The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

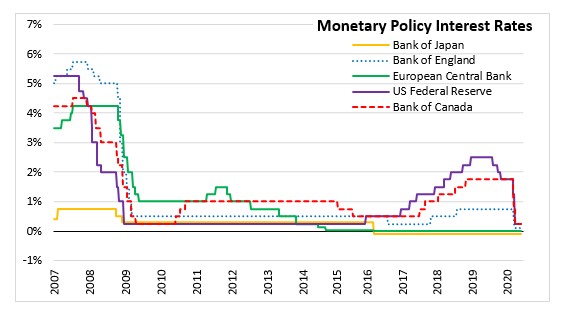

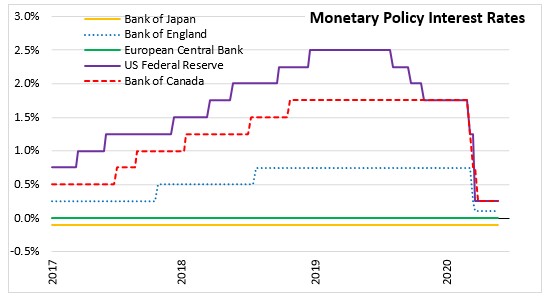

June 03, 2020BANK OF CANADA MONETARY POLICY Today, Tiff Macklem assumes his role as the Bank of Canada’s tenth Governor. In his first interest rate announcement, the Bank of Canada maintained its target for the overnight rate at the effective lower bound of 0.25 percent. The Bank Rate is correspondingly 0.5 per cent and the deposit rate is 0.25 per cent.

To cushion the negative impacts of COVID-19 shock in the economy, advanced economies have introduced an unprecedented amount of economic stimulus and lowered interest rates. These measures seem to have softened the impacts of economic shutdowns. The Bank of Canada notes that financial conditions have improved, and commodity prices have increased in recent weeks.

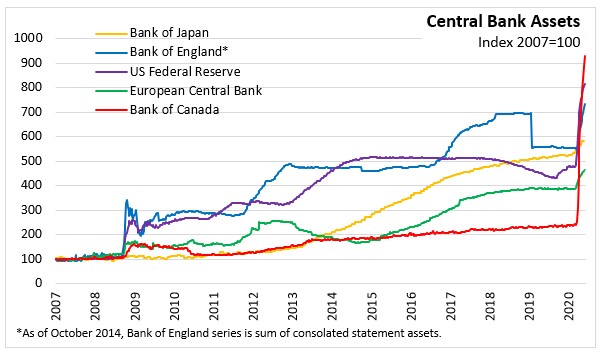

The Bank of Canada’s recent actions in response to the economic shock from COVID-19 included lowering the target for the overnight rate 150 basis points and conducting lending operations to financial institutions and asset purchases in core funding markets of around $200 billion. The Bank of Canada notes that recent data confirms that the Bank’s programs to improve market function are working as intended. As a result, the Bank will be reducing the frequency of its term repo operations to once a week, and its program to purchase bankers’ acceptances to bi-weekly operations. other programs to purchase federal, provincial, and corporate debt are continuing at their present frequency and scope.

In Canada, the real GDP in the first quarter of 2020 was 2.1 per cent lower than the fourth quarter of 2019. The Bank notes that this level of GDP is in the middle of the Bank’s April monitoring range and reflects the combined impact of falling oil prices and widespread shutdowns. The Bank of Canada projects GDP level to further decline by 10-20 per cent due to continued lower consumption and investment.

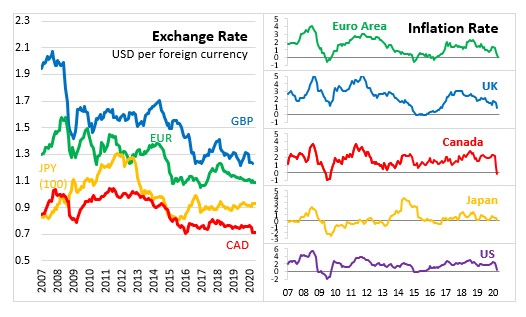

CPI inflation has decreased to near zero in line with the projections provided in the April Monetary Policy Report (MPR). The decline in inflation was primarily due to lower gasoline prices. The Bank expects temporary factors to keep CPI inflation below the target band in the near term.

With global economies turning their focus to reopening, uncertainty remains on how the recovery will unfold nationally and globally. The Bank expects the Canadian economy to resume growth in the third quarter of 2020 supported by household consumption.

As market conditions improve, the Bank’s focus will shift to supporting growth in employment and output. The Bank maintains its commitment to continue large-scale asset purchases until the economic recovery is well underway. Any further policy actions would be calibrated to provide the necessary degree of monetary policy accommodation required to achieve the inflation target.

The next scheduled date for announcing the overnight rate target is July 15, 2020. The next full update of the Bank’s outlook for the economy and inflation, including risks to the projection, will be published in the MPR at the same time.

Bank of Canada: Rate announcement

<--- Return to Archive