The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

June 11, 2020CANADA'S INTERNATIONAL INVESTMENT POSITION, Q1 2020 (REVISED) The COVID-19 pandemic has caused significant volatility in the prices of global financial assets and foreign exchange rates.

Statistics Canada has published revised estimates of changes to Canada's international investment position for Q1 2020.

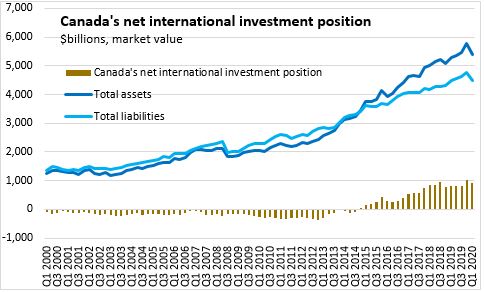

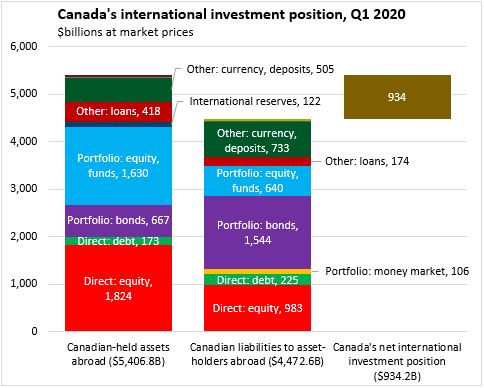

As of Q1 2020, Canada had a positive net international investment position (at market value) of $934.2 billion. This consistent of Canadian-held assets abroad worth $5,406.8 billion and Canadian liabilities to asset-holders abroad valued at $4,472.6 billion.

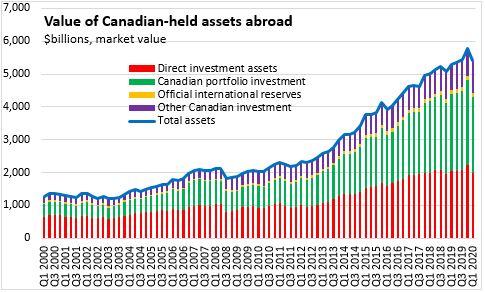

In Q1 2020, Canada's international assets declined by $382.2 billion (-6.6 per cent) to $5,406.8 billion. This is the largest decline in Canada's international asset values since 2008.

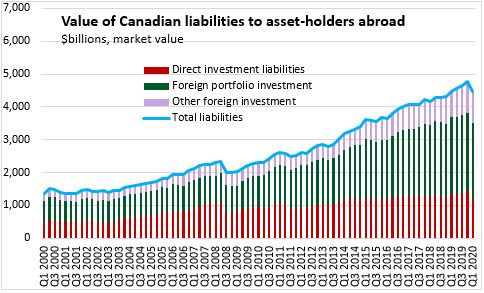

Canada's international liabilities decreased by $304.9 billion (-6.4 per cent) to $4,472.6 billion, also the largest decline since Q3 2008. Between the drop in asset and liability values, Canada's net international investment position declined by $77.3 billion to $934.2 billion.

With the outbreak of COVID-19, asset prices have changed significantly. So have foreign exchange rates. The impact of declining equity prices reduced both asset and liability values in Canada's international investment position. However, depreciation of the Canadian dollar offset declining asset and liability prices.

Canada's international assets abroad consist primarily of equity (either direct investment or portfolio investment). Debt, bonds, loans, currency/bank deposits make up the bulk of the rest of Canada's international asset position. In contrast, Canada's liabilities to asset-holders abroad consist more of debt, bonds, money market securities and currency/bank deposits than of equity.

Source: Statistics Canada. Table 36-10-0485-01 International investment position, book and market values, quarterly (x 1,000,000)

<--- Return to Archive