid changes in business conditions during the COVID-19 pandemic, Statistics Canada has conducted a second iteration of the Canadian Survey on Business Conditions. Where the first survey of business conditions was based on crowdsourced data, the second iteration used a probability-based sample and its results are therefor applicable to employer businesses across Canada.

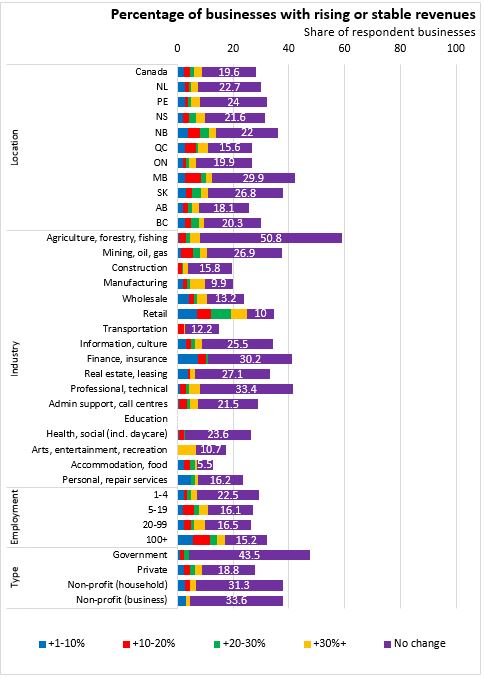

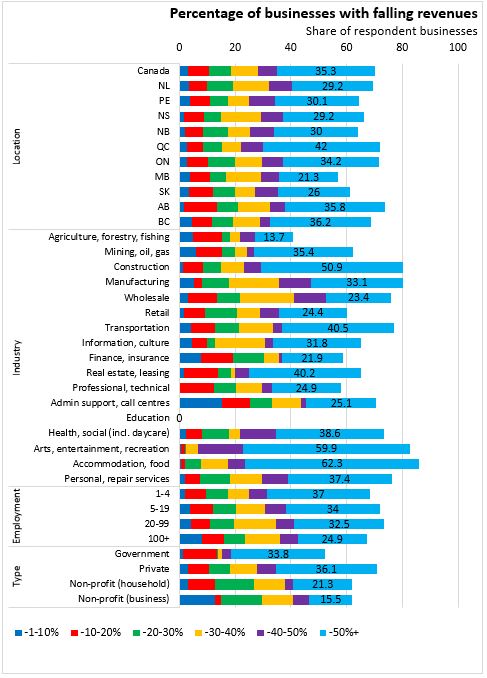

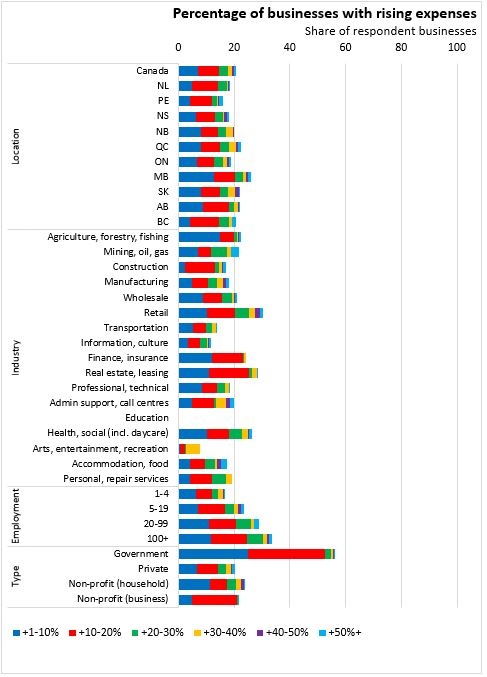

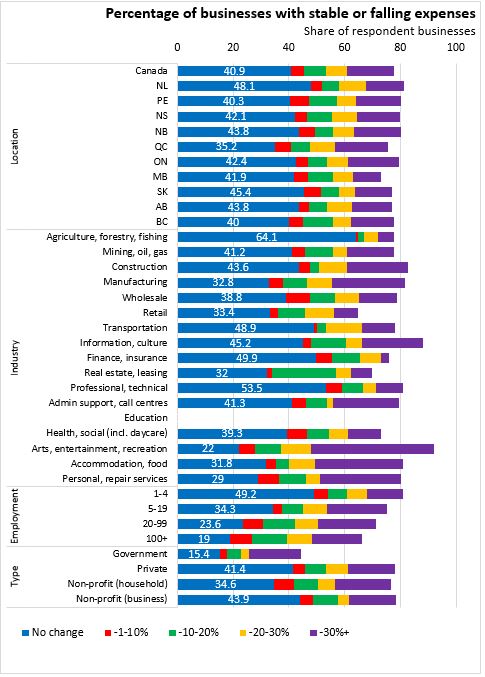

The results reported here are a selection of the impacts found by province, by industry, by size of business (measured by number of employees) and by business type (government agency, private business, non-profit organization serving households, non-profit organization serving business). The horizontal axis in all charts measures the share of businesses reporting each outcome.

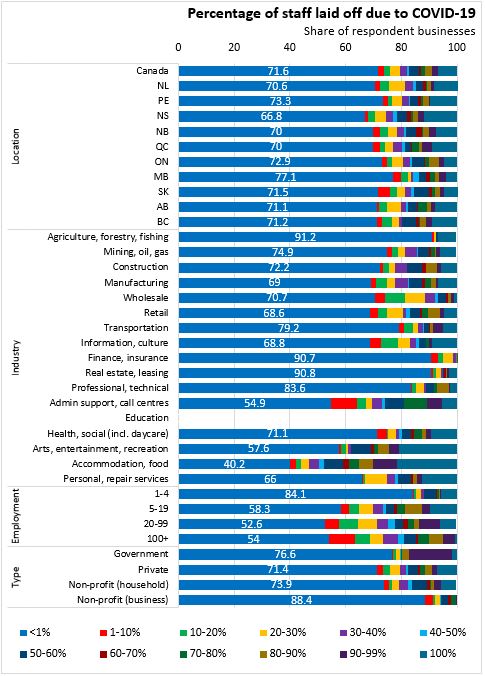

Across Canada, 71.6 per cent of businesses reported laying off just 1 per cent or less of staff due to COVID-19. This ranged from a low of 66.8 per cent in Nova Scotia to a high of 77.1 per cent in Manitoba. The portion of businesses that laid of 100 per cent of staff was 7 per cent across Canada, ranging from a low of 3.9 per cent in Manitoba to a high of 11.9 per cent in Nova Scotia.

Among industries, layoffs were less prevalent in agriculture/forestry/fishing, finance/insurance, real estate/leasing and professional/technical services. There were larger layoffs in accommodation/food services, administrative support/call centres, arts/entertainment/recreation, personal/repair services, information/culture and retail.

Layoffs were higher among larger employers and non-profit organizations.

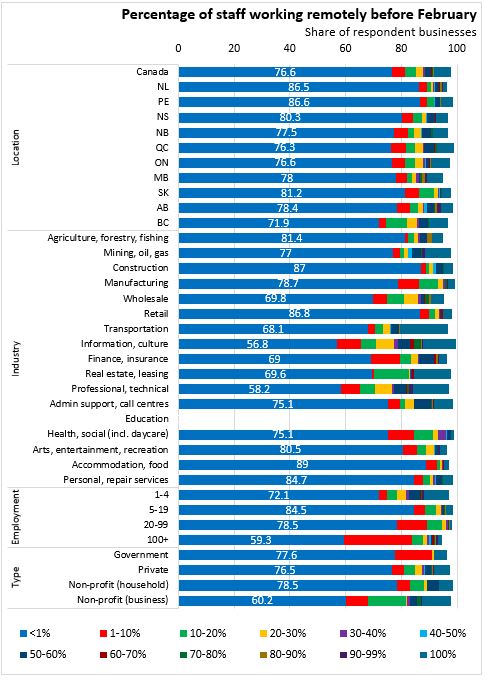

Working remotely has been one strategy employed to maintain business output during COVID-19. Prior to February, 23.4 per cent of businesses reported some degree of remote or telework arrangement. Telework was more common in British Columbia and less prevalent in Atlantic Canada and the prairire provinces. Remote and telework was more common in information/culture as well as professional/technical services and less common across goods-producing industries.

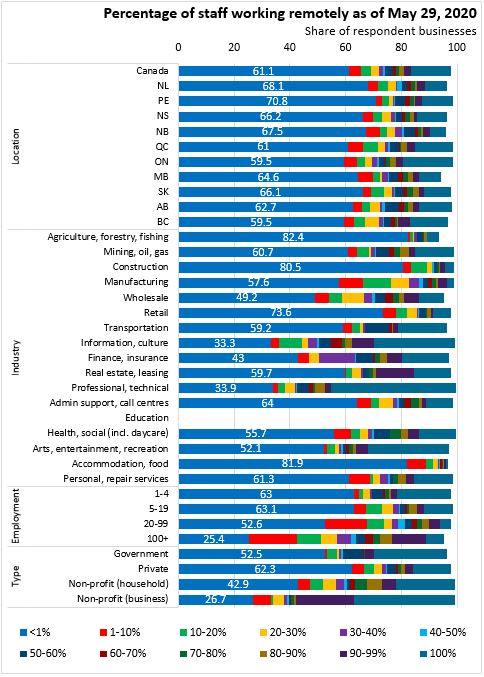

As of May 29, the prevalence of remote and telework arrangements grew to 28.9 per cent of businesses. There were increases in remote and teleworking in each province. Remote and telework expanded to more than half of businesses in many service industries, notably wholesale trade, information/culture, finance/insurance and professional/technical services. Increased use of remote and telework arrangements was particularly common among larger employers (>100 employees).

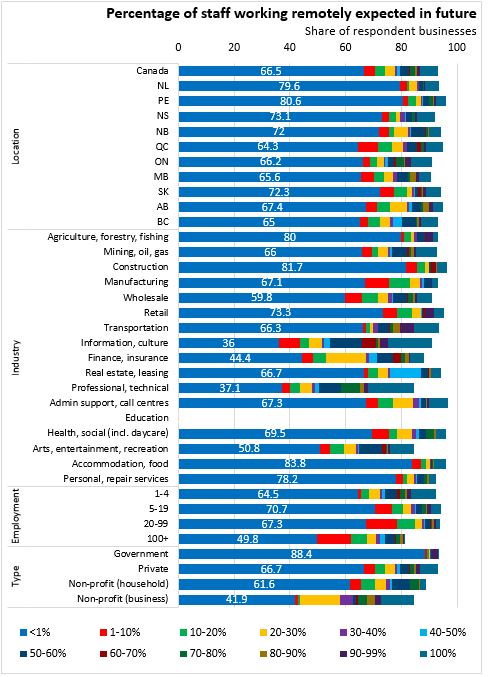

Looking beyond the COVID-19 pandemic, about one-third of Canadian businesses expect to maintain some form of remote or telework. This is greater than the prevalence of these arrangements prior to February. Future remote and telework is expected to be more common in information/culture, finance/insurance, professional/technical services and arts/entertainment/recreation industries.

Just over 28 per cent of businesses report stable or rising revenues during the COVID-19 period. The portion of businesses with stable/rising revenues is higher in Manitoba, Saskatchewan and New Brunswick and lower in Ontario, Quebec and Alberta. Stable or rising revenues are more commonly reported in agriculture/forestry/fishing, finance/insurance and professional/technical services as well as among government agencies.

Over 70 per cent of Canadian businesses report revenue declines, with 35 per cent reporting declines in excess of 50 per cent. Falling revenues were more prevalent in Ontario, Quebec and Alberta. Among industries, declining revenues were more widespread in accommodation/food, arts/entertainment/recreation, transportation, health/social (which includes daycares), personal/repair services, construction and manufacturing.

Rising expenditures were reported by just over 20 per cent of businesses. This share was higher in Manitoba as well as in government agencies, retail businesses and real estate/rental/leasing services.

Almost 78 per cent of businesses in Canada report stable or falling expenses.

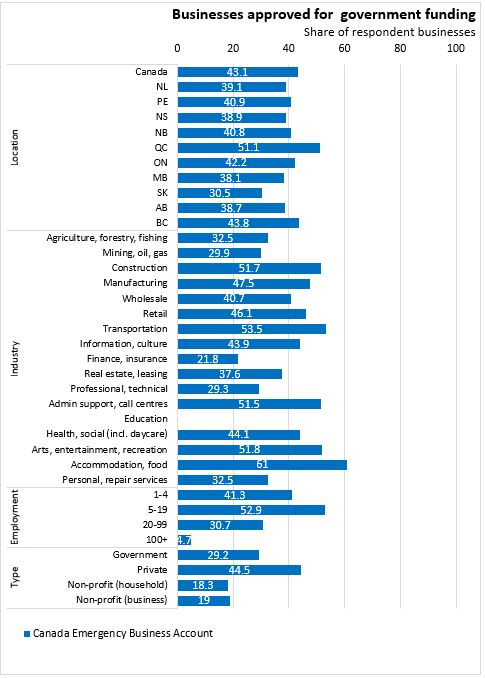

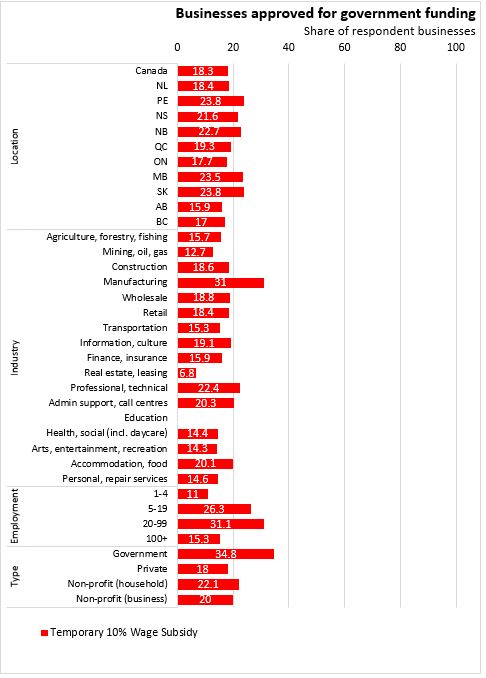

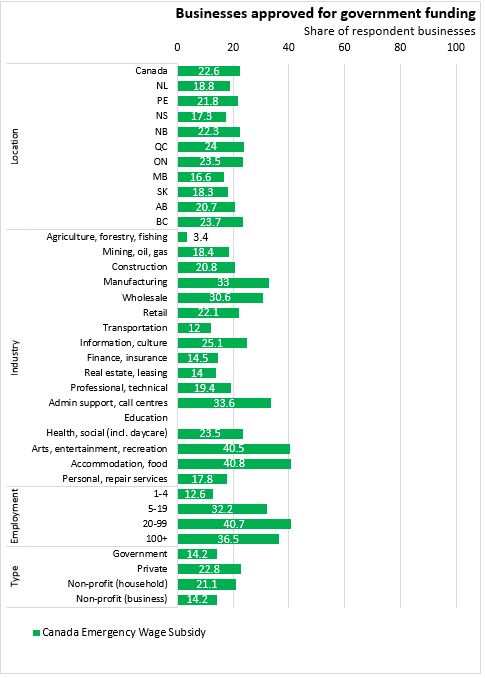

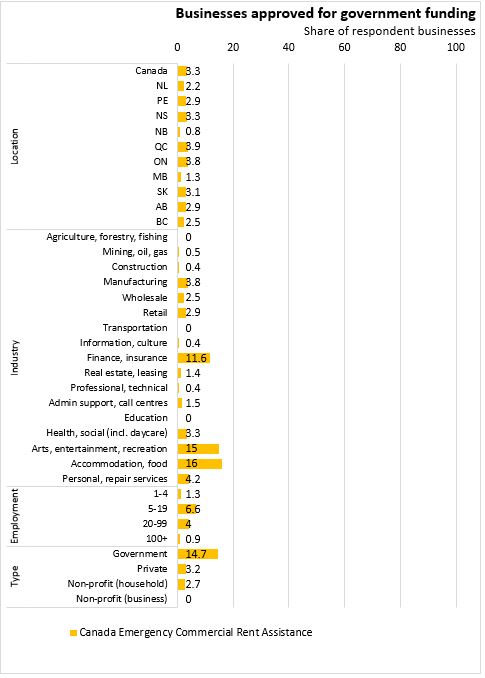

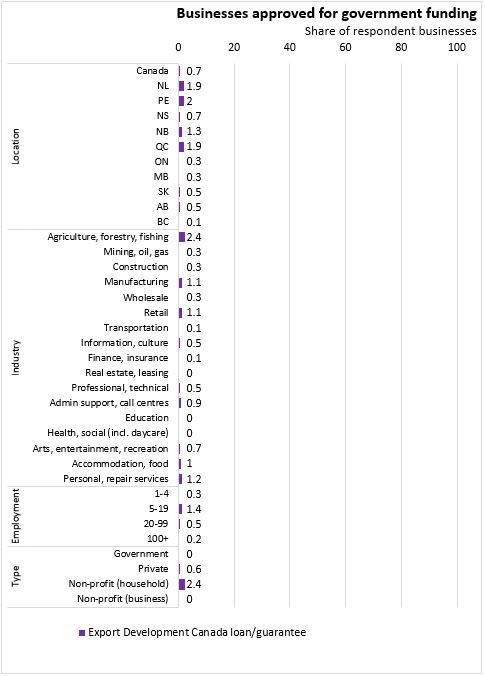

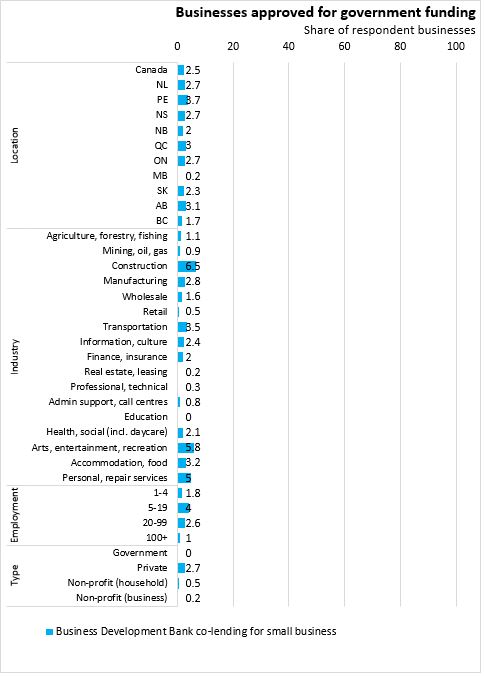

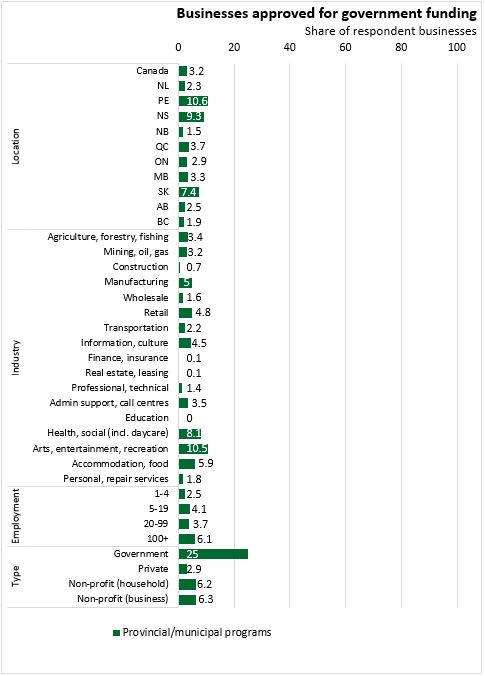

During COVID-19, Canada's federal, provincial, territorial and municipal governments have implemented various business support programs. These data refer to approvals as a share of businesses though not all businesses may have applied for assistance through these programs.

The Federal Canada Emergency Business Account (CEBA) was approved for 43 per cent of businesses, with higher uptake in Quebec and lower approvals in Manitoba, Saskatchewan and Alberta. Among industries, CEBA was more widely approved in accommodation/food, transportation, arts/entertainment/recreation, construction and administrative support/call centres. CEBA approval was lower in finance/insurance, mining/oil/gas, professsional/technical services and agriculture/forestry/fishing.

The Federal temporary 10 per cent wage subsidy was approved for 18.3 per cent of Canadian businesses, with notably higher approvals in Prince Edward Island, Manitoba and Saskatchewan. Manufacturers reported a higher share of businesses approved for the temporary 10 per cent wage subsidy.

The Canada Emergency Wage Subsidy (CEWS) was approved for 22.6 per cent of businesses, with higher shares in Quebec, Ontario and British Columbia. CEWS was approved for a lower share of businesses in Manitoba and Nova Scotia. Among industries, CEWS approval was higher as a share of businesses in accommodation/food, arts/entertainment/recreation, administrative support/call centres, manufacturing and wholesale trade. Larger employers reported greater percentages with CEWS approval.

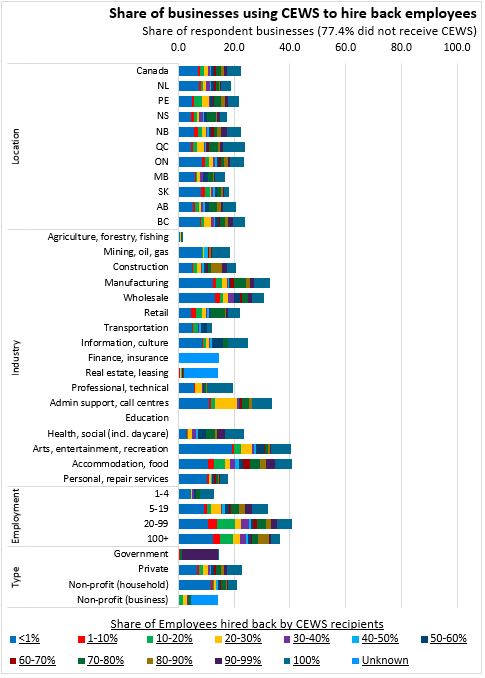

Among all businesses, 9.3 per cent used CEWS to hire back 70 per cent or more of laid off employees. However, a further 6.8 per cent of businesses were approved for CEWS but hired back less than 1 per cent of laid off employees.

The Canada Emergency Commercial Rent Assistance (CECRA) program was approved for a much smaller share of Canadiaan businesses at 3.3 per cent, but this was notably higher for accommodation/food and arts/entertainment/recreation businesses as well as finance/insurance and government agencies.

Approval of Export Development Canada and Business Development Bank assistance programs was reported by a very small share of Canadian businesses.

Provincial and municipal government assistance programs were approved for 3.2 per cent of Canadian businesses, with higher shares in Prince Edward Island, Nova Scotia and Saskatchewan. Provincial and municipal government assistance approval was more common among government agency respondents.

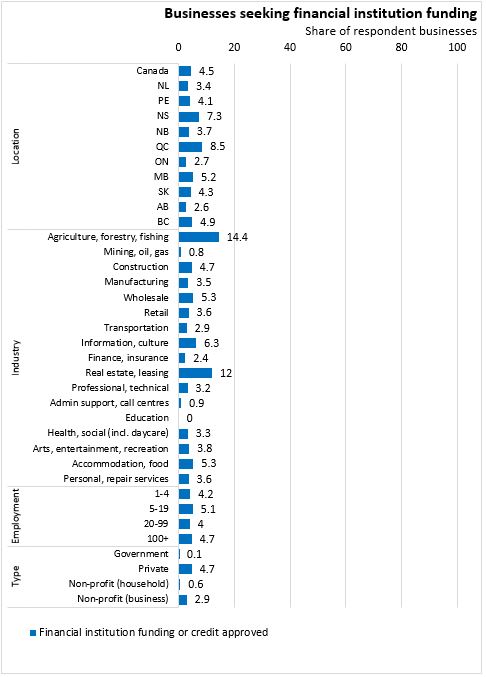

Some businesses sought additional credit support through financial institutions, amounting to 4.5 per cent of businesses. Approved credit through financial institutions was more prevalent in Quebec and Nova Scotia. Additional credit was more common among businesses in agriculture/forestry/fishing and real estate/rentals/leasing.

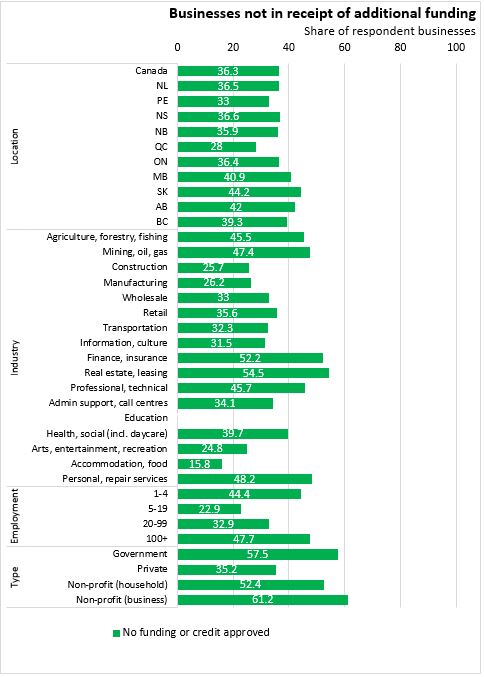

Over 36 per cent of Canadian businesses did not seek additional funding through government programs, financial institution credit or other sources.

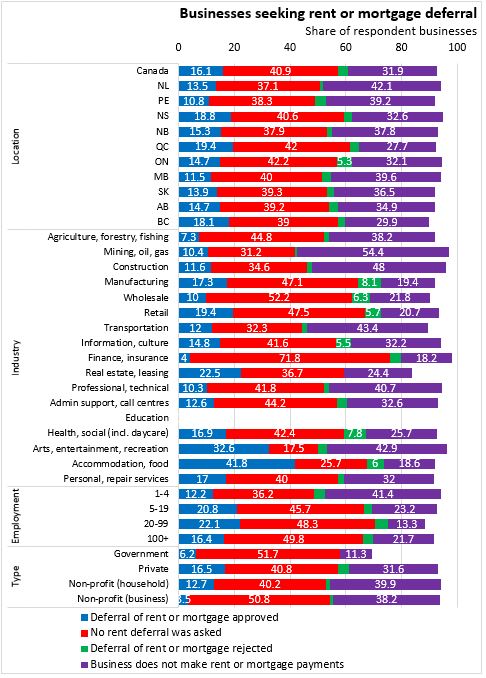

One-fifth of Canadian businesses have sought rent deferral during COVID-19. Over 16 per cent of Canadian businesses sought and received deferral of rent or mortgage payments. Rent or mortgage deferral was more common among businesses in Quebec and Nova Scotia as well as in accommodation/food and arts/entertainment/recreation industries. Just under 4 per cent of businesses sought rent or mortgage relief and were rejected. Rejection of rent relief was higher in Ontario as well as in manufacturing, wholesale, retail and information/culture industries.

Almost 73 per cent of Canadian businesses either do not pay rent or a mortgage or did not seek relief from rent or mortgage payments.

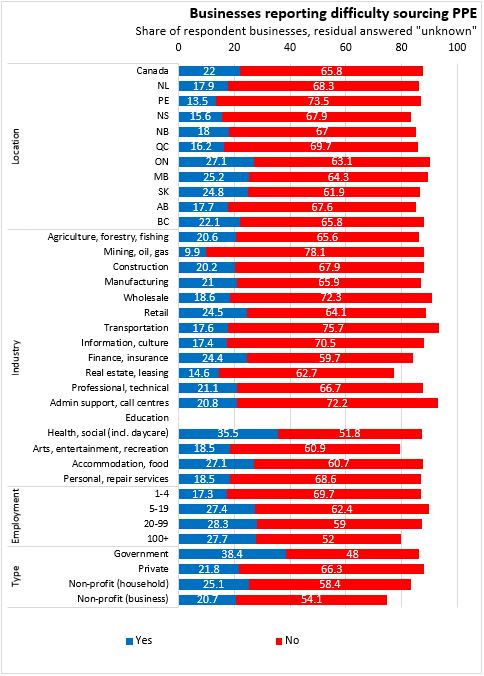

Over 80 per cent of Canada's businesses report requiring some form of personal protective equipment (PPE). About 22 per cent report difficulty in sourcing PPE, a portion that is higher in Ontario, Manitoba and Saskatchewan. Among industries, PPE sourcing difficulties are more commonly reported in health/social (incl. daycares), accommodation/food, retail and finance/insurance.

Additional results about the impact of COVID-19 on respondent businesses are available from Statistics Canada.

Source: Statistics Canada. Table 33-10-0247-01 Percentage of workforce teleworking or working remotely, and percentage of workforce expected to continue teleworking or working remotely after the pandemic, by business characteristics

Table 33-10-0248-01 Methods used to conduct sales or secure orders remotely before and during the COVID-19 pandemic, by business characteristics

Table 33-10-0249-01 Cyber security incidents in May 2020 compared to February 2020, by business characteristics

Table 33-10-0250-01 Changes made by businesses to adapt to the COVID-19 pandemic, by business characteristics

Table 33-10-0251-01 Staffing actions taken by businesses to adapt to the COVID-19 pandemic, by business characteristics

Table 33-10-0252-01 Percentage of workforce laid off to adapt to COVID-19, by business characteristics

Table 33-10-0253-01 Business revenue from April 2020 compared with April 2019, by business characteristics

Table 33-10-0254-01 Business expenses from April 2020 compared with April 2019, by business characteristics

Table 33-10-0255-01 Funding or credit approved due to COVID-19, by business characteristics

Table 33-10-0256-01 Percentage of workforce hired back after business was approved for the Canadian Emergency Wage Subsidy, by business characteristics

Table 33-10-0257-01 Deferral of rent or mortgage payments owed by businesses, by business characteristics

Table 33-10-0258-01 New products businesses have begun manufacturing, by business characteristics

Table 33-10-0259-01 Personal protective equipment or supply needs, by business characteristics

Table 33-10-0260-01 Difficulty procuring personal protective equipment or supplies, by business characteristics

Table 33-10-0261-01 Sources of personal protective equipment or supplies, by business characteristics

Table 33-10-0262-01 Extent to which businesses are expecting to face various challenges with regards to recruitment and training, by business characteristics

Table 33-10-0263-01 Likelihood of various measures being permanently adopted once COVID-19 pandemic is over, by business characteristics

<--- Return to Archive