The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

June 16, 2020SASKATCHEWAN BUDGET 2020-21 At the beginning of measures to contain the spread of COVID-19, the government of Saskatchewan had yet to release its provincial Budget. Expenditure Estimates were presented in April, along with three potential economic scenarios. Since then, it has emerged that Saskatchewan has a relatively low case count and fatality rate as well as a less severe rise in unemployment and business closures.

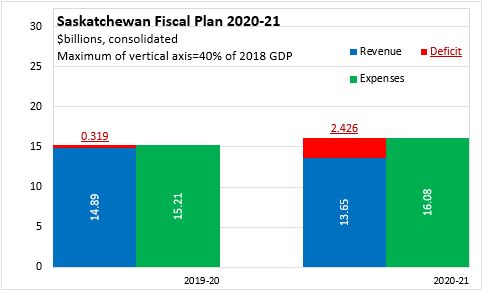

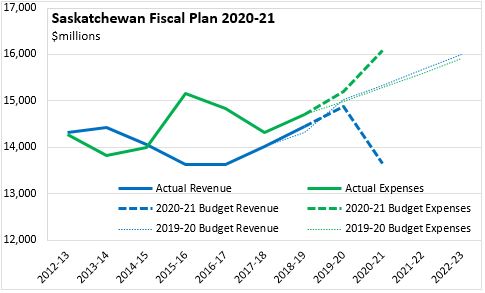

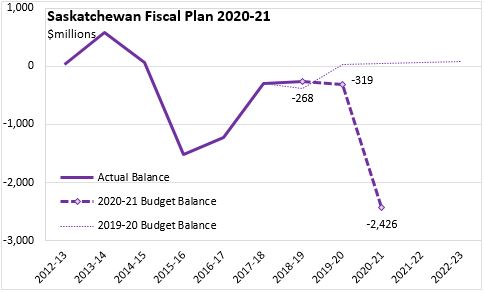

With the extent of COVID-19 and its near term economic impact somewhat better understood, the government of Saskatchewan has released a full Budget for 2020-21. The government anticipates that Saskatchewan will run a deficit of $2.4 billion in 2020-21. Expenses are projected to rise by 7.2 per cent, including the costs of managing COVID-19 as well as measures to support vulnerable residents and stimulate the economy. Saskatchewan's revenues are projected to decline 8.3 per cent in 2020-21 because of the combined effects of shuttering the economy and the collapse in oil prices.

There remains substantial uncertainty about future fiscal years and the impact of COVID-19 on medium to long term economic outlook and the Saskatchewan Budget does not present any projections beyond the current fiscal year.

In the 2019-20 fiscal plan, the government of Saskatchewan was expecting to return to balance in 2019-20. For 2019-20, provincial expenditures are higher than the Budget estimate while revenues have fallen short of expectations. For 2020-21, expenditures are almost $800 million higher than planned while revenues are almost $1.7 billion below prior expectations.

Saskatchewan's decline in revenue is spread across all own-source revenue categories, including:

- A $753 million decline in non-renewable resource revenue (-43.0 per cent) compared with the latest forecast for 2019-20 as a result of the impacts that lower oil prices have on royalties and the resource surcharge.

- A $350 million decline in tax revenues (-4.6 per cent), with larger declines in sales tax and fuel tax and a smaller drop in income taxes

- A $127 million decline in government business enterprise revenues (-14.8 per cent) resulting from casino/video lottery closures and lower customer demand for utilities. Government business enterprise revenues in 2019-20 were already down $225 million from the Budget Estimate.

Saskatchewan's Federal transfer revenues are projected to be up $197 million or 7.6 per cent including $212 million in COVID-related federal support.

Saskatchewan's provincial expenditures are projected to rise with additional expenditures of $502 million for COVID-related costs, including:

- $171.4 million in capital stimulus funding for third parties, of which $150.0 million is for the Municipal Economic Enhancement Program's shovel-ready projects.

- $56.0 million for a temporary wage supplement for lower income essential workers

- $50.0 million for a Saskatchewan Small Business Emergency Payment

- $50.0 million in emergency pandemic support for First Nations and Metis organizations

- $12.6 million for Canada Emergency Commercial Rent Assistance

- $11.7 million for other measures including support for livestock producers and enhancements to correction and justice systems

Saskatchewan's projected deficit of $2.4 billion is a significant deviation from the previously planned surplus for 2020-21. The documents state that: "The 2020-21 deficit is not a structural deficit. It is a pandemic deficit." The 2019-20 fiscal year is also projected to be in deficit (-$319 million) as a result of the economic deterioration in the final quarter of the fiscal year.

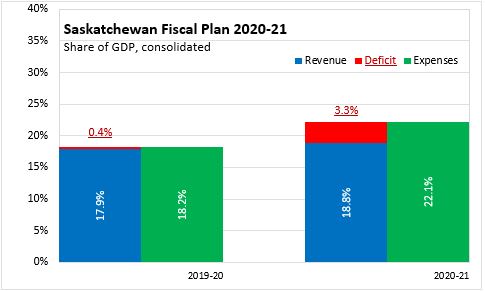

Saskatchewan's planned deficit amounts to 3.3 per cent of provincial GDP, a level not seen since the early 1990s. With the projected decline in Saskatchewan's nominal GDP (which is heavily influenced by the fall in oil prices), the footprint of government in the Saskatchewan economy is projected to rise. Expenditures for 2020-21 amount to 22.1 per cent of projected nominal GDP while revenues amount to 18.8 per cent of nominal GDP.

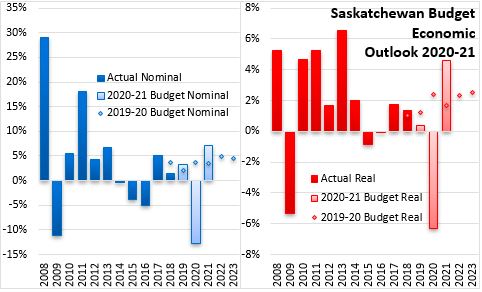

Sasaktchewan's economic outlook is impaired both by the effects of COVID-19 and the collapse in oil prices. With oil prices assumed to average $30 (WTI - USD/bbl), Saskatchewan's oil production is projected to decline by 13.8 per cent while oil investment falls by 37.1 per cent. Overall, Saskatchewan's real GDP is projected to decline by 6.3 per cent in 2020, followed by a rebound of 4.6 per cent in 2021. Nominal GDP is projected to fall by 12.8 per cent in 2020 (including the effects of a sharp decline in oil prices) followed by a recovery of 7.2 per cent in 2021. This shock and recovery is more severe than the one Saskatchewan experienced during the Global Financial Crisis in 2008-09.

Although Saskatchewan's job losses to date have been extreme, the impacts on the economy have been mitigated by income support programs. As restrictions are lifted, job losses are expected to be reversed. The Saskatchewan economic outlook does not incorporate any assumptions about a further spread of COVID-19 (such as a second wave of infections) and this is a significant source of uncertainty in the Province's outlook.

Key Measures and Initiatives

Most of Saskatchewan's Budget planning focuses on measures to contain and mitigate the impacts of COVID-19, though the Budget did announce:

- automatic indexation of personal income tax brackets

- a new investment incentive for chemical fertilizer industries

- extension of the manufacturing and processing exporter tax incentive

Saskatchewan Budget 2020-21

<--- Return to Archive